Alphabet (GOOGL) to Commercialize Project Starline With HP Deal

Alphabet’s GOOGL Google recently partnered with Hewlett Packard HPE to commercialize its 3D video conferencing technology, Project Starline, in 2025.

With the HP collaboration, Google plans to integrate this video technology into popular workplace video conferencing services like Google Meet and Zoom by leveraging HP’s expertise in computing.

The Starline technology uses advanced computer vision, machine learning and real-time compression to create a “magic window,” allowing life-size participants to make eye contact and perceive depth.

This Starline integration into the workplace will foster authentic in-person interactions in hybrid environments, enabling better visual attentiveness, memory recall and an overall sense of presence.

Google is expected to gain solid traction across various enterprises working in a remote or hybrid setting on the back of its latest announcement.

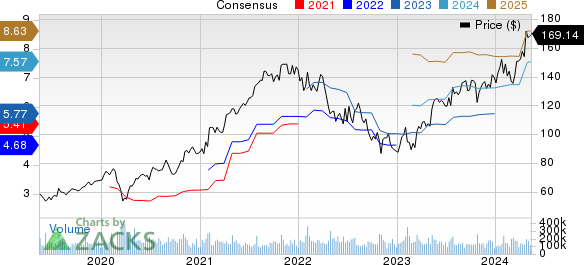

Alphabet Inc. Price and Consensus

Alphabet Inc. price-consensus-chart | Alphabet Inc. Quote

Growth Prospects

The partnership will enable the company to capitalize on growth opportunities present in the global video conferencing space. Per a Fortune Business Insights report, the global video conferencing market is expected to hit $33.04 billion in 2024 and reach $60.2 billion by 2032, indicating a CAGR of 7.8% between 2024 and 2032.

Moreover, the Starline integration will bolster Alphabet’s Google Meet capabilities, adding strength to the Google Workspace environment. This, in turn, will boost the Google Cloud segment, which remains a key growth catalyst for the company. Its shares have rallied 21.1% in the year-to-date period compared with the Zacks Computer & Technology sector’s growth of 12.4%.

In the first quarter of 2024, Google Cloud revenues rose 28.4% year over year to $9.6 billion, accounting for 11.9% of the quarter’s total revenues.

The strengthening Google Cloud segment is expected to aid its overall financial performance in the near term.

The Zacks Consensus Estimate for 2024 total revenues stands at $295.12 billion, indicating year-over-year growth of 15.1%. The consensus estimate for 2025 total revenues is pegged at $329.03 billion, indicating an 11.5% rise year over year.

Stiff Competition

The latest move will also aid this Zacks Rank #1 (Strong Buy) company to compete well with some notable industry players like Microsoft MSFT and NVIDIA NVDA, which are also making concerted efforts to strengthen their positions in the 3D video conferencing space.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Recently, Microsoft launched Mesh virtual meeting spaces, allowing workers to interact in three-dimensional environments using a virtual reality headset. These spaces can be accessed via a regular PC, with users controlling a personalized avatar.

Mesh provides a co-presence experience for employees, allowing them to customize 3D environments with a no-code editor and a Unity-based toolkit, enhancing hybrid working arrangements by addressing limitations.

NVIDIA, on the other hand, strengthened its foothold in the video conferencing space with NVIDIA Maxine. The Maxine AI Developer Platform enhances real-time video conferencing applications with AI-driven features, enhancing user flexibility, engagement and efficiency, available through the NVIDIA AI Enterprise software platform.

NVIDIA also announced upcoming feature updates to the Maxine platform with the introduction of Maxine 3D, a cloud micro-service that enhances 3D video conferencing engagement with real-time NeRF technology.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report