Personal Finance

Visualizing American Income Levels by Age Group

Visualizing American Income Levels by Age Group

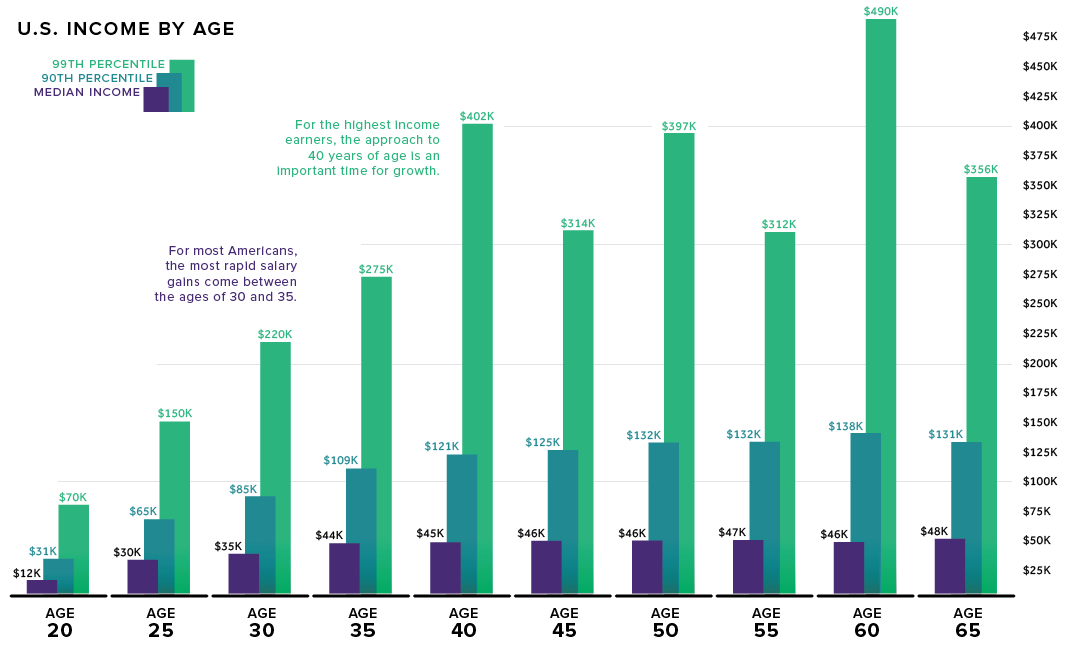

There are two commonly held beliefs around income and age:

1) Earning trajectory is largely determined by the time a person is 35-years-old

2) Income is positively correlated with age

How do these beliefs stand up to the actual income data? As it turns out, quite well.

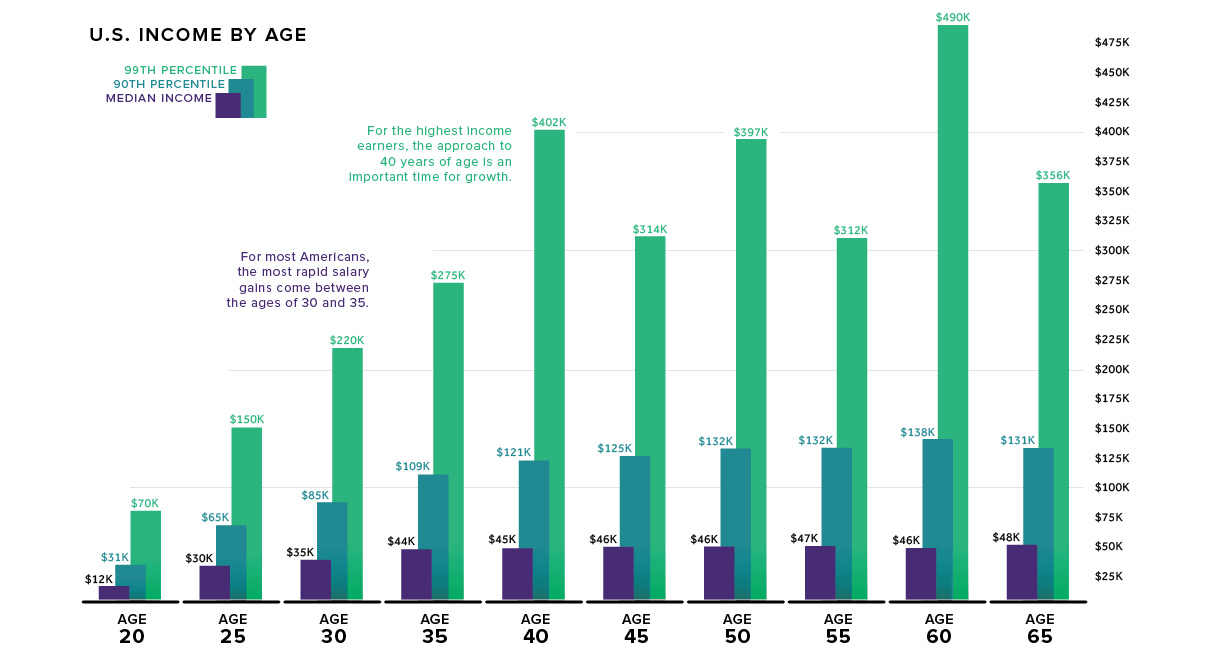

Today’s data, from the IPUMS.org Current Population Survey, is a detailed look at income by age group.

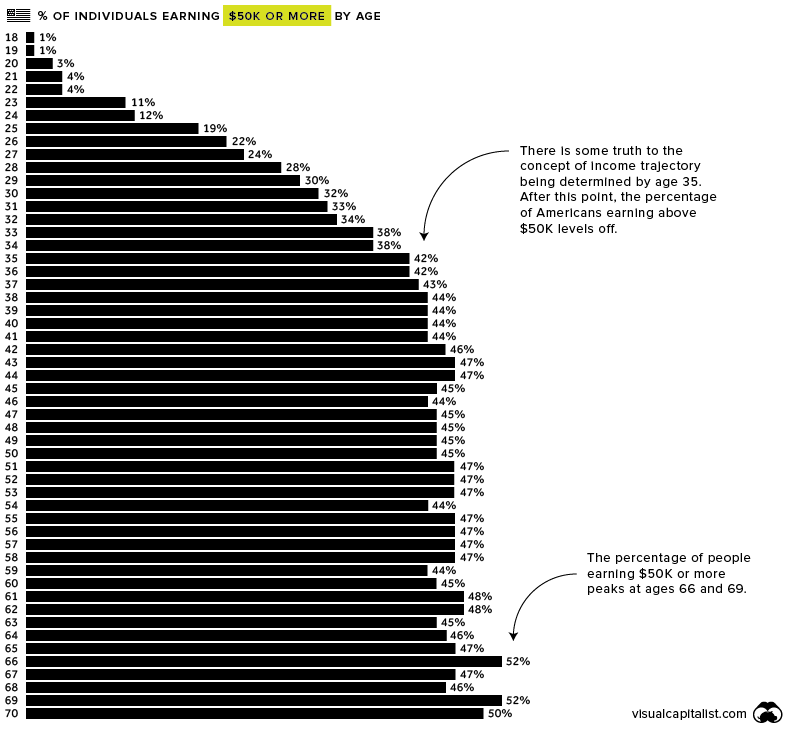

The $50K Threshold

In the age of LinkedIn bragging it’s no surprise that two-thirds of people who are being paid the market rate believe they’re actually underpaid.

For people just starting out in the workforce, there can be a lot of pressure to earn a higher salary, but as the data shows, only a tiny percentage of workers under the age of 25 surpass a salary of $50K.

The majority of people in the work force make their greatest income strides between the ages of 30 and 35, with median income jumping by 26% during that short time-frame.

After the age of 35, the percentage of people earning $50K or more is surprisingly consistent until retirement age, hovering between 42% and 48%.

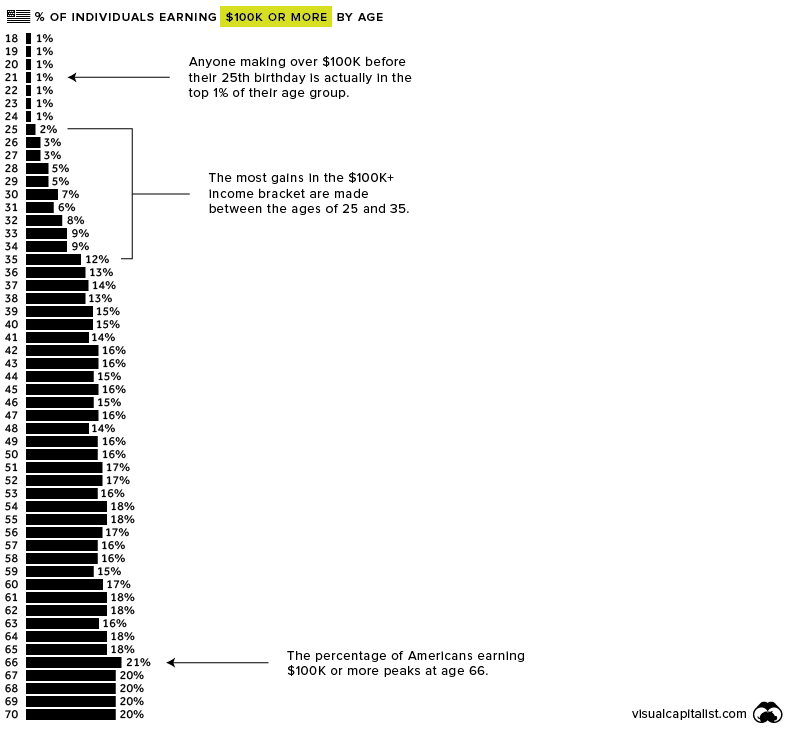

The $100K Threshold

Making $100K per year won’t put you in the top 1% – you’ll need to earn $300K to join that club – however, it’s still enough to live comfortably in most places in America.

Approximately 21 million people in the U.S. workforce earn over $100K. Here’s how they break down by age.

Interestingly, the percentage of Americans earning $100K or more jumps from 2% to 12%, and moves very little after that. Put another way, it’s rare for anyone in their 20s to earn over $100K, but many people who hit that threshold do so by the time they turn 40.

Much like those earning $50K or more, the percentage of $100K+ earners stays fairly consistent until retirement, peaking at age 66.

Individual salary situations will vary widely, of course, but it’s interesting to zoom out at the big picture of income in America.

Personal Finance

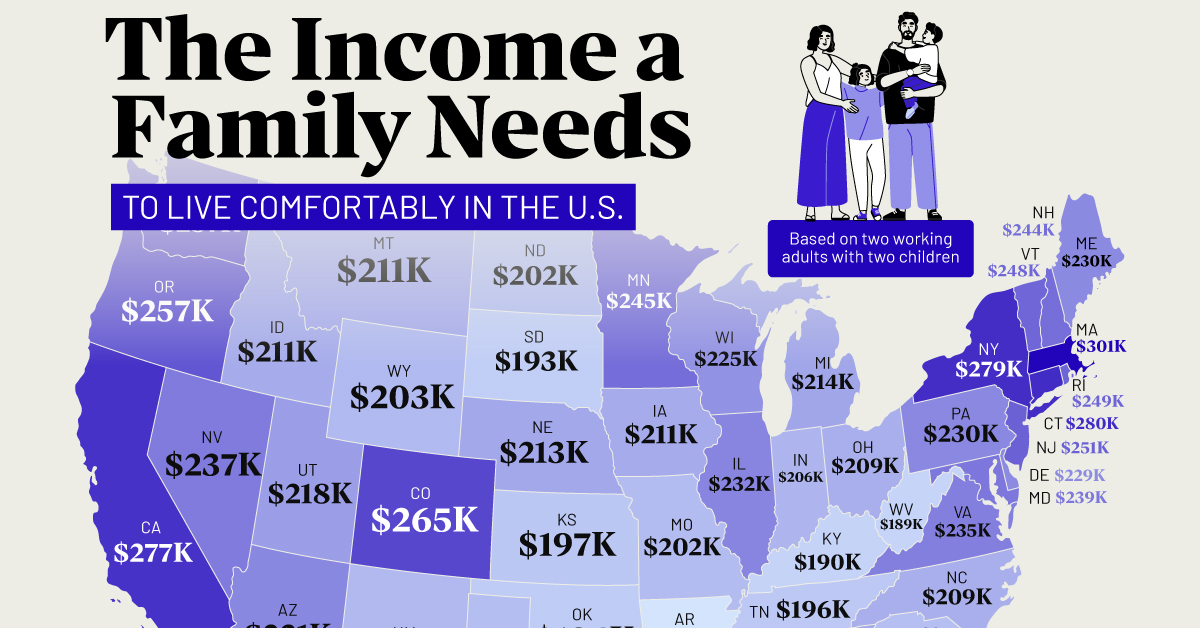

Mapped: The Income a Family Needs to Live Comfortably in Every U.S. State

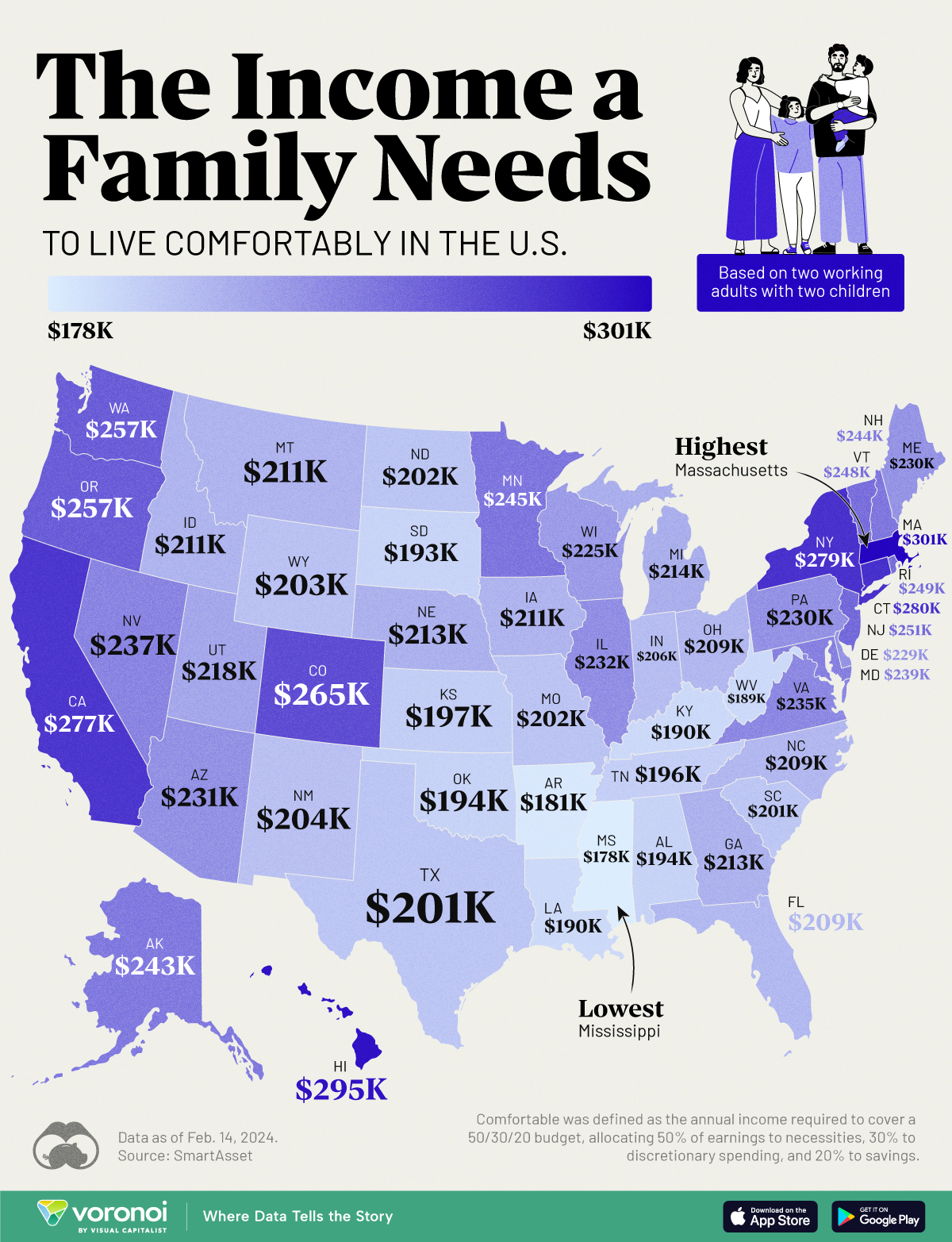

Families in expensive states require over $270,000 annually to live comfortably.

The Income a Family Needs to Live Comfortably in Every U.S. State

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Families in the top five most expensive U.S. states require an annual income exceeding $270,000 to live comfortably.

This visualization illustrates the income necessary for two working adults with two children to maintain a comfortable lifestyle in each state.

“Comfortable” is defined as the income needed to cover a 50/30/20 budget, with 50% allocated to necessities like housing and utilities, 30% to discretionary spending, and 20% to savings or investments.

The calculations for family income needed in each state were done by SmartAsset, using the cost of necessities sourced from the MIT Living Wage Calculator, last updated on Feb. 14, 2024.

Massachusetts Tops the List

Massachusetts is the most expensive state to live comfortably in, requiring a total family income of about $301,184. Hawaii ($294,611) comes in second, followed by Connecticut ($279,885).

Housing is one main reason Massachusetts is an expensive state to live in, particularly in the Boston area. In addition, the state also has a high cost of living, including expenses such as healthcare and utilities.

| Rank | State | Income for 2 working adults raising 2 children |

|---|---|---|

| 1 | Massachusetts | $301,184 |

| 2 | Hawaii | $294,611 |

| 3 | Connecticut | $279,885 |

| 4 | New York | $278,970 |

| 5 | California | $276,723 |

| 6 | Colorado | $264,992 |

| 7 | Washington | $257,421 |

| 8 | Oregon | $257,338 |

| 9 | New Jersey | $251,181 |

| 10 | Rhode Island | $249,267 |

| 11 | Vermont | $248,352 |

| 12 | Minnesota | $244,774 |

| 13 | New Hampshire | $244,109 |

| 14 | Alaska | $242,611 |

| 15 | Maryland | $239,450 |

| 16 | Nevada | $237,286 |

| 17 | Virginia | $235,206 |

| 18 | Illinois | $231,962 |

| 19 | Arizona | $230,630 |

| 20 | Pennsylvania | $230,464 |

| 21 | Maine | $229,549 |

| 22 | Delaware | $228,966 |

| 23 | Wisconsin | $225,056 |

| 24 | Utah | $218,483 |

| 25 | Michigan | $214,490 |

| 26 | Nebraska | $213,075 |

| 27 | Georgia | $212,826 |

| 28 | Montana | $211,411 |

| 28 | Iowa | $211,411 |

| 30 | Idaho | $211,245 |

| 31 | North Carolina | $209,331 |

| 31 | Ohio | $209,331 |

| 33 | Florida | $209,082 |

| 34 | Indiana | $206,003 |

| 35 | New Mexico | $203,923 |

| 36 | Wyoming | $203,424 |

| 37 | Missouri | $202,259 |

| 38 | North Dakota | $202,176 |

| 39 | Texas | $201,344 |

| 40 | South Carolina | $200,762 |

| 41 | Kansas | $196,768 |

| 42 | Tennessee | $195,770 |

| 43 | Oklahoma | $194,106 |

| 44 | Alabama | $193,606 |

| 45 | South Dakota | $192,608 |

| 46 | Kentucky | $190,112 |

| 47 | Louisiana | $189,613 |

| 48 | West Virginia | $189,363 |

| 49 | Arkansas | $180,794 |

| 50 | Mississippi | $177,798 |

Meanwhile, Mississippi is the least expensive state for a family to live comfortably, requiring $177,798 per year. Arkansas ($180,794) comes in second, followed by West Virginia ($189,363). In common, all these states share low prices of housing.

Learn More About Cost of Living From Visual Capitalist

If you enjoyed this post, be sure to check out this graphic, which ranks the median down payment for a house by U.S. state.

-

War7 days ago

War7 days agoMapped: The World’s Largest Armies in 2024

-

Maps2 weeks ago

Maps2 weeks agoMapped: The World’s Wettest and Driest Countries

-

Healthcare2 weeks ago

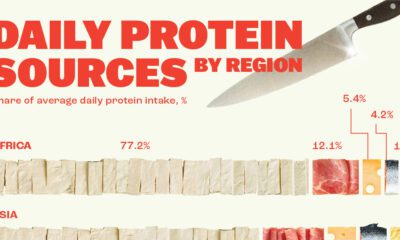

Healthcare2 weeks agoVisualizing Daily Protein Sources by Region

-

Maps2 weeks ago

Maps2 weeks agoMap: Where Are America’s Largest Landfills?

-

AI2 weeks ago

AI2 weeks agoNvidia is Worth More Than All of These Companies Combined

-

Stocks2 weeks ago

Stocks2 weeks agoVisualizing Berkshire Hathaway’s Stock Portfolio (Q1 2024)

-

Markets1 week ago

Markets1 week agoThe Top Retailers in the World, by Store Count

-

Crime1 week ago

Crime1 week agoTop 10 Most Stolen Vehicles in America