By FocusEconomics

The Middle East and North Africa (MENA) is at a crossroads, both economically and politically. A war ravages the Levant, inflicting immense human suffering and threatening to boil over into a wider regional conflict. But despite the war, the MENA economy remains one of the world’s most promising. Regional powers, such as Saudi Arabia, are pushing for a political settlement to the conflict that would guarantee longer-term peace and stability. Riyadh and neighboring capitals are impatient to continue sowing the seeds of their countries’ future economic success: In 2022, the MENA economy grew at the fastest rate since the early 2000s, and the non-oil sector’s share of GDP among Gulf countries was up 9 percentage points from a decade ago.

Our new outlook on the region

To reflect the MENA region’s growing clout, this month we penned a fresh outlook for the region’s economy over 2024–2028. The report is free and covers our Consensus Forecasts for GDP growth, oil and non-oil output, inflation and the fiscal balance.

Our upgraded coverage of the region

In addition, this month we also upgraded our coverage of Qatar and Kuwait, two of the region’s most promising economies. Our coverage now features dedicated written analysis for both countries on high-frequency economic data – written by our in-house team of economists – including GDP, purchasing managers’ index readings, industrial production, oil production, and inflation. As well as this, our coverage now includes quarterly forecasts for GDP growth and inflation for both Qatar and Kuwait, as well as monthly data for oil production, industrial production and purchasing managers’ index readings. Finally, our coverage contains new detailed charts and panelist breakdowns for additional indicators for both countries, including private consumption, total investment, public debt, exports and imports.

Insight from our panelists

On the outlook for regional GDP growth, analysts at Fitch Solutions said:

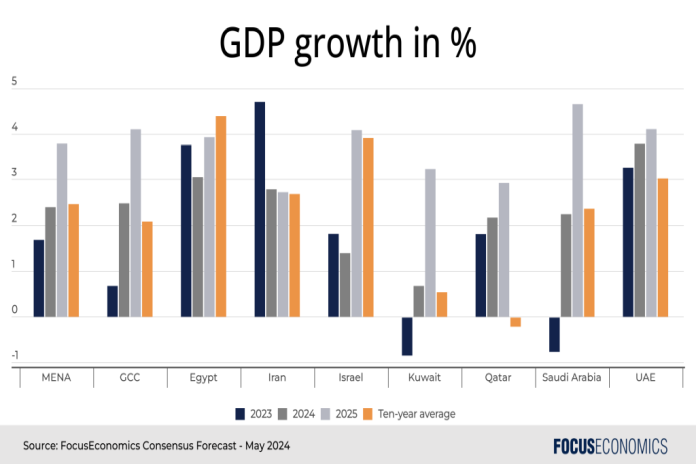

“The MENA region’s growth will slightly accelerate from 1.9 percent in 2023 to 2.4 percent in 2024 but face major headwinds from the Israel-Hamas war, slower growth in key economies, and the Red Sea crisis. The GCC will see growth accelerate from 0.6 percent to 2.6 percent in 2024, driven by normalisation of oil production and strong non-hydrocarbon sector performance, particularly due to investment in diversification efforts. Growth in North Africa will slow from 3.1 percent in 2023 to 2.4 percent in 2024 […while] the Levant will experience a contraction of 0.6 percent in 2024 due to the Israel-Hamas war.”

On OPEC+’s next possible moves, Natasha Kaneva, Head of the Global Commodities Strategy team at JPMorgan, commented:

“Our fundamental view on oil has not changed. We now expect OPEC to extend voluntary production cuts beyond 2Q at its June 1st meeting. The stock builds in April will turn to draws in May through August and can push prices into $90s in September. We opt to keep our price forecast unchanged (high $80s/90 through May, $85 thereafter) as OPEC’s rollover does not address 2025 imbalances. We maintain a bullish risk bias around our base-line price view but flag that it might shift back to neutral were the US-Saudi security deal to succeed.”

Our latest analysis

Qatar’s non-energy PMI rose to a seven-month high in April.

Kuwait’s crude output was muted in March.