The content arms race is in full effect, and Amazon.com Inc. is showing some unprecedented firepower.

The company agreed to buy legacy film and television company MGM Holdings Inc., which operates the studio Metro-Goldwyn-Mayer Inc., for $8.45 billion. The move will give the e-commerce, cloud and streaming conglomerate a substantial catalog of content to battle streaming rivals The Walt Disney Co., Netflix Inc. and AT&T Inc.

The price is extremely high based on historic comparisons and is more than $3 billion above what the studio was reportedly looking for at the end of 2020. But it comes with some of TV's and cinema's most recognized properties. Further, if more studios keep their content to their own platforms, analysts agree that to stay competitive, a company like Amazon needs to do more than just make its own handful of originals each year.

MGM carries a massive catalog of titles, with the most lucrative being the James Bond franchise.

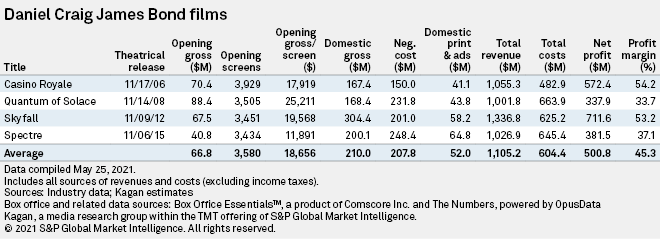

The most recent four Bond films featuring actor Daniel Craig averaged $210.0 million in domestic box office gross and $1.11 billion in total revenue, according to Kagan, a media research group within S&P Global Market Intelligence.

The Rocky boxing action franchise, including its newer iterations under the Creed character, is perhaps the second most valuable run of titles. MGM also distributes "G.I. Joe," "The Hobbit" and "Pink Panther" film content as well as television productions like "The Voice" and "Survivor." All told, the studio controls 4,000 film titles and more than 17,000 TV episodes.

Adding that to Amazon's existing library, along with a recent deal to stream NFL Thursday Night Football, launches Amazon into a competitive position in the "content arms race" among studio giants building massive, and exclusive, digital libraries, CFRA Research analyst Tuna Amobi said in an interview.

"With Netflix and Disney now getting a lot of traction, they recognize that to be a formidable long-term player, they needed to do something," Amobi said. "Buying a studio might be the ... solution for them to at least get some scale that will enable them to boost their offering on Prime Video.”

Still, Amazon’s $8.45 billion valuation for MGM is not small, and it is more than $3 billion above what the studio was reportedly looking for at the end of 2020.

MGM Holdings reported total 2020 revenue of $1.50 billion, down 3% from $1.54 billion in 2019, as the pandemic prevented the studio from debuting any big-screen titles in 2020. However, it managed to grow its profits last year, likely due to the strength of its third-party distribution partners that saw big viewership gains during the pandemic, Kagan analyst Wade Holden said. The studio reported $172.4 million in 2020 EBITDA, up from $93.7 million in 2019.

That put the price of the deal at about 5.6x revenue and 49x EBITDA, no modest accounting. By comparison, Disney's $90.56 billion deal to buy the studio assets of 21st Century Fox, which closed in March 2019, carried an enterprise value-to-trailing revenue multiple of 2.8x and an enterprise value-to-trailing EBITDA multiple of 12.9x.

Box Office Pro chief analyst Shawn Robbins said the price tag speaks to the demand for content assets in today's competitive climate.

With Disney making content increasingly exclusive on its Disney+ streaming platform, Netflix winning awards for its multibillion catalog of streaming films, and other studios like Warner Bros. and ViacomCBS Inc.'s Paramount withholding rights to their content to carry exclusively on their own streaming services, Amazon "needed to make this kind of deal" to keep Prime Video original and competitive, Robbins said in an interview.

"Exclusivity is becoming the name of the game," Robbins said. "It's about having as much control over the content as possible."

Already, Amazon spent about $7.11 billion in 2020 on content, and it is on pace to grow that annual spend to about $9.58 billion by 2024, according to estimates from Kagan.

And MGM does not just give Amazon a robust library of titles. It also gives the Seattle-based company a legacy in Hollywood, Kagan's Holden said.

"The opportunity for access to a major Hollywood studio for someone on the outside is getting slimmer," Holden said. "Amazon wants to be a big name."

And the tie-up between Amazon and MGM could be the "tip of the iceberg" with content acquisitions among technology companies, said Wedbush Securities analyst Daniel Ives. He pointed to the pending tie-up between AT&T's WarnerMedia and Discovery Inc., which recently upped the ante for content consolidation.

Ives said he expects Apple Inc. to also acquire a major Hollywood studio in the next six to nine months.

"Right now we are seeing Amazon, Apple, among other tech giants, go after these assets," Ives said. "Content is king."