You can help empower voters with the information they need when heading to the ballot box. Join the Ballotpedia Society.

Financial regulation in Alaska

![]() This article does not contain the most recently published data on this subject. If you would like to help our coverage grow, consider donating to Ballotpedia.

This article does not contain the most recently published data on this subject. If you would like to help our coverage grow, consider donating to Ballotpedia.

| Alaska information | |

| Commercial banks (2016): 4 | |

| Deposits, in billions (2015): $91.44 | |

| Financial crimes (2015): 4,898 | |

| Bank closures (2015): 0 | |

| FRASE score: 1.63 | |

| FRASE ranking: 2 | |

| State financial regulation policy | |

| Alabama • Alaska • Arizona • Arkansas • California • Colorado • Connecticut • Delaware • Florida • Georgia • Hawaii • Idaho • Illinois • Indiana • Iowa • Kansas • Kentucky • Louisiana • Maine • Maryland • Massachusetts • Michigan • Minnesota • Mississippi • Missouri • Montana • Nebraska • Nevada • New Hampshire • New Jersey • New Mexico • New York • North Carolina • North Dakota • Ohio • Oklahoma • Oregon • Pennsylvania • Rhode Island • South Carolina • South Dakota • Tennessee • Texas • Utah • Vermont • Virginia • Washington • West Virginia • Wisconsin • Wyoming | |

Finance policy in the U.S. • Dodd-Frank Act • Glass-Steagall Act | |

| Note: This page utilizes information from a variety of sources. The information presented on this page reflects the most recent data available as of October 2016. | |

The United States financial system is a network that facilitates exchanges between lenders and borrowers. The system, which includes banks and investment firms, is the base for all economic activity in the nation. According to the Federal Reserve, financial regulation has two main intended purposes: to ensure the safety and soundness of the financial system and to provide and enforce rules that aim to protect consumers. The regulatory framework varies across industries, with different regulations applying to different financial services.[1]

Individual federal and state entities have different and sometimes overlapping responsibilities within the regulatory system. For example, individual states and three federal agencies—the Federal Reserve, the Office of Comptroller of the Currency (OCC), and the Federal Deposit Insurance Corporation (FDIC)—regulate commercial banks. Other sectors of the financial market are regulated by specific entities.[2][3]

Some, such as the Brookings Institution, argue that expanded governmental regulation of banks and financial products (e.g., mortgages) can prevent large-scale financial crises, protect consumers from abusive practices, and stabilize financial markets. Others, such as the Cato Institute, argue that over-regulation of banks of banks and financial products burdens business, stalls economic growth, and does little, if anything, to stabilize financial markets. Beyond this basic debate about the role of the government in regulating the private financial sector, there are varying opinions about the proper extent of governmental regulation.[4][5]

Background

Key terms and definitions

The following is a list of key terms that are used throughout this article:

- Commercial bank: An entity that provides financial services to individuals and businesses; commercial banks provide a variety of financial products and services, including savings accounts, checking accounts, and certificates of deposit.[6]

- Credit union: A financial entity similar to a commercial bank that is owned by its members.[7]

- Depository institution: A financial entity, such as a bank or credit union, that accepts deposits from individuals and pays interest on those deposits.[8]

- Financial system: The network of financial entities that facilitates exchanges between lenders and borrowers.[9]

- Investment banking: A form of banking that is "related to the creation of capital for other companies, governments, and other entities. Investment banks underwrite new debt and equity securities for all types of corporations, aid in the sale of securities, and help to facilitate mergers and acquisitions, reorganizations and broker trades for both institutions and private investors."[10]

- Security: A security "represents an ownership position in a publicly traded corporation (stock), a creditor relationship with a governmental body or a corporation (bond), or rights to ownership as represented by an option."[11]

Historical context

In October 1907, a financial crisis known as the Panic of 1907 occurred in the United States. Also known as the Knickerbocker Crisis, the Panic of 1907 began with a failed attempt to manipulate the stocks of the United Copper Company. As the manipulation failed, banks that had lent money for the purpose of manipulating United Copper's stocks, including the Knickerbocker Trust Company, began to fail. This triggered a rush of depositors demanding their money back from Knickerbocker, leading to the company's collapse. This collapse stoked fears that other banks would go bankrupt, and so customers began withdrawing their funds from regional banks. This, in turn, caused a recession as banks failed due to lack of funds. During this time, the New York Stock Exchange fell by about half.[12][13]

The lack of a central bank for the United States, which proponents argued might have provided a source of assets for struggling financial institutions, was seen by some to be a cause of the Panic of 1907. In 1910, Senator Nelson Aldrich (R) introduced legislation for the creation of a central bank. The first bill failed to pass, but provisions of it were incorporated into the Federal Reserve Act of 1913. This act provided for the creation of the Federal Reserve System (also known as the Fed), the central bank of the United States. The establishment of the Federal Reserve marked a key turning point in the federal government's regulation of the private financial sector.[14]

In the wake of the Great Depression, a worldwide economic depression in the 1930s, the United States government adopted the Glass-Steagall Act, which represented an expansion of the federal government's role in regulating the financial sector. The Glass-Steagall Act was a direct reaction to banking failures; the law sought to prevent future failures by separating commercial banking and securities activities. The role of the Federal Reserve in the Great Depression has been a subject of debate. According to former Federal Reserve Chairman Ben Bernanke, the actions of the Fed were a cause of the Great Depression. Bernanke said the Fed's decision to raise interest rates in 1928 and 1929 contributed to the depression. The raise was an attempt to limit speculation in the securities market, but instead slowed economic activity as investors feared losing money due to inflation on their investments. Economist Milton Friedman argued that the Fed did not cause the depression, but that mistakes in policy prevented the Fed from stopping the recession from becoming a depression.[15][16]

More recently, the financial crisis of 2008, sometimes referred to as the Great Recession, launched the United States and the global economy into the most severe economic crisis since the Great Depression. Investopedia, an online financial encyclopedia, describes the recession as follows:[17]

| “ | During the American housing boom of the mid-2000s, financial institutions began marketing mortgage-backed securities (MBSs) and sophisticated derivative products at unprecedented levels. When the real estate market collapsed in 2007, these securities declined precipitously in value, jeopardizing the solvency of over-leveraged banks and financial institutions in the U.S. and Europe.

Although the global economy was already feeling the grip of a credit crisis that had been unfolding since 2007, things came to a head a year later with the bankruptcy of Lehman Brothers, the country’s fourth-largest investment bank, in September 2008. The contagion quickly spread to other economies around the world, most notably in Europe. As a result of the Great Recession, the United States alone shed more than 7.5 million jobs, causing its unemployment rate to double. Further, American households lost roughly $16 trillion of net worth as a result of the stock market plunge.[18] |

” |

| —Investopedia | ||

There are competing theories as to what led to the housing boom and bubble that spurred the recession of 2008. There is also debate about whether the repeal of the Glass-Steagall Act in 1999 contributed to the recession. In 2008, at the height of the crisis, U.S. gross domestic production growth slowed to 0.4 percent. The nation's unemployment rate spiked, hitting 10 percent in October 2009.[19][20][21]

This period of stagnant growth and high unemployment lasted from December 2007 to June 2009. During this time, the federal government spent $700 billion via the Troubled Asset Relief Program (TARP) in an attempt to support the failing financial system. Lawmakers supporting TARP claimed that certain financial institutions, such as Citigroup and Wells Fargo, were “too big to fail,” meaning that the failure of these entities would threaten the entire financial system. Critics referred to this program as a "bailout," arguing that the program forced taxpayers to rescue, or "bailout," a private industry.[22][23]

In 2009, Representative Barney Frank (D) and Senator Chris Dodd (D) drafted a financial regulation bill, known as Dodd-Frank, which was introduced in the United States House of Representatives in December 2009 and enacted the following year. According to the United States House of Representatives Financial Services Committee, Dodd-Frank created 400 new financial regulations. Additionally, the bill created four new federal agencies: the Consumer Financial Protection Bureau (CFPB), the Office of Financial Research (OFR), the Federal Insurance Office (FIO), and the Financial Stability Oversight Council (FSOC).[24][25]

Federal regulation

Legislation

Dodd-Frank Act (2010)

- See also: Dodd-Frank Act

The stated purpose of the Dodd–Frank Wall Street Reform and Consumer Protection Act, adopted in 2010, was "to promote the financial stability of the United States by improving accountability and transparency in the financial system, to end 'too big to fail,' to protect the American taxpayer by ending bailouts, to protect consumers from abusive financial services practices, and for other purposes."[26]

According to the House Financial Services Committee, Dodd-Frank created 400 new financial regulations. Additionally, the sixteen-title act created four new federal agencies: the Consumer Financial Protection Bureau (CFPB), the Office of Financial Research (OFR), the Federal Insurance Office (FIO), and the Financial Stability Oversight Council (FSOC).[27]

The act was subject to debate. Proponents argued that the regulations mandated by the Dodd-Frank Act were necessary for financial markets. Opponents, however, argued that the rules in the act would not mitigate financial risk and challenged the constitutionality of the act. At the signing ceremony for the act, President Barack Obama said the following:[28]

| “ | The fact is, the financial industry is central to our nation’s ability to grow, to prosper, to compete and to innovate. There are a lot of banks that understand and fulfill this vital role, and there are a whole lot of bankers who want to do right -- and do right -- by their customers. This reform will help foster innovation, not hamper it. It is designed to make sure that everybody follows the same set of rules, so that firms compete on price and quality, not on tricks and not on traps.[18] | ” |

| —President Barack Obama | ||

John Boehner (R), the House minority leader at the time of the bill's passage, said the following on July 15, 2010:[29]

| “ | It ought to be repealed. The financial reform bill is ill-conceived. There are common-sense things that we should do to plug the holes in the regulatory system that (already) were there and to bring more transparency to financial transactions. It’s going to punish every banker in America for the sins of a few on Wall Street.[18] | ” |

Truth in Lending Act (1968)

According to the Office of the Comptroller of the Currency, the Truth in Lending Act (TILA) is a federal law intended to promote accurate credit billing and credit card practices. The act was signed into law by President Lyndon B. Johnson in 1968 and took effect in July 1969. Initially, the act gave regulatory authority to the Federal Reserve Board, but this authority was transferred to the Consumer Financial Protection Bureau in July 2011 as part of the Dodd-Frank Act.[30][31]

TILA mandated that all consumer lenders disclose to borrowers the annual percentage rate, or APR, of loans. This was in response to misleading interest rate calculations some lenders had been using. TILA also required lenders to provide consumers with loan cost information, including the length of the loan and total costs, and mandated that loans covered under the act be subject to a three-day period during which a customer could back out of the loan process.[30][32]

Glass-Steagall Act (1933)

- See also: Glass-Steagall Act

According to the Congressional Research Service, the Glass-Steagall Act, also known as the Banking Act of 1933, was enacted to limit the interaction between investment and commercial banks.[33][34]

Commonly, Glass-Steagal refers to four specific provisions of the law. These four provisions separated commercial and investment banking by preventing member banks of the Federal Reserve from dealing in non-governmental securities for customers, investing in non-investment-grade securities for themselves, underwriting and distributing non-governmental securities, or affiliating with any company involved in these activities. This separation also prevented investment banks from accepting deposits from customers.[33][35]

In the 1960s, bank regulators and the Office of the Comptroller of the Currency issued interpretations of the act that allowed banks and affiliates to engage in increasing amounts of securities activities. Beginning in the 1980s, the United States Congress debated repealing the act. The act was repealed in 1999 via the Gramm–Leach–Bliley Act.[33][35]

According to some politicians and economists, this repeal contributed to the financial crisis of 2008. According to economist Joseph Stiglitz, "As we stripped back the old regulations, we did nothing to address the new challenges posed by 21st-century markets." Others argued that the repeal of Glass-Steagall had nothing to do with the crisis, or that the effects were minor. In a 2015 interview, former president Bill Clinton, who signed the Gramm–Leach–Bliley Act into law, said, "There's not a single, solitary example that [the repeal of Glass-Steagall] had anything to do with the financial crash."[36][37]

Regulators

Federal Deposit Insurance Corporation

- See also: Federal Deposit Insurance Corporation

The Federal Deposit Insurance Corporation (FDIC) is an independent government corporation that provides deposit insurance to banks. Deposit insurance covers a depositor's accounts dollar-for-dollar in the event of a bank failure or closing, ensuring that depositors do not lose their money as a result of a bank's actions. The FDIC was created as part of the Glass-Steagall Act, after numerous bank failures had eroded trust in the nation's banking system. Bank failures occur when banks are unable to meet their financial obligations and thus become insolvent. As banks failed, many depositors began withdrawing money from their own banks, fearing that they too would also become insolvent. These mass withdrawals, referred to as bank runs, further eroded trust in the banking system, as banks closed after being unable to handle the volume of withdrawal requests. At its creation, the FDIC insurance limit was $2,500. This limit was raised periodically after its creation; for example, the Dodd-Frank Act expanded this coverage to $250,000.[38][39]

The FDIC does not receive public funds. Instead, the FDIC is funded by membership dues paid by member banks. While no federal law mandates participation, most states require banks to be members in the FDIC to be chartered in the state. As of October 2014, the FDIC employed over 7,000 people and insured over 6,000 institutions.[40]

National Credit Union Administration

- See also: National Credit Union Administration

The National Credit Union Administration (NCUA) is an independent federal agency created to regulate and supervise federal credit unions. The NCUA was originally known as the Bureau of Federal Credit Unions, and was renamed in 1970 due to an overhauling of authority and the formation of the National Credit Union Share Insurance Fund (NCUSIF), a fund intended to insure deposits at federal credit unions.[41]

The NCUA is governed by a three-member board appointed by the President of the United States with the advice and consent of the United States Senate. Members serve six-year terms. The NCUA is organized through five regional offices, which cover specific states and territories. As of May 2016, the NCUA employed over 1,200 people.[42]

Like the FDIC, the NCUA and NCUSIF do not receive public funds and are instead funded by dues paid by participating federal credit unions. All federally-chartered credit unions are required to participate, and thought it is not required of them, most state-chartered credit unions also participate. Deposits at federal credit unions are insured up to $250,000.[43]

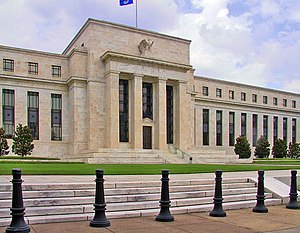

Federal Reserve

- See also: Federal Reserve

The Federal Reserve System, also referred to as the Fed, is the central banking system of the United States. The Fed was established on December 23, 1913, as part of the Federal Reserve Act, as a result of financial crises that some believed showed a need for central control of the nation's monetary system. Financial crises, such as the Great Depression and the Great Recession, led to the expansion of the Fed's authority and responsibilities.[44]

According to the Fed, its duties fall into four areas:

| “ |

|

” |

The Fed is composed of the Board of Governors (who are presidentially appointed), the Federal Open Market Committee, twelve Federal Reserve Banks, privately owned member banks, and advisory councils.[46]

As the Fed is the central bank of the nation, the United States government receives the profits of the system, after a dividend is paid to member banks. In 2015, the Fed made a profit of $100.2 billion, of which $97.7 billion went to the United States Treasury. The rest was used to fund a surplus account for federal infrastructure projects.[47]

State regulation

Legislation

Financial institutions are regulated under Title 6 of the Alaska State Code. As part of Alaska's Code, banks are subject to examination by the Department of Commerce, Community, and Economic Development at least once every 18 months. The department may, as part of this examination, determine that a bank is in danger of becoming illiquid if the bank does not meet the state's reserve fund requirements. If this happens, the bank has 15 days from notification of this decision to submit a plan to the department to correct the condition and bring the bank into compliance with the state's reserve fund requirements.[48]

Blue sky laws

Blue sky laws regulate the sale of securities. Blue sky laws are enacted at the state level and are enforced by state regulatory agencies. Alaska's blue sky law, the Alaska Securities Act, is contained within Title 45, Chapter 45.55 of the Alaska State Code.[49]

Regulators

State governments may charter, regulate, and supervise depository institutions. States are the primary regulators in the insurance field. States also have authority over securities companies, mortgage lending companies, personal finance companies, and other types of companies offering financial services.

Division of Banking and Securities

The Division of Banking and Securities regulates financial institutions in the state of Alaska. The division serves as part of the state's Department of Commerce, Community, and Economic Development. The division includes three sections: banking, consumer finance, and securities. The banking section charters and examines state-chartered banks, bank holding companies, credit unions, and similar institutions. As part of its responsibilities, the banking section publishes a directory of banks and financial institutions, available here. The consumer finance section registers, licenses, examines, and investigates complaints regarding non-depository financial institutions. The securities and enforcement section examines and registers securities, securities dealers, and salespeople.[50]

Impact

FRASE regulation score

Devised by the Mercatus Center at George Mason University, the federal regulation and state enterprise (FRASE) index score measures the impact of federal financial regulations on a state's economy. The Mercatus Center describes the scoring rubric as follows: “ A FRASE index score of 1 means that federal regulations affect a state to precisely the same degree that they do the nation as a whole. A score higher than 1 means federal regulations have a higher impact on the state than on the nation, and a score less than 1 means they have a lower impact on the state.”[51][52]

As of 2016, Alaska earned a FRASE index score of 1.63, ranking second in the nation. The table below compares the FRASE score and ranking of Alaska with those of neighboring states.[53]

| FRASE index scores, as of 2016 | |||||||

|---|---|---|---|---|---|---|---|

| State | FRASE index score | FRASE ranking | |||||

| Alaska | 1.63 | 2 | |||||

| California | 0.92 | 29 | |||||

| Oregon | 0.80 | 46 | |||||

| Washington | 1.04 | 19 | |||||

| Source: Mercatus RegData, "The Impact of Federal Regulation on the 50 States," accessed September 28, 2016 | |||||||

Federal regulations vary from state to state according to industry concentrations. For example, a state like New York with a large financial sector will face different impacts from financial regulation than states like Michigan, where the primary industry is manufacturing.[54]

According to the Mercatus Center, restrictions imposed by regulatory bodies, which are regulations that include legal obligations such as "shall," "must," and "prohibited," grew from 55,613 in 1997 to 65,486 in 2010, an increase of 1.4 percent annually. After the passage of the Dodd-Frank Act in 2010, restrictions grew from 65,486 in 2010 to 78,270 in 2012, an increase of 9.8 percent annually.[55]

Banking data

Depository institutions include banks, savings and loan associations, and credit unions. These entities are critical to financial markets because they operate payment systems. When banks fail, or become insolvent, there are serious implications for the economy as a whole. To analyze the banking system, it is useful to look at the number of depository institutions, the number of institutions that fail, the amounts of deposits, and the number of newly created banks. For the purposes of the table below, commercial banks include national banks, state-chartered commercial banks, loan and trust companies, stock savings banks, private banks under state supervision, and industrial banks. Branches include all offices of banks operating more than one office. Offices include multiple service offices, military facilities, drive-in facilities, loan production offices, consumer credit offices, seasonal offices, administrative offices, messenger service offices, supermarket banking offices and other offices.[56]

In 2016, there were a total of four commercial banks in Alaska, with total deposits of $91.44 billion. The table below compares these numbers with those of neighboring states.

| State banking data, 2015 (dollars in billions) | |||||||

|---|---|---|---|---|---|---|---|

| State | Commercial banks | Branches | Offices | Deposits | |||

| Alaska | 4 | 122 | 126 | $91.44 | |||

| California | 182 | 6,897 | 7,079 | $1,161.21 | |||

| Oregon | 22 | 1,018 | 1,040 | $65.69 | |||

| Washington | 40 | 1,653 | 1,693 | $134.52 | |||

| Source: Federal Deposit Insurance Corporation, "BankFind," accessed September 28, 2016 Source: American Bankers Association, "Total Deposits by State," accessed October 3, 2016 | |||||||

Changes in institutions

In 2015, no new financial institutions opened in Alaska, and none closed. The table below compares institution figures in Alaska with those of neighboring states. For the purposes of the table below, new charters are newly chartered or licensed financial institutions. Conversions refer to existing institutions that convert to any type of entity that meets the definition of a commercial bank and receives FDIC insurance; conversions also include relocations from one state to another. Unassisted mergers refer to voluntary mergers or consolidations, while failures represent mergers, consolidations, or closures that were a result of supervisory actions.[57]

| Changes in institutions, 2015 | |||||||

|---|---|---|---|---|---|---|---|

| State | Additions | Deletions | |||||

| New charters | Conversions | Unassisted mergers | Failures | ||||

| Alaska | 0 | 0 | 0 | 0 | |||

| California | 0 | 0 | 15 | 0 | |||

| Oregon | 0 | 0 | 3 | 0 | |||

| Washington | 0 | 0 | 6 | 1 | |||

| Source: Federal Deposit Insurance Corporation, "Commercial Bank Reports," accessed September 28, 2016 | |||||||

Financial crimes

In 2015, a total of 4,898 financial crimes were reported in Alaska according to the Financial Crimes Enforcement Network (FINCEN), an agency of the United States Department of Treasury. This information comes from complaints filed by consumers; FINCEN compiles these complaints via Suspicious Activity Reports (SAR). In July 2012, FINCEN mandated electronic filing for all complaints and reports, which may explain the general spike in reported crimes that occurred between 2012 and 2013. Considering the trends in financial crimes is one way to gauge the effectiveness of financial regulation in preventing fraud and abuse.[58]

The table below provides financial crimes data for Alaska and surrounding states

| Financial crimes, 2012 to 2015 | ||||

|---|---|---|---|---|

| State | 2012 financial crimes | 2013 financial crimes | 2014 financial crimes | 2015 financial crimes |

| Alaska | 113 | 2,594 | 3,971 | 4,898 |

| California | 13,126 | 252,925 | 335,852 | 354,771 |

| Oregon | 505 | 8,574 | 12,510 | 15,375 |

| Washington | 1,066 | 18,409 | 25,225 | 30,828 |

| Source: Financial Crimes Enforcement Network, "Suspicious Activity Report Statistics," accessed September 28, 2016 | ||||

Recent legislation and news

Recent legislation

The following is a list of recent finance policy bills that have been introduced in or passed by the Alaska state legislature. To learn more about each of these bills, click the bill title. This information is provided by BillTrack50 and LegiScan.

Note: Due to the nature of the sorting process used to generate this list, some results may not be relevant to the topic. If no bills are displayed below, then no legislation pertaining to this topic has been introduced in the legislature recently.

State legislation

Recent news

The link below is to the most recent stories in a Google news search for the terms Alaska financial regulation. These results are automatically generated from Google. Ballotpedia does not curate or endorse these articles.

See also

Financial regulation in the 50 states

Click on a state below to read more about financial regulation in that state.

External links

Footnotes

- ↑ Board of Governors of the Federal Reserve System, "Government Performance and Results Act Annual Performance Report 2011," July 10, 2012

- ↑ The National Bureau of Economic Research, "A Brief History of Regulations Regarding Financial Markets in the United States: 1789 to 2009," September 2011

- ↑ Federal Deposit Insurance Corporation, "The U.S. Federal Financial Regulatory System: Restructuring Federal Bank Regulation," January 19, 2006

- ↑ Brookings, "The Origins of the Financial Crisis," November 24, 2008

- ↑ The Cato Institute, "Did Deregulation Cause the Financial Crisis?" July 2009

- ↑ Investopedia, "Commercial Bank," accessed October 18, 2016

- ↑ Investopedia, "Credit Union," accessed October 18, 2016

- ↑ Business Dictionary, "Depository institution," accessed October 18, 2016

- ↑ Investopedia, "Financial System," accessed October 18, 2016

- ↑ Investopedia, "Investment Banking," accessed October 18, 2016

- ↑ Investopedia, "Security," accessed October 18, 2016

- ↑ Federal Reserve History, "The Panic of 1907," accessed November 2, 2016

- ↑ Investopedia, "Bank Panic of 1907," accessed November 2, 2016

- ↑ Federal Reserve Bank of Boston, "Panic of 1907," accessed November 2, 2016

- ↑ The New York Times, "What Is Glass-Steagall? The 82-Year-Old Banking Law That Stirred the Debate," October 14, 2015

- ↑ Wall Street Journal, "Long Study of Great Depression Has Shaped Bernanke's Views," December 7, 2005

- ↑ Investopedia, "The Great Recession," accessed November 1, 2016

- ↑ 18.0 18.1 18.2 18.3 Note: This text is quoted verbatim from the original source. Any inconsistencies are attributable to the original source.

- ↑ Bureau of Labor Statistics, "The Recession of 2007–2009," February 2012

- ↑ The Atlantic, "It Wasn't Household Debt That Caused the Great Recession," May 21, 2014

- ↑ Heritage Foundation, "Government Policies Caused The Financial Crisis And Made the Recession Worse," accessed December 1, 2016

- ↑ United States Treasury Department, "TARP Programs," January 13, 2016

- ↑ The New York Times, "If It’s Too Big to Fail, Is It Too Big to Exist?" June 20, 2009

- ↑ Office of the Clerk, "Final Vote Results for Roll Call 413," accessed October 11, 2016

- ↑ Financial Services Committee, "Oversight of Dodd-Frank Act Implementation," accessed October 11, 2016

- ↑ Government Publishing Office, "HR 4137," January 5, 2010

- ↑ Dodd Frank Update, "Dodd-Frank Summary," accessed September 8, 2016

- ↑ whitehouse.gov, "Remarks by the President at Signing of Dodd-Frank Wall Street Reform and Consumer Protection Act," July 21, 2010

- ↑ Washington Times, "Boehner calls for repeal of Wall Street reform bill," July 15, 2010

- ↑ 30.0 30.1 Office of the Comptroller of the Currency, "Truth in Lending," accessed September 29, 2016

- ↑ Consumer Finance Protection Board, "Truth in Lending Act," accessed September 29, 2016

- ↑ Investopedia, "Truth In Lending Act - TILA," accessed September 29, 2016

- ↑ 33.0 33.1 33.2 The New York Times, "What Is Glass-Steagall? The 82-Year-Old Banking Law That Stirred the Debate," October 14, 2015

- ↑ Congressional Research Service, "The Glass-Steagall Act: A Legal and Policy Analysis," January 19, 2016

- ↑ 35.0 35.1 Investopedia, "Glass-Steagall Act," accessed September 29, 2016

- ↑ Vanity Fair, "Capitalist Fools," January 2009

- ↑ Inc., "Bill Clinton on How Entrepreneurs Can Transform the Country," September 2015

- ↑ Federal Deposit Insurance Corporation, "History of the FDIC," accessed October 4, 2016

- ↑ Federal Deposit Insurance Corporation, "Deposit Insurance FAQs," accessed October 4, 2016

- ↑ Federal Deposit Insurance Corporation, "Who is the FDIC?" accessed October 4, 2016

- ↑ National Credit Union Administration, "History," August 28, 2015

- ↑ National Credit Union Administration, "Leadership," May 6, 2016

- ↑ National Credit Union Administration, "Share Insurance Fund Overview," September 21, 2015

- ↑ Board of Governors of the Federal Reserve System, "Federal Reserve Timeline," accessed October 4, 2016

- ↑ Board of Governors of the Federal Reserve System, "Mission," November 6, 2009

- ↑ Board of Governors of the Federal Reserve System, "Structure of the Federal Reserve System," October 3, 2016

- ↑ Los Angeles Times, "Federal Reserve sends record $97.7-billion profit to Treasury," January 11, 2016

- ↑ Alaska Legal Resource Center, "3 AAC 02.110. Reserves against deposits," accessed November 28, 2016

- ↑ Alaska State Legislature, "Chapter 45.55 ALASKA SECURITIES ACT," accessed November 28, 2016

- ↑ State of Alaska, "Division of Banking and Securities," accessed November 28, 2016

- ↑ Mercatus RegData, "The Impact of Federal Regulation on the 50 States," accessed September 28, 2016

- ↑ RegData, "The Impact of Federal Regulation in the 50 States," accessed October 18, 2016

- ↑ Mercatus RegData, "The FRASE Index," accessed September 28, 2016

- ↑ Mercatus RegData, "The Impact of Federal Regulation on the 50 States," accessed September 28, 2016

- ↑ Mercatus RegData, "Measuring the Dodd-Frank Act (and Other Major Acts) with RegData 2.0," September 23, 2014

- ↑ Federal Deposit Insurance Corporation, "Index to Notes on Insured Commercial Banks," accessed October 11, 2016

- ↑ Federal Deposit Insurance Corporation, "Index to Notes on Insured Commercial Banks," accessed October 6, 2016

- ↑ Financial Crimes Enforcement Network, "Suspicious Activity Report Statistics," accessed September 28, 2016

|

State of Alaska Juneau (capital) |

|---|---|

| Elections |

What's on my ballot? | Elections in 2024 | How to vote | How to run for office | Ballot measures |

| Government |

Who represents me? | U.S. President | U.S. Congress | Federal courts | State executives | State legislature | State and local courts | Counties | Cities | School districts | Public policy |