Kenya Shilling Down to KSh 130 Per US Dollar as CBK Maintains Forex Reserves Above KSh 900b

- The Central Bank of Kenya (CBK) reported that the Kenya shilling remained stable against major international and regional currencies during the week ending May 16, 2024

- The shilling gained value against the US dollar, exchanging at KSh 130.48 per US dollar on May 16, compared to KSh 131.25 on May 9

- Joan Ogara, a forex market and finance expert told TUKO.co.ke that forex market volatility is highly influenced by speculations and the demand for dollars

- Ogara emphasised the need for Kenya to attract foreign investments, diversify exports, and strengthen local industries to sustain the shilling's value

PAY ATTENTION: Leave your feedback about TUKO.co.ke. Fill in this short form. Help us serve you better!

Elijah Ntongai, a journalist at TUKO.co.ke, has more than three years of financial, business, and technology research expertise, providing insights into Kenyan and global trends.

The Central Bank of Kenya (CBK) released its weekly disclosures, reporting stable foreign exchange rates for the Kenya shilling.

Source: UGC

In the bulletin for the week ending May 16, CBK reported that the shilling gained against the US dollar compared to the first week of May.

"The Kenya shilling remained stable against major international and regional currencies during the week ending May 16. It exchanged at KSh 130.48 per US dollar on May 16, compared to KSh 131.25 per US dollar on May 9," CBK reported.

PAY ATTENTION: Share your outstanding story with our editors! Please reach us through news@tuko.co.ke or WhatsApp: 0732482690.

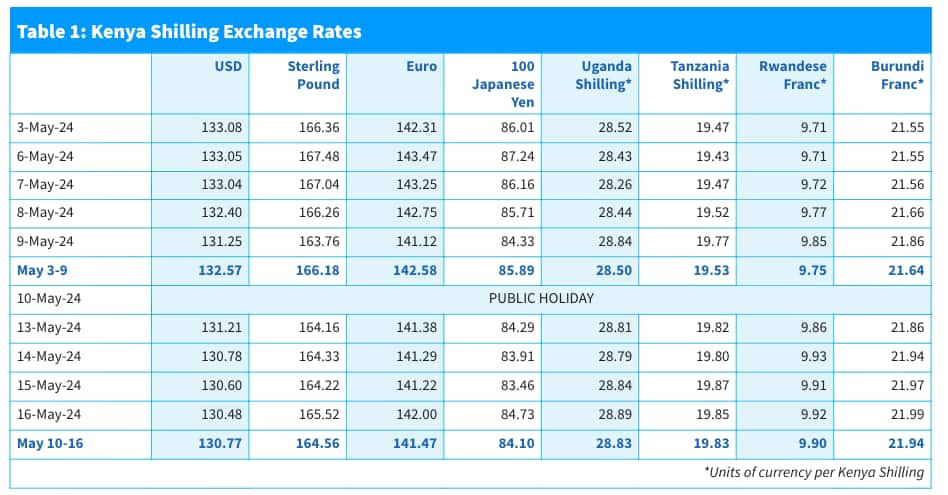

Notably, the Kenya shilling gained against other major global and regional currencies, as shown in the table below.

Source: UGC

Compared to East African currencies, the Kenya shilling lost cents against the Uganda, Tanzania and Burundi currencies and gained cents against the Rwandese Franc, as shown in the table above.

The US dollar has experienced losses against major currencies in the world and Africa in recent weeks.

Read also

Finance Bill 2024: Foreigners Working Remotely for Kenyan Employers Required to Register for KRA PIN

Kenya's forex reserves

Owing to the strong shilling, the CBK has maintained the national foreign exchange reserves to the required minimum.

"The usable foreign exchange reserves remained adequate at USD 7,130 million (3.8 months of import cover) as of May 16. This meets the CBK’s statutory requirement to endeavour to maintain at least 4 months of import cover," Said CBK.

Factors affecting Kenya's forex market

Speaking to TUKO.co.ke, Joan Ogara, a forex market and finance expert, noted that the forex markets are still volatile because of the increased dependency on market speculations.

"The demand for dollars has not declined. Sceptics who are speculating a further depreciation are still hoarding while others are taking advantage of the current appreciation to buy dollars. In order to make a sound financial decision of whether to buy or sell, investors must not be swayed by speculatory market sentiments but rather be grounded on fundamental analysis," Ogara told TUKO.co.ke.

Ogara noted that to maintain the shilling's value against the dollar, the government must create an environment that attracts foreign direct investments and exports.

This will ensure the value of the shilling is founded on a sustainable economic foundation.

"As a mid-term to long-term strategy, for the currency to stabilise and even appreciate, Kenya needs to create a favourable business environment, increase and diversify its exports, seriously invest in agriculture, support local manufacturing to avoid depleting its foreign reserves in unnecessary imports and create a strong regulatory framework that curbs pilferage of public resources now that we are borrowing foreign debt to finance local projects," said Ogara.

As reported earlier on TUKO.co.ke, the appreciation of the Kenya shilling began in February following the inflow of US dollars after the issuance of a new Euro Bond in 2024.

Proofreading by Otukho Jackson, a multimedia journalist and copy editor at TUKO.co.ke

Source: TUKO.co.ke