Vinod Khosla: Indian start-ups with strong fundamentals will get funding

- Published

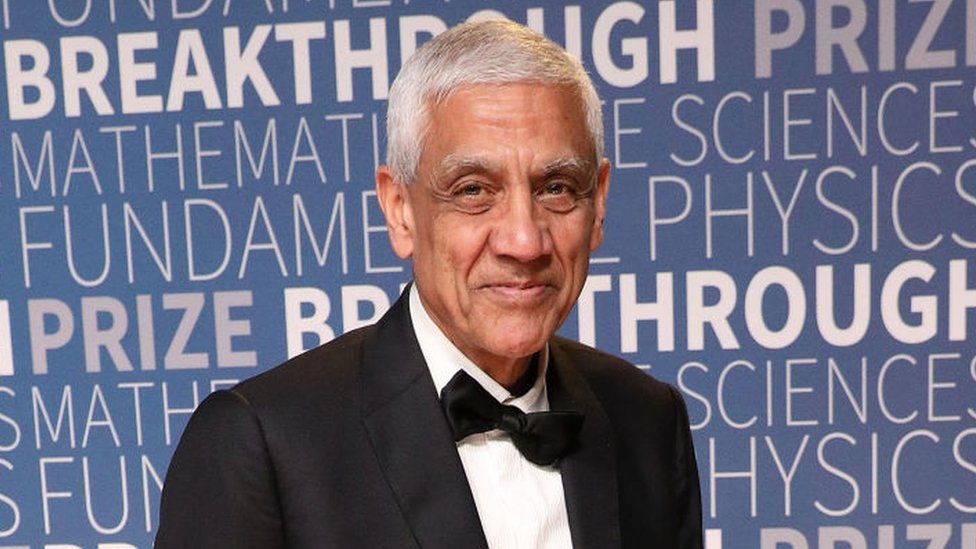

Vinod Khosla is a Silicon Valley veteran

Indian start-ups with "strong fundamentals" will continue to be funded even as investor exuberance wanes, says Indian-origin Silicon Valley veteran Vinod Khosla.

Mr Khosla, who co-founded technology giant Sun Microsystems in 1982, was speaking to the BBC about the likely impact of the current financial climate on the start-up ecosystem in India and globally, and the recent problems in the banking sector.

The US Federal Reserve has been raising interest rates in a bid to stabilise prices, but this has caused strains in the banking system - two US banks, including Silicon Valley Bank which lent largely to the tech sector, collapsed earlier this month. Many central banks have also announced measures to keep credit flowing through banking systems.

Mr Khosla, a billionaire investor who has funded several Silicon Valley start-ups, warns, however, that company valuations on offer will be lower as the availability of capital declines. That's because inflation, higher interest rates and lower revenue growth at tech companies - after a period of robust hiring and expansion - have impacted availability of funds, changing investor sentiment.

Earlier, says the 68-year-old, it was easy for a start-up "to get a billion-dollar valuation which made no sense. I think that will moderate down".

Over the past few years, several tech companies have gone public with huge valuations in the US and other parts of the world. Vast amounts of wealth generation and near-zero interest rates had created an easy supply of venture capital. Many prominent funds poured money into India, and "everything [valuations] got bid up, which made no economic sense".

But as the supply of capital contracts, this won't be sustainable anymore - and it could actually be positive in the long term.

"The wheat will get separated from the chaff," Mr Khosla says, adding that "not-so-good Indian start-ups will not get funded and go bust" this year.

As a result, there will be fewer but larger start-ups. These companies could use their capital more efficiently as they won't have to compete with smaller firms, Mr Khosla says, although he adds a caveat that he is not in India "day to day" and hence "doesn't know the ground reality".

Given global headwinds, investors could benefit from taking a steady, long-term approach, he says, rather than making sporadic or hype-driven impulsive investments.

Sun Microsystems, co-founded by Mr Khosla, was acquired by Oracle in 2009

Mr Khosla believes that technology has driven a large part of GDP growth in the US and defined the country's global competitiveness. Now, he sees India getting the same opportunity.

"There is long-term opportunity in India as a major developing country with lots of GDP growth to be captured by start-ups," Mr Khosla says.

He adds that these companies can also benefit from supportive government policies.

"India Stack, UPI [Unified Payments Interface] and others are good infrastructure for the start-up ecosystem to develop on," Mr Khosla says, referring to India's unique digital infrastructure that aids cashless transactions across sectors.

The venture firm Mr Khosla founded in 2004, Khosla Ventures, is based in Menlo Park, California, and focuses on investing in a range of areas including enterprise, semiconductors, biomedicine, big data, and robotics.

The firm was the first to invest in OpenAI, the San Francisco-headquartered Artificial Intelligence (AI) research lab whose products include the chatbot ChatGPT, which is now used by millions of people.

Mr Khosla, whose firm manages over $15bn (£12bn) in assets, says that when stock markets were buoyant, new venture funds proliferated.

When capital becomes easily available, investing becomes cheap; and because it's "other people's money" - as referred to in the investment community - speculative investments become rampant.

"It's free money at zero interest rates and suddenly there's a lot of bets that make sense. That's the problem," he says.

But once this "hype phase" peters out, venture funds that don't have access to good entrepreneurs or enjoy a reputation among them will have poor returns and will either consolidate or not get more funds.

"That's already happening; a lot of funds that got funded three years ago are not getting funded today," he says.

Silicon Valley Bank collapsed after its troubles sparked a rush of customer withdrawals

Talking about the recent collapse of America's Silicon Valley Bank, Mr Khosla says he thinks that the crisis has been handled, but it raises questions about the fragility of the banking sector.

The $212bn bank collapsed after its clients - including large and small tech companies and prominent venture firms - withdrew $42bn in one day, fearing for its fiscal health. A rival bank has bought its assets and loans.

Mr Khosla says that the banking sector in the US and other countries is plagued by unrealised losses - which arise from assets that have decreased in value. In the current climate, this decline could can be attributed to rising interest rates.

Unless regulators handle this fundamental problem well, problems in the banking sector could escalate, affecting businesses all over the world, including the tech innovation ecosystem, he says.

But the current slump, he says, is just a natural part of a capitalistic fluctuating cycle and the technology sector will ultimately benefit from the tightening of capital as "money will get focused on the best opportunities".

"There will be phoenixes rising from the ashes. Really innovative ideas will get funded; they won't get the valuation they got before, but four years from now, we'll be in the middle of another hype cycle. When that happens, fewer companies will do well, they'll be much bigger and better," he says.

And he has one prediction for the future: "AI will be dominant everywhere."

BBC News India is now on YouTube. Click here, external to subscribe and watch our documentaries, explainers and features.