How do you know how much an investment is worth? Conducting a discounted cash flow (DCF) analysis is the best way to arrive at an educated estimate, whether you’re assessing the cost of a specific project, purchasing shares of a publicly traded company, or investing in a private business.

Previously, we looked at how private and public comps help analysts compare companies within a similar growth stage and industry to determine a company’s current market value. Coupled with an intrinsic valuation method like discounted cash flow analysis—which evaluates the value of an investment based on its projected future cash flows—DCF models can help investors, business owners, and transaction advisors gauge a company’s current market value, before assessing if that company is under- or overvalued.

Wondering how to value a company using discounted cash flow analysis? Here we explore the discounted cash flow model and why this valuation method is important to use in conjunction with public and private comps when assessing the value of a business.

What is discounted cash flow (DCF) analysis?

Discounted cash flow analysis is an intrinsic valuation method used to estimate the value of an investment based on its forecasted cash flows. It establishes a rate of return or discount rate by looking at dividends, earnings, operating cash flow, or free cash flow, which is then used to establish the value of the business outside of other market considerations.

In other words: DCF models look to answer the question, “How much money will I get from this investment over a period of time, and how does that compare to the amount I could make from other investments?”

It does this by adjusting for the time value of money—which assumes a dollar invested today is worth more than a dollar invested tomorrow because it’s generating interest over that period.

How does discounted cash flow analysis work?

Conducting a discounted cash flow analysis involves making assumptions about a variety of factors, including a company’s forecasted sales growth and profit margins (its cash flow), the interest rate on the initial investment in the business, the cost of capital, and potential risks to the company’s underlying value (its discounted rate). All these considerations are then combined in a discounted cash flow model to shine light on the future cash flows of an investment. The more insight into a company’s financials you have, the simpler the process becomes.

But with so many variables, it’s easy to see why pricing a deal can be difficult, and why most investors and transaction advisors choose to use multiple types of valuation models to inform their decision-making along with DCF analysis. An accurate answer helps inform how much an investment is currently worth—and which deals are worth walking away from.

What are the main three inputs of a discounted cash flow model?

Discounted cash flow models typically consider three values:

- DCF—Discounted cash flow, which is the sum of all future discounted cash flows that an investment is expected to produce

- CF—Cash flow for a given year

- r—Discount rate, or the target rate of return on the investment expressed in decimal form

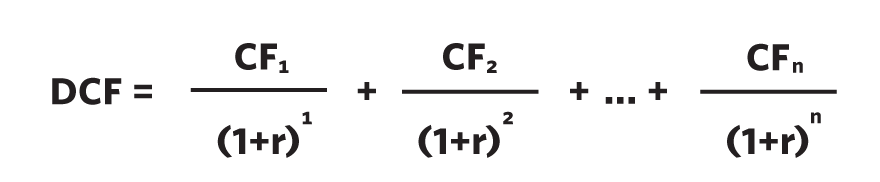

Here’s the basic discounted cash flow formula for a simplified analysis:

Keep in mind, there are a wide range of formulas used for discounted cash flow analysis outside of this simplified one, depending on what type of investment is being analyzed and what financial information is available for it. This discounted cash flow formula is simply meant to highlight the general reasoning used in the process.

Benefits and drawbacks of discounted cash flow analysis

In using discounted cash flow models to gain insight into an investment’s value, it’s important to consider the benefits and drawbacks of this approach. Namely, this method of valuation relies on estimates, and the projection can only be as accurate as these assumptions.

Advantages of discounted cash flow analysis

Discounted cash flow analysis values company’s or investments through a unique lens, offering some unique benefits over alternative valuation methods:

- DCF models allow you to calculate the “intrinsic value” of a business. Since it calculates value apart from subjective market sentiment, it is considered a more objective valuation method than other alternatives. The market can often misprice companies, and the discounted cash flow analysis is unaffected by temporary market distortions.

- DCF models consider the long-term value of a potential investment. Discounted cash flow analysis assesses the potential earnings of an investment over the long-term, considering the time value of money and allowing investors to estimate how long it will take them to see a certain level of return.

- DCF models offer an extremely detailed approach to valuations. Discounted cash flow analysis uses specific numbers and metrics that are derived based off assumptions about a business, including cash flow projections and discount rates. If these assumptions are accurate, it can provide a good picture of a company or investment’s value.

Disadvantages of discounted cash flow analysis

While discounted cash flow analysis has some unique characteristics over other valuation methods, there are also some important limitations to consider:

- DCF analysis depends on accurate estimates. Discounted cash flow analysis models rely heavily on the assumptions previously mentioned, and if these estimations are inaccurate, it can have a significant impact on the investor. For example, if an investor estimates future cash flows to be too high, it can result in an investment that won’t pay off in the future—hurting profits. Conversely, assuming cash flows to be too low can result in missed opportunities.

- Creating a DCF model requires significant data. Creating a discounted cash flow analysis model requires a substantial amount of financial information that can be difficult and timely to obtain and analyze.

- Using DCF models, it is difficult to estimate the terminal value of an investment, or the value of all future cash flows outside of a particular projection period. And the terminal value represents a large portion of a business’s total value.

How to build a discounted cash flow analysis model

Let’s say you’re looking at acquiring a 10% stake in a private company. It has an established and profitiable business model, and its revenue is growing at a consistent rate of 5% per year. Last year, it produced $2 million in cash flow, so a 10% stake purchased at that time would likely have yielded $200,000.

Here’s a simplified explanation of how discounted cash flow analysis might help you determine a what is a reasonable price for that 10% stake:

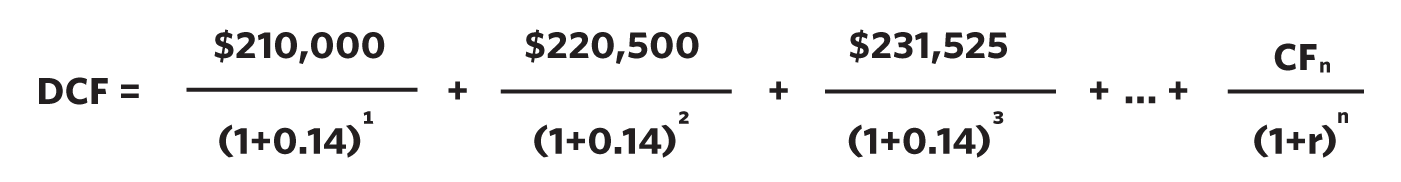

This year, the business would give you $210,000, assuming the company’s established 5% YoY revenue growth. Next year, $220,500, and so on, assuming the company’s growth rate stays consistent.

Let’s also assume your target compound rate of return is 14%—that is to say, the rate of return you know you can likely achieve on other investments. This means you wouldn’t want to purchase the stake in the business unless you knew you could achieve at least that rate of return; otherwise, you’re better off investing your money elsewhere. Because of this, 14% becomes the discount rate (r) you apply to all future cash flows for the prospective investment.

The numerators in the discounted cash flow formula above represent the expected annual cash flows, assuming a 5% YoY growth rate. Meanwhile, the denominators convert those cash flows into their present value since they’re divided by your target 14% annual compound interest. The DCF is the sum of all future cash flows and is the most you should pay for the stake in the company if you want to realize at least 14% annualized returns over whatever time period you choose.

For the sake of simplicity, let’s say you only have a three-year outlook for this investment—the table below illustrates how in this example, even as the expected cash flows of the company keep growing, the discounted cash flows will shrink over time. That’s because the discount rate is higher than the growth rate, meaning you’d make more money on your investment elsewhere, provided you were certain you could reach your target rate of return through other means.

| Year | Cash flow | Discounted cash flow |

| 1 | $210,000 | $184,210 |

| 2 | $220,500 | $169,668 |

| 3 | $231,525 | $156,273 |

| Total | $662,025 | $510,151 |

In this scenario, even though you’d hypothetically receive $231,525 in cash flow in year three of your investment, it would only be worth $156,273 to you today. Reason: If you invested that same amount today and realized a 14% YoY return on it through another investment, you could have turned it into $231,525 within the same time period. And because the discount rate (14%) is higher than the growth rate of the company’s cash flow (5%), the discounted versions of those future cash flows will continue to decrease in value each year until they reach zero.

Assuming your target YoY rate of return is 14% for this investment and your exit window is three years out, $510,151—the total DCF for that time period—is the most you should pay for the 10% stake at this time.

Discounted cash flow analysis vs NPV: How do you calculate NPV from DCF?

Often, investors use NPV along with discounted cash flow analysis when vetting the profitability of an investment. The net present value (NPV) builds upon the DCF formula by considering the cost of an initial investment through adjusting for the initial investment costs. In other words, it represents the present value of all future discounted cash flows subtracted by the original amount an investor paid for an investment. Calculating the NPV typically involves three values:

- CFn—the cash flow in each year of an investment

- r—the discount rate or the target rate of return on the investment expressed in decimal form

- Initial investment—the amount paid for the investment

Here’s the basic formula for NPV:

The result of calculating NPV can be positive or negative, as the initial investment costs to fund a given project can be either higher or lower than its present value. When NPV is positive, it demonstrates that there is additional value that can be made from an investment. Alternatively, when NPV is negative, it shows that the investment cost is greater than the cash flows the investment will generate over its lifespan. Therefore, NPV is often used by investors to determine the rationality of an investment.

Discounted cash flow analysis vs comparables: When should you use each approach?

Calculating discounted cash flow analysis is just one approach to calculating valuations. Building comparables and an accurate peer group is another. The widely accepted best practice for arriving at a valuation for a company combines a series of the three DCF models: private comps, public comps, and discounted cash flow analysis.

Discounted cash flow analysis will make it clearer how long it might take to see a certain level of return, whereas a comparable gives better insight into the mood of the market. Finding the inputs for a discounted cash flow analysis can also be more difficult than a comps analysis if you don’t have a trusted data source.

How to save time on your next company valuation

Accurately valuing a private company requires insight into the flow of capital across the entire venture capital, private equity, and M&A landscape—not to mention the public markets. The process can take up a lot of valuable analyst time, especially if your firm uses legacy valuation tools and data that live on disparate systems.

Integrating a tool like PitchBook into your workflow means you have access to the world’s largest database of multiples and valuations, as well as a suite of tools designed specifically to help you to work more efficiently.

We know that along with accuracy, speed is essential when building discounted cash flow analysis models. A thoroughly vetted transaction or company comparable analysis won’t do you much good if your target signs with someone else while you’re still doing it.

PitchBook lets you build financial models in a matter of minutes. By allowing you to quickly identify different types of funding rounds, companies, and financings, PitchBook enables you to seamlessly navigate between datasets to find relevant transactions fast.

Learn more about valuations and evaluating cash flows

Learn more about other types of valuation models

Read our blog: What’s the difference between relative and intrinsic business valuations?

Explore best practices for forecasting cash flows of private market funds

Read our blog: Best practices for optimizing cash flow forecasting

Gain a full view into how LPs can mitigate cash flow forecasting and commitment pacing challenges

Download our Allocator solutions: cash flow forecasting and commitment pacing report

Learn how to use IRR and public market equivalents to evaluate fund performance

Read our blog: What is the difference between IRR and PME?

Find out how PitchBook can help simplify your valuation workflow by checking out our full suite of valuation tools.

Learn more

Update: This article originally had a calculation error that has been corrected