PAN Card is a Permanent Account Number which consists of 10-digit alphanumeric characters and is assigned to all taxpayers in India. It is issued under the Indian Income Tax Act, 1961 by the Indian Income Tax Department under the supervision of the Central Board for Direct Taxes (CBDT).

Basically, PAN card is an electronic system in which all the tax related information of a person or company is recorded against a single PAN number. Let us tell you that two tax paying entities can't have the same PAN Card. For major financial transaction PAN card is mandatory like for opening a bank account, sale or purchase of assets etc. That is why PAN card provides the details of the account holder in a unique way.

Classification of characters in PAN Card

Out of these 10 digits of PAN card: the first five figures represents alphabets, next four digits are numbers and the last number is again an alphabet. All these digits have some meaning and reveal the information of the account holder.

For better understanding of the classification we have divided 10 characters of PAN card into five parts as follows:

(1) First three Characters:

The first three characters are normal alphabetic series starting from AAA to ZZZ. Department of I.T allocates the digits randomly which is a combination of the letters like AZT or ZRT.

(2) Fourth Character:

The fourth character represents the status of the PAN card holder. It is one of the most important character and those who deals in PAN card usually look at this character to identify the status of that particular person. The fourth character for a majority of PAN holders is the letter “P”, which stands for “person”. The other nine letters that can represent the fourth character are C, H, F, A, T, B, L, J, and G.

These letters stands for:

C – Company

H – Hindu Undivided Family

F – Firm

A – Association of Persons

T – Trust

B – Body of Individuals

L – Local Authority

J – Artificial Juridical Person

G – Government

Taxation in India: An Overview

(3) Fifth Character:

The fifth character represents the first alphabet of PAN holder’s last name or surname. Like a person has Amit Goyal name then G will be the fifth character on his PAN card because his last name’s first alphabet is G. Also, if your surname changes after marriage or due to any other reason, then also your PAN card number will remain unchanged.

(4) Sixth to Ninth characters:

These four characters are sequential numbers starting from 0001 to 9999. Like first three characters, here too the selection is random.

(5) Tenth Character:

The last or Tenth character in the PAN card is an alphabetic check digit which can be any alphabet.

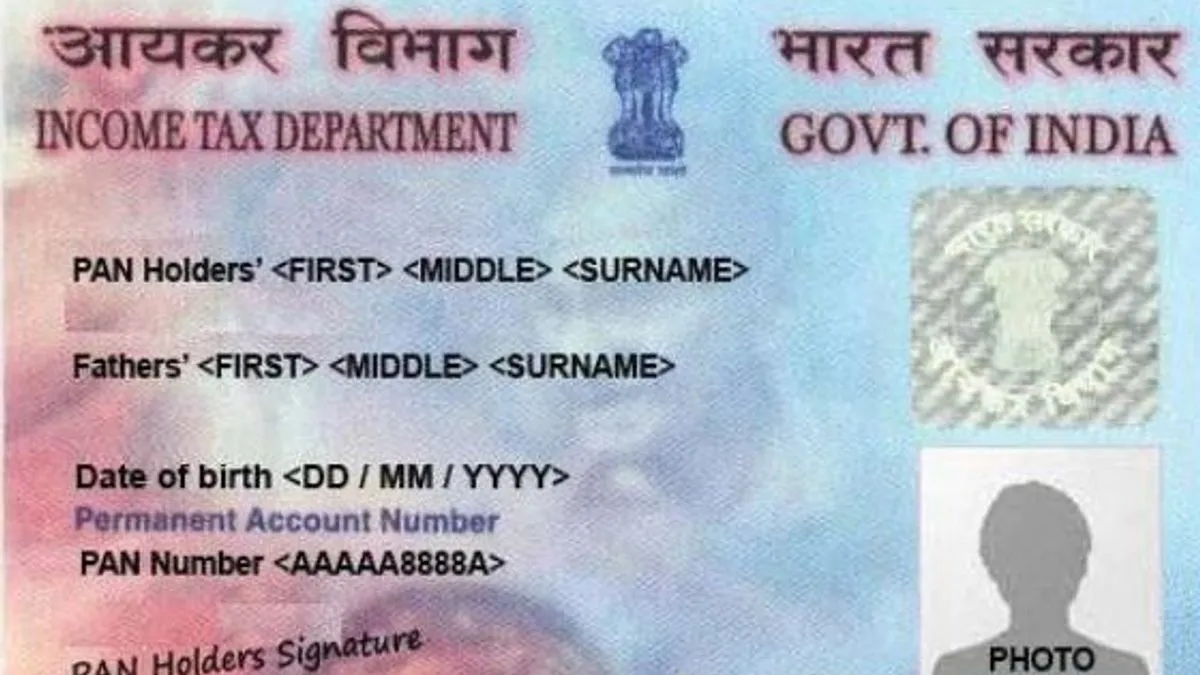

PAN card also consists of:

Name of cardholder - Individual or Company

Name of the father of the cardholder - Applicable for individual cardholders.

Date of birth - The cardholder's date of birth in case of an individual or date of registration is mentioned in case of company or firm.

Signature of the Individual - PAN card has individual signature as a proof required for financial transactions.

Photograph of the Individual - PAN card acts as a photo identity proof of the individual. In case of companies and firms, photogrpahs are not present on the card.

Have you thought that why this classification is important?

Income tax department can link all the transactions of a person with the department by the help of PAN card unique number. These transactions may be payment of tax, tax deduction, tax collection at source credits, income return, wealth, gift or may be any specified transactions etc. So, we can say that PAN card is a universal identification key which help in tracking the financial transactions that may have a taxable component to prevent the tax evasion. It remains unaffected throughout India by the change of address.

Benefits of PAN card

- PAN Card is important for doing transactions of sale or purchase of assets, of any immovable property valued at five lakh rupees or more, during sale and purchase of motor vehicles having more than two wheels.

- PAN card is required to open a bank account in both private and nationalised banks.

- PAN card is required for Phone connection.

- PAN card is required for new Gas connection.

- PAN Card is required to make one time payment against their bill of the amount exceeding twenty-five thousand rupees in any hotels and restaurants.

- To make payment in cash at any one time of more than twenty-five thousand rupees while travelling to any foreign country PAN card is required.

- PAN card may help in the deduction of fraudulent transactions. It also reduces tax evasion and provide transparency in transactions between buyer and seller.

Frequently asked questions on PAN Card

Q1. Who should apply for PAN Card?

Ans. In India, who earn taxable income which include foreign nationals and pay taxes. Also, persons who have retail business, services or consultancy and total sales business and turnover or gross receipt is exceeding Rs 5 lakhs in the previous financial year should apply for PAN card.

Q2. Can minor also apply for PAN Card?

Ans. Section 160 of IT Act, 1961 provides that a non-resident, minor, lunatic, idiot, and court of wards and such other persons may be represented through a Representative Assessee. In such cases, application for PAN will be made by the Representative Assessee.

Q3. How we can apply for PAN Card?

Ans. 1. For this, use ‘Form 49 A’ or ‘Form 49AA’ as applicable to you and for more details visit incometaxindia.gov.in. From the websites of Income Tax Department or National Securities Depository Limited (NSDL) you can find the location of PAN Card offices in any city. Also, photocopy of identity card and address proof is required to fill the form. Payment can be made via cheque, cash or DD in any nearby office.

Source:www.cdn.ndtv.com

2. You can also apply online through the websites of the I-T Department or NSDL. Fee can be paid via net banking, credit card or debit card. And you can even track your application online.

Source:www.google.co.in

Q4. Why there is a need for PAN Card?

Ans. PAN Card is necessary to file income tax returns, for the payment of direct taxes, to avoid deduction of tax at higher rate and also some provisions are there to enter in to specific transaction like sale or purchase of immovable property of Rs 5 lakh or more, Sale or Purchase of a vehicle other than a two wheeler, Payment to hotels or restaurants of amount exceeding Rs 25,000 at one time, deposit exceeding Rs 50,000 with any single banking institution in 24 hours, Payment exceeding Rs 5 lakh for purchase of bullion and jewellery, gas connection, phone connection, etc. PAN card is an identity proof and also act as a proof of address.

As we know that now it is mandatory to link PAN to Aadhaar for e-KYC and verification to avail services and benefits from respective service providers.

Q5. How long does it take to get a PAN card?

Ans. After applying for a new PAN card via online or offline it takes approximately 15 to 20 working days. In case if an individual want some correction or replacement then it takes around 30 to 40 working days. But it may vary depending upon the authorities discretion and load.

Q6. What are the documents required to apply for a new PAN card?

Ans.

- Driving License

- Elector's Photo Identity Card

- Passport

- Ration Card having photograph of the applicant

- Certificate of identity in original signed by a Gazetted Officer.

- Certificate of identity in original signed by a Member of Parliament.

- Certificate of identity in original signed by a Member of Legislative Assembly.

- Certificate of identity in original signed by a Municipal Councilor.

- Aadhaar Card issued by UIDAI

- Arm's License

- Photo Identity Card issued by the Central Government or a State Government or a Public Sector Undertaking.

- Pensioner Card having photograph of the applicant.

- Central Government Health Scheme card.

- Ex-Servicemen Contributory Health Scheme photo card.

- Bank Certificate in original on letter head from the branch.

Q7. What is form 49A?

Ans. Form 49A is filled for applying PAN card in case of Indian Citizen/Indian Companies/Entities incorporated in India/Unincorporated entities formed in India.

Q8. How to apply for change in PAN Card or correction in a PAN Card?

Ans. Following documents have to be submitted along with the form of changes in PAN card: Proof of PAN, identity proof, address proof, date of birth proof and proof in support of changes required.

Procedures for applying change in PAN card:

Fill the online application form - Composite Service Form

Make payment online

Sign - Download the prefilled application and affix photos and signature

Send - Send the signed application and supporting documents by post or courier to the address provided.

So now we come to know that Income Tax Department introduced PAN card which is unique, national and permanent. It will help to monitor all financial transactions of tax payers and high net worth individuals and indirectly prevent tax evasion.

Source: pancard.com

What are the Benefits of Plastic Notes in the Indian Economy