Resurrecting some form of CAPM?

We find that procyclical stocks, whose returns comove with business cycles, earn higher average returns than countercyclical stocks. We use almost a three-quarter century of real GDP growth expectations from economists’ surveys to determine forecasted economic states. This approach largely avoids the confounding effects of econometric forecasting model error. The loading on the expected real GDP growth rate is a priced risk measure. A fully tradable, ex-ante portfolio formed on this loading generates a procyclicality premium that is statistically significant, economically large, long-lasting over a few years, and independent of the size, book-to-market, and momentum effects.

That is from a recent NBER working paper by William N. Goetzmann, Akiko Watanabe, and Masahiro Watanabe.

Thursday assorted links

1. Good thread on AI and national security.

2. NYT on South African jazz. Here is one cut.

4. Finland will offer bird flu vaccinations to select groups of people.

5. Andrew Stuttaford on my GOAT dialogue. And the transcript from the Dominic Pino chat.

Mark Lutter reports on the Bahamas (from my email)

I won’t double indent, this is all Mark:

“The Prime Minister of the Bahamas recently gave a speech on revitalizing Grand Bahama. He called out the current asset owners of Intercontinental Diversified Corporation, a holding company for Freeport, for not re-investing and for selling off various pieces of the asset. He wants a world class partner to develop Grand Bahama. Half his cabinet attended the speech in person. It is the strongest stance a Prime Minister has taken in 50 years with respect to Grand Bahama.

Here is some additional background reading on Grand Bahama and Freeport. The Prime Minister has two years left in his term and has made revitalizing growth on Grand Bahama his political legacy. Some key facts about Freeport

- 70k+ acres of developable land under Grand Bahama Development Company

- Infrastructure to support 250k residents, current population is 50k

- 25 minute flight to Miami

- Existing legal framework for a charter city, though some of the rights of the Grand Bahama Port Authority, the city government, have been eroded over time

I hope you find this interesting enough to blog about and would appreciate a shout out. Happy to answer any additional questions you might have.”

TC again: Here Mark comments on Twitter.

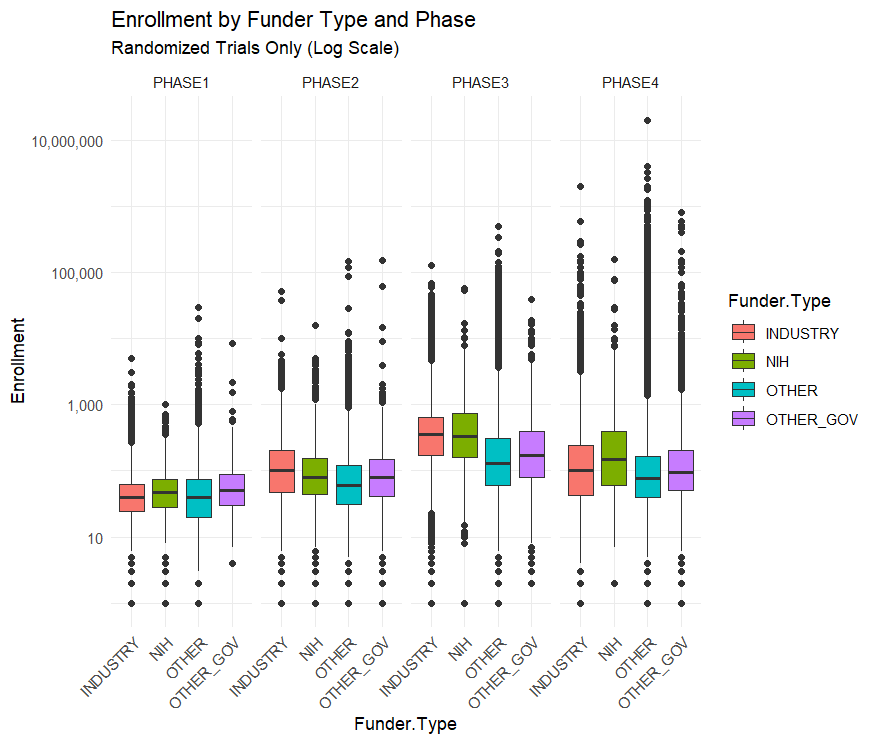

The NIH Doesn’t Fund Small Crappy Trials

A nice catch by Max at Maximum Progress:

[A common critique] is that the NIH funds too many “small crappy trials.” That quote is from a FDA higher up, but the story has been repeated by many others…I downloaded all of the clinical trial data from ClinicalTrials.gov to find out….The median NIH funded trial has 48 participants while the median industry funded trial has 67. The average NIH funded trial has 288 participants while the average industry trial has 335 and the average “Other” funded trial (mostly universities and the associated hospitals) has 923 participants.

By median or by average NIH trials are the smallest out of all the funders. This seems to confirm the “small crappy trials” narrative

…This narrative is reversed, however, when you split up the trials by phase.

Across all trials NIH funded ones are the smallest, but within each phase NIH trials are the largest or second largest. Their overall small enrollment average is just due to the fact that they fund more Phase I trials than Phase III. But NIH Phase I trials have a bigger sample size than industry funded trials on average.

This is an example of Simpson’s Paradox in the wild!

Arguing that the NIH should stop funding unusually small trials is easy but arguing that they should shift from funding the Phase I trials closest to basic research towards later stage trials is less clear.

The NIH’s clinical trial strategy is certainly not perfect and improving it is valuable. But a systematic bias towards “small crappy trials” doesn’t really seem like it’s an important problem facing the NIH.

Rhino capital markets in everything?

In 2022 the World Bank priced the world’s first wildlife bond, raising $150 million that will be partially used for the conservation of black rhinos at two reserves in South Africa. Returns on those five-year bonds will be determined by the rate of population growth. It said at the time that it hoped that the structure would be emulated…

Under the rhino bond’s structure the issuer makes contributions toward conserving the animals instead of paying coupons and the buyers of the bond receive a payment based on preset targets for population growth. Black rhino numbers have dropped to about 2,600 from 65,000 in 1970, and may once have been as high as 850,000, according to documentation from the World Bank. They are smaller than the more common white rhino.

Here is more from Antony Sguazzin at Bloomberg. As the article notes, Rand Merchant Bank is considering issuing wild dog and lion bonds as well, with the exact structure still being discussed.

What if investors overextrapolate from small samples?

We build a model of the law of small numbers (LSN)—the incorrect belief that even small samples represent the properties of the underlying population—to study its implications for trading behavior and asset prices. In our model, a belief in the LSN induces investors to expect short-term price trends to revert and long-term price trends to persist. As a result, asset prices exhibit short-term momentum and long-term reversals. The model can reconcile the coexistence of the disposition effect and return extrapolation. In addition, it makes new predictions about investor behavior, including return patterns before purchases and sales, a weakened disposition effect for long-term holdings, doubling down in buying, a positive correlation between doubling down and the disposition effect, and heterogeneous selling propensities to past returns. By testing these predictions using account-level transaction data, we show that the LSN provides a parsimonious way of understanding a variety of puzzles about investor behavior.

That is from a new NBER working paper by Lawrence J. Jin and Cameron Peng. A nice sequel would be “what if non-investors overextrapolate from small samples?”

The best business books aren’t in the management section

I expand on this theme in my latest Bloomberg column, here is one excerpt from that:

I thus have a modest proposal for anyone interested in business books: Read books about specific businesses or industries that you already know a lot about. That way, you will have enough contextual knowledge for the book to be meaningful. Of course many people don’t work at a company or industry big or famous enough that there are books about it, so I have a corollary proposition: You will learn the most about management by reading books about sports and musical groups.

And this:

Many music and sports books are not only written for obsessed fans, but also written by obsessed fans. Traditional business books, in contrast, are frequently written to get consulting work or on to the speaker’s circuit. The incentive is not to offend anybody and to put forward some “least common denominator” insights, rather than say anything truly original that might be complicated to explain. The end result is a bookstore section that would be mind-numbing to have to read.

There is much more of interest at the link, recommended.

Wednesday assorted links

1. Retrospective by Jack Clark of Anthropic.

2. How will AI alter worker bargaining power? (as distinct from shifting the demand for labor in various ways)

3. Tony Morley doing Progress Studies in Australia.

4. Teles and Saldin on where is the political room for an abundance agenda?

The Danish Mortgage System Avoids Lock-In

Tyler and I have been promoting the Danish mortgage system for years. Recall that in the Danish system each mortgage is backed by a matching bond. As a consequence, mortgage holders have two ways to pay a mortgage: 1) hold the mortgage and pay the monthly payments or 2) buy the matching bond and, in effect, extinguish the mortgage. The latter option is valuable because when interest rates rise, the price of mortgages fall. As I wrote earlier:

Thus, if a Danish borrower takes out a 500k mortgage at 3% interest and then rates rise to 6%, the value of that mortgage falls to $358k and the borrower could go to the market, buy their own mortgage, deliver it to the bank, and, in this way, extinguish the loan. Since the value of homes also falls as interest rates rise this is also a neat bit of insurance. Remarkable!

James Rodriguez writing at Business Insider points out another advantage of the Danish system, it avoids lock in:

When mortgage rates shoot up, as they did over the past two years, many would-be sellers decide they don’t want to move after all. Sure, a new home could be nice, but trading up would mean parting ways with a cheap mortgage rate. What may have been a welcome change suddenly sounds like a painful, expensive divorce. So they sit tight. A gummed-up housing market is good for nobody: First-time buyers can’t find enough homes for sale, and wannabe sellers remain trapped in places that are either too big or too small. This is called the lock-in effect — and it could linger for decades.

… One estimate (here, AT) suggests the lock-in effect prevented more than 1 million people from selling their homes in the span of just a year and a half, a steep toll considering about 5 million homes exchange hands in a typical year. I used to think of these golden handcuffs as an inevitable side effect of the magical 30-year fixed mortgage. But it doesn’t have to be this way. The answer to our problems may lie thousands of miles away … in Denmark.

…Danish sellers are able to earn a profit when they trade in their low mortgage rates for more-expensive ones, making it easier to move even when rates rise.

*Cosmic Connections*

The author is Charles Taylor (yes, the Charles Taylor) and the subtitle is Poetry in the Age of Disenchantment. This book is a very good introduction to romanticism, and also to the poetry of romanticism, noting that its degree of originality may depend on how much you already know. I liked the chapters on Rilke and Mallarme best, here is one excerpt:

It follows that for Rilke, our full capacity to Praise can only be realized if we take account of the standpoint of the dead. The medium of Preisen is Gesang [song]. thus the voice which most fully carries this song would have to be that of the gold Orpheus, who moves in both realms, that of the living and that of the dead.

And the sonnet is the medium. As its name suggests, it is a poetic form which asks to be heard, and not only read on the page. These two modes of reception are essential to all poetry, but in the sonnet the musical dimension becomes the most important avenue to the message.

So a praise-song from both sides, that of the dead, as well as the living. They call on Orpheus, the singer-god who moves between the two realms. Hence the Sonnets to Orpheus.

I am very glad to see that Taylor is still at it, and 640 pp. at that. Furthermore, this book is (unintentionally?) a good means for thinking about just how much deculturation has taken place.

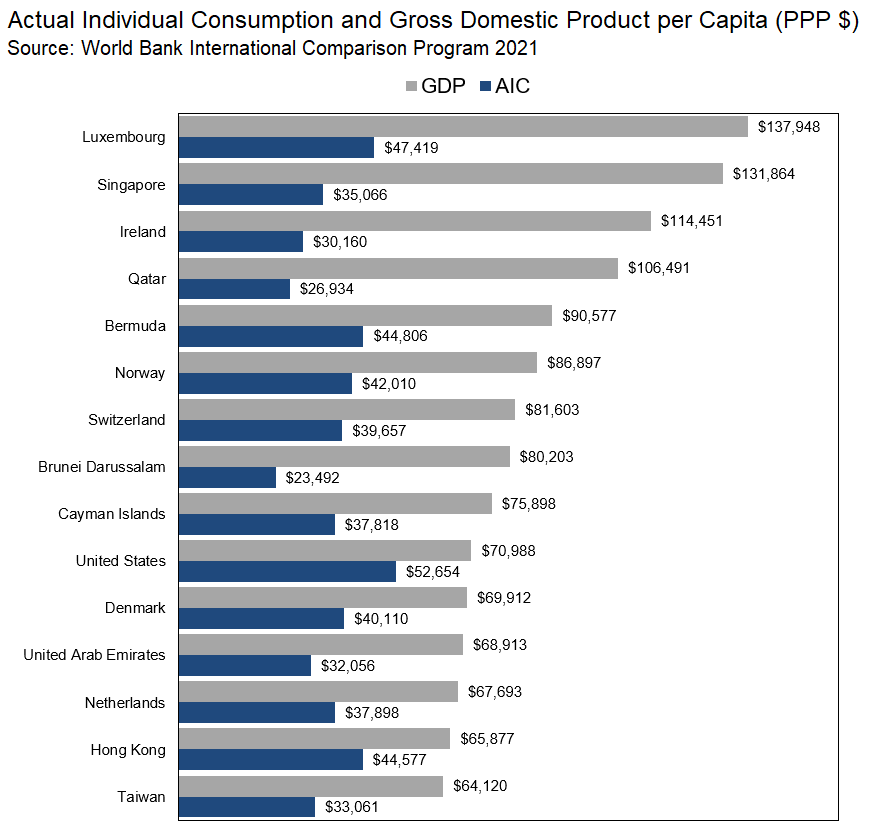

GDP vs. individual consumption

Here is the source tweet.

The partisanship of American inventors

Using panel data on 251,511 patent inventors matched with voter registration records containing partisan affiliation, we provide the first large-scale look into the partisanship of American inventors. We document that the modal inventor is Republican and that the partisan composition of inventors has changed in ways that are not reflective of partisan affiliation trends amongst the broader population. We then show that the partisan affiliation of inventors is associated with technological invention related to guns and climate change, two issue areas associated with partisan divide. These findings suggest that inventor partisanship may have implications for the direction of inventive activity.

Here is the full piece by Daniel Fehder, Florenta Teodoridis, Joseph Raffee, and Jino Lu. Via Kris Gulati.

Tuesday assorted links

Leopold Aschenbrenner on AGI, and security matters

Here is the 165 pp. pdf piece, here is html, here is a Twitter short TOC preview.

And now Leopold on Dwarkesh. I haven’t heard it, but a friend sends along this excerpt:

Why didn’t I ultimately pursue econ academia? There were several reasons, one of them being Tyler Cowen. He took me aside and said, “I think you’re one of the top young economists I’ve ever met, but you should probably not go to grad school.”

Dwarkesh Patel 02:19:50

Oh, interesting. Really? I didn’t realize that.

Leopold Aschenbrenner 02:19:53

Yeah, it was good because he kind of introduced me to the Twitter weirdos. I think the takeaway from that was that I have to move out west one more time.

Dwarkesh Patel 02:20:03

Wait Tyler introduced you to the Twitter weirdos?

Leopold Aschenbrenner 02:20:05

A little bit. Or just kind of the broader culture?

Dwarkesh Patel 02:20:08

A 60-year-old economist introduced you to Twitter?

TaskRabbit for AI Hires

Many people are interested in knowing, which AI is the closest to achieving AGI? That’s an important question for philosophers and computer scientists but more and more I am seeing firms arise to answer a different question, Which AI should I hire?

EquiStamp, for example, rates dozens of AIs based on multiple evaluations, including custom evaluations tailored to specific business tasks. For instance, one firm may want to hire an AI to handle customer queries, another to sort packages, another to summarize internal technical documents. The best AI for each task might differ from the AI that scores highest on general reasoning power. In addition, businesses care not just about performance but also about speed and cost. No reason to hire AI-Einstein to sort the mail. AIs are also continually being re-trained so their performance can fluctuate. Businesses, therefore, may want to continually test their AIs and quickly hire and fire AIs as needed.

In short, a spot-market for hiring AIs is developing.