Enjoy fast, free delivery, exclusive deals, and award-winning movies & TV shows with Prime

Try Prime

and start saving today with fast, free delivery

Amazon Prime includes:

Fast, FREE Delivery is available to Prime members. To join, select "Try Amazon Prime and start saving today with Fast, FREE Delivery" below the Add to Cart button.

Amazon Prime members enjoy:- Cardmembers earn 5% Back at Amazon.com with a Prime Credit Card.

- Unlimited Free Two-Day Delivery

- Streaming of thousands of movies and TV shows with limited ads on Prime Video.

- A Kindle book to borrow for free each month - with no due dates

- Listen to over 2 million songs and hundreds of playlists

- Unlimited photo storage with anywhere access

Important: Your credit card will NOT be charged when you start your free trial or if you cancel during the trial period. If you're happy with Amazon Prime, do nothing. At the end of the free trial, your membership will automatically upgrade to a monthly membership.

Buy new:

$11.13$11.13

Buy used: $8.36

Other Sellers on Amazon

+ $3.99 shipping

98% positive over last 12 months

FREE Shipping

83% positive over last 12 months

FREE Shipping

100% positive over last 12 months

Download the free Kindle app and start reading Kindle books instantly on your smartphone, tablet, or computer - no Kindle device required.

Read instantly on your browser with Kindle for Web.

Using your mobile phone camera - scan the code below and download the Kindle app.

Image Unavailable

Color:

-

-

-

- To view this video download Flash Player

-

-

VIDEO

VIDEO -

Audible sample Sample

Audible sample Sample

Follow the author

OK

America for Sale: Fighting the New World Order, Surviving a Global Depression, and Preserving USA Sovereignty Hardcover – October 13, 2009

Purchase options and add-ons

Between President George W. Bush's "new world order" and the unprecedented governmental growth and massive redistribution of wealth under President Barack Obama, the United States risks losing the greatest middle class ever created in the history of the world. In his groundbreaking new book, Dr. Jerome R. Corsi blows the whistle on a movement to undercut the fundamental principles of limited government that our Founding Fathers fought for and died for trying to establish. As policy-makers manipulate the economic panic of our times to advance a globalist agenda that threatens American sovereignty, we must protect our independent and self-governing nation and preserve the decades of economic power and military strength we have enjoyed since the end of World War II .

In America for Sale, Corsi explains the globalists' plan to put America on the chopping block. While the radical Left promotes socialism and the radical Right champions unbridled free trade, valuable jobs are being outsourced, our national borders erased, and our dollar destroyed before our very eyes. Foreign investors are buying up U.S. assets, from financial-services firms to public infrastructure such as highways. We are on our way to a European Union-type North American common market and a one-world government.

With constructive solutions for resisting the global New Deal, reversing our dependence on foreign oil, and strengthening our middle class, Corsi shares important and practical strategies to help American families survive an imminent economic depression. The United States can be a major player in the world economy without sacrificing our sovereignty, the strength of our national domestic economy, or the dollar. America is for sale -- unless taxpayers stand up and say "NO!" to the globalist political agenda that threatens our great nation's freedom.

- Print length336 pages

- LanguageEnglish

- PublisherThreshold Editions

- Publication dateOctober 13, 2009

- Dimensions6.12 x 1.1 x 9.25 inches

- ISBN-101439154775

- ISBN-13978-1439154779

The Amazon Book Review

Book recommendations, author interviews, editors' picks, and more. Read it now.

Frequently bought together

Customers who viewed this item also viewed

Editorial Reviews

About the Author

Excerpt. © Reprinted by permission. All rights reserved.

The U.S.A. Bankrupt

Debt cannot go on compounding faster than output forever.

-- James Dale Davidson and Lord William Rees-Mogg, The Great Reckoning, 1991

In February 2009, as the Obama administration pushed a $787 billion deficit-spending economic stimulus plan through Congress, the American public was largely unaware that the true deficit of the federal government was already measured in trillions of dollars.

Moreover, total U.S. obligations, including Social Security and Medicare benefits to be paid in the future, have effectively placed the U.S. government in bankruptcy, even before we take into consideration the future and continuing social-welfare obligations embedded within the Obama administration's massive new spending plan. According to the U.S. Treasury, the total obligations of the United States in 2007 exceeded a negative $59 trillion, a sum that was more than the 2007 gross domestic product, or GDP, of the world, which the World Bank estimated to be $54 trillion. By 2008, the total obligations of the U.S. had grown to over $65 trillion, with no end in sight.

There is no way the federal government could ever meet the future obligations of the massive social-welfare state we have created since Franklin Roosevelt signed the Social Security Act, even if we confiscated all salaries and corporate earnings of individuals and corporations in the United States as an emergency form of taxation. The United States today is bankrupt, whether or not the government wants to admit it, and whether or not the public is aware of how extreme the situation has become.

Understanding that the United States is bankrupt is fundamental to understanding the true dimensions of the Economic Panic of 2009. Had the United States been running federal budget surpluses on a cash basis, the nation would still be bankrupt. Why? The answer is that future liabilities in federal social-welfare-entitlement programs have grown beyond the ability of the federal government to raise by taxes enough money to pay what is already due to the baby boomers as they retire.

This reality severely limits the ability of the federal government to manage a financial crisis like what we have faced since the mortgage bubble burst. It is necessary to appreciate fully just how bankrupt the federal government truly is: Mortgage losses as well as losses in a variety of consumer credits plus losses in commercial loans and commercial real estate already total trillions of dollars. We are certain to have more losses in complicated investments including hedge funds and derivatives, regardless of how smart the federal government officials at the U.S. Treasury and the Federal Reserve appear to be or how clever Wall Street experts seem. Ultimately, financial bubbles have no alternative but to burst.

Doesn't $65 Trillion Terrify Anyone?

The real 2008 federal budget deficit was $5.1 trillion, not the $455 billion previously reported by the Congressional Budget Office, according to the 2008 Financial Report of the United States Government released by the U.S. Department of the Treasury.

The difference between the $455 billion "official" budget deficit number and the $5.1 trillion deficit based on data reported in the 2008 report is due to the fact that the official budget deficit is calculated on a cash basis, where all tax receipts, including Social Security tax receipts, are used to pay government liabilities as they occur. The calculations in the 2008 report are calculated on a GAAP basis ("Generally Accepted Accounting Principles"), which includes year-for-year changes in the net present value of unfunded liabilities in social-insurance programs such as Social Security and Medicare. Under cash accounting, money is spent as it comes in, while the government makes no provision for future Social Security and Medicare benefits in the year in which those benefits accrue.

"As bad as 2008 was, the $455 billion budget deficit on a cash basis and the $5.1 trillion federal budget deficit on a GAAP accounting basis does not reflect any significant money from the financial bailout or Troubled Asset Relief Program, or TARP, which was approved after the close of the fiscal year," John Williams, an economist who publishes the website Shadow Government Statistics, told World Net Daily.

"For 2009, the Congressional Budget Office estimated the fiscal year 2009 budget deficit as being $1.2 trillion on a cash basis and that was before taking into consideration the full costs of the war in Iraq and Afghanistan, before the cost of the Obama $787 billion economic stimulus plan, or the cost of the second $350 billion tranche in TARP funds, as well as all current bailouts being contemplated by the U.S. Treasury and Federal Reserve," he stressed.

"The federal government's deficit is hemorrhaging at a pace which threatens the viability of the financial system," Williams added. "The popularly reported 2009 budget deficit will clearly exceed $2 trillion on a cash basis and that full amount has to be funded by Treasury borrowing. It's not likely this will happen without the Federal Reserve acting as lender of last resort for the Treasury by buying Treasury debt and monetizing the debt."

"Monetizing the debt" is a term used to signify that the U.S. Treasury will ultimately be required simply to issue huge amounts of new debt to meet current Treasury debt obligations. We have monetized the debt when we are forced to issue debt both to cover current budget deficits and to pay interest on outstanding federal debt. So far, the Treasury has been largely dependent upon foreign buyers, principally China and Japan and other major holders of U.S.-dollar foreign-exchange reserves, including Middle Eastern oil-producing nations purchasing U.S. debt through their financial agents in London. "The appetite of foreign buyers to purchase continued trillions of U.S. debt has become more questionable as the world has witnessed the rapid deterioration of the U.S. fiscal condition in the current financial crisis," Williams noted.

The sad reality is that the U.S. Treasury has not reserved any funds to cover the future Social Security and Medicare obligations we are incurring today. "Truthfully," Williams pointed out, "there is no Social Security 'lock-box.' There are no funds held in reserve today for Social Security and Medicare obligations that are earned each year. It's only a matter of time until the public realizes that the government is truly bankrupt. No taxes are being held in reserve to pay in the future the Social Security and Medicare benefits taxpayers are earning today."

If President Obama manages to add universal health care to the list of entitlement payments the federal government is obligated to pay, the negative net worth of the United States government can only get worse.

Calculations from the 2008 Financial Report of the United States Government, as displayed in the chart below, show that the GAAP negative net worth of the federal government has increased to $59.3 trillion while the total federal obligations under GAAP accounting now total $65.5 trillion.

U.S. Federal Budget Deficits, GAAP Accounting

"Put simply, there is no way the government can possibly pay for the level of social welfare benefits the federal government has promised unless the government simply prints cash and debases the currency, which the government will increasingly be doing this year," Williams said, explaining in more detail why he feels the government is now in the process of monetizing the federal debt.

"Social Security and Medicare must be shown as liabilities on the federal balance sheet in the year they accrue according to GAAP accounting," he argued. "To do otherwise is irresponsible, nothing more than an attempt to hide the painful truth from the American public. The public has a right to know just how bad off the federal government budget deficit situation really is, especially since the situation is rapidly spinning out of control."

Williams makes a compelling case that in a post-Enron world, if the federal government were a private corporation, "the president and senior Treasury officers would be at risk of being thrown into a federal penitentiary."

Are Massive Federal Deficits Sustainable?

On March 12, 2008, David M. Walker resigned as comptroller general of the United States and head of the Government Accountability Office, or GAO, out of concern that as head of the GAO, he could no longer certify the financial soundness of the U.S. government under the GAAP accounting analysis of the federal budget conducted annually by the U.S. Treasury. As the CBS television show 60 Minutes noted, even before he resigned Walker had begun "traveling the country like an Old Testament prophet, urging people to wake up before it is too late." Walker was highly regarded as a respected public official while head of the GAO, charged with managing its more than three thousand employees. The GAO serves as auditor of the government's books, as an investigative office of the U.S. Congress.

"I would argue that the most serious threat to the United States is not someone hiding in a cave in Afghanistan or Pakistan, but our own fiscal irresponsibility," Walker, once the nation's top accountant, told 60 Minutes, in an obvious reference to Al Qaeda terrorist leader Osama bin Laden.

"We are spending more money than we make," Walker told a group on his "Wake-Up Tour" throughout America. "We are charging it to a credit card," he said, warning that by 2040, U.S. tax dollars would not be able to keep up even with just the interest payments on our national debt. No federal funds would be left for any other programs, including national defense or homeland security. "We suffer from a fiscal cancer that is growing within us and if we do not treat it, the cancer will have massive consequences for our country," he said.

Wal...

Product details

- Publisher : Threshold Editions; 1st edition (October 13, 2009)

- Language : English

- Hardcover : 336 pages

- ISBN-10 : 1439154775

- ISBN-13 : 978-1439154779

- Item Weight : 1.16 pounds

- Dimensions : 6.12 x 1.1 x 9.25 inches

- Best Sellers Rank: #2,231,241 in Books (See Top 100 in Books)

- #1,799 in Economic Policy

- #2,301 in Economic Policy & Development (Books)

- #3,951 in Political Conservatism & Liberalism

- Customer Reviews:

Videos

Videos for this product

3:02

Click to play video

America for Sale

Merchant Video

Videos for this product

8:52

Click to play video

Customer Review: Fact Filled and Very Educational

BC

About the author

Jerome R. Corsi, Ph.D. is the Founder and CEO of CorsiNation.com.

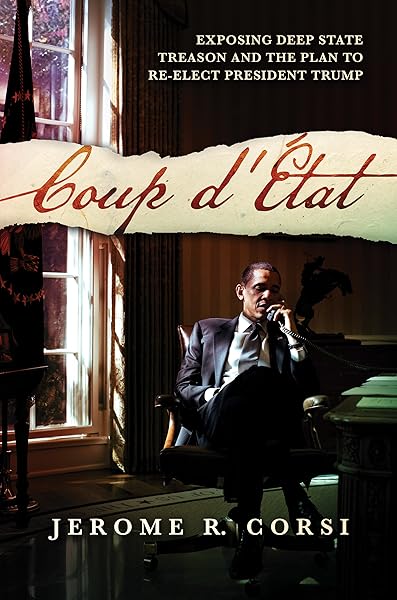

My next book, to be published in January 2020, is COUP D'ÉTAT: EXPOSING DEEP STATE TREASON AND THE PLAN TO RE-ELECT PRESIDENT TRUMP.

In March 2019, Dr. Corsi published SILENT NO MORE: HOW I BECAME A POLITICAL PRISONER OF MUELLER'S "WITCH HUNT."

His previous New York Times bestselling books, published in March 2018, was KILLING THE DEEP STATE: THE FIGHT TO SAVE PRESIDENT TRUMP.

From 2004-January 2017, he worked as a Senior Staff Reporter for WND.com.

From 1968-1981, he worked at universities where he conducted research on federally funded grants.

In 1981, he published “Terrorism as a Desperate Game: Fear, Bargaining, and Communication in the Terrorist Event” in Journal of Conflict Resolution, a mathematical game-theoretical model for predicting the outcome of terrorist events. This resulted in a top-secret clearance by the State Department’s Agency for International Development, where he joined a team of psychiatrists and psychologists to develop a hostage-survival training program for State Department officials stationed overseas.

For 25 years, beginning in 1982, Dr. Corsi worked with financial institutions, insurance companies, and mutual funds in the United States and abroad, specializing in the development of third-party marketing firms working with banks to develop retail financial planning services selling annuities and mutual funds to investment and retirement customers.

Since 2004, Dr. Corsi has published over 25 books, six of which were New York Times Bestsellers, including two #1 New York Times best-sellers. Dr. Corsi graduated magna cum laude with a B.A. in Political Science and Economics from Case Western Reserve University and received a Ph.D. in Political Science from Harvard University.

Working for WND.com for 12 years, starting in 2004, Dr. Corsi obtained press credential to cover the U.S. Congress in Washington, as well as many presidential speeches in events in the second term of President George W. Bush and during the two terms of President Barack Obama. In 2012, the Secret Service cleared Dr. Corsi to fly as “traveling press” on GOP presidential candidate Mitt Romney’s airplane for the last three weeks of the presidential campaign.

Customer reviews

Customer Reviews, including Product Star Ratings help customers to learn more about the product and decide whether it is the right product for them.

To calculate the overall star rating and percentage breakdown by star, we don’t use a simple average. Instead, our system considers things like how recent a review is and if the reviewer bought the item on Amazon. It also analyzed reviews to verify trustworthiness.

Learn more how customers reviews work on Amazon-

Top reviews

Top reviews from the United States

There was a problem filtering reviews right now. Please try again later.

This reviewer has never been a fan of conspiracy theories, but it appears that the entire world has been tricked by the twin utopian conspiracies of Globalism and Socialism. The free trade Globalism push came from the Rockefeller Republicans and the push to Socialism came from the Liberals in the Democrat Party.

"Globalism, instead of creating an era of flourishing U.S. employment, has left millions of U.S. workers behind, such that no amount of education and training will enable them to compete with a world population ready and willing to work for a fraction of what U.S. workers demand in terms of wages and benefits." Anyone who has lost their job and is trying to get another one is probably well aware of this fact. "In the final analysis, America is for sale precisely because globalism failed, precisely because a `free trade' international economy failed to fulfill the promises the globalists made."

"The modern social-welfare state, despite all the humanitarian arguments that can be made to support it, may in the final analyses end up being too expensive for either Europe of the United States to afford..."

This book is "a clarion call to take America back before it is too late...a clarion call to prevent the globalists from outsourcing U.S. jobs that will never return to our shores, and from erasing our borders and destroying the dollar. American patriots do not want to live in Barack Obama's internationalist social-welfare state any more than we should want to live in George H. W. Bush's internationalist `new world order.'" To avoid becoming another third world nation of slaves, the only people with the power to stop this kind of "change" is the American Tax Payer who with their votes and taxes can shut the government down and force the government to listen to the endangered species known as the American Middle Class. If the taxpayers don't pay, the take-over of America falls flat on its face.

The book is constructed in three major parts: The Global Economic Panic of 2009, America For Sale, and Fighting the New World Order, Surviving a Global Depression, and Preserving U.S.A. Sovereignty. The preface, introduction and conclusion are unusually well written and important to the overall book. The chapter on surviving a global depression offers common sense, obvious advice for surviving the collapse of American Freedom and the Most Successful Economic System the world has ever known. Everyone should take note of that advice.

It's not too late to stop the United States from giving up its sovereignty as well as its wealth, power and freedoms. This book includes important and practical strategies for Middle-Class Survival in Economic Hard Times. One World Government is almost here but it can still be defeated by returning to the teachings and policies of America's Founding Fathers, who in their great wisdom set up a Constitution that would keep the United States from becoming just another third world country with a world government taxing the U.S. serfs without any kind of representation from or voting rights of the citizens/serfs of the new world order that aims to spread the world's wealth equally around the globe, except of course for the leaders of this new utopian world of Oz. The secret wizards behind the token leaders have been working for years to reach the point where the USA would voluntarily give up their sovereignty and becomes slaves to the New World Socialist Order. Included in the upcoming Cap and Trade bill is language subordinating the America's Constitution in favor of world government and international organizations such as the United Nations and voluntarily giving them the power to tax the USA into poverty with the taxed having absolutely no recourse to challenge those taxes.

It's time for the little Red, White and Blue Frogs swimming lazily around in the cooking pot of slowly warming hot water wrongly believing it is a hot tub, to wake up and jump out of the pot before they are boiled and eaten by the Globalist-Socialist-Welfare World Order. It's especially important because there is no proof that either Socialism or Globalism has ever worked or will ever work. The historic records indicate that both concepts are doomed to failure because they defy the laws of economics and the very human instinct for self-preservation and/or self-interest.

This is required reading for any citizen who would like to better understand what is happening to our country and why the President and his administration seems so critical of America and its accomplishments and at the same time don't seem to show any real interest in following proven methods of improving the economy and providing jobs. The Obama Administration has a very different agenda and our President is using his present job as a stepping-stone to ruling the entire world. The radicals and hippies are in charge. Like many of you, this reader would never have believed this possible in this country even as late as two years ago. After watching the current government administration at work and reading this and other excellent books on the subject, it appears that we in America are on the verge of falling off the cliff into slavery.

Likewise, Crosi does a good job "bashing" both left and right equally so those inclined toward one view or another will either not be insulted or will find themselves equally insulted depending upon how personally they take criticism of each party. I'm not a "conspiracy theorist" and tend to avoid authors that lean in that direction however, unlike many authors that rely upon 'hype', Corsi presents an abundance of information to support his premise and position. Whether one agrees with the conclusions is entirely optional - the information itself is what makes this book well worth the time and effort to read.

Equally optional is the suggested means of protecting both self and nation...depending upon your personal situation, politics and other beliefs you may agree or disagree. Most is solid advice that would do little harm and has the potential to help the average citizen much more than most suggestions.

Bottom line...excellent research, extensive footnotes/references, minimal hype/hysteria enjoyable to read whether you "buy into" conspiracy theories or not.

It is thoroughly documented with end notes and references for every claim stated and charge levied.

What becomes clear is the concerted effort by the International Monetary Fund and the World Trade Organization along with every major government in the world to develop a world economy with a world currency using the Euro as a blueprint.

Obama may be leading the charge to the emerging New World Order and the destruction of American sovereignty and economy, but it is MUCH bigger than any single president.

There is a storm coming. Those who are wise enough to try and prepare for an economic Katrina would be wise to buy this book and read it for all that it is worth.