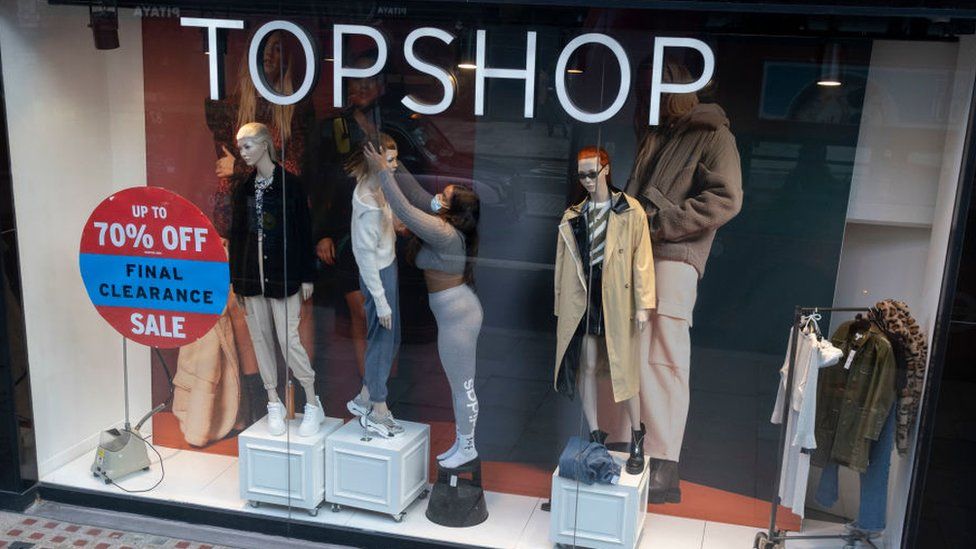

Topshop owner in talks over Arcadia £30m lifeline

- Published

Topshop owner Arcadia is in talks with lenders to secure around £30m in funding following the second coronavirus lockdown in England.

The discussions, revealed by Sky News, external, are understood to be progressing and a deal could be close to being reached.

Another report suggested, external that Arcadia is drawing up plans to place the business into administration.

But the company said: "It is not true that administrators are about to be appointed."

"Clearly, the second UK lockdown presents a further challenge for all retailers and we are taking all appropriate steps to protect our employees and other stakeholders from its consequences."

It is understood that Arcadia - led by Sir Philip Green - has contingency plans in place regarding the future of the business but there is confidence it will secure financing to continue trading.

As well as Topshop, the group also owns the chains Topman, Miss Selfridge, Evans, Burton and Dorothy Perkins.

Non-essential retailers in England have been forced to close for four weeks until 2 December to contain the spread of the coronavirus.

During the first country-wide lockdown, Arcadia furloughed the vast majority of its 13,000-strong workforce across more than 500 outlets.

Sir Philip Green leads Arcadia while his wife, Lady Cristina Green, is its biggest shareholder

Staff at its shops in England have been placed back on the government's wage subsidy scheme though its stores in Wales, Scotland and Northern Ireland have now reopened.

Arcadia said: "We are continuing to trade online through our own channels as well as through those of our partners."

However, Debenhams, a major Arcadia partner which sells a number of its brands, is facing its own challenges. The department store chain is in administration and is in talks to find a buyer.

Pension schemes

Arcadia underwent restructuring last year through a company voluntary arrangement (CVA). It agreed to shut 50 shops, secured a rent cut with landlords on property and struck a deal with the Pension Protection Fund to put money into the company's pension schemes.

At the time, the pension scheme deficit was estimated to be around £700m but the Sunday Times reported it is now £350m on a buyout basis.

In a deal with the Pensions Regulator, trustees of Arcadia's pension schemes were granted security over £210m worth of assets by the company.

Sir Philip's wife, Lady Cristina Green, who is Arcadia's biggest shareholder, agreed to pump £100m into the schemes over three years while Arcadia said it would inject a further £75m.

Sir Philip faced controversy over the pension scheme at one of his other businesses, BHS, which he sold to Dominic Chappell for £1 in 2015.

BHS collapsed a year later, with the loss of 11,000 jobs and a pension deficit of £571m.

Sir Philip reached a deal with the Pensions Regulator to inject £363m into that scheme.

More recently, Chappell was sentenced to six years in prison after being found guilty of tax evasion.

- Published15 January 2021

- Published4 September 2020