Why Am I Poor? 10 Common Reasons (and How to Fix Them)

Our readers always come first

The content on DollarSprout includes links to our advertising partners. When you read our content and click on one of our partners’ links, and then decide to complete an offer — whether it’s downloading an app, opening an account, or some other action — we may earn a commission from that advertiser, at no extra cost to you.

Our ultimate goal is to educate and inform, not lure you into signing up for certain offers. Compensation from our partners may impact what products we cover and where they appear on the site, but does not have any impact on the objectivity of our reviews or advice.

Improving money habits starts with identifying the specific problems that you're currently struggling with. Some in your control -- others not -- here are ten things that may be bringing you down (and how to fix them).

Are you one of those people who is always asking yourself, “why am I broke all the time?”

Forget about investing for the future, you need money now.

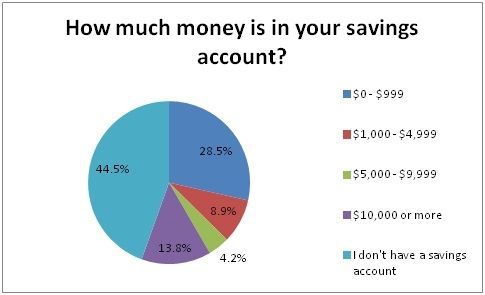

I read a statistic a few weeks back that said 73% of Americans had less than $1,000 in their savings accounts, and I was astounded.

How is it even possible that a majority of Americans could have less in savings than me?

Check out the chart below and see where you fall:

Even though I consider myself fortunate to be a part of the 13.8% of Americans that have $10,000 or more in savings, I still feel like I am only a few bad breaks away from being broke.

And that feeling kind of sucks.

For those who have less, I can imagine the stress is unbearable.

But how in the world do we expect to retire when we can’t even maintain $1,000 in our savings accounts? Where in the world do we expect this money is going to come from?

Why are we so bad with money?

I understand that everyone’s circumstances are not the same as my own. I understand that it is much harder for some to put money aside each month into our savings. That said, there are areas where we can all improve.

Let’s highlight those.

1. You make the B.I.G. mistakes.

Never mind the rest of the items on this list. If you can focus on avoiding the B.I.G. mistakes, you’re taking the single most important step in fixing your money problems.

B: You don’t have a budget.

66% of Americans don’t have a budget (which helps explain why we suck with money).

Even a basic one goes a long way in helping guide your spending decisions. If you have no idea where to begin, start with the 50/20/30 rule.

- 50% of your net income on housing, food, transportation costs and utility bills.

- 20% into savings/paying off debt.

- 30% for you.

It’s important to remember that this is based on your net income. Don’t make budgeting decisions on your gross pay or you’re going to be sorely disappointed when taxes start coming out and you wonder why you’re still struggling to make ends meet.

Related: 8 Apps That’ll Help You Make (and Stick to) a Budget

I: You ignore your money problems.

I cannot say enough about this concept.

Money problems can lead to immense stress, relationship strain, anxiety, and even depression. Bad decisions can get you to where you are, but you exponentially worsen them by not getting the help you need in tackling the problem head-on.

You think you need money now? Keep ignoring your money issues and see where you are in a year.

Do not be too afraid to ask for help. Take the time to educate yourself. There is nothing more relieving than knowing that you took that first positive step in the right direction.

G: You go out too much.

The 50/20/30 rule is especially helpful to people in this category because those proportions start to look like 50/0/60 where you’re likely maxing out your spending on essentials, saving nothing, and driving yourself into debt with discretionary spending.

Whether it’s eating out, shopping, the lottery — doesn’t matter. We all have our vices and it takes discipline/lifestyle changes to correct the root of our overspending problems.

If you’re looking to get ahead, focus on your spending in this category; it can make a huge difference as it is the easiest to change.

How to fix it:

Stop ignoring your money and create a budget. It sounds daunting, but once you get the hang of it, it shouldn’t take more than 15-30 minutes per week to evaluate your spending and update your plan.

2. You’re worried what others think of you.

Everyone struggles with this.

Everyone.

…that Michael Kors bag you overspent on when a $14 Walmart purse would have done…that $90 polo button-down you bought…the iPhone X you just had to have (despite your fully functional 6s having no problems)…

Society exerts enormous pressure to buy these things under the guise that you won’t fit in without them. It’s incredibly effective too. It’s okay to have nice things and to treat yourself once in a while but don’t make a habit of it if you’re struggling to bump those savings.

If someone was auditing your expenses each month, would you be embarrassed by what they saw?

Would the list of big purchases weigh on your conscience?

How to fix it:

This one requires some self-work. It’s time to stop focusing on what everyone else thinks of you and start focusing on what’s important to you. What do you truly value, and what do you want to do in life? Once you start nailing these down, your view of money and the way you spend it will begin to change.

3. You have expensive habits.

If only the ATF dealt with gambling they’d be regulating the quadfecta of things that often deal a devastating blow to your take-home pay (pun intended).

Alcohol, tobacco, firearms, and gambling…they’re all addicting to various degrees (no really…per the ATF, the average American household owns 8.1 guns as of 2015 – at several hundred to even several thousand bucks a pop, we’re talking a lot of money).

Seriously, check out these figures:

- The average smoker spends over $2,000/year on cigarettes ($5,000+ in NY).

- The average adult spends over $500/year on alcohol.

- US households spend $162 yearly on lotteries on average; for low-income households, the figure is $289 and for those who make less than $10,000 it’s $597, or around 6% of their yearly income.

If you’re working a full-time minimum wage job (or close to it) and wonder where all of your money is going? Ummm…well, yeah. I think you can figure it out.

How to fix it:

Again, it’s time to reevaluate your priorities and decide what’s truly important to you. Remember, it’s okay to ask for help. If you’re suffering from an addiction of any kind, you’re probably going to need it. Reach out to an addiction hotline — they’ll be able to refer you to someone who can help.

4. You dropped out of school.

Perhaps not literally, but at some point along the way you fell short of your doctoral degree. No big deal. I don’t have one either.

However, just about every study ever published confirms that on average, the more schooling you complete, the more that paycheck swells.

According to U.S. Census Bureau projections, over a 40-year career, a worker with a bachelor’s will earn $1 million more than a worker with just a high school diploma. That’s $2.42 million versus $1.37 million… a master’s degree bumps up that figure to $2.83 million.

That being said, a degree in certain fields isn’t always worth its weight in paper.

How to fix it:

Could going back to school double, triple, or even quadruple your pay? Do your homework – find something you enjoy that will provide value/a positive return on your higher education investment.

5. You painfully ignore the power of interest.

So you were young and dumb and maxed out a credit card because you were desperate. Not an uncommon occurrence. But that singular decision can have a lasting impact.

Sure missing a payment lowers your credit score, making it harder to get a car loan or that mortgage you’ve been hoping for…everyone knows that.

But that’s not the problem only problem — it’s the crushing interest payments that you didn’t take into consideration. If you send in just the monthly minimum (2% of the balance) on a credit card with a $5,000 balance and 15% interest rate, it will take 32 years to get rid the debt, and you will pay nearly $8,000 in interest on the original $5,000 balance.

32 years.

How to Fix It:

Stop making the minimum payments on your debt. Create a plan to pay off your debt and stick to it.

6. You spend too much time doing useless things.

Everyone needs some downtime to regroup, relax, and refocus. But there is a difference between all that and being a straight-up couch potato.

Consider this: according to Thomas Corley (a Business Insider featured Author), 77% of people who struggle financially are spending an hour or more per day watching TV.

On top of that, 74% are spending an hour or more surfing the Web. That’s two (or more) hours each and every single day on average that you’re more or less wasting your time.

On the flip side, wealthy individuals spend their time pursuing activities that promote self-improvement, volunteering, working a side-job, and/or chasing a dream that might otherwise lead to more financial reward.

How to fix it:

Stop asking yourself “Why am I broke?” and do something about it. You don’t have to make it your life’s work to get rich. But if you need money now because you’re falling behind, odds are you’re wasting your time doing otherwise useless activities.

7. You’re house (or car) poor.

Remember that 50/30/20 rule we talked about earlier? Sure it’s a guideline, and if you’re tweaking it just a bit, I’m not going to yell at you. But if you’re blowing it out of the water, you may be digging yourself into a hole.

Let’s look at my situation as an example:

I’ll gross around 60k this year at my full-time job (for the sake of this example, I won’t include any of my nursing side hustle pay). I’ll probably net somewhere around 42k after taxes.

50% of my monthly income for essentials equates to ~$1,750/month.

If I assume my housing should be no more than 25-30% of my monthly net income (general rule); I can afford up to a $1,050/month mortgage (my housing is $515/month so I’m definitely saving some money here).

So yeah:

- Housing: $515/month

- Vehicles + Insurance: $400/month

- Utilities: $200/month

- Groceries: $300/month

- Health + Dental Insurance: $150/month (yay for being a young, healthy male).

Total: ~$1550/month.

It’s costing me just under $1,600/month (a conservative figure) for the bare bones essentials. I am barely making it under the $1,750/month I can theoretically afford and that is with fairly cheap housing. Coming in under the 50% allows me to have a little extra money to play with and/or save.

How to fix it:

This scenario took me less than 2 minutes to map out. Apply it to yourself. If you’re exceeding 60% on the essentials, you likely can’t afford your house and/or your car.

That might come as a huge punch to the gut as we are often extremely attached to both. But it’s not worth driving yourself further into debt. It may be time to look into selling one of them.

8. You don’t buy in bulk.

Of all the things on this list, the concept of buying things in bulk seems like the easiest thing to do – yet most of us don’t.

Why?

Because we’re afraid of sticker shock. Or receipt shock. Or whatever you want to call it.

You see this massive bill for stuff you bought in bulk and your stomach rolls.

It seems like a lot up front, but you’re saving a ton of money in the long run. As long as you’re not stretching yourself too thin during any particular month, this is absolutely the way to go.

How to fix it:

If it isn’t perishable, buy it in bulk. Stop buying one tube of toothpaste at a time. Stop buying 4 rolls of toilet paper that you know you’ll go through by next week. Next time you go shopping, look for deals for buying nonperishables in bulk (e.g. toothpaste, paper goods, etc.).

9. You can’t say no.

I am pretty sure my mom could be featured on an episode of TLC’s Hoarding: Buried Alive (I immediately change the channel before my PTSD kicks in).

My parents’ house has piles of useless stuff they don’t need and/or no longer use because of the awful, wretched, no good concept of a sale.

For some reason those little, red, flashy signs announcing to the world that “this item is 25% off”triggers something in her mind that goes something along the lines of “omg, I. MUST. BUY. IT.”

Congrats, you saved $10.00 on a nice pair of paints. You also wasted $30.

It’s something we all struggle with.

How to fix it:

It’s not actually “saving money” if you weren’t planning on spending it to begin with. Learn to say no.

A great way to avoid impulse purchases is to make a 30-day wish list. If you want to buy something, but you don’t need it, put it on your list. At the end of 30 days, come back to your list and see how you feel about those purchases.

Chances are, the impulse will have subsided and you won’t feel the strong desire to purchase it anymore.

10. You don’t have a side hustle.

If you’re struggling to make ends meet and you have no way up at your legitimate day job/no improvement in sight…you need a side hustle.

Not everything out there will be suitable for you and your needs, but I guarantee if you look, you’ll find something that is.

Side hustles have allowed me to supplement my take-home pay by several thousand dollars every month.

How to fix it:

If you’re thinking “I don’t have time for all this — I need money fast!” then you, my friend, need to get on your side hustle game. Try this list of ways to make extra money with a side hustle.