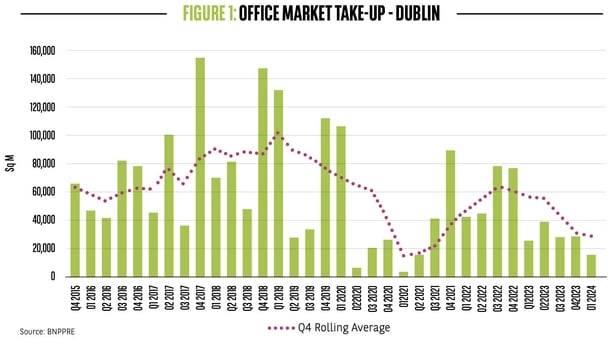

Take-up of office space in Dublin dropped to a three-year low between January and March, new data shows.

The latest report from BNP Paribas Real Estate Ireland reveals that just 16,310 sqm of space was leased during the three-month period.

It follows a surge in the number of offices completed during the quarter, with 84,000 sqm of space added to the market.

This is more than the amount of office space completed in the whole of 2023.

This combination of strong supply and weak demand caused the vacancy rate to jump from 13.1% in December to 14.5% in March.

John McCartney, Research Director at BNPRE said this has created a tenants' market.

He said rising vacancy rates have given tenants choice and more leverage in their rent negotiations with landlords.

"Prime headline rents have remained at €670 per square metre per annum since June 2022," he said.

"But inflation has deducted 7.3% from the value of money since then so, in real terms, rents are under pressure even at the top-end of the market.

"Moreover, lease terms are getting shorter, break options are coming earlier and rent-free periods are creeping up - all signs that tenants have the whip-hand," he added.

We need your consent to load this rte-player contentWe use rte-player to manage extra content that can set cookies on your device and collect data about your activity. Please review their details and accept them to load the content.Manage Preferences

Speaking on RTÉ's Morning Ireland, Mr McCartney said there has been a geographical shift in activity, with office space outside of the city centre now proving more attractive for businesses.

"The suburban share of take-up has risen quite strongly and that may well be because companies are reconfiguring their footprint to try to locate themselves close to where people live, he said.

"Particularly because we are nearly at full employment, I think they are trying to locate close to where housing is less expensive and that has been particularly the west and north suburbs," he added.

Today's report states that three factors are dragging down overall office uptake in the capital - the global economic slowdown, inactivity in the tech sector and remote working.

Global economic slowdown

After rebounding following the Covid pandemic, global economic growth has slowed from 6.5% to 3.2% in the past two years.

"As a highly globalised small economy, Ireland has naturally been impacted by this, and official figures show that real GDP contracted by 3.2% last year, " said Mr McCartney of BNPPRE.

"Although inter-group flows within Ireland's large multinational sector can distort headline economic aggregates, it is clear that the domestic economy has slowed," he added.

Mr McCartney also pointed out that jobs growth has tapered off, and unemployment appears to be creeping higher at the margin.

Tech sector

2022 saw a slowdown in hiring in the Information and Communications Technology (ICT) sector in Ireland, followed by a wave of tech job losses.

Today's report states that ICT employment is currently down 3.3% in the year to February 2024.

With tech accounting for 51% of office take-up in Dublin between 2017-2021, Mr McCartney said this has created a specific challenge for the leasing market.

Remote working

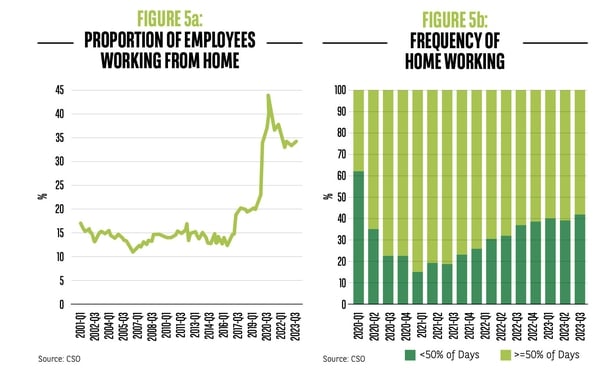

The report outlines how the shift to remote working has impacted the Dublin office market.

It highlights how jobs growth in the service sector rebounded after pandemic restrictions were lifted.

But because many newly created jobs, and many existing jobs in the service economy had become remote or hybrid - the demand for additional office space dropped.

"The relationship between jobs growth and office demand became disrupted," Mr McCartney said.

BNPPRE said CSO data shows that while the number of people working remotely has stabilised, those that are working remotely are spending less time at home and more in the office.

Looking ahead, BNPPRE said it expects the office vacancy rate to keep rising until late 2025, due to a strong pipeline of supply.

However, it said there are signs that demand is improving.

Reserved space, which it said is a strong indicator of next-quarter take-up rose by 25% in the first quarter.

Today's report also states that some unused office space is being repurposed - but mostly to hotels, and education and medical facilities - rather than for residential use.