Compare Car Insurance Rates Side-by-Side

Use The Zebra's insurance comparison tool to see rates from GEICO, Progressive, Nationwide, Liberty Mutual and Allstate (+100 other companies).

How to compare car insurance

This unbiased guide — written by The Zebra's insurance experts — outlines the factors that comprise car insurance premiums and provides tips to help you compare quotes and find the right car insurance policy.

Key Takeaways

- Car insurance rates vary by person and by company. Who you pick as your insurance provider can be just as impactful as your driving record.

- It is recommended to compare auto insurance quotes from different companies every six months.

- The fastest way to get multiple quotes is with independent agents or comparison websites.

- The Zebra is both an independent insurance agency and a comparison website. Whether you're ready to compare car insurance or are just looking for a quick answer, The Zebra is here to help.

We search and compare car insurance so you don’t have to.

Why insurance comparison shopping is important

Your driving record, your vehicle and where you live are major rating factors for car insurance. But who you trust to insure your vehicle is equally as important.

For example, below you can see the average rates for a 30-year-old male driver with full coverage.

| Company | Avg. 6 Mo. Premium |

|---|---|

| Allstate | $1,206 |

| Farmers | $893 |

| GEICO | $771 |

| Nationwide | $738 |

| Progressive | $941 |

| State Farm | $785 |

| USAA | $683 |

The Zebra’s Dynamic Insurance Rating Tool data methodology

The Zebra’s Dynamic Insurance Rating Tool for home and auto insurance rates utilizes the latest ZIP code-level rate filings from across the U.S., sourced from Quadrant Information Services and S&P Global. These filings, typically updated annually or biennially by insurers, are verified through Quadrant’s QA process and then integrated into The Zebra’s estimator.

The displayed rates are based on a dynamic home and auto profile designed to reflect the content of the page. This profile is tailored to match specific factors such as age, location, and coverage level, which are adjusted based on the page content to show how these variables can impact premiums.

For a comprehensive understanding, see our detailed methodology.

Although the driving profile is the same, there's still hundreds of dollars in premium difference between the cheapest and most expensive company. This price difference shows why it is so important to compare multiple providers. Even if your driving profile or vehicle is the same, the rate a company charges for its services is not.

Comparing car insurance companies and their services

Of the companies listed above, USAA is one of the cheapest but it's also the most exclusive. USAA is only available to military members and their families – so while the lower premium is appealing, not everyone will qualify.

Although Allstate is more expensive, it does not have occupation restrictions and it's one of the best and largest insurance companies. For many customers, the peace of mind and availability of local agents is worth the additional cost.

Outside of its services, a company might be more expensive because of simple economics. If your current company paid out more claims than it earned in premium, it could account for that by increasing rates next year.

Even if you didn't file a claim, your rate can still increase because your insurance company's cost of doing business increased. In fact, 39% of customers who use our product state they are paying too much with their current provider.[2]

Zebra Tip: Price isn't everything – consider company reputation

Sometimes an insurance company is cheap for a reason. After an accident is not the time to wish you'd known about your provider's poor customer service and claims record. Before purchasing a policy, pay close attention to national and regional reviews like The Zebra's Satisfaction Survey.

Best way to compare auto insurance

Regardless of how you get car insurance rates, you'll first need the following information handy:

- Personal information — including date of birth, driver’s license number*, and address

- Driving and insurance history of all drivers on the policy

- Vehicle information of all vehicles including VIN*

- Payment. If you’re getting a policy for the first time, the insurance company will likely require a down payment before the policy is bound (accepted)

*Note that you can get a quote without a VIN or driver license number, but you will not be able to buy your policy without it.

Zebra Tip: Don't "forget" to mention that speeding ticket

It’s important to be as accurate as possible when requesting quotes. The more honest you are during this process, the more accurate your final rate will be. If you leave out a ticket or accident in your quote to try to get a cheaper premium, insurance companies eventually find out and update your rate when they finalize your policy.

Using insurance comparison sites

The benefit of using online insurance comparison sites is obvious: avoid the tedious task of going through the quoting process for many different companies.

But be careful, many of the popular sites aren't comparison tools — they're just ads. Lead aggregators who will sell your data to insurance companies who contact you relentlessly in pursuit of your business.

If you want to avoid spam emails, texts and phone calls, pay close attention to the website's privacy disclosures and how they earn money. We recommend looking for websites or companies that are independent agents of insurance providers. Independent agents are licensed and authorized to write policies for multiple insurance companies.

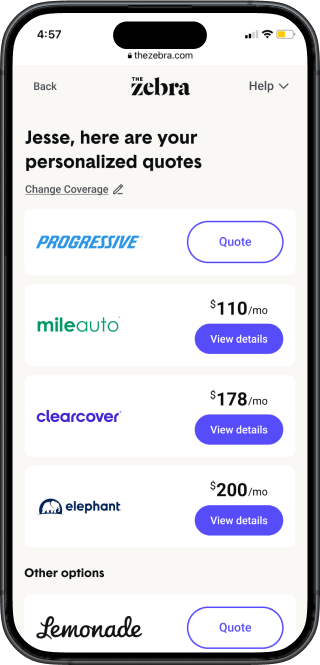

The Zebra's comparison tool:

- This is exactly what The Zebra is. Only with our comparison tool can you fill out 1 form to get multiple quotes — all on a single page. Our team of independent insurance agents partners with over 100 partnerships across the US. Together, we can help you compare policies by price and by how much car insurance coverage you want.

- The Zebra does not partner with any lead generation sites. We do not ask for your phone number at any point in our product and never sell your information. We earn money by helping you get insured, but we will not sell you a policy if you already have the appropriate coverage at the best price.

Real image of The Zebra's mobile experience — individual results may vary.

Start the process online or reach out by phone to speak to one of our agents. Our in-house agency is licensed to write policies for many top insurance companies.

Ready to try it out for yourself?

Personal factors that impact car insurance rates

We've talked about the big reasons why you should compare, but now we'll talk about who you are and how that impacts what you'll pay for car insurance.

We will outline in more detail the impact your age, driving history, and credit score impact your rates. It is worth noting there are other factors you should keep in mind:

- Your vehicle type

- Where you live (your city and state)

- Your coverage level

Car insurance comparison by age

Insurance companies equate age to years of driving experience. Younger drivers lack experience behind the wheel and are seen as riskier and more expensive customers. As you can see below, insuring a teen driver can double your premium.

| Age | Avg. 6 Mo. Premium |

|---|---|

| 16-19 | $2,520 |

| 20s | $1,142 |

| 30s | $872 |

| 40s | $834 |

| 50s | $777 |

| 60s | $785 |

| 70s | $903 |

Rates change as drivers age. If you're looking for more information about how your age can impact your car insurance, check out our guides below:

Zebra Tip: Seek out other coverage types to be fully covered

- While property damage and bodily injury liability coverage are required in most states, it always pays to look into the optional coverage options

- Uninsured/underinsured motorist coverages provide a great way to protect yourself against drivers without enough coverage

- Comprehensive and collision coverage, together known as “full coverage,” should be added to any leased, financed or new/moderately new vehicle. Around 70% of our customers insure their vehicle with full coverage[2]

Car insurance comparison by driving history

Insurance companies use your previous driving history as a predictor for future driving behavior. Speeding tickets, DUIs, and at-faults accidents can be “chargeable” offenses on your driving record for 3-10 years (depending on your state). If you have any of these or similar driving violations, shopping around as often as possible is pivotal.

| Violation | Avg. 6 Mo. Premium |

|---|---|

| None | $816 |

| Speeding Ticket | $1,003 |

| At-Fault Accidents | $1,119 |

| DUI | $1,413 |

Driving infractions can have a serious impact on your car insurance. The Zebra has put together the following handy guides on how your insurance is impacted by certain driving violations.

Car insurance comparison by credit score

More and more states are banning credit scores as a rating factor for auto insurance. However, it’s still a pretty common practice. Historical claims data tells insurance companies that drivers with poor credit tend to file costlier claims more frequently.

As you can see below, drivers with “Poor” credit pay almost twice as much for car insurance than drivers with “Excellent” credit.

| Credit Tier | Avg. 6 Mo. Premium |

|---|---|

| Excellent | $701 |

| Very Good | $756 |

| Good | $817 |

| Average | $891 |

| Fair | $966 |

| Poor | $1,417 |

Data Methodology. The Zebra’s Dynamic Insurance Rating Tool

Anonymized User Survey. The Zebra

Stay in touch and subscribe!

Get advice, insights and tips from our newsletter.

Comparing car insurance: frequently asked questions

Related content

Customer Questions & Answers

Other people are also asking...

Can I drive a truck I'm buying across state lines, without plates, to get it home?

It is illegal to pay for someone else's car insurance

My car was towed by an apartment complex. Will State Farm reimburse me for the towing cost?

What happens if the repo guy damaged my car?

About The Zebra

The Zebra is not an insurance company. We publish data-backed, expert-reviewed resources to help consumers make more informed insurance decisions.

- The Zebra’s insurance content is written and reviewed for accuracy by licensed insurance agents.

- The Zebra’s insurance editorial content is not subject to review or alteration by insurance companies or partners.

- The Zebra’s editorial team operates independently of the company’s partnerships and commercialization interests, publishing unbiased information for consumer benefit.

- The auto insurance rates published on The Zebra’s pages are based on a comprehensive analysis of car insurance pricing data, evaluating more than 83 million insurance rates from across the United States.