What is the difference between a loan officer, mortgage broker, banker and other lenders?

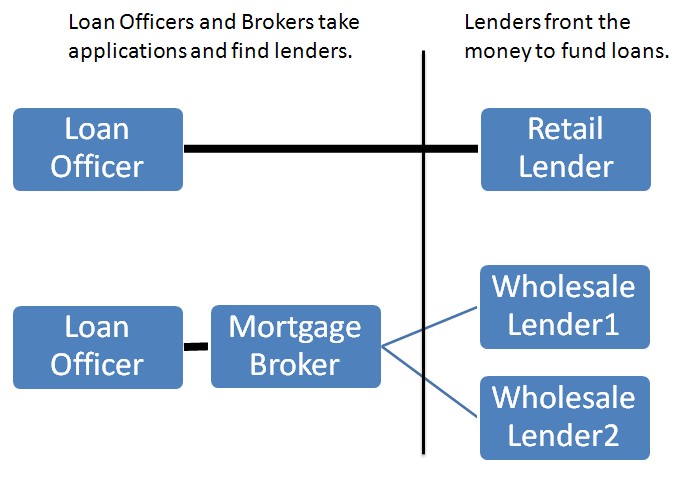

What are the differences between these mortgage professionals and why is it important? We will try to shed some light on their roles and how they affect you, the borrower. Let’s start by looking at how loan officers and mortgage brokers differ from lenders.

Mortgage Brokers

Mortgage brokers can be thought of as independent consultants who match you with a lender. They find new customers, counsel them on appropriate loans, shop for lenders, and process the loan. The processing includes gathering data including credit checks, appraisals, and employment verification. Once the loan is processed, it is sent it to a lender who funds the loan. Brokers have ties to multiple banks so they can shop across many lending sources for lower rates. They usually make their money by marking up rates they get from lenders, adding fees to the loan, or a combination of the two.

Loan Officers

Loan officers are typically employed by lenders or mortgage brokers. They find new clients, counsel borrowers on how to choose the best mortgage, and fill out loan applications. They typically make their money through commissions on the loans. Loan officers can also be mortgage brokers if they also process and broker loans. Loan officers are sometimes called mortgage consultants, mortgage loan originators, home loan consultants, and mortgage planners.

Lenders

Lenders are the ones who front the money to fund your loan. Lenders have various names based on how they acquire their clients and what they do with your loan after it is funded.

Retail vs. Wholesale Lenders (how customers are acquired

- Retail lenders reach out directly to consumers. For example, Wells Fargo has loan officers in local branches that perform all loan origination functions.

- Wholesale lenders fund mortgages acquired through brokers outside of their company. The brokers process loans and then sell them to wholesale lenders to fund.

- Many banks, such as Wells Fargo, have both retail and wholesale channels.

Mortgage Bankers vs. Portfolio Lenders (what happens to your loan)

- Mortgage bankers fund loans but typically turn around and sell them in the secondary market to secondary lenders such as Fannie Mae and Freddie Mac. This is very common. Mortgage bankers borrower money from banks to fund the loans and then repay the money when the loans are sold. Most large lenders such as Wells Fargo Mortgage are mortgage banks.

- Portfolio lenders include many community banks, credit unions, and savings & loans companies. Portfolio lenders use money from their customers’ bank deposits to fund loans so they can hold onto the loans and keep them in their portfolios.

Correspondent Lenders

Correspondent lenders are a mix between brokers and lenders. They technically fund loans with their own borrowed money but typically lock in rates with wholesale lenders at the same time. This mitigates their risk since they can quickly turn around and sell the loan.

What type of mortgage professional is best?

The type of professional does not matter as long as you get the rate, fees, and loan you were promised. You should be more concerned about finding the lowest rate and fees, as well as working with someone you trust.

Where can you find the best rates?

It depends. The lender with the lowest rate could change daily. Using a broker may help you find the lowest rate and fees since they can search multiple lenders (similar to how Expedia searches multiple airlines). However, the lowest rate may be at a bank not connected to the broker or may only be found at a given bank’s website (in the travel analogy, this would be like Southwest or NWA who always have their best rates on their own sites).

To search across thousands of loan officers, mortgage brokers, mortgage banks, savings and loan companies, and credit unions, you can use Zillow Mortgage Marketplace. This service allows you to compare quotes and fees side-by-side, across a broad range of lenders, so you find the best value. I recommend starting your search there since it is free and anonymous, and then consulting your local bank or mortgage broker to see if they can compete with the rates on Zillow Mortgage Marketplace.

Written by

Zillow

07.08.2009

How much home can you afford?

At Zillow Home Loans, we can pre-qualify you in as little as 3 minutes, with no impact to your credit score.

Zillow Home Loans, NMLS # 10287. Equal Housing Lender

Get pre-qualified