Too Narrowly Focused?

By Peter Tchir of Academy Securities

Too Narrowly Focused?

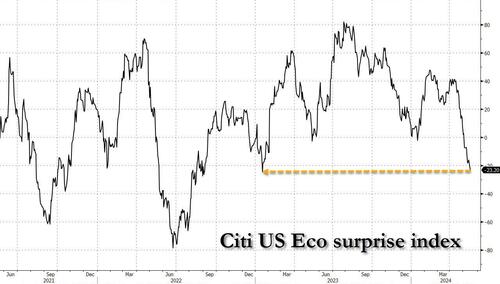

The Citi Economic Surprise Index continues to deteriorate (worst levels in a year).

Bond yields have declined (the 10-year Treasury got to 4.31% on Thursday, basically the bottom of our 4.3% to 4.5% range, and crept higher the rest of the week). Bonds in part moved on economic data (weak), inflation (high, but “explainable”), and Powell (who couldn’t resist being dovish) effectively dismissing the higher than anticipated PPI (explainable as it was). I’d argue that bond yields went lower partly due to economic data and partly due to Powell.

Stocks did well again this week (1% to 2% depending on the index), but the narrative seemed narrowly focused on Powell, cherry picking economic data, and the ongoing importance of corporate buybacks in an otherwise slow and boring tape.

As we start this week, Nvidia’s earnings on May 22nd seem to be the biggest catalyst as there is virtually no data on Monday or Tuesday. While we will likely hear from more Fed speakers, will anyone pay attention after Powell’s tone last week?

My concern, I guess, is that we are spending too much time focused on the Fed and inflation, while ignoring (or not treating as importantly) other data.

Inflation Fixation

The market, to some degree, has seemed to:

- Wait for inflation data.

- Explain away higher than expected prints.

- Rally.

I completely understand the arguments for why the inflation prints were not as bad as they seemed on the surface. The explanations ranged from:

- Downward revisions to prior months meant that inflation has been overstated (which I could agree with, if everyone didn’t seem to believe that official inflation data has underestimated the rise in prices that we all face every day).

- The components. The components are critical, and the misses can be explained (at least somewhat) by components that aren’t as relevant or seem like one-time things (auto insurance for example). That all makes sense, though I have to admit that my rate of health insurance cost has blown away any official estimate of health insurance (maybe I’m unique? I don’t think so. Maybe healthcare isn’t that important? I beg to differ). In any case there are enough arguments to be made that I understand why the market was not overly perturbed by the prints (plus I have liked the 10-year down to 4.3% and still am in the 2-cut camp, so the arguments didn’t hurt there – they just didn’t translate into my equity underweight view).

- Lag effects. This one bothers me on so many levels. Partly, when a year or so ago we were arguing that official inflation was too high due to the lagged effect of rent, it was a struggle to get traction with the theme (the government data was showing the highest monthly increases in decades, at times when online information was confirming a slowdown in rents). Actual rent increases still are occurring and have been pretty stable around pre-COVID levels (according to Zillow). So, the excitement that we use old data, which will start reflecting declines from almost a year ago, seems strange (to say the least). I cannot understand, for the life of me, why we use Owners ’ Equivalent Rent (which has always seemed like a bizarre method) and why we accept a methodology that is lagged (on purpose). Making any policy, on knowingly incorrect data, has never made sense and never will.

The next paradox for the Fed: since Shelter/OER inflation lags by 18 months, housing inflation will decline well into 2025 even as actual rents are again starting to tick up.

— zerohedge (@zerohedge) December 12, 2023

By the time lagged CPI catches up with "today", real rents will be rising double digits. pic.twitter.com/sHOWxN2OVQ

But, I’m not here to argue about where inflation has been, I’m here to point out that I think the market has been too narrowly fixated on past inflation, and what the Fed might do about that, while not thinking enough about some bigger picture issues.

My simple case for inflation is this:

- If inflation continues to come down, it is likely to be tied to a weakening economy, which should be good for bonds, but not so good for stocks (assuming that tenuous link between lower bond yields and higher stocks can be broken again).

- My worst-case view would be seeing a decline in inflation due to more and more selling of Chinese brands, which will put margin pressure on companies domiciled outside of China as they need to compete. The benefit of lower inflation will accrue to bondholders, but stocks won’t like declining sales, increased competition (largely on price), and the associated margin pressures.

- If inflation goes higher, it could be due to:

- Robust domestic job growth. A resurgence in the global economy, which would not be good for bonds, but stocks should do quite well even with rising bond yields.

- Increased cooperation between China and Russia. Accidental or willful acts to increase commodity prices. Demand from India as their economy surges and the wealth effect takes hold. While this might not accompany “stagflation,” it could set us up for inflation on a global basis without commensurate growth in the domestic economy.

I do believe that with PPI and CPI behind us, markets will start delving deeper into the overall slew of economic data and are unlikely to like what they see.

China, Russia, and the Geopolitical Landscape

We asked the question, Will Tariffs Outweigh CPI? They didn’t. The media and most economists were quite sanguine about this round of tariffs (as opposed to the ones imposed in 2018, which remain in place). Maybe they were so “concentrated” that they are unlikely to impact the shape of the global economy? Maybe China won’t respond? Or maybe we are missing a big risk?

In Friday’s Geopolitical Risks – Perception versus Reality, we examine CYBER, Commodities, the Middle East, Russia, Trade War, and “wildcard” risk. For now, our assessment is that the biggest gap between perception and reality is around the Trade War (with commodities not too far behind). Please see that report, as nothing about the recent announcement that China and Russia are cooperating more makes me any less concerned that the Trade War is about to ratchet higher.

Also, if you missed it, I recommend listening to this month’s Around The World Podcast.

Bottom Line

- Neutral on yields. We are too close to the bottom end of our range to be very bullish, and the specter of inflation (especially from commodities) is too troubling to take the range lower.

- Underweight equities. As we move beyond inflation and the Fed (hopefully), the reality that is “less than exceptional” might start sinking in. As a reminder, FXI and KWEB (my proxies for China stocks) were up 5.6% and 7.1% respectively last week! I also think, based on our geopolitical work, that adding exposure to commodity related stocks (and the commodities themselves) makes sense.

- I’m still not sure what we will learn about the AI story on Wednesday (everyone wants it, everyone needs it, everyone is getting it, and there are shortages even as prices rise), that isn’t already priced into this market.

Hopefully we do get an expanded narrative and spend less time and energy worrying about an inflation print here or there and how the Fed will act, and focus instead on the bigger discourse on the state of the global economy and the likely direction of travel (which I continue to think will not be favorable for our markets).

On the other hand, I could be the one being too narrowly focused (on China and geopolitics), but I’m encouraged by recent announcements that my fixation is valid (not encouraged for the state of global affairs, just in the narrow definition that I don’t think I’m wasting time or energy thinking about trade war escalation).