Abstract

This paper reviews the existing literature on the intertemporal choice from a methodological perspective. After a summary of the neoclassical model with its inaccuracies and controversies, the paper introduces the concept of present bias presented through time discounting research. It investigates differences in the relative evaluation and decisions made over some type of utility, generally money or goods, at different points in time by comparing the evaluation at an earlier date with one for a later date. Specifically, the hyperbolic discounting model is put forth again as well as the various standard types of present-focused models are analyzed. Furthermore, the paper discusses the recent evidence on commitment devices, how this evidence relates to theoretical questions about the demand for, and effectiveness of, commitment. An earlier generalization of the discounted utility model implied that people’s intertemporal marginal rate of substitution would diverge depending on the stretch of time a choice was made: This would give rise to a preference for commitment.

Similar content being viewed by others

Keywords

- Intertemporal decision-making

- Present focused preferences

- Time discounting resources

- Commitment devices

1 Introduction

In literature, decisions that can affect multiple time periods are known as intertemporal choices. These decisions are crucial to many research and policy issues, and they embrace a ton of different branches, from medicine to education, including much fundamental and applied research in microeconomics and finance as well as public choice, social choice theory, and welfare economics. The very first formalization of an intertemporal choice model is due to Ramsey [1] and Samuelson [2]. The model features time-separable utility flows exponentially discounted and included the so called exponential discount function, where the discount rate is constant and independent of the time-frame. This modeling also implies dynamically consistent preferences, thus preferences held at time t will be identical to the ones held at a later time, regardless of circumstances. This “Discounted Utility Model” was the main reference point for intertemporal choice research for much of the twentieth century and despite laying the very foundations for this literature, it’s been criticized by many and was proven unreliable by the empirical evidence collected from numerous experiments. In particular, Loewenstein and Prelec [3] highlighted the main inaccuracies and anomalies presented by the model itself, these being: the gain-loss asymmetry, which implies that losses are discounted at a lower rate than gains are, the absolute magnitude effect which implies that large sums of money suffer less proportional discounting compared to smaller ones, the delay-speedup asymmetry, which highlighted inconsistent preferences between speeding up and delaying consumption, the same choice which presented the same set of options being framed in two different ways and leading to wildly different results: indeed, the amount required to compensate delaying consumption was two to four times greater than the estimated amount necessary to speedup consumption by the same time frame. The last one was the common difference effect, easily explained by Thaler [4], who concluded that, despite a person preferring one apple today to two apples tomorrow, that same person might prefer two apples in 101 days instead of one apple in 100 days, assuming the given time frame is large enough to be meaningful, thus the absolute time interval separating two actualized consumption decisions is the only relevant factor, as it pertains to the choice itself. They then proposed a “behavioral model” of intertemporal choice alternative to normative theory that accounted for these issues; this model described intertemporal choices in terms of deviations from a predetermined consumption plan, in contrast with normative theory which assumed that people modified their existing consumption plans with new alternatives once they acquired new information before making a choice. The discount function is thus a generalized hyperbola

The utility function is replaced by a value function with a reference point that reflects three main conditions, these being: the value function for losses is steeper than the value function for gains, the value function for losses is more elastic than the one for gains, the value function is more elastic for outcomes that are larger in absolute magnitude.

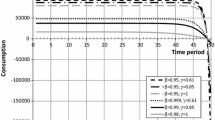

Laibson [5] developed the golden eggs model, that analyzes consumption decisions of an hyperbolic discounter, this paper paved the way for the hyperbolic discounting model to become a pillar within the literature. It focused on the possibility that illiquid assets could function as an indirect commitment technology (despite the chance that customers gravitated towards such an asset because of different reasons like risk management, large marginal revenues and arbitrage opportunities). The model divides the agent’s portfolio in two consumption options, an illiquid asset, (which requires waiting one period, before being allowed to generate the associated cash flow) and a liquid asset that can be immediately consumed if the agent so desires. He then pondered equilibrium strategies for a finite-horizon game which featured multiple selves who make choices at least two periods from the end of the game and face a nonconvex restricted choice-set, which led various future selves to adopt discontinuous equilibrium strategies, thus enforcing the nonmarginality property and having to find a way around those problems. This paper, alongside the one mentioned above [3], was the first to introduce the hyperbolic discount function, which featured a higher discount rate in the short term compared to the long term:

This model suggests that agents’ preferences aren’t dynamically consistent and are subject to change with the passage of time once new information is available. This discrete time quasi-hyperbolic function features a high short term discount rate, while its long term discount rate is relatively low; this implies that agents give a disproportionate amount of importance to the present in comparison to the future, this concept is known as “present focused preferences” and has led to numerous models trying to accurately portrait human behavior that we will analyze in the following section. Section 3 discusses humans’ longing for commitment technologies, their effectiveness in restricting choice sets and moderating our present biased self-fulfilling wishes, in addition to that, it also denotes that active choice promotes empowering behavior and how “taking matters into our own hands”, might prove to be instrumental in bettering behavior. Section 4 contains some concluding remarks.

2 Present Focused Preferences

Human beings assign a qualitatively different importance to the present, and are used to pursue instant gratification despite being mindful of renouncing a substantially higher amount of gratification at a delayed time. Ericson and Laibson [6] define present focused preferences as the situation wherein an agent is more likely to opt for a more pleasurable outcome that generates immediate perceived utility in the present moment, than she would be if the effects of the options in her choice set were delayed by the same interval. Present focused preferences generate dynamically inconsistent choices, as in the decision between two assets made at time t is different from the one made at a later time \(\tau \), but they don’t necessarily generate dynamically inconsistent preferences (the concept of dynamic consistency in regards to preferences can be illustrated with this example: the stage contingent preferences held at date t and declared at a later time \(\tau \) are the same as the ones held at date \(\tau \) and declared at time \(\tau \)).

2.1 Present Bias

Present bias is a special case of the more generalized concept of present-focused preferences, and it is usually referred to as quasi-hyperbolic discounting [7]. In this intertemporal choice model, the present-biased preferences enclose a continuative payoff stream that is weighted by parameter \(\beta \), and exponentially discounted afterwards, \(\beta \) being the discount factor in the following equation [8]:

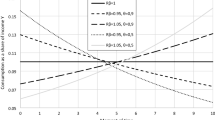

The discount rate in the above discount function decreases as \(\tau \) increases:

This function declines at a faster rate in the short term, rather than in the long term, its’ most precipitous segment reflecting agents’ impulsiveness as we inch closer to the present day, this allows us to observe the subsequent sharp short run drop in valuation, as measured by the experimental data. An important distinction to be made between different agents is whether their beliefs are sophisticated or naïve. A sophisticated agent is consciously aware of her own present bias and thus acts accordingly, whether by restricting her choice sets or by employing commitment devices, since she has a correct understanding of her own future preferences. Partially sophisticated agents are aware of their own present bias, but they underestimate its’ extent and thus believe that their future selves will have a higher value of \(\beta \) than those selves will actually have. Naïve agents esteem that their future selves won’t be present biased at all, and as such will make the optimal decision without a need for commitment, since their future preferences will perfectly reflect their current preferences for the future.

2.2 Temptation Models

As stated before, dynamically inconsistent choices can stem from dynamically consistent preferences and rational beliefs. Different models that could explain this pattern were subsequently introduced as the so called unitary self models [9], by incorporating temptation as a relevant variable of choice and analyzing the degree to which choice itself was affected by such factor. These unitary self models attempt to describe our discounting process, and, while very different from each other, all feature one common characteristic, choice sets affect utility, up to and accounting for the options that are not chosen. We can consider two mutually exclusive activities, a pleasurable one, like playing, and a tedious one, like studying, and ask two agents with varying degrees of temptation, (one strong and one weak) to choose at time t for a later time \(\tau \). Under strong temptation, the agent will opt for playing at time t and will commit to studying at time \(\tau \), displaying present focused preferences. This example is a case of preference reversal that is consistent with dynamically consistent preferences; in this scenario, the reversal would probably be caused by the alluring temptation that only arises in the actual moment the choice is made, whereas this influence isn’t present when the agent is merely choosing for the future, with an unrestricted choice set the agent would opt for the alluring alternative in this instance. In the case of present-biased agents, preference reversals are connected to the concept of present focused preferences. In the case of weak temptation, the agent will choose to study at time t and will commit to studying at time \(\tau \) as well. Removing the tempting option would actually increase the agent’s utility in this case, since instinctively, it’s psychologically costly to resist a more alluring alternative, despite this longing for commitment ultimately proving irrelevant in the agent’s choice, (she will choose to study either way).

2.3 Dual Self Models

Another branch of present focused models is predicated upon the concept that conflicting selves simultaneously steer the decision-maker in diametrically opposed directions. Thaler and Shefrin [10] had hypothesized conflict between a myopic “doer” and a far-sighted “planner”. A meticulous formalization of this framework was done by Fudenberg and Levine [11], who model decisional issues as a game between a short-term impulsive self and a long-term patient self. The model assumes that a sequence of short-run selves and the long-run self share the same preferences as it pertains to the present about the results of the various stages of the game, differing exclusively in their vision of the future; short-run selves are assumed to be fully myopic as well. The two stages evolve as follows: in the first phase the short-run self chooses an action capable of influencing her utility function, thus modifying the original preferences, in the second phase the short-run self makes her final decision. The long-run self however cannot impose commitment for the entire length of the dynamic game, instead she’ll have to choose which preferences to assign to the short-run self and thus specify the level of self-control she wants to exercise. The “Dual Self Model of Impulse Control” underlines how the short and long run selves possess the same preferences, the long-run self thus wishes to act in the best interest of future short-run selves. Fudenberg and Levine [11] further imposed a restriction that forced short-run selves to always make the best reply, thus allowing the long-run self to implicitly control it, albeit sustaining a substantial cost in the process. This dual self model implies a preference for commitment, like the quasi-hyperbolic one. The short-run self can be influenced in different ways, whether via the long-run self actively modifying utility functions and suffering a cost as discussed previously, or restricting choice sets of future short-run selves. This descriptive model features a single equilibrium and is capable of accurately predicting agent’s choices.

2.4 Models of Psychometric Distortions

Models of psychometric distortions affirm that psychic distortions skew our temporal perception and our ability to properly manage hazards. When forming our intertemporal preferences, our subjective estimations don’t match objective time accurately [12]: subsequently, it can be hypothesized that agents’ subjective perception of time isn’t linear and is characterized by an insufficient flexibility to changes within the temporal horizon. It can also be noted that time is often perceived as a concave function, \(\tau (t)\) [13]. If we assume that agents discount exponentially, but at the same time discern time t with a concave function as argued by the papers cited above, then we could postulate the following discount function and formally introduce this intertemporal choice model:

The discount rate instead is summarized by the following equation:

When the derivative of \(\tau \) with respect to t is equal to 1, then we obtain the normative theory in what we would deem as a special case. However if that’s not the case and time is perceived with a concave function, then the discount rate will prove to be inversely proportional to the temporal horizon. We can thus make analogous considerations to the ones made regarding hyperbolic discounting models; indeed, we register high discount rates in the short-run and low discount rates in the long-run, thus generating present focused preferences. Psychometric distortions tend to generate dynamically inconsistent preferences, since biased agents currently evaluate intertemporal tradeoffs wrongly. Read [13] proposed an alternative to the hyperbolic discounting model by introducing the concept of subadditivity, which affirms that discounting on a delay is larger when the delay is divided into sub-intervals rather than when it’s left intact. Read remarks that declining impatience, (according to this concept, average discount rates decline when the delay increases), has played a crucial role in formalizing the quasi-hyperbolic discounting model. However, its explication is mistake-laden in its foundations according to him, since it confuses between delay, (identified as the time frame that occurs between the present and the moment when the outcome transpires) and the interval between two outcomes. Hyperbolic discounting attributes declining impatience to delay, whereas subadditivity relates it to the aforementioned interval. Read’s experiments confirmed his hypotheses, particularly an inverse relation between the length of the delay and the average discount rate for that delay, how the absolute interval influences discounting, since longer delays will lead to a bigger discount. Subadditivity generates dynamically consistent preferences and doesn’t generate present focused preferences. Rubinstein [14] argued that hyperbolic discounting was merely one of the infinite possibilities to model the psychological findings that were used to justify it. He thus proposed a different method to properly describe and explain decisions made under uncertain conditions, especially agents’ discounting habits, particularly he argued that decision-makers try to simplify their choices by applying likeness relations, the so called heuristic reasoning. Objects of choice were shaped as the pair, (a, \(\tau \)) with a and \(\tau \) referring to the number of utilities and the delay, respectively. When pondering options, Rubinstein believed that agents went through a triple staged process where they applied heuristic reasoning, if they had a dominant strategy at their disposal, (such as higher utilities combined with lower delay), they would always play that strategy, whenever a dominant strategy was lacking, agents would look for similarities in the options available to them between either the utilities dimension or the delay one and then decide based on the dimension that featured no such similarities.

2.5 Models of Myopia

We could define myopia as the inability to clearly glimpse into the future when it is theoretically forecastable in nature. The most rigorous and thorough modeling of myopia dates back to Gabaix and Laibson [15], who argue that behavior generated from imperfect prediction is indistinguishable from the one generated by intertemporal choices. The model analyzes a perfectly patient Bayesian decision-maker that receives distorted signals from the future. The extraction and extrapolation process of those signals will induce her to exhibit a behavior that mimics intertemporal discounting, in what the authors define “as if hyperbolic discounting”, proving how imperfect prediction and erratic discernment will lead perfectly patient agents to be more impatient than what their preferences would suggest they actually are. The model assumes agents receive untrustworthy but unbiased signals from the future, which they proceed to combine with prior expectations in order to form posteriors. Under this framework, agents, when facing a binary choice with mutually exclusive rewards, one closer and one further time wise, exhibit as-if discounting, the variance of the erratic component of their prevision increases linearly compared to the horizon. They also demonstrate preference reversals coherently with hyperbolic discounting; however, they don’t show a preference for commitment, since imperfect foresight stems at the origins of their inaccurate prediction; so, unlike present-biased agents, they don’t have a self-control issue. Intelligence, knowledge and experience are cited as major factors in determining the scale of agents’ myopia.

3 Active Choice, Commitment Technologies and Behavior Improvement

We have seen how present-biased agents try to restrict their future choice-sets, assuming they are sophisticated and are consciously aware of their own present-bias. Partially naïve agents, however, can not fully anticipate the extent of their present focus. Procrastination is an empirical pattern that refers to the inability to complete a task, specifically to the continuous postponement of its completion despite the delay being perceived as disadvantageous by the agent herself. Naiveté is brought up as a likely source of procrastination by [16], who found that individuals fail to cancel their gym contracts in time after their last attendance, incurring in significant monetary losses in the process. Applying for a flat monthly fee despite having to pay a price per expected visit that was 70% higher than if they were to use a 10 day pass, or monthly users being more likely to keep staying enrolled rather than clients who had signed up for a year, despite having to face higher cancellation costs than the former, were further observed behavioral patterns that were hard to reconcile with common sense and beliefs. Time inconsistent preferences and present bias have been cited as possible sources of procrastinating behavior. Other possible reasons relate to hazy memory, limited attention spans and cognitive excess due to having to process too many things at the same time, resulting in being unable to focus on each aspect and thus making unsubstantiated and rushed decisions, we could also call this cognitive imbalance.

The authors opined that firms purposefully structure contracts with automatic renewal clauses and exorbitant switching costs and cancellation penalties, taking advantage of agents’ inability or unwillingness to choose, this passivity directly affecting agents’ finances. The example brought forth above suggests that active choice is beneficial to people with self-control issues and helps steer behavior in the right direction.

Deadlines constitute a powerful tool that may help reduce procrastinating behavior [17]. Their experiment contemplated a class of students to be split up in two sections, one section of students was given strict and non negotiable deadlines that were evenly spaced, while students in the other section could freely choose the deadlines that were most suitable to them. The paper highlights how students who were allowed flexibility in their chosen deadlines showed lower levels of class performance and thus didn’t choose their deadlines optimally, though this may be by design, if the students weren’t prioritizing academic success but rather enjoying their freedom. Neoclassical economics believe that, if properly educated and within a regime of informational disclosure, agents will always make optimal choices. Behavioral economics instead highlight how commitment technologies that actively encourage choice and force agents to become more engaged and take matters into their own hands, constitute a far more powerful tool in order to steer behavior in an optimal direction.

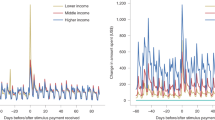

An example of information sharing proving ineffective in bettering behavior within the confines of the household financial investment literature has also been provided in [18]. The paper analyzed a congruous set of employees from different firms that were over 59 and a half years old and had their contributions matched by the employer, that is, for every contribution they made up to a certain threshold, their employer would make an additional matching contribution proportionate to the employee’s original contribution. Employees over that age threshold had unrestrained access to their 401(k) savings account, since they were allowed to withdraw their contributions penalty-free, whenever they wanted and without right cause. Statistically, the authors found that between 20 and 60% of employees failed to take advantage of this arbitrage opportunity, despite the fact that the monetary gains available to them were risk-free. Informing the employees of the mismanagement of their portfolios didn’t produce significant results, indeed only 0.1% of employees corrected their mistake and raised their contribution rate up to the matching threshold, the neoclassical approach ultimately proved ineffective in this instance. The firms involved in the survey assured optimal conditions to the participants, since different issues often plague and bias participation in 401(k) savings plans, such as liquidity constraints, insurance policies and withdrawal penalties. However, as detailed above, less than half of employees on average actually contributed to the match threshold.

The authors bring up various motivations in order to shine light upon this apparently inexplicable conundrum, like knowledge deficiencies in the investment and savings confines and a lack of general financial savviness and excessively high decision making costs that render active participation in retirement savings plan unwelcome. Evidence of procrastinating behavior was found, the authors argued financial incentives to be ineffective, instead suggesting active intervention as a possible solution. The latter strategy was resoundingly successful in studies done by [19] who explored the potential of active choice as an enrolling mechanism for 401(k) plans. The authors studied a firm that had accidentally switched from standard procedure (where employees aren’t enrolled by default, but have the option to opt in), to active decision cohort (where employees have to apply directly and are requested to choose), and they found out that the participation rate was substantially higher under the active decision cohort scenario.

Additional studies [20, 21] also strived to find a way to properly model savings patterns and optimize them. The papers suggested that, should employers actually wish to increase participation and investment in 401(k) retirement plans, then they should adopt automatically renewed procedures while keeping the option to drop out, or otherwise encourage the employees themselves to actively indicate whether they want to take part in these projects or not. Legislators were also urged to design retirement savings contracts that wouldn’t discourage enrollment and that wouldn’t force departing employees to liquidate funds, but rather re-allocate them in a retirement fund. This adjustment, alongside automatic enrollment, would increase contribution rates and employer matches. The authors further note that, under an automatic enrollment regime, few would actually invest sums above the default contribution rate designed by the system, so including a feature that gradually increased the percentage employees contribute over time was stressed as a possible solution. Asset diversification and more generous matching funds were other alternative options to encourage employees into taking part in 401(k) plans.

4 Conclusion

Decision-making that can have an impact over multiple time periods is reflected as an intertemporal choice. This methodological review seeks to demonstrate some theoretical challenges and empirical observations. In particular, overwhelming empirical evidence tends to make economists abandon the neoclassical exponential discounting model that had been used to model intertemporal tradeoffs in favor of quasi-hyperbolic models. The concepts of present bias and present-focused preferences upon which the latter was based paved the way for the different classes of models trying to best frame the intertemporal decision-making, analyzed in this paper. Robust empirical regularities as commitment, naiveté, and procrastination play a role in shaping our intertemporal preferences; however, the extent of this role is still mostly unclear and of even more importance is understanding how all these different factors intertwine and interact with each other. Future research will build upon established concepts from the existing literature and expand on them. It is considered appropriate to study the potential for active choice and commitment technologies to improve decision-making in the relentless attempt to accurately represent human behavior and economics. In any case, several research and policy questions remain still unanswered, while the area of further research is extensive. Among all questions, the ones to which we will attempt to contribute in a near future is the following: Can commitment technologies be implemented to instilling long-term behavioral change or can they create merely short-term changes requiring further commitment devices to maintain behavior on an ongoing basis? Do agents have a preference for commitment? How much are they willing to pay for it?

References

Ramsey, F.P.: A mathematical theory of saving. Econ. J. 38(152), 543–559 (1928)

Samuelson, P.A.: A note on measurement of utility. Rev. Econ. Stud. 4(2), 155–161 (1937)

Loewenstein, G., Prelec, D.: Anomalies in intertemporal choice: evidence and an interpretation. Q. J. Econ. 107(2), 573–597 (1992)

Thaler, R.: Some empirical evidence on dynamic inconsistency. Econ. Lett. 8(3), 201–207 (1981)

Laibson, D.: Golden eggs and hyperbolic discounting. Q. J. Econ. 112(2), 443–478 (1997)

Ericson, K.M., Laibson, D.: Intertemporal choice, Chap. 1, vol. 2, pp. 1–68. Elsevier (2019)

O’Donoghue, T., Rabin, M.: Doing it now or later. Am. Econ. Rev. 89(1), 103–124 (1999)

Laibson, D.: Intertemporal decision making. In: Nadel, L. (ed.) Encyclopedia of Cognitive Science. Nature Publishing Group (2003)

Laibson, D.: A cue-theory of consumption*. Q. J. Econ. 116(1), 81–119 (2001)

Thaler, R.H., Shefrin, H.M.: An economic theory of self-control. J. Polit. Econ. 89(2), 392–406 (1981)

Fudenberg, D., Levine, D.K.: A dual-self model of impulse control. Am. Econ. Rev. 96(5), 1449–1476 (2006)

Zauberman, G., Kim, B.K., Malkoc, S.A., Bettman, J.R.: Discounting time and time discounting: subjective time perception and intertemporal preferences. J. Mark. Res. 46(4), 543–556 (2009)

Read, D.: Is time-discounting hyperbolic or subadditive? J. Risk Uncertain. 23(1), 5–32 (2001)

Rubinstein, A.: “Economics and psychology”? The case of hyperbolic discounting. Int. Econ. Rev. 44(4), 1207–1216 (2003)

Gabaix, X., Laibson, D.: Myopia and discounting. Technical report, National Bureau of Economic Research (2017)

Malmendier, U., Della Vigna, S.: Paying not to go to the gym. Am. Econ. Rev. 96(3), 694–719 (2006)

Ariely, D., Wertenbroch, K.: Procrastination, deadlines, and performance: self-control by precommitment. Psychol. Sci. 13(3), 219–224 (2002)

Choi, J.J., Laibson, D., Madrian, B.C.: 100 bills on the sidewalk: suboptimal investment in 401 (k) plans. Rev. Econ. Stat. 93(3), 748–763 (2011)

Carroll, G.D., Choi, J.J., Laibson, D., Madrian, B.C., Metrick, A.: Optimal defaults and active decisions. Q. J. Econ. 124(4), 1639–1674 (2009)

Choi, J.J., Laibson, D., Madrian, B.C., Metrick, A.: Defined contribution pensions: plan rules, participant choices, and the path of least resistance. Tax Policy Econ. 16, 67–113 (2002)

Choi, J.J., Laibson, D., Madrian, B.C., Metrick, A.: For better or for worse: default effects and 401 (k) savings behavior. In: Perspectives on the Economics of Aging, pp. 81–126. University of Chicago Press (2004)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Lafratta, M. (2021). Understanding the Intertemporal Choice: A Methodological Review. In: Bucciarelli, E., Chen, SH., Corchado, J.M., Parra D., J. (eds) Decision Economics: Minds, Machines, and their Society. DECON 2020. Studies in Computational Intelligence, vol 990. Springer, Cham. https://doi.org/10.1007/978-3-030-75583-6_25

Download citation

DOI: https://doi.org/10.1007/978-3-030-75583-6_25

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-75582-9

Online ISBN: 978-3-030-75583-6

eBook Packages: Intelligent Technologies and RoboticsIntelligent Technologies and Robotics (R0)