The best free payroll software creates pay stubs, calculates deductions, prints tax forms, and issues payments. Some even offer free tools such as e-filing, employee portals, and time management solutions.

With so many options, finding the right tool when you’re on a budget can be challenging. That’s why we’ve reviewed the top 5 free payroll solutions so you can compare them and make an informed choice for your business.

The Best Free Payroll Software Ranked

- HR.my — Free forever, unlimited employee management software

- Payroll4Free — Free, unlimited payroll for up to 10 employees

- Excel Payroll — Simple and intuitive free Excel-based payroll app

- Roll by ADP — Premium payroll software with the first three months free

- eSmart Paycheck — First three months free and a free forever online payroll calculator

The Best Free Payroll Software Reviewed

Here are in-depth reviews of the best free payroll software and premium payroll solutions with free plans/trials. We’ve focused on each platform’s functionality, automation, and integration capabilities, as well as its pros and cons, so you can see how they compare and choose the best one for your business.

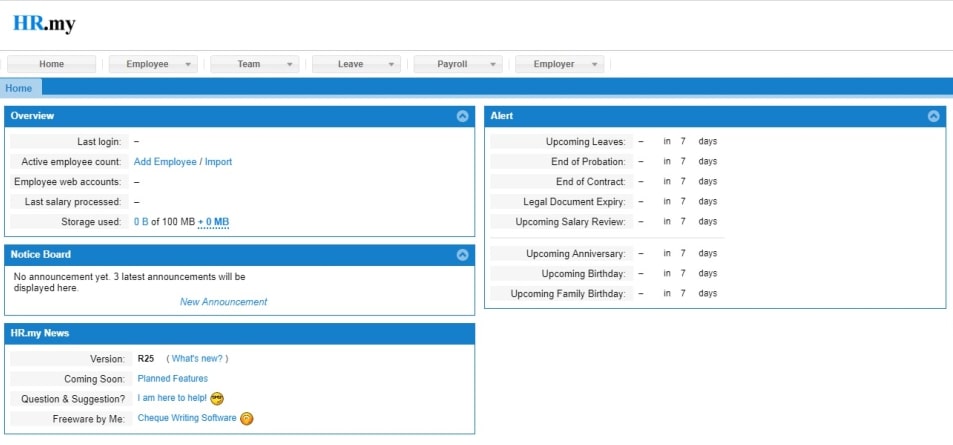

1. HR.my — Completely Free, Unlimited Employee Management Software

| Free Plan Offer | Top Features | Leave Tracking | Reporting |

|---|---|---|---|

| Unlimited | Unlimited Payroll Runs, Time and Leave Tracking, Expense Claims | ✅ | ✅ |

HR.my is a free forever employee management application. There are no limitations regarding the number of employees, the number of payroll runs, or the amount of data storage.

With the app, you can simplify and automate payroll, automatically generate payslips, pay employees, complete tax forms, and process salaries on a weekly, bi-weekly, monthly, and bi-monthly basis.

In addition to payroll, HR.my lets you track all business expenses and payroll data, so you’ll know exactly what each dollar was invested in. You’ll be able to set monthly or annual limits for each claim entitlement, as well as easily sort claims by type. What’s more, your managers/department heads will receive email notifications the instant an employee submits an expense claim.

This payroll solution also lets you manage and approve employee time off requests, track their accrued PTO, and see every team member’s historical leave records. Processing payroll because simple using this software.

You’ll also be able to leverage HR.my to track daily attendance and overtime. The app features easy web clock-in and clock-out and can even optionally capture selfies and geolocation. The former prevents buddy punch-in (someone else clocking in for another person), while the latter helps ensure that your employees are on-site.

You can even use HR.my to share business documents and forms with your team members, which greatly facilitates collaboration and new employee onboarding. The right free payroll software will offer plenty of opportunities for collaboration with staff and clients.

HR.my Pricing Plans

HR.my is free forever, with no paid add-ons or fees. To get started, download the mobile app on your Android or iPhone and create a free account.

Pros

- Free forever with absolutely no limitations

- Built-in attendance and leave tracking

- Free expense claim functionality

- Incident management

- Custom approval workflows (e.g., claims, leave)

Cons

- No customer support

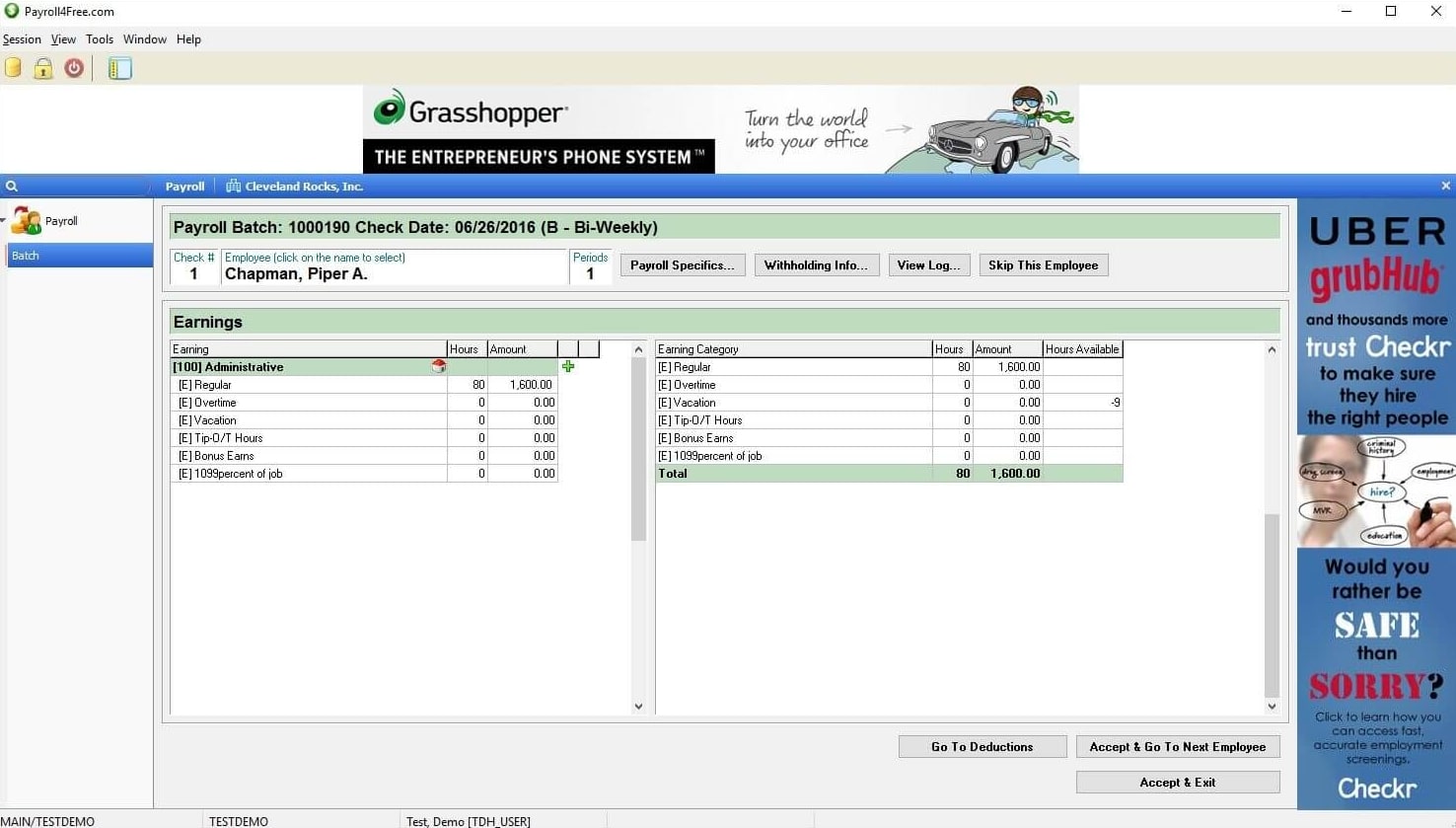

2. Payroll4Free — Free Forever for up to 10 Employees

| Free Plan Offer | Top Features | Leave Tracking | Reporting |

|---|---|---|---|

| Unlimited free payroll for up to 10 people | Automatic Tax Calculations, Employee Portal, PTO Tracking | ✅ | ✅ |

Payroll4Free is a free payroll software solution for small businesses with up to 10 employees. There are absolutely no fees, charges, or paid add-ons associated with the software, and you get access to every feature with your free account.

The downside is that in order to be free, the software displays ads when you log in to process payroll, unlike HR.my, which is ad-free, where you also have unlimited users compared to Payroll4Free’s maximum of 10.

You can utilize Payroll4Free to complete unlimited payroll runs, pay your employees by checks or direct deposits, and calculate all your federal, state, and local payroll taxes. The platform even lets you track your team’s sick leave and PTO, so you’ll always be able to see the exact number of hours worked by each employee.

Payroll4Free also features an employee portal, giving your team members the option to access and update their pay information online, print pay stubs and W-2s, and review their accrued vacation time.

What’s more, Payroll4Free has a professional support team available via email and phone, which is a huge plus for free software – something that HR/my lacks.

Payroll4Free Pricing Plans

The payroll software is free forever, as long as you’re running payroll for up to 10 employees. There is no pricing information for larger teams, so you will need to contact the company with your inquiry.

Additionally, Payroll4Free offers two paid services:

- Payroll Tax Service — Payroll4Free handles payroll tax calculations and filing for you.

- Direct Deposit Service — The ability to leverage the company’s bank to pay your employees via direct deposits.

While the pricing for these two paid add-ons isn’t listed individually, the company does mention that the most you’ll pay for both of them together is $40/month.

Pros

- Free unlimited payroll for up to 10 employees

- Automated payroll taxes

- Built-in PTO tracking

- Employee self-service portal

- In-depth reporting

Cons

- Runs in-app ads that may be distracting

- Outdated user interface

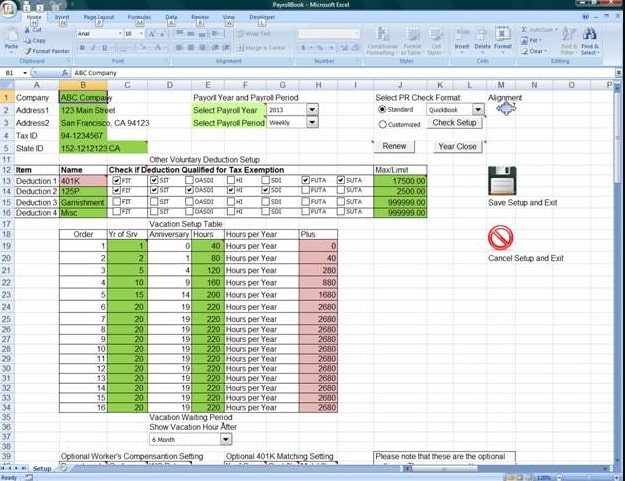

3. Excel Payroll — Simple and Intuitive Free Excel-Based Payroll App

| Free Plan Offer | Top Features | Leave Tracking | Reporting |

|---|---|---|---|

| Free forever payroll for up to 57 active employees | W-2 Preparation, Check Printing, Expense Tracking | ❌ | ❌ |

Excel Payroll is a perfect free payroll software for businesses who don’t want to deal with complex payroll software but still want to automate payroll calculations. This Excel-based program is super simple and intuitive, and it comes with pre-formulated Excel functions, which effectively eliminates the possibility of human error.

Although the app runs in Excel, its layout ensures that everything’s visible at a glance. You’ll have a dedicated tab for each functionality, as well as the ability to save your setup, undo, and cancel & exit.

You can use Excel Payroll to store relevant information on each employee, calculate their monthly earnings and deductions, prepare W-2 forms, and even create and print checks.

Additionally, you can set up flexible payment schedules within the app, which allows you to pay freelancers, contractors, and FTEs (full-time employees) at different intervals.

However, the interface for processing payroll is not the best when compared to HR.my or even Roll by ADP. Since it’s Excel, it’s all just that—based on Excel, which might not be everyone’s first choice.

Excel Payroll Pricing Plans

The core payroll service of Excel Payroll is completely free, provided you’re a small business or a nonprofit. If you want to run payroll for more than 50 employees or need to complete more than 3,640 payroll transactions annually, you’ll have to buy a premium license:

- Trial Version — $40; one-year renewal

- Trial Version with Extended Time — $50; renews every year and a half

- Standard Version — $100; two-year renewal

- Premium Version — $500; unlimited access

Additionally, if you want to automate tax calculations, you’ll have to pay $50 for an updated tax table specific to your state.

Pros

- Free to use for up to 57 active employees

- Simple, Excel-based app with no learning curve

- Comes with a variety of pre-built expense management forms

- Lets you prepare W-2 and print checks

- Free demos available on the site to guide you through payroll setup

Cons

- No time tracking capabilities

- Only compatible with Microsoft Office 2007, 2010, and 2013

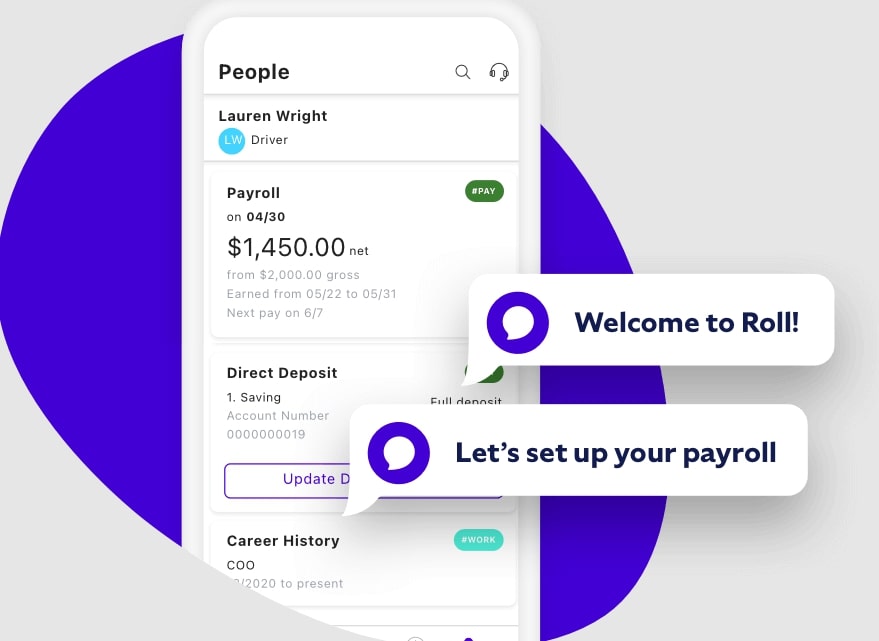

4. Roll by ADP — Premium Payroll Software With the First Three Months Free for New Users

| Starting Price | Free Plan Offer | Top Features | Leave Tracking | Reporting |

|---|---|---|---|---|

| $29/month + $5/month per employee | First three months free | Same-Day and Next-Day Direct Deposits, Done-for-You Tax Calculations, Automatic Benefit and Retirement Plan Deductions | ❌ | ✅ |

Roll by ADP is a premium free payroll software solution, but you get the first three months free when you create your account for the first time. The key advantages of Roll by ADP over free forever payroll apps are that the company handles payroll taxes for you, provides unlimited live chat support, and supports same-day and next-day direct deposits.

With Roll by ADP, you can pay both full-time employees and contractors in minutes, either by direct deposit or company check. All payroll tax deductions are handled by the company, meaning everything is double-checked by tax filing and payroll experts at ADP.

In addition to the ability to process payroll, Roll by ADP helps you streamline HR and business management, thanks to GenAI chat functionality that offers real-time assistance. The AI also proactively checks for any errors, ensuring complete accuracy of all payroll runs.

Like HR.my and Payroll4Free, the app also features an employee portal, where your team members can view their job, pay, and benefit info, receive payday notifications, view and download pay stubs and payroll tax filing statements, and receive real-time reminders regarding tasks and upcoming deadlines.

Roll by ADP Pricing Plans

Roll by ADP has a singular subscription plan, priced at $29/month + $5/month for each active employee. There are no long-term contract commitments, and first-time users get the first three months free. This gives you plenty of time to test the app in practice and see if it meets the unique needs of your business before committing to a monthly subscription.

Pros

- Unlimited payroll runs and flexible pay schedules

- Done-for-you payroll tax calculations

- Automatic deductions for benefits and retirement plans

- AI-powered error checks

- Real-time task and deadline notifications

Cons

- No attendance or leave tracking

- The AI chat commands require a bit of trial and error to learn

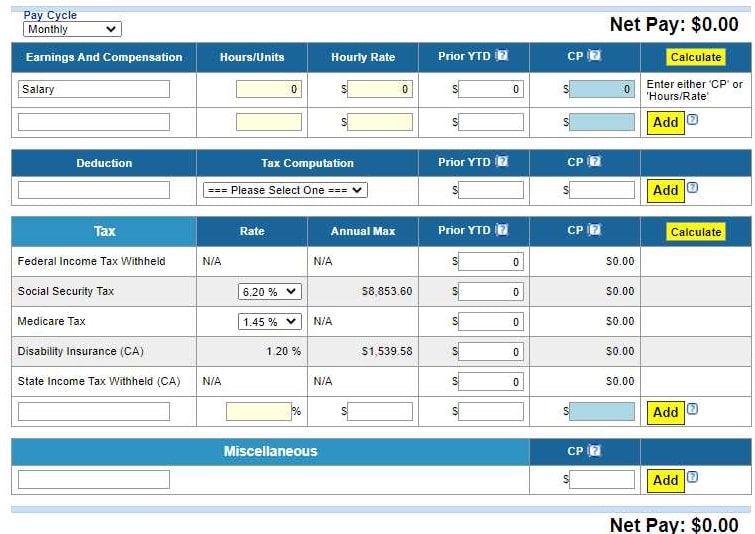

5. eSmart Paycheck — Paid Online Payroll Tool With the First Three Months Free and a Free Forever Online Payroll Calculator

| Starting Price | Free Plan Offer | Top Features | Leave Tracking | Reporting |

|---|---|---|---|---|

| $75/year for up to 5 employees + $2 per W-2 form | First three months free + Free forever online payroll calculator | Payroll Calculations with Bonuses, Commissions, and Overtime, Online Payroll Calculator, Automatic Tax Calculations | ❌ | ✅ |

eSmart Paycheck is an online payroll processing tool that lets you calculate payroll, payroll tax filing, and deductions, prepare W-2s, and prepare and print checks and pay stubs. The tool is paid, but new users get the first three months free to test it out in practice before committing.

What’s unique about this software is the fact that it enables you to set up commission-based payroll, overtime, bonuses, and other earning items with complete flexibility. This makes it ideal for running payroll for companies with sales departments, where commissions and bonuses are an essential part of payroll calculations.

If you don’t want to pay for the tool after the first three months, you can utilize the eSmart Paycheck free online payroll calculator. You can simply add hours worked or monthly salary for payroll tax filing and computations, as well as overtime, bonuses, and commissions. You can also add any tax deductions and print pay stubs and paychecks.

This would require you to keep track of hours worked and deductions in a separate program like Excel or Google Spreadsheets (in which case, you might as well use Excel Payroll), but it’s a much better option considering that the paid version of the software offers very few advanced functionalities, so it’s hardly worth the money.

While eSmart Paycheck has a free offering, Roll by ADP has an edge in terms of the overall experience using the software and what is included in your plan.

eSmart Paycheck Pricing Plans

The platform has a rather convoluted pricing plan, with the prices varying based on the number of employees and the functionalities you want to have access to. Here’s a quick breakdown:

- Payroll — From $75/year for up to 5 employees

- Deposit Fed taxes automatically, ACH — $35/year

- Deposit State taxes — $30/year

- Print or e-File State payroll forms — $20/year

- Print, mail, or e-File W-2s — $20/year

Pros

- Simple and easy to use

- First three months free

- Free forever online payroll calculator

- The ability to include overtime, bonuses, and commissions in the calculations

Cons

- Expensive for what it does

- No leave tracking or expense management

The Best Free Payroll Software Compared

| Payroll Software | Best For | Standout Features | Free Plan Offer | Leave Tracking | Reporting | Mobile App |

|---|---|---|---|---|---|---|

| HR.my | Free forever payroll, attendance, and leave tracking | Unlimited Payroll Runs, Time and Leave Tracking, Expense Claims | Unlimited | ✅ | ✅ | ✅ |

| Payroll4Free | Small businesses with <10 employees | Automatic Tax Calculations, Employee Portal, PTO Tracking | Unlimited free payroll for up to 10 people | ✅ | ✅ | ❌ |

| Excel Payroll | Running payroll for a small team in Excel | W-2 Preparation, Check Printing, Expense Tracking | Free forever payroll for up to 57 active employees | ❌ | ❌ | ❌ |

| Roll by ADP | Outsourcing tax filing to professionals | Same-Day and Next-Day Direct Deposits, Done-for-You Tax Calculations, Automatic Benefit and Retirement Plan Deductions | First three months free | ❌ | ✅ | ✅ |

| eSmart Paycheck | Free online payroll calculations | Payroll Calculations with Bonuses, Commissions, and Overtime, Online Payroll Calculator, Automatic Tax Calculations | First three months free + Free forever online payroll calculator | ❌ | ✅ | ❌ |

Paid vs Free Payroll Software

Whether small business owners should opt for a free payroll solution or a paid one depends largely on your business needs.

As you have seen in this guide, there are a few excellent free payroll apps, like HR.my, that cover all the fundamentals — from payroll and payroll tax filing to time tracking and PTO management. Overall, free payroll platforms can be a decent choice if you’re running payroll for a smaller team. Their biggest drawbacks are outdated, clunky interfaces and the lack of advanced features, automations, integration capabilities, or professional support.

On the other hand, the best paid payroll software solutions are typically faster and easier to use, guarantee payroll accuracy, help you automate the bulk of repetitive admin tasks, offer superb data security, and often come with a slew of additional features and functionalities.

If you’re unsure whether you should opt for a free or a paid payroll solution, you can always get started with a free one and upgrade to a premium solution as the need arises. Alternatively, you can test out free plans/free trials of premium payroll apps and compare them with free tools, so you can see the difference between the two first-hand.

How We Test Payroll Software

Here are the criteria we rely on when testing, reviewing, and comparing payroll software solutions for small business owners:

- Pricing — The availability of free plans or free trials, plus the overall value for money of all the different pricing plans for paid payroll software.

- Features — All the available features and functionalities and the benefits they offer to businesses of different sizes in different industries.

- Integrations — Native integrations with third-party HR, accounting, and time-tracking tools.

- Automation — Automatic tax calculations, real-time alerts and notifications, error checks, and payroll report scheduling.

- Ease of use — The overall ease of use of the app/platform, the UI (User Interface) and navigation, and the time required to learn how to fully utilize all of its features.

- Third-Party Reviews — The overall sentiment of the users and the most commonly mentioned advantages and drawbacks in public review on reputable review sites.

How to Choose the Best Payroll Software

Here are a few factors you should consider to ensure that you choose the best payroll software for your business:

Budget — How much money can you afford to invest in the software, and will you get all the features and functionalities on the plan you can afford/on the free plan.

Ease of Use — How much time, money, and energy you’d have to invest to ensure everyone on your team can properly utilize the software. It’s always best to opt for a fairly intuitive platform, so you don’t have to organize training workshops or double-check everything for errors.

Compatibility — What devices and operating systems can you use the platform on, and whether or not there’s a mobile app so you can handle payroll on the go.

Key Features — What features are available on different pricing plans, and whether or not there are any limitations you’d have to circumvent or paid add-ons you need, which might bump up the monthly subscription price. The top free payroll software will offer the minimum features you’ll need.

Scalability — How easy would it be to add new users to your account and upgrade to a more feature-rich pricing plan. The ideal free payroll software should scale.

Customer Support -— What options are there for contacting customer support, what are their working hours, and what do users have to say about the support agent’s response time and technical knowledge. Free payroll providers know how to offer comprehensive customer support.