-

Private Banking

International. Interconnected. Inter-generational.

Exploration for entrepreneurs and their future generations

Here to help you grow and protect your wealth. As your wealth needs extend beyond wealth management, our 170-year history and presence in 53 markets connects you to a global network of opportunities to help you make the most of your successes and leave a lasting legacy

International connections

Unlocking new opportunities in dynamic markets

Interconnected bank

Serving your personal and business needs

Inter-generational services

Helping you look after your future generations

Wealth insights

Latest insights from the Chief Investment Office team

Tailored solutions

Supporting your wealth aspirations your way

Spot investment opportunities

See our latest Global Market Outlook

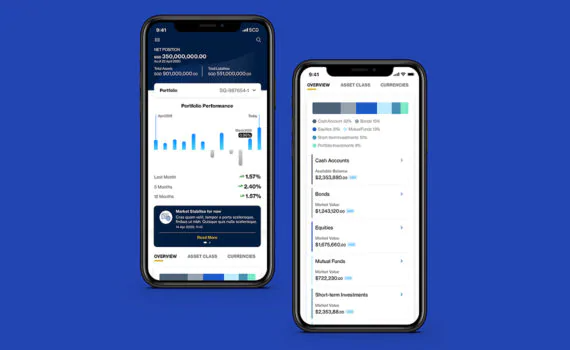

Manage your private banking

Access your account conveniently when it matters

Future-proofing your portfolio

Providing you with opportunities in sustainable investing

Follow us on Facebook

See our daily Wealth insights on social media

We are delighted to be conferred

Latest CIO view across asset classes

Equity

Δ Overweight ∇ Underweight — Neutral

Equity – at a glance —

26 APRIL 2024

- Short-term volatility can create buying opportunities. We are Overweight US equities. US macro data has been solid, offsetting the less supportive Fed outlook. US companies continue to display strong pricing power, resulting in solid net margins. We are also Overweight Japan equities. The earnings outlook is improving, ROE is rising and valuations are still attractive. The hawkish Fed is soothing some concerns about the risk of a significant rise in JPY against the USD.

- We are Neutral Asia ex-Japan equities. India is our biggest Overweight. Its economy is growing the fastest among key markets within the region, and its companies have strong ROEs, justifying its expensive valuation. Korea and Taiwan are our two other Overweight positions. The tailwinds from semiconductor and AI-themes justify their heavy positioning. We are Neutral China equities. There is low expectations on the macro data, and positioning is very light – these counteract against deflationary risks and issues with its property markets. We are Neutral China onshore versus offshore. Lastly, we are Underweight ASEAN, which is overly defensive in a growth environment.

- We are upgrading UK equities to Neutral. A higher-yield environment help value sectors. Euro area equities is our Underweight. Cheap valuation reflects weak EPS growth. Consumer confidence remains weak, and service inflation remains sticky.

North America equities – Preferred holding Δ

26 APRIL 2024

The bullish case:

- Strong earnings growth amid robust consumption

The bearish case:

- Impact of high interest rates

Europe ex-UK equities – Less Preferred holding ∇

26 APRIL 2024

The bullish case:

- Inexpensive relative valuations

The bearish case:

- Still-weak cyclical & structural growth outlook

UK equities – Core holding —

26 APRIL 2024

The bullish case:

- Attractive valuations, dividend yield

The bearish case:

- Stagflation risks

- Political uncertainty

Japan Equities – Preferred holding Δ

26 APRIL 2024

The bullish case:

- Reasonable valuations

- Rising dividends/share buybacks

The bearish case:

- Expected JPY strength

Asia ex-Japan equities – Core holding —

26 APRIL 2024

The bullish case:

- Earnings rebound

- China policy support

The bearish case:

- China structural growth concerns

Bonds

Δ Overweight ∇ Underweight — Neutral

Bonds – at a glance —

26 APRIL 2024

- We have a Neutral allocation to Developed Market (DM) Investment Grade (IG) government bonds. The rise in US government bond yields has further improved the risk-reward balance, although upside inflation surprises are headwinds that are likely to keep the Fed on hold for longer than previously anticipated. We revise our 3-month target and 12-month target of the benchmark 10-year US government bond yield higher to 4.50-4.75% and 4.0%, respectively.

- Higher government bond yields have naturally pushed DM IG corporate bond yields higher. However, a low yield premium over underlying government bonds, relative to history, leads us to maintain a Neutral allocation here as well. The same rationale is extended to DM High Yield (HY) corporate bonds, where we also have a Neutral allocation.

- In Emerging Markets (EM), we have upgraded USD government bonds to an Overweight. EM fundamentals continue to strengthen, with fiscal balances improving to pre-pandemic levels. We view the current yield and asset class sensitivity to US bond yields as attractive. Separately, the differentiation in fiscal policies and EM currency volatility have led us to have an Underweight allocation to EM local currency government bonds. We remain tactically bullish on INR-denominated bonds.

- In Asia, a mixed economic backdrop among regional countries leads us to have a Neutral Asia USD bonds allocation. Within this, we have a slight tilt towards Asia HY bonds over Asia IG bonds.

Developed Market Investment Grade government bonds – Core holding —

26 APRIL 2024

The bullish case:

- High credit quality

- Attractive yields

The bearish case:

- High sensitivity to monetary policy

Developed Market Investment Grade corporate bonds – Core holding —

26 APRIL 2024

The bullish case:

- High credit quality

- Sensitive to falling yields

The bearish case:

- Elevated valuations

Developed Market High Yield corporate bonds – Core holding —

26 APRIL 2024

The bullish case:

- Attractive yield

- Low rate sensitivity

The bearish case:

- Elevated valuations

- Sensitive to growth

Emerging Market USD government bonds – Preferred holding Δ

26 APRIL 2024

The bullish case:

- Attractive yield

- Sensitive to US rates

The bearish case:

- EM credit quality

- Election/political risks

Emerging Market Local currency government bonds – Less Preferred holding ∇

26 APRIL 2024

The bullish case:

- Attractive yield

- Room for policy rate cuts

The bearish case:

- USD strength

- Election/political risks

Asia USD bonds – Core holding —

26 APRIL 2024

The bullish case:

- Moderate yield

- Low volatility

The bearish case:

- China property contagion risk

- Elevated IG valuations

Commodities

Δ Overweight ∇ Underweight — Neutral

Commodities – at a glance

26 APRIL 2024

- We revise higher our 3-month gold forecast to USD 2,300/oz and continue to have a Neutral allocation in our portfolios. The yellow metal defied rising real yields to scale fresh all-time highs on the back of continued strong official sector and physical demand, particularly in China. Tactical positioning has also risen as investors added gold to hedge against the heightened geopolitical risks and reflationary signs. In our view, the recent price action suggests that real yields are less of a headwind at least for now. Put together, we see continued resiliency in the precious metal. Over the longer term, while we still expect the next leg of rally to be driven by rate cuts, our expectations of delayed rate cuts and the reduced role of the real yields mean that the gains are likely to be limited. Therefore, our 12-month forecast is only slightly higher at USD 2,325/oz.

- We expect WTI oil to remain volatile around USD 89/bbl in the near term on tighter demand-supply. Crude oil prices have receded from the 5-month high posted during the initial Iran attack on Israel. It appears that the geopolitical risk premium is easing, but oil prices could spike on any bad tidings. The risk of further escalation and even a broader fallout, while low, is not negligible. Furthermore, the second-order effects of the conflict, such as the ramp-up of sanctions on Iranian crude oil, could exert upward pressure on oil prices. Elsewhere, there are downside supply risks lingering in the background. Demand, on the other hand, is creeping up in recent months. In the long run, the focus would return to the longer-term demand-supply forces, which we assess to be finely balanced, fading the WTI oil to around USD 82/bbl.

Crude Oil

26 APRIL 2024

The bullish case:

- Resilient DM economies

- Stable demand growth in Asia

- Supply reduction from geopolitical conflicts

- OPEC+ supply cuts

- Low inventories

- US shale underinvestment

- US SPR refill

The bearish case:

- Tight monetary policies and resulting growth slowdown

- Redirection of Russian oil flows

- Easing of sanctions against Venezuela

- Significant global spare capacity

- OPEC+ supply discipline

- Lower demand from energy transition

Gold —

26 APRIL 2024

The bullish case:

- Portfolio hedge

- Central bank demand

The bearish case:

- Resilient USD

Alternatives

Δ Overweight ∇ Underweight — Neutral

Alternatives at a glance —

26 APRIL 2024

The bullish case:

- Diversifier characteristics

The bearish case:

- Equity, corporate bond volatility

Multi-Asset

Δ Overweight ∇ Underweight — Neutral

Multi-Asset – at a glance

26 APRIL 2024

- Income assets trailed as equity markets soared to record highs. Our Multi-Asset Income (MAI) model allocation has delivered just 2.0% since 27 December 2023 till date, modestly better than most fixed income assets, but lagging the strong performance seen in global equities. Our Underweight to dividend equities hurt as equities have outperformed bonds thus far, while the Overweight allocation to fixed income was negatively impacted by the rise in US government bond yields.

- Greater probability of a soft landing as economic data continues to surprise on the upside. The recent central bank meetings also suggest DM policymakers are turning more supportive of growth and less concerned about inflation. This suggests a more stable interest rate environment, amid resilient growth, which will likely be positive for both bonds and equity risk assets over the next 6-12 months. For multi-asset income strategies, the reduced risk of an economic downturn can benefit dividend equities and non-core income assets, which have performed well so far into the year.

- We close our Overweight to fixed income, turning Neutral between bonds and dividend equities this month. The overall yield on our MAI allocation remains at an attractive c.6%, with MAI strategies likely to benefit from a combination of more resilient economic growth and a less uncertain interest rate environment, given the Fed guidance on policy rate direction for 2024.

We are here for you

Get in touch now or explore our private banking resources