If you’ve traded stocks, offloaded concert tickets on StubHub, or finally sold your extensive baseball card collection (congratulations), you’ll need to report those transactions on Form 8949.

Here’s what you need to know about the form, including how to fill it out, how to file it, and how to account for it elsewhere on your tax return.

What is Form 8949?

Form 8949 is used to report the “sales and dispositions of capital assets,” so you can pay taxes on any profit you made. This basically means that, if you’ve sold a significant piece of property, you’ll let the IRS know by sending in this form when you do your taxes.

What is a capital asset?

“Almost everything you own and use for personal or investment purposes is a capital asset,” according to the IRS. For the purposes of filling out Form 8949, this could be:

- Securities like stocks and bonds

- Collectibles like coins, jewelry, or art

- A piece of land or real estate

“Lunch is not a capital asset,” says CPA Robert Persichitte, who worked as an IRS tax auditor for 10 years. “Your 1962 Dudley Do-Right lunchbox is a capital asset.”

Do crypto and NFTs count?

Yes, cryptocurrency, NFTs, stablecoins, and related property count as capital assets. They’re what’s known as “digital assets,” and they’re treated the same as other assets for federal tax purposes.

Who needs to fill out Form 8949?

Anyone who sells a capital asset should fill out Form 8949, unless you’re a professional business seller. There are a few other scenarios that would force you to fill out the form, but the sale of capital assets is the most common one.

Individuals and organizations can fill out Form 8949 if applicable, but we’ll concentrate on individuals here.

Here’s what the IRS says should be reported on Form 8949:

- “The sale or exchange of a capital asset not reported on another form or schedule” — i.e., if you’ve offloaded a capital asset, you’ll report it here

- “Gains from involuntary conversions (other than from casualty or theft) of capital assets not used in your trade or business” — i.e. income from a sale that you “didn’t want to make but had to,” according to Persichitte. One example of this is if you’re forced to sell your home to make way for a highway

- “Non-business bad debts” — that is, if you lent money that you didn’t get back

- “Worthlessness of a security” — that is, if a company you’ve invested in goes bankrupt and you’re able to write off your investment

- “The election to defer capital gain invested in a qualified opportunity fund (QOF)”: If you have a QOF, you might be eligible for certain tax breaks. That said, QOFs are “very hard to invest in by accident,” Persichitte says. “If you had this, you’d probably know.”

- “The disposition of interests in QOFs” — i.e. the sale of one of the above investments

What if you’re a business seller?

The rules change a bit if you sell capital assets as a self-employed worker — for instance, if you source and sell clothing on Poshmark, or if you day trade on Coinbase. In those cases, you’d report your sales and earnings on Schedule C of Form 1040, and you wouldn’t need to fill out Form 8949.

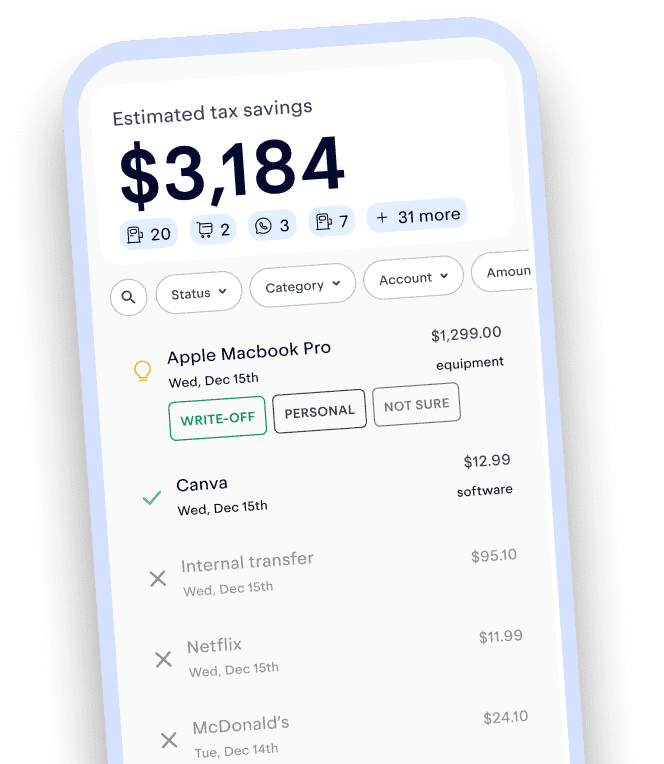

If you’re a business seller, you’re also eligible to take business write-offs, which Keeper can track for you automatically. These might include inventory costs, shipping costs, or even a portion of your internet bill — whatever it takes to keep your business functioning.

{upsell_block}

Not sure if you’re a business seller? Check out our explainer on business vs. hobby guidelines. In general, though, if you’re in it to make a profit rather than offloading unwanted items once in a while, you’re probably running a business in the IRS’s eyes.

What if you lost money on your sale?

If you lost money on your sale — for example, if you bought stock for $1,000 and sold that same stock for only $700 — you’ll still need to fill out Form 8949. However, you won’t have to pay taxes on the transaction. There’s no profit to pay taxes on!

In even more good news, you can write off your losses on your taxes. This will lower the overall amount of income you’re taxed on, which means your bill will be lower, too.

For example, let’s say you made $60,000 at your day job, but you lost $1,000 when you sold a chunk of stock. According to IRS rules, you’re able to deduct up to $3,000 in capital losses from your other income. Thus, you’d only be taxed on 60,000 minus 1,000 — $59,000.

What do you need in order to file Form 8949?

First, let’s take a look at the form’s structure.

Form 8949 is divided into two parts. The two parts are very, very similar to one another. The only real difference is that Part 1 is for short-term capital gains and losses and Part 2 is for long-term capital gains and losses.

If you have both, you’ll fill out both sections of the form. If you only have one, you’ll only need to fill out one section.

With Keeper, you can file Form 8949 right on the app — whether you sold a single stock or your entire coin collection. Plus, a team of tax assistants is available to help answer any questions you have.

{filing_upsell_block}

Understanding short-term vs. long-term capital gains

The difference between a short-term and a long-term capital gain comes down to how long you owned the asset before you sold it. You’ll be taxed less if you owned it for at least a year. Note that it’s unusual for long-term capital gains to be taxed at more than 15%.

Your Form 1099-B

If you sold stocks, bonds, or other securities through a broker, you’ll receive a Form 1099-B from the broker. For example, if you sold stock using Robinhood, you’ll receive a 1099-B from Robinhood detailing the transactions you made throughout the year.

You’ll transfer information from your 1099-B form onto your Form 8949, which you’ll then file with your tax return. You don’t need to file the 1099-B itself — if you’ve received a copy from your broker, the IRS has received a copy too.

What if you don’t receive a 1099-B?

Form 1099-B is intended to report the sale of securities, so if you sold something else — physical collectibles or land, for instance — you won’t receive one. Other types of 1099 forms you might use include:

- 1099-S: For some real estate transactions. This will be sent to you by whoever closed the transaction, likely an agent

- 1099-A: If your home was foreclosed on, you can use the data on this form to report the capital loss

If you don’t receive a 1099 at all, you’ll have to use other sources of information to fill out Form 8949. Luckily, that shouldn’t be too difficult — think bank statements, personal records, emails, and so on.

{write_off_block}

How to fill out Form 8949

Next, we’ll move through the form step by step, beginning with short-term gains and losses.

Step #1: Check box A, B, or C in Part 1

First, you’ll indicate whether the IRS is already aware of your assets’ “basis” — or the amount you originally paid for it. For example, if you bought a rare coin for $400, your basis is $400 — no matter how much you ultimately sell it for. You’ll do this by checking box (A), box (B), or box (c).

If you’ve received Form 1099-B for the short-term transactions you’re reporting, you can narrow down your options to box (A) and box (B).

When to check box A

Next, ask yourself: Does the entity that sent you the 1099-B know how much you originally paid for the asset? For example, if you do all your trading on Robinhood, the app would be aware that you paid $1,000 for your shares of Company X, and you’d check box (A).

When to check box B

If you transferred shares to Robinhood from another brokerage, Robinhood may not be aware of how much you initially paid for them. In this case, you’d check box (B).

When to check box C

Finally, you’ll check C if you did not receive a Form 1099-B at all. This will apply if you’re dealing with assets other than securities.

What should you do if multiple boxes apply?

If your list of transactions falls under multiple boxes (for example, you have some transactions that fall under box (A) and some that fall under box (B), you’ll need to fill out a separate form for each type.

Step #2: Fill out Section 1

Here’s the meat of the form. Let’s go through it column by column. As you read, you can refer to the below hypothetical example for reference.

Column (a): Description of property

What asset are you talking about? Be specific, but don’t stress too much. A brief description will do just fine. If the asset is stocks, be sure to specify the number of shares.

Column (b): Date acquired

When did you acquire the asset? This could be the day you bought it, the day it was gifted to you, or the day you found it by the side of the road. Be as specific as possible.

Column (c): Date sold or disposed of

When did you sell the asset? This will theoretically have happened quite recently, so you should be able to nail down the exact date.

Column (d): Proceeds (sales price)

How much did you sell the asset for?

Column (e): Cost or other basis

How much did you initially pay for the asset? It’s possible that you paid $0, which is fine. In that case, you’ll generally enter the fair market value of the asset at the time you got it. You can figure that out a few ways, including from a previous appraisal or by comparing the asset to similar assets that were sold around the same time.

Columns (f) and (g): Adjustments

You’ll only need to fill out these columns if you received an incorrect 1099 form, if you’re “excluding or postponing” a capital gain, or if you have a disallowed loss.

One example of a disallowed loss is a wash sale, or a sale in which you purchase a security 30 days before or 30 days after you’ve sold the same security. If you take a loss on that sale, the IRS won’t let you write it off. This is to prevent people from deliberately using these types of sales to lower their taxable income.

Column (h): Gain (or loss)

To find this number, you’ll simply calculate the difference between column (d) and column (e). This could be a positive number, which means you’ve made a capital gain, or a negative number, which means you’ve taken a capital loss and won’t have to pay taxes. It could also be zero, which also means you don’t have to pay taxes. Can’t be taxed on nothing!

Step #3: Calculate your short-term totals

Here, you’ll add up the amounts in columns (d), (e), (g), and (h) to find your totals for each. Remember that if one of your entries is a negative number, you should subtract that amount.

Next, we’ll move to Part 2, which deals with long-term transactions. You don’t need to fill out the next section if you don’t have any!

Step #4: Check box (D), (E), or (F) in Part 2

Part 2 functions identically to Part 1: You’ll check:

- Box (D) if you received Form 1099-B and the IRS is aware of your basis

- Box (E) if you received Form 1099-B and the IRS is not aware of your basis

- Box (F) if you did not receive Form 1099-B at all

{email_capture}

Step #5: Fill out Section 1

Look familiar? It should! This is essentially a replica of the section where you filled out your short-term transactions. You’ll follow the same steps to report your long-term transactions here.

Step #6: Calculate your long-term totals

Repeat step 3 for your long-term transactions.

Remember to fill out Schedule D

Before you send Form 8949 on its merry way, you’ll also need to report your totals on Schedule D of Form 1040. You’ll see that there are sections to report both your short-term and long-term totals — just like Form 8949.

You’ll also use Schedule D to figure out your overall gain or loss from the totals you reported on Form 8949 (or forms, if you had to fill out multiple copies). This will help you determine your overall gain or loss for the year, with both short-term and long-term transactions included.

When that’s done, you’re ready to send all your capital sales information to the IRS. Whew! You did it. We knew those baseball cards would come in handy one day.

Over 1M freelancers trust Keeper with their taxes

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

Over 1M freelancers trust Keeper with their taxes

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

Over 1M freelancers trust Keeper with their taxes

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

Sign up for Tax University

Get the tax info they should have taught us in school

Expense tracking has never been easier

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

What tax write-offs can I claim?

At Keeper, we’re on a mission to help people overcome the complexity of taxes. We’ve provided this information for educational purposes, and it does not constitute tax, legal, or accounting advice. If you would like a tax expert to clarify it for you, feel free to sign up for Keeper. You may also email support@keepertax.com with your questions.