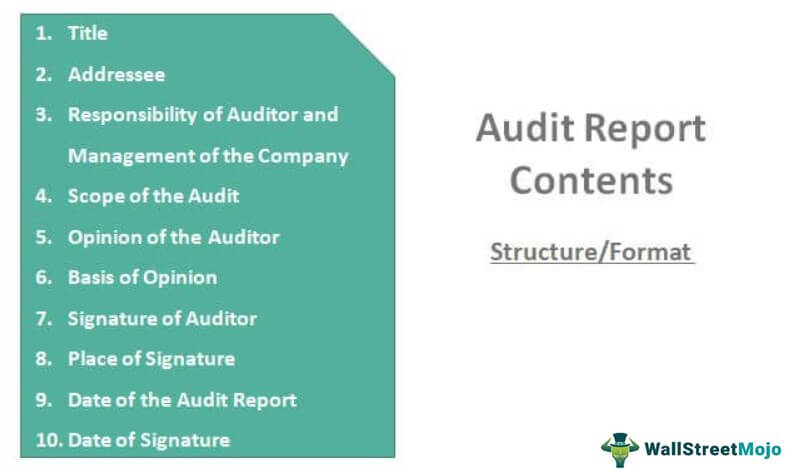

Audit Report Contents are the basic structure of the audit report which needs to be clear, providing sufficient evidence providing the justification about the opinion of the auditors and includes Title of Report, Addressee details, Opening Paragraph, scope Paragraph, Opinion Paragraph, Signature, Place of Signature, and Date of the Report.

Basic Content of an Audit Report

An audit report is an opinion on the financial statements of the Company given by the Auditors after conducting the financial audit of the Company. The Auditor’s report is published with the Annual report of the Company. Auditors report is read by investors, analysts, Company’s management, lenders while analyzing the Companies performance and ascertaining that the financial reports are as per the generally accepted accounting standards.

Table of contents

Example of Audit Report Content Format

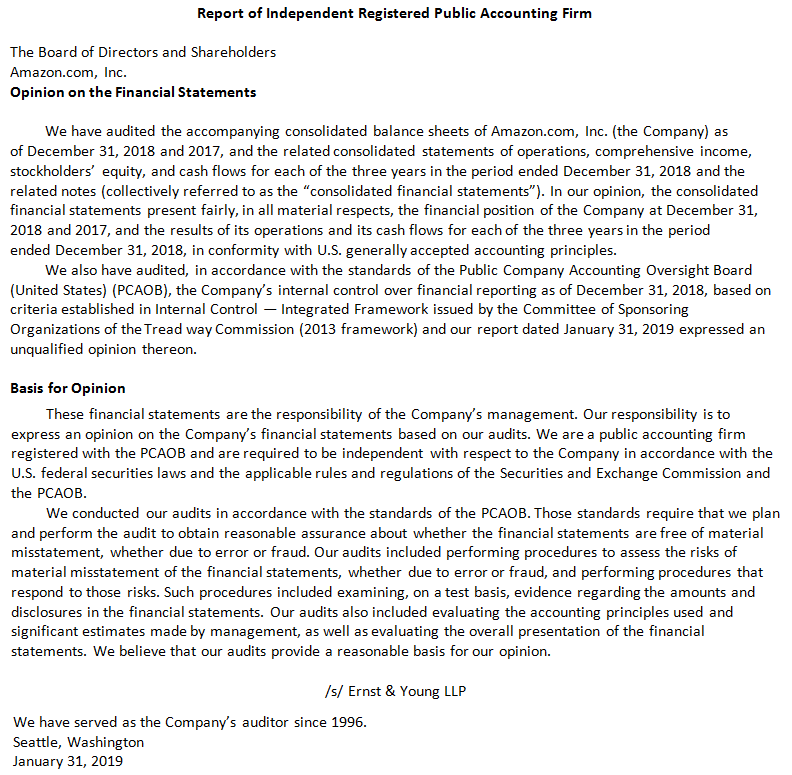

The below snapshot is the audit report contents of Amazon.com.

Source: www.sec.gov

If you want to learn more about Auditing, you may consider taking courses offered by Coursera –

Accounting for Financial Analyst (16+ Hours Video Series)

–>> p.s. – Want to take your financial analysis to the next level? Consider our “Accounting for Financial Analyst” course, featuring in-depth case studies of McDonald’s and Colgate, and over 16 hours of video tutorials. Sharpen your skills and gain valuable insights to make smarter investment decisions.

Structure/Format of an Audit Report Contents

A typical audit report has the following contents. Let us look at a brief understanding of each heading in the audit report.

You are free to use this image on your website, templates, etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be Hyperlinked

For eg:

Source: Audit Report Contents (wallstreetmojo.com)

#1 – Title

The title of the report mentions it is ‘Independent Auditors’ report.’

#2 – Addressee

The addressee is the person/group of persons to whom the report addresses. In the case of the statutory audit report, the addressee is the shareholders of the Company. Also, addressee refers to the person appointing the auditors. Since the shareholders of the Company appoint the auditors, the report addresses to them.

#3 – The Responsibility of the Auditor and the Management of the Company

This paragraph gives the responsibility of the auditor and the management of the Company. It defines that the responsibility of the auditor is to perform an unbiased audit of financial statements and give their unbiased opinion.

#4 – The Scope of the Audit

This paragraph describes the scope of the audit conducted by the Auditor by explicitly mentioning that the audit was done as per the generally accepted auditing standards in the country. It refers to the ability of the auditor to perform an audit and provides assurance to the shareholders and investors that audit was done as per auditing standards. It should include that the audit examination of the Company’s financial reports was done, and there are no material misstatements. The Auditor shall assess the internal controls and perform tests, inquiries, and verifications of the Company’s accounts. Any limitations on the scope of work done by the auditor are provided in this section of the Auditors report.

#5 – The Opinion of the Auditor

It is the primary paragraph of the Audit report content. The Auditors give their opinion on the financial reporting by the Company. There are four different types of opinions:

- Unqualified Opinion: An unqualified opinion, also called a clean opinion, is issued when the auditor determines that the financial records are free of any misrepresentations. An unqualified opinion is the best opinion given to the Company and the management. The unqualified opinion represents that the financial reports are in accordance with Generally Accepted Accounting Principles (GAAP)

- Qualified Opinion: The Auditor gives a qualified opinion in case the financial records are not maintained in accordance with GAAP, but the auditors do not find any misrepresentation in the financial reports. A qualified opinion highlights the reason for the audit report being qualified. A qualified opinion is also given in the case when adequate disclosures are not made to the financial statements.

- Adverse Opinion: Adverse opinion on the financial report is the worst type of financial report issued to the Company. An adverse opinion is given in case the financial reports do not conform to the GAAP, and the financial records are grossly misrepresented. The adverse opinion may refer to the onset of fraud in the Company. In this case, the Company has to correct its financial reports and financial statements. The Company will have to get the statement re-audited as investors and lenders would require the Company to give financial reports free of any errors and misrepresentation.

- Disclaimer of Opinion: In cases when the auditor is unable to complete the audit of the Company due to details not provided by the Company, it will give a disclaimer of Opinion. It means that the status of the financial condition of the Company cannot be determined.

#6 – Basis of Opinion

This paragraph gives the basis on which the opinion was based. It should mention the facts of the grounds in the report.

#7 – Signature of Auditor

The partner of the auditor must sign the audit report content at the end.

#8 – Place of Signature

It gives the city in which the audit report was signed.

#9 – Date of the Audit Report

Let us look at a brief understanding of each heading in the audit report.

#10 – Date of Signature

It gives the date on which the audit report was signed.

The Emphasis of Matter in Audit Report Format

The Content of Audit report can have an Emphasis of matter paragraph. The emphasis of matter paragraph can be added in the audit report if the auditor feels to draw the attention of the readers towards the vital matter. The auditor does not need to alter its opinion in case it has emphasized on some subject. This paragraph includes the audit conducted by the Auditor and their reliance on audits performed by other auditors on some of the subsidiaries of the Company. Sometimes auditors do not perform any Audit of non-material subsidiaries, and they mention the details like revenue, profit, assets of such subsidiaries, and their reliance on the financial reports furnished by the management of the Company.

Conclusion

The auditors issues an audit report after doing a financial audit of the Company, which contains their opinion about the financial status of the Company. The Audit report is a mandatory report to be attached to the annual report of the Company. It gives an independent view of the Company’s accounts and highlights misrepresentations (if any) by the Company.

Recommended Articles

This article has been a guide to Audit Report Contents. Here we discuss the content/structure of a typical audit report along with the practical examples of Amazon.com. You may learn more about financing from the following articles –

THANK FOR THE NOTES. THEY REALLY HELPED ME CLEAR MY ADVANCED AUDIT AND ASSURANCE PAPER

Your information was so helpful

Thanks so much for this article, for it gives detailed explanations of audit report. Thank you once more.

good auditing notes