Land

What Daiwa House's Latest Acquisition Means For U.S. Homebuilding

The purchase of North Carolina-based Prestige tells of a strategic roadmap that includes plans to secure and sustain asset-light land control, build technology and manufacturing platforms, and gain advantages to a deeper domestic talent pool as well as better strategic M&A opportunities.

An announcement this week that Daiwa House U.S. subsidiary Stanley Martin Holdings will append $100 million-a-year-plus North Carolina-based land developer Prestige Corporate Development and Prestige Site Works into its Eastern Seaboard operations is the latest variation on an epic theme: The upending of balances of power in U.S. homebuilding's $1 trillion marketplace for new single-family for-sale and rental homes.

A decade in the making, three diversified Osaka, Japan-based enterprises – Daiwa House, Sekisui House, and Sumitomo Forestry – and Knoxville, TN-based Clayton Homes, now all rank as top 20 U.S. homebuilding companies. Two of the four are already in the top 10. Likely, it won't be long before all four nest among the very largest publicly traded U.S. residential construction and development powerhouses.

Amidst a pivotal moment that signals a prolonged, industry-wide constraint on land, skilled labor, materials, and capital resources, the just-unveiled integration of Prestige's two operating units into Stanley Martin is not just a shift in aggressiveness among the leading Japan-based players but a strategic roadmap that includes careful plans to secure and sustain asset-light land control, incremental building technology and modern manufacturing implementation, and gain advantages to a deeper domestic talent and leadership pool as well as better strategic M&A opportunities.

On the face of it, Prestige – founded in 2017 by owner and Managing Member Brian Mahoney – is an acquisition and development engine, with extensive relationships and trust capital in its Carolinas-area operating sphere. For Reston, VA-based Stanley Martin, the combination represents a transportable, scalable, and flexible capability model among current and potential land sellers, municipal planning and political officials, horizontal development and construction crews, and area homebuilder customers seeking new lot pipelines.

Steve Alloy, President of Stanley Martin, released this statement on the combination:

Stanley Martin’s growth strategy includes expanding beyond its core homebuilding business into additional real estate segments. The two Prestige companies will become our fourth and fifth subsidiary businesses, further enabling that expansion. When we met the principals of Prestige, we knew that the individuals and their company culture were extremely well-matched to join Stanley Martin’s group of companies.”

With lifetime value-of-customer focus at the top of Japan-based real estate and construction enterprises' value chains, a close and inter-related second level of strategic priority pillars includes sustainable access to developed homesites, progress toward advanced precision manufacturing building technologies, and the engagement and well-being of team member employees. In finding matches with U.S.-based acquisitions, Daiwa, Sekisui House, and Sumitomo place a high premium on already robust business culture, principles, and values at the front end, allowing operational integration to follow a more patient, learning-and-discovery runway.

Per the Stanley Martin press statement on the deal:

Stanley Martin Holdings announced today that it has entered into an agreement to acquire Prestige Corporate Development (a land acquisition, development, and lot sales business) and Prestige Site Works (a land development general contracting business), both headquartered in the Charlotte, North Carolina metro area. Prestige controls more than 8,000 lots in the Greater Charlotte area and is actively performing site development work on 15 projects representing more than 2,500 lots throughout North Carolina and South Carolina. The transaction is expected to close in May 2024."

Adding to those baseline deal KPIs, Daiwa House press materials give color to the regional market outlook and expectations around the acquisition:

Although there is high demand for houses, there is a shortage of new home communities due to restrictive policies by local governments. Therefore, high housing demand alongside restricted supply makes Charlotte a favorable location for land investment, creating a favorable environment for acquiring the Prestige membership interests. Moreover, there is high demand for land development general contracting services in the Southeast, creating an opportunity for Prestige Site Works to expand its geographic footprint."

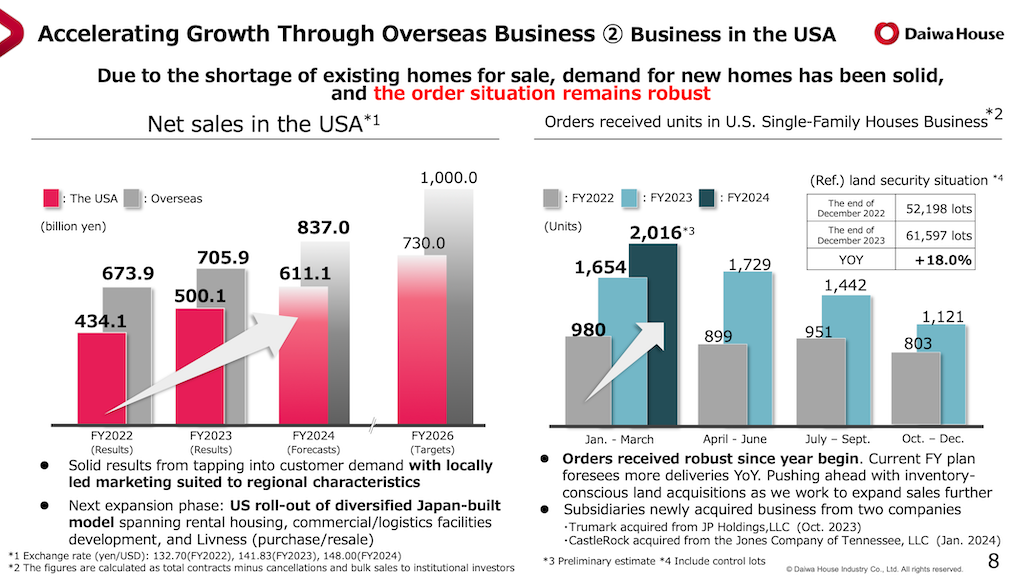

Importantly, on a competitive and macro strategic level, Daiwa House – like its hyper-motivated and activated Japan-based counterparts Sekisui House, which closed last month on its $4.9 billion acquisition of M.D.C. Holdings, and Sumitomo Forestry North America, which continues to be active on the M&A front – considers its 7th Medium-Term Management Plan, begun in 2022 to reflect a shift from "market entry" to "the business expansion phase."

Motivated by a series of challenges and opportunities – ranging from geopolitical risks and economic uncertainty in the U.S., to inflationary pressures on building materials, to wage pressures, to the acceleration of AI and other technologies, capped by negative population growth and declining housing demand in Japan – Daiwa House's structural 2022-through-2027 planning includes solutions platforms that have taken time and nurturing to establish in North America, but are now ready to kick into a higher gear.

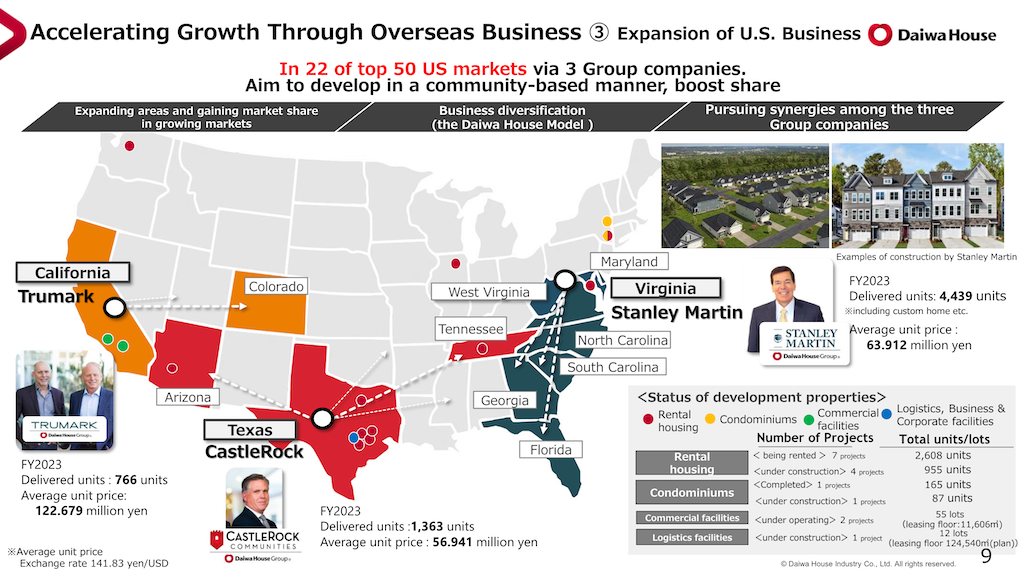

For itself, Daiwa's U.S. revenue and unit volume goals are to grow from 2023 revenues across three principal operating subsidiaries of $3.52 billion on sales of 6,568 single-family, condo, and rental homes, to $5 billion in 2026 on sales of more than 10,000 homes.

With an emphasis on achieving stable and sustainable growth by "proactively adapting to changes in the business environment," Daiwa House and its Japan-based counterparts – as well as Clayton Homes – have emerged as ever-more formidable competitors among U.S. homebuilding's most powerful and extensively-penetrated, publicly-traded enterprises, not to mention less well-heeled privately-capitalized local and regional homebuilders.

Competition for Millennial, GenZ and Baby Boom homebuyers – a torrent over the next five-plus years, and then a less robust demand stream into the mid-2030s – is just one of the arenas in which builders are working for primacy and market share growth to trigger greater profitability opportunities in the near- to mid-term future.

Amidst a long-term undersupply of new vacant-developed lots, permitted lots, and even raw land, on top of a pronounced and worsening decline in front-line skilled labor capacity that intense competition has spread into fierce rivalries over access to lot pipelines, trade crews, timely materials distribution, credit access, even access to accelerating data and technology resources.

Most important of all, when it comes to Clayton and the three Japan-based real estate and construction giants pursuing leadership positions in American homebuilding, American public enterprises now compete with daunting, extremely deep-pocketed rivals in two make-or-break dimensions: Leadership and management talent, and M&A acquisition candidates themselves.

In the race for competitive advantage in a rapidly accelerating period of concentration, being high up in the consideration set among talented next-generation divisional, regional, and national leaders and among energized, cycle-tested private firms ready to talk about selling.

After the past five years or so, Daiwa House, Sekisui House, Sumitomo, and Clayton can now clearly count themselves on that very short list of preferred builders to work for and with.

MORE IN Land

It's Always About Land In Homebuilding, But Now It's Different

Prices for it are high; multiple bidders for it strive to control it and build on it; borrowing costs to finance it are high, time-value-of-money costs for entitlement, permitting, etc. are running longer and longer, and ... "they're not making it anymore" has become "they're making less."

Narrow Pathways: 7 Options Key Private Homebuilders' Roadmap

A more challenging entitlement world with chronic undersupply likely means being at a margin disadvantage is not a question of merely accepting lower returns. It is the difference between buying and not buying land.

A Start-Up With A Model Built To Scale Up In Scattered Infill Sites

A competitive advantage for a new homebuilding firm in a hotbed of market share-thirsty rivals in North and Central Florida can come only one way – and it's not by outspending them in any part of the end-to-end building lifecycle – the hard way.