Markets

Visualizing India’s Top Companies by Market Capitalization

Visualizing India’s Top Companies by Market Capitalization

India’s stock market valuation hit $4 trillion in 2023 for the first time ever, bringing the world’s fifth-biggest equity market closer to Hong Kong, which is worth around $4.7 trillion.

This graphic, utilizing data from CompaniesMarketCap, showcases India’s top 50 publicly traded companies by market capitalization.

India’s Biggest Companies Worth Over $2 Trillion

Altogether, the 50 biggest companies in India are worth over $2.1 trillion, or ₹180 trillion in Indian Rupees.

At the top is the multinational conglomerate Reliance Industries. The company operates in diverse sectors, including energy, petrochemicals, natural gas, retail, telecommunications, mass media, and textiles. Additionally, it holds the rank of the 100th largest company worldwide.

Reliance’s Chairman and Managing Director, Mukesh Ambani, is India’s richest person with a net worth of $95.6 billion. The company was founded by his late father Dhirubhai Ambani, a yarn trader, in 1966 as a small textile manufacturer.

| Company | Industry | Market Cap (USD) |

|---|---|---|

| Reliance Industries | Conglomerate | $198 billion |

| HDFC Bank | Banking | $159 billion |

| Tata Consultancy Services | Information Technology | $155 billion |

| ICICI Bank | Banking | $85.4 billion |

| Bharti Airtel | Information Technology | $72.5 billion |

| Hindustan Unilever | Consumer Staples | $72.3 billion |

| Infosys | Information Technology | $72.3 billion |

| ITC | Conglomerate | $67.6 billion |

| State Bank of India | Banking | $65.2 billion |

| Housing Development Finance Corp | Banking | $60.7 billion |

| Larsen & Toubro | Conglomerate | $54.7 billion |

| Bajaj Finance | Financial Services & Real Estate | $54.5 billion |

| Life Insurance Corporation of India | Financial Services & Real Estate | $54.2 billion |

| Kotak Mahindra Bank | Banking | $43.6 billion |

| HCL Technologies | Information Technology | $42.8 billion |

| Axis Bank | Banking | $41.9 billion |

| Adani Enterprises | Conglomerate | $40.5 billion |

| Maruti Suzuki India | Automotive | $40.5 billion |

| Titan Company | Consumer Discretionary | $37.9 billion |

| Asian Paints | Consumer Discretionary | $37.1 billion |

| Sun Pharmaceutical | Other | $35.7 billion |

| NTPC Limited | Energy & Mining | $33.2 billion |

| Bajaj Finserv | Financial Services & Real Estate | $32.3 billion |

| UltraTech Cement | Industrial | $32.3 billion |

| DMart | Consumer Staples | $31.6 billion |

| Tata Motors | Automotive | $31.2 billion |

| Oil & Natural Gas (ONGC) | Energy & Mining | $30.5 billion |

| Nestlé India | Consumer Staples | $28.5 billion |

| Coal India | Energy & Mining | $26.3 billion |

| Adani Ports & SEZ | Other | $26.3 billion |

| Adani Green Energy | Energy & Mining | $25.6 billion |

| Wipro | Information Technology | $25.4 billion |

| Mahindra & Mahindra | Automotive | $25.2 billion |

| Adani Power | Energy & Mining | $24.9 billion |

| Powergrid Corporation of India | Energy & Mining | $24.8 billion |

| JSW Steel | Industrial | $24 billion |

| Bajaj Auto | Automotive | $20.9 billion |

| Hindustan Aeronautics | Other | $20.5 billion |

| Indian Oil | Energy & Mining | $20 billion |

| Tata Steel | Industrial | $19.6 billion |

| LTIMindtree | Information Technology | $19.5 billion |

| DLF | Financial Services & Real Estate | $19.3 billion |

| SBI Life Insurance | Financial Services & Real Estate | $17.6 billion |

| HDFC Life | Financial Services & Real Estate | $17.4 billion |

| Varun Beverages | Consumer Staples | $16.6 billion |

| Hindustan Zinc | Energy & Mining | $16.5 billion |

| Siemens India | Conglomerate | $16.4 billion |

| Grasim Industries | Conglomerate | $16.4 billion |

| Pidilite | Industrial | $15.7 billion |

| Power Finance Corp | Financial Services & Real Estate | $14.9 billion |

In second place is India’s largest private sector bank by assets and the world’s fifth-largest bank by market capitalization, HDFC Bank. The institution employs over 177,000 people.

Furthermore, in third place is IT company Tata Consultancy Services, which provides services in cloud, cognitive business operations, consulting, and cybersecurity in 55 countries, including the U.S., Canada, China, Australia, Germany, and the United Kingdom.

In total, IT comprises six of India’s 50 biggest companies. The list also includes 16 financial and banking groups and spans other sectors such as mining and energy, automotive, and consumer staples.

Markets

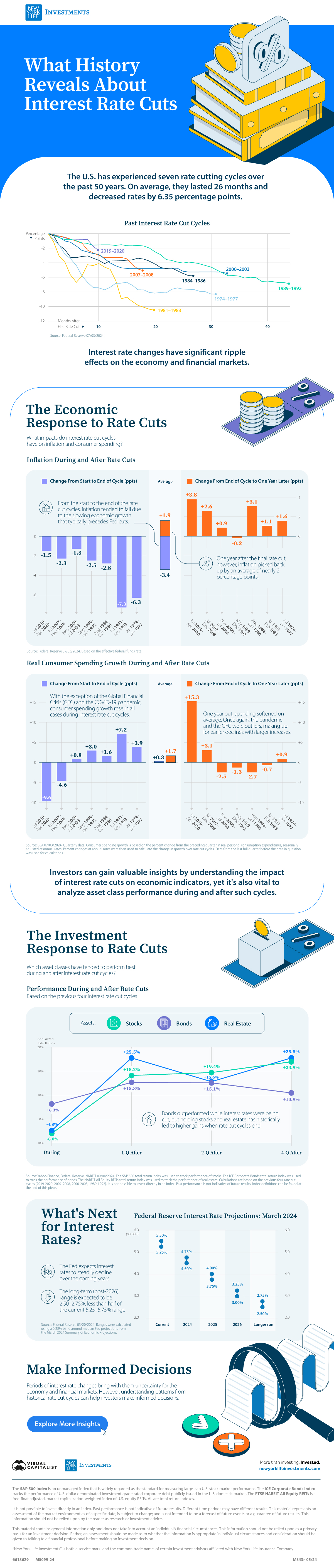

What History Reveals About Interest Rate Cuts

How have previous cycles of interest rate cuts in the U.S. impacted the economy and financial markets?

What History Reveals About Interest Rate Cuts

The Federal Reserve has overseen seven cycles of interest rate cuts, averaging 26 months and 6.35 percentage points (ppts) each.

We’ve partnered with New York Life Investments to examine the impact of interest rate cut cycles on the economy and on the performance of financial assets in the U.S. to help keep investors informed.

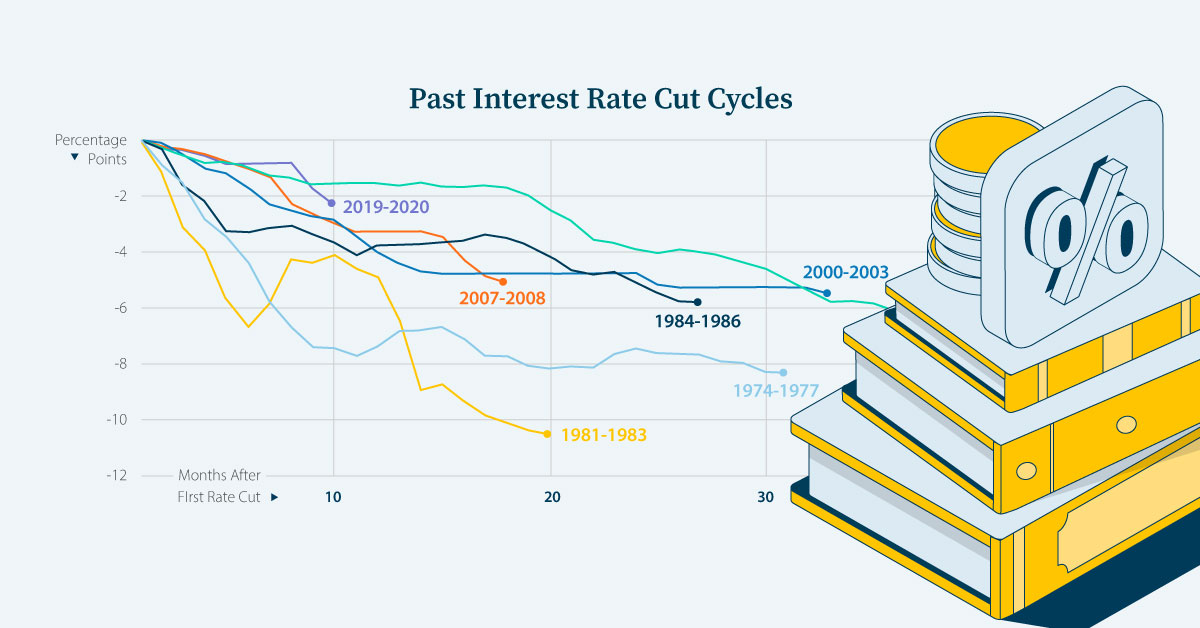

A Brief History of Interest Rate Cuts

Interest rates are a powerful tool that the central bank can use to spur economic activity.

Typically, when the economy experiences a slowdown or a recession, the Federal Reserve will respond by cutting interest rates. As a result, each of the previous seven rate cut cycles—shown in the table below—occurred during or around U.S. recessions, according to data from the Federal Reserve.

| Interest Rate Cut Cycle | Magnitude (ppts) |

|---|---|

| July 2019–April 2020 | -2.4 |

| July 2007–December 2008 | -5.1 |

| November 2000–July 2003 | -5.5 |

| May 1989–December 1992 | -6.9 |

| August 1984–October 1986 | -5.8 |

| July 1981–February 1983 | -10.5 |

| July 1974–January 1977 | -8.3 |

| Average | -6.4 |

Source: Federal Reserve 07/03/2024

Understanding past economic and financial impacts of interest rate cuts can help investors prepare for future monetary policy changes.

The Economic Response: Inflation

During past cycles, data from the Federal Reserve, shows that, on average, the inflation rate continued to decline throughout (-3.4 percentage points), largely due to the lagged effects of a slower economy that normally precedes interest rate declines.

| Cycle | Start to end change (ppts) | End to one year later (ppts) |

|---|---|---|

| July 2019–April 2020 | -1.5 | +3.8 |

| July 2007–December 2008 | -2.3 | +2.6 |

| November 2000–July 2003 | -1.3 | +0.9 |

| May 1989–December 1992 | -2.5 | -0.2 |

| August 1984–October 1986 | -2.8 | +3.1 |

| July 1981–February 1983 | -7.3 | +1.1 |

| July 1974–January 1977 | -6.3 | +1.6 |

| Average | -3.4 | +1.9 |

Source: Federal Reserve 07/03/2024. Based on the effective federal funds rate. Calculations are based on the previous four rate cut cycles (2019-2020, 2007-2008, 2000-2003, 1989-1992, 1984-1986, 1981-1983, 1974-1977).

However, inflation played catch-up and rose by +1.9 percentage points one year after the final rate cut. With lower interest rates, consumers were incentivized to spend more and save less, which led to an uptick in the price of goods and services in six of the past seven cycles.

The Economic Response: Real Consumer Spending Growth

Real consumer spending growth, as measured by the Bureau of Economic Analysis, typically reacted to rate cuts more quickly.

On average, consumption growth rose slightly during the rate cut periods (+0.3 percentage points) and that increase accelerated one year later (+1.7 percentage points).

| Cycle | Start to end (ppts) | End to one year later (ppts) |

|---|---|---|

| July 2019–April 2020 | -9.6 | +15.3 |

| July 2007–December 2008 | -4.6 | +3.1 |

| November 2000–July 2003 | +0.8 | -2.5 |

| May 1989–December 1992 | +3.0 | -1.3 |

| August 1984–October 1986 | +1.6 | -2.7 |

| July 1981–February 1983 | +7.2 | -0.7 |

| July 1974–January 1977 | +3.9 | +0.9 |

| Average | +0.3 | +1.7 |

Source: BEA 07/03/2024. Quarterly data. Consumer spending growth is based on the percent change from the preceding quarter in real personal consumption expenditures, seasonally adjusted at annual rates. Percent changes at annual rates were then used to calculate the change in growth over rate cut cycles. Data from the last full quarter before the date in question was used for calculations. Calculations are based on the previous four rate cut cycles (2019-2020, 2007-2008, 2000-2003, 1989-1992, 1984-1986, 1981-1983, 1974-1977).

The COVID-19 pandemic and the Global Financial Crisis were outliers. Spending continued to fall during the rate cut cycles but picked up one year later.

The Investment Response: Stocks, Bonds, and Real Estate

Historically, the trend in financial asset performance differed between stocks, bonds, and real estate both during and after interest rate declines.

Stocks and real estate posted negative returns during the cutting phases, with stocks taking the bigger hit. Conversely, bonds, a traditional safe haven, gained ground.

| Asset | During (%) | 1 Quarter After (%) | 2 Quarters After (%) | 4 Quarters After (%) |

|---|---|---|---|---|

| Stocks | -6.0 | +18.2 | +19.4 | +23.9 |

| Bonds | +6.3 | +15.3 | +15.1 | +10.9 |

| Real Estate | -4.8 | +25.5 | +15.6 | +25.5 |

Source: Yahoo Finance, Federal Reserve, NAREIT 09/04/2024. The S&P 500 total return index was used to track performance of stocks. The ICE Corporate Bonds total return index was used to track the performance of bonds. The NAREIT All Equity REITs total return index was used to track the performance of real estate. Calculations are based on the previous four rate cut cycles (2019-2020, 2007-2008, 2000-2003, 1989-1992). It is not possible to invest directly in an index. Past performance is not indicative of future results. Index definitions can be found at the end of this piece.

However, in the quarters preceding the last rate cut, all three assets increased in value. One year later, real estate had the highest average performance, followed closely by stocks, with bonds coming in third.

What’s Next for Interest Rates

In March 2024, the Federal Reserve released its Summary of Economic Projections outlining its expectation that U.S. interest rates will fall steadily in 2024 and beyond.

| Year | Range (%) | Median (%) |

|---|---|---|

| Current | 5.25-5.50 | 5.375 |

| 2024 | 4.50-4.75 | 4.625 |

| 2025 | 3.75-4.0 | 3.875 |

| 2026 | 3.00-3.25 | 3.125 |

| Longer run | 2.50-2.75 | 2.625 |

Source: Federal Reserve 20/03/2024

Though the timing of interest rate cuts is uncertain, being armed with the knowledge of their impact on the economy and financial markets can provide valuable insight to investors.

Explore more insights from New York Life Investments.

-

Markets3 days ago

Markets3 days agoWhich Retailers Operate in the Most Countries?

From fast-fashion giant H&M to Apple, we show the top retailers globally with the largest international presence.

-

Maps1 week ago

Maps1 week agoMapped: The 10 U.S. States With the Lowest Real GDP Growth

In this graphic, we show where real GDP lagged the most across America in 2023 as high interest rates weighed on state economies.

-

Venture Capital1 week ago

Venture Capital1 week agoRanked: The World’s 50 Largest Private Equity Firms

In this graphic, we show the largest private equity firms in the world—from titan Blackstone to China’s leading alternative funds.

-

Debt1 week ago

Debt1 week agoTop 10 Countries Most in Debt to the IMF

Argentina tops the ranking, with a debt equivalent to 5.3% of the country’s GDP.

-

Markets1 week ago

Markets1 week agoRanked: The Top 6 Economies by Share of Global GDP (1980-2024)

Gain a unique perspective on the world’s economic order from this graphic showing % share of global GDP over time.

-

Economy3 weeks ago

Economy3 weeks agoMapped: Europe’s GDP Per Capita, by Country

Which European economies are richest on a GDP per capita basis? This map shows the results for 44 countries across the continent.

-

Globalization1 week ago

Globalization1 week agoMapped: The Top Exports in Asian Countries

-

Demographics2 weeks ago

Demographics2 weeks agoMapped: U.S. Immigrants by Region

-

Healthcare2 weeks ago

Healthcare2 weeks agoWhich Countries Have the Highest Infant Mortality Rates?

-

Politics2 weeks ago

Politics2 weeks agoCharted: How Americans Feel About Federal Government Agencies

-

Mining2 weeks ago

Mining2 weeks agoVisualizing Copper Production by Country in 2023

-

Culture2 weeks ago

Culture2 weeks agoHow Popular Snack Brand Logos Have Changed

-

Misc2 weeks ago

Misc2 weeks agoVisualized: Aircraft Carriers by Country

-

United States2 weeks ago

United States2 weeks agoMapped: Countries Where Recreational Cannabis is Legal