Descarga la app de Kindle gratuita y comienza a leer libros Kindle al instante en tu smartphone, tablet o computadora no se requiere un dispositivo Kindle.

Lee instantáneamente en tu navegador con Kindle para web.

Con la cámara de tu teléfono celular: escanea el siguiente código y descarga la app de Kindle.

Seguir al autor

Aceptar

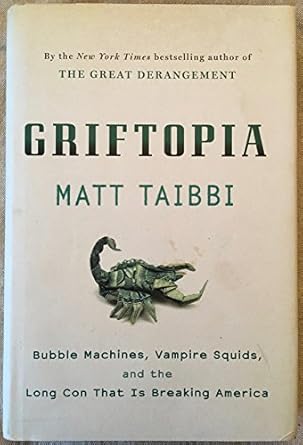

Griftopia: Bubble Machines, Vampire Squids, and the Long Con That Is Breaking America Pasta dura – 2 noviembre 2010

| Plazo | Por mes | costo de financiamiento | Total |

|---|---|---|---|

| 24 meses | $22.43* | $156.06 | $538.55 |

| 18 meses | $27.73* | $116.66 | $499.15 |

| 12 meses | $38.82* | $83.38 | $465.87 |

| 9 meses | $49.63* | $64.26 | $446.75 |

| 6 meses | $71.59* | $47.05 | $429.54 |

| 3 meses | $137.57* | $30.22 | $412.71 |

Opciones de compra y productos Plus

- Número de páginas252 páginas

- IdiomaInglés

- EditorialSpiegel & Grau

- Fecha de publicación2 noviembre 2010

- Dimensiones16.51 x 3.18 x 24.77 cm

- ISBN-100385529953

- ISBN-13978-0385529952

Comprados juntos habitualmente

Los clientes que compraron este producto también compraron

Descripción del producto

Biografía del autor

Matt Taibbi is a contributing editor for Rolling Stone and the author of four previous books, including the New York Times bestseller the Great Derangement. He lives in Jersey City, New Jersey.

Detalles del producto

- Editorial : Spiegel & Grau; Primera edición (2 noviembre 2010)

- Idioma : Inglés

- Pasta dura : 252 páginas

- ISBN-10 : 0385529953

- ISBN-13 : 978-0385529952

- Dimensiones : 16.51 x 3.18 x 24.77 cm

- Clasificación en los más vendidos de Amazon: nº622,515 en Libros (Ver el Top 100 en Libros)

- nº1,869 en Condiciones Económicas (Libros)

- nº1,956 en Historia Económica (Libros)

- nº3,665 en Ciencias Políticas Textos

- Opiniones de los clientes:

Acerca del autor

Descubre más sobre los libros del autor, ve autores similares, lee blogs del autor y más

Opiniones de clientes

Las opiniones de los clientes, incluidas las calificaciones por estrellas de los productos, son útiles para que otros usuarios obtengan más información acerca del producto y decidan si es el adecuado para ellos.

Para calcular la calificación global por estrellas y el desglose porcentual por estrellas, no utilizamos un promedio simple. En cambio, nuestro sistema considera aspectos como la fecha de la reseña y si el autor compró el artículo en Amazon. También se analizaron las reseñas para verificar la fiabilidad.

Más información sobre cómo funcionan las opiniones de los clientes en AmazonMejores reseñas de otros países

If you want to understand how this happened, a good place to start is with Alan Greenspan. He is the human embodiment of a political and economic hypocrite; the trends he set during his twenty-year tenure as President of the Federal Reserve have left us with a broken system. On the one hand, he preached free market economics, while on the other hand he gave massive governmental bailouts to the banks on Wall Street. These two ideas cannot co-exist, as the definition of a free market is one with no financial safety net. It is a contradiction of dire consequences, and if you match it with his deregulatory approach to macroeconomics, you have the perfect template for what we have today: a system that rewards the rich elite politicians and bankers and punishes the rest of us. The founders of this country ultimately decided against setting up a Federal Bank for this exact reason—they understood human nature well enough to know that if the wrong people were put in charge of a Federal Bank, corruption would inevitably ensue.

Bankers, like everyone in a capitalist society, want to make as much money as possible. The more you give them the ability to do this, without holding them accountable for screwing people over, the more they will take advantage of whatever amount of leeway you give them. This is the same human nature the founding fathers intrinsically understood, but that has now been backed up by psychological studies showing how people will cheat at games more egregiously if they believe nobody is paying attention and that they will get away with it. This is how we came to live in a ‘bubble economy.’ First it was the dot com bubble, then the commodities bubble, then the famous housing bubble of 2007-08. What these all have in common is a foundation of Wall Street corruption. They put a mask on the economy. To any regular investor, things looked safe and reliable. Behind the scenes, however, they knew they were selling crap packaged with a pretty bow. They propped up stocks in websites and businesses that were going nowhere and invested their client’s money in houses that were bought with no money down. Make no mistake, this is fraud. It is the literal definition of fraud. And yet, none of them have seen a minute of jail time.

The worst of these players is Goldman Sachs. During the commodities bubble of the 2000s, when prices on food, oil, metals, and most notably gas rose significantly, Goldman Sachs had an exclusive contract with the Federal Reserve on trading rights. Historically, commodities were restricted from outside trading because, well, they’re essentials. If food prices spike and all of a sudden people can’t afford to eat, society collapses. So, the government separated commodities from regular business stocks and passed into law the 1936 Commodity Exchange Act in order to keep a watchful eye on them. What happened next? You guessed it, the higher ups at Goldman Sachs wanted a piece of the action. There was money to be made! And Alan Greenspan and the rest of the executives at The Federal Reserve were happy to grant them exclusive rights to do so. While you and I saw gas prices rising and thought there was a shortage of natural gas in the Middle East, or whatever other lie the media fed the public on that particular day, the truth is that Goldman Sachs was intentionally raising the prices so that they could line their own pockets.

The culture of Wall Street and high ranking politicians has become one in favor of short term gain over long term prosperity. It has trickled down to state and city levels. For example, “Mayor Richard Daley had struck a deal with Morgan Stanley to lease all of Chicago’s parking meters” Taibbi writes, “The final amount of the bid was $1,156,500,000, a lump sum to be paid to the city of Chicago for seventy-five years’ worth of parking meter revenue.” This is an absolutely ludicrous business deal and when I looked it up, Wikipedia informed me that the money was spent and gone within 3 years. My jaw literally dropped. Any fool with half a brain knows you don’t sell out your future to put a band-aid on your present. The potential revenue from the meters is $3-5 billion dollars. What’s crazier is that this was only a template, quickly followed by many cities leasing the future revenue rights to everything from their parking meters to their public highways and airports. A majority of our major cities have condemned themselves to decades of financial hardship and the citizens don’t even know it.

By this point in history, this repeating trend has grown tiresome. Every single time ordinary citizens get screwed over, the banks on Wall Street walk away richer. Whereas we once had bubbles, now we have Coronavirus. The CARES act that was passed in congress in March of 2020 gave the people one single $1,200 check. How much did Wall Street get? $500 billion. While 30 million people filed for unemployment, the stock market was saved! It’s almost as if the people in this country don’t matter, so long as Wall Street is being taken care of. Taibbi writes: “This dynamic allows the bank[s] to suck wealth out of the economy and vitality out of the democracy at the same time, resulting in a snowballingly regressive phenomenon that pushes us closer to penury and oligarchy at the same time.”

The recent Reddit mobilization and use of Wall Street’s crooked tactics against them is a glimmer of hope, although the reality is that the fight against this type of historic corruption will be a long and ugly one. The truth is obvious, and there is no other way to summarize this book, and ultimately our political and economic situation, then this: If we do not hold these people accountable and begin to undo what they have done, our country will fall into ruins.

Reseñado en los Estados Unidos el 2 de febrero de 2021

If you want to understand how this happened, a good place to start is with Alan Greenspan. He is the human embodiment of a political and economic hypocrite; the trends he set during his twenty-year tenure as President of the Federal Reserve have left us with a broken system. On the one hand, he preached free market economics, while on the other hand he gave massive governmental bailouts to the banks on Wall Street. These two ideas cannot co-exist, as the definition of a free market is one with no financial safety net. It is a contradiction of dire consequences, and if you match it with his deregulatory approach to macroeconomics, you have the perfect template for what we have today: a system that rewards the rich elite politicians and bankers and punishes the rest of us. The founders of this country ultimately decided against setting up a Federal Bank for this exact reason—they understood human nature well enough to know that if the wrong people were put in charge of a Federal Bank, corruption would inevitably ensue.

Bankers, like everyone in a capitalist society, want to make as much money as possible. The more you give them the ability to do this, without holding them accountable for screwing people over, the more they will take advantage of whatever amount of leeway you give them. This is the same human nature the founding fathers intrinsically understood, but that has now been backed up by psychological studies showing how people will cheat at games more egregiously if they believe nobody is paying attention and that they will get away with it. This is how we came to live in a ‘bubble economy.’ First it was the dot com bubble, then the commodities bubble, then the famous housing bubble of 2007-08. What these all have in common is a foundation of Wall Street corruption. They put a mask on the economy. To any regular investor, things looked safe and reliable. Behind the scenes, however, they knew they were selling crap packaged with a pretty bow. They propped up stocks in websites and businesses that were going nowhere and invested their client’s money in houses that were bought with no money down. Make no mistake, this is fraud. It is the literal definition of fraud. And yet, none of them have seen a minute of jail time.

The worst of these players is Goldman Sachs. During the commodities bubble of the 2000s, when prices on food, oil, metals, and most notably gas rose significantly, Goldman Sachs had an exclusive contract with the Federal Reserve on trading rights. Historically, commodities were restricted from outside trading because, well, they’re essentials. If food prices spike and all of a sudden people can’t afford to eat, society collapses. So, the government separated commodities from regular business stocks and passed into law the 1936 Commodity Exchange Act in order to keep a watchful eye on them. What happened next? You guessed it, the higher ups at Goldman Sachs wanted a piece of the action. There was money to be made! And Alan Greenspan and the rest of the executives at The Federal Reserve were happy to grant them exclusive rights to do so. While you and I saw gas prices rising and thought there was a shortage of natural gas in the Middle East, or whatever other lie the media fed the public on that particular day, the truth is that Goldman Sachs was intentionally raising the prices so that they could line their own pockets.

The culture of Wall Street and high ranking politicians has become one in favor of short term gain over long term prosperity. It has trickled down to state and city levels. For example, “Mayor Richard Daley had struck a deal with Morgan Stanley to lease all of Chicago’s parking meters” Taibbi writes, “The final amount of the bid was $1,156,500,000, a lump sum to be paid to the city of Chicago for seventy-five years’ worth of parking meter revenue.” This is an absolutely ludicrous business deal and when I looked it up, Wikipedia informed me that the money was spent and gone within 3 years. My jaw literally dropped. Any fool with half a brain knows you don’t sell out your future to put a band-aid on your present. The potential revenue from the meters is $3-5 billion dollars. What’s crazier is that this was only a template, quickly followed by many cities leasing the future revenue rights to everything from their parking meters to their public highways and airports. A majority of our major cities have condemned themselves to decades of financial hardship and the citizens don’t even know it.

By this point in history, this repeating trend has grown tiresome. Every single time ordinary citizens get screwed over, the banks on Wall Street walk away richer. Whereas we once had bubbles, now we have Coronavirus. The CARES act that was passed in congress in March of 2020 gave the people one single $1,200 check. How much did Wall Street get? $500 billion. While 30 million people filed for unemployment, the stock market was saved! It’s almost as if the people in this country don’t matter, so long as Wall Street is being taken care of. Taibbi writes: “This dynamic allows the bank[s] to suck wealth out of the economy and vitality out of the democracy at the same time, resulting in a snowballingly regressive phenomenon that pushes us closer to penury and oligarchy at the same time.”

The recent Reddit mobilization and use of Wall Street’s crooked tactics against them is a glimmer of hope, although the reality is that the fight against this type of historic corruption will be a long and ugly one. The truth is obvious, and there is no other way to summarize this book, and ultimately our political and economic situation, then this: If we do not hold these people accountable and begin to undo what they have done, our country will fall into ruins.

Of course the present outcome would not have been possible without the generations of indifference to the actions of the Supreme Court of the United States. If the financial industries black boxes have remained somewhat opaque to Americans, the Judicial Industries black box that is Constitutional Interpretation impervious to enquiry. Perhaps an avenue of enquiry for a bloke of Matt's caliber?

Ps This book like "The untold History of the United States" deserves to be made in to a documentary! It would have to be better than the PBS doco that painted Paulson as savior of the nation lol

七つの記事から成っており、最初の『The Grifter Archipelago』はあまり面白くない。金融危機直後の大統領選挙戦を取材しながら、金融危機の深遠とimplicationsに全く思い及ばす、相変わらず単純極まりない左右イデオロギー対立構造でしか世界を捉えられない一般庶民の姿を苛立ちととも眺めているのだが、私の感想は「え、でも、そんなもんでしょフツー」でしかなかった。

具体的にGS弾劾に当てられているのは『Hot Potato:The Great American Mortgage Scam』『Blowout:The Commodities Bubble』、そして発表と同時にかなり話題になった『The Great American Bubble Machine』の三本。

GSのシノギの様相が垣間見えて興味深いのはAIG破綻にまつわる新ネタ。AIGはsupersafe債のプロテクション(CDS)を売り過ぎてヤラれたというのが一般認識だが、実は証券貸付業でも窮地に立たされた。空売り業者から受け取った保証金をナントCDOで運用してしまっていた為、GSに先導されるカタチで保証金返還要求が津波のように押し寄せた時には手元資金がなかった。子会社の資産にまで手を付けようかというところまで追い詰められ、州政府はそれを阻止すべく地方子会社の資産凍結に動き出そうという展開になる。無数の一般保険加入者を人質に、「さっさと金を出せ!」とNY連銀でAIG幹部に対して凄むブランクファイン氏の姿が印象的だ。AIGとてない袖は振れないので、これは実質的にはFRBに向けての要求だったと解釈していいのか。まあカタギのシロートには到底分からない神の仕事の領分である。

今風に口の悪い英語が嫌いな方にはお薦めしないが、ガラが悪く煽情的な筆致の割にリサーチが手堅くて、やるじゃんローリングストーン誌、である。日本のサブカル誌の若手ライターでここまでやる人材はいるだろうか。例えば、ロッキンオン誌のライターに金融物が書ける人材はいるだろうか。著者のキャラ立ちも含めて五つ星。