Which country has the highest-valued currency in the world? Well, it’s the Kuwaiti Dinar. Surprisingly simple, right? However, even though it holds a high value, it doesn’t have a dominant presence in the global currency markets. Undoubtedly, the most powerful currency worldwide is the American dollar.

For history enthusiasts or those studying the past of coinage, it’s known that British and Spanish currencies once dominated the world. However, currently, it’s clear that the US dollar holds that position.

Generally, a currency’s performance is assessed by comparing it to another currency, often using the American dollar as the benchmark in many cases.

In the complex world of economics, currencies act like threads that weave nations together. Understanding the strength of a currency is akin to deciphering the heartbeat of a country’s economic health. It mirrors a nation’s economic vitality, stability, and confidence and, in turn, influences its standing on the global stage.

Below, we have listed the 14 highest currencies in the world, with their values compared to the American dollar.

Did you know?

Kuwaiti Dinar is pegged to a basket of currencies (instead of one currency), including the US Dollar, Euro, British pound, and Japanese Yen.

Table of Contents

14. Libyan Dinar

Country: Libya

Exchange Rate: 1 LYD = 0.21 USD

The Libyan dinar was introduced in 1971, replacing the British pound at an equal value. One dinar is subdivided into 1000 Dirhams, and there are five banknote denominations along with four coin denominations.

The Central Bank of Libya issues and regulates the dinar, overseeing banks and regulating credit systems across the country.

13. New Zealand Dollar

$5 banknote obverse

$5 banknote obverse

Country: New Zealand

Exchange Rate: 1 NZD = 0.62 USD

The New Zealand dollar became the country’s official currency in 1967. The currency is subdivided into 100 cents with a total of 10 denominations (5 banknotes and 5 coins), the smallest being 10 cent coins. Initially, there were even smaller denominations, but they were discontinued due to higher costs and ongoing inflation.

Throughout the majority of the 21st century, the New Zealand dollar has been among the top ten most-traded currencies globally. In 2022, it represented approximately 1.6% of the daily turnover in the foreign exchange market.

12. Australian Dollar

20 Australian Dollars Banknote (1966-1994)

20 Australian Dollars Banknote (1966-1994)

Country: Australia

Exchange Rate: 1 AUD = 0.66 USD

The Australian dollar is extensively traded on international currency exchanges and is often considered a proxy for the Asia-Pacific region. In 2016, it ranked as the 5th most traded currency globally, following the US dollar, Euro, Japanese yen, and pound sterling, accounting for 6.9% of the world’s daily share.

However, by 2022, it had slipped to the 6th position, representing 6.4% of the daily volume in the global foreign exchange market.

Forex traders commonly favor the Australian dollar due to Australia’s relatively stable economy and government, minimal intervention in the foreign exchange market by the central government, and its substantial exposure to major Asian markets.

Moreover, Australia was among the pioneers in adopting polymer banknotes, made from a type of plastic. Renowned for their durability and resistance to wear and tear, these banknotes have become a distinctive feature of the Australian currency system.

11. Singapore Dollar

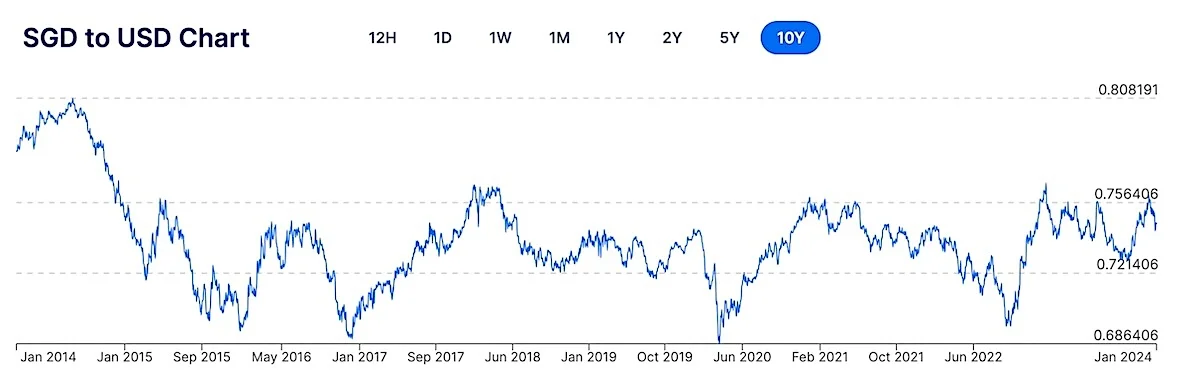

Singapore Dollar conversion rate | Chart Credit: XE

Singapore Dollar conversion rate | Chart Credit: XE

Country: Singapore

Exchange Rate: 1 SGD = 0.75 USD

According to a 2016 survey conducted by the Bank of International Settlements, the Singapore dollar came out as the 12th highest traded currency in the world. In 2012, the total currency in circulation was about $29.1 billion.

Fast forward to 2022, it has ascended to the 10th position, representing 2.4% of the global foreign exchange market turnover.

In addition to being used in Singapore, the Singapore dollar is also accepted as legal tender in Brunei, thanks to the Currency Interchangeability Agreement between the Monetary Authority of Singapore and Brunei Darussalam.

10. Canadian Dollar

10 dollars note, Bank of Montreal (1935)

10 dollars note, Bank of Montreal (1935)

Country: Canada

Exchange Rate: 1 CAD = 0.76 USD

Though the Canadian dollar has been around since the 1840s, it was standardized across the country only after the Currency Act in 1871.

In the 2015-2016 fiscal year, the Canadian dollar ranked as the fifth largest reserve currency globally, accounting for approximately 2% of total global reserves.

By 2022, it became the seventh most traded currency in the global exchange market, representing 6.2% of the daily volume.

Its popularity among foreign banks and traders is attributed to Canada’s strong economic health and political stability. According to news reports, businesses in various regions of the United States are now accepting Canadian dollars, primarily for commercial purposes.

9. United States Dollar

The US Dollar has lost 87% of its purchasing power since 1971. pic.twitter.com/Yk2PSGbxIf

— The Spectator Index (@spectatorindex) January 19, 2024

Country: The United States

Ever wondered about the origin of the iconic $ sign? It traces back to the Spanish peso, represented by “ps” in Latin. The peso was a renowned Spanish monetary unit used from the 16th to the 18th century and continues in several former Spanish territories in Latin America.

Without a doubt, the US dollar stands as the world’s most powerful currency. It holds the top spot in trading and remains the largest reserve currency globally, even after the end of the Bretton Woods system.

Additionally, it’s a common de facto currency used by small countries like Aruba, Cambodia, and the Dominican Republic.

8. Swiss Franc

A 20 CHF banknote

A 20 CHF banknote

Country: Switzerland and Liechtenstein

Exchange Rate: 1 CHF = 1.15 USD

Switzerland is among the world’s wealthiest nations, with an economy deemed a tax haven by investors due to its low tax rates and stability. The Swiss Franc serves as the official currency in Switzerland and Liechtenstein, and it’s accepted as legal tender in Campione d’Italia, a small Italian enclave in Lombardy.

In 2016, the Swiss franc constituted 0.2% of the total foreign exchange reserves, slightly down from 2015.

In 2022, it accounted for 5.2% of the daily volume in the global foreign exchange market, up from 4.9% in 2019.

7. Euro

The euro turned 25 this year!

Since 1999, it fosters stability and prosperity in the EU.

And it makes it easier to work, study and travel abroad for almost 350 million people in 20 countries.

What does the euro mean to you? ↓ pic.twitter.com/p2J1EVLciR

— European Commission (@EU_Commission) January 21, 2024

Country(s): Eurozone

Exchange Rate: 1 EUR = 1.09 USD

The Euro is the second most traded and the second-largest reserve currency globally, following the US dollar. Beyond the Eurozone countries, numerous European and even African nations peg their currencies to the Euro to ensure stable exchange rates.

It has simplified travel within the Eurozone, as people can use the same currency across multiple countries. This has contributed to a more integrated European tourism sector.

In contrast to many other currencies worldwide, the Euro is relatively young, coming into existence in 1999, and its development is closely tied to political events within the Eurozone.

6. Caymanian Dollar

Country: Cayman Islands

Exchange Rate: 1 KYD = 1.20 USD

Situated in the western Caribbean Sea, it’s an autonomous British Overseas Territory with the 14th largest GDP in the world based on PPP value.

The Cayman Islands Dollar is pegged to the US Dollar at a fixed rate. This means that the exchange rate between the Cayman Islands Dollar and the US Dollar is maintained at a constant rate, providing stability in currency value.

The Islands is known for its offshore financial services industry, including banking and insurance. The stability of its currency contributes to the territory’s economic activities.

5. Pound Sterling

Country: United Kingdom

Exchange Rates: 1 GBP = $1.27

The British Pound sterling once served as the currency for half of the world, legally used in various countries within the British Empire. At times, it coexisted with the local currency of those nations. After the Second World War, the pound sterling entered an agreement with the United States, pegging it to the US dollar at a rate of £1 = $4.03. This agreement, known as the Bretton Woods system, set global post-war exchange rates.

However, in 1949, facing increasing economic pressure, the pound was devalued by 30.5% to $2.80. This move had a direct and negative impact on several major currencies, which were devalued against the dollar.

When the Euro was introduced, as a Eurozone nation, Great Britain had the option to adopt the Euro as its legal tender. Instead, the UK chose to opt out, a decision that was highly controversial at the time.

4. Jordanian Dinar

Country: Jordan

Exchange Rate: 1 JOD = 1.41 USD

The Jordanian dinar became the official legal tender of The Hashemite Kingdom of Jordan in 1950, four years after Jordan gained independence. This currency is also informally used in the West Bank, part of the Palestinian territories.

The official pegging of the Jordanian dinar to the IMF Special Drawing Rights (SDRs) means it is almost fixed at a rate of 1 dinar = 1.41044 dollars.

This fixed exchange rate of the Jordanian dinar carries implications for foreign aid and remittances. It plays a role in stabilizing the value of remittances received from Jordanians working abroad.

3. Omani Rial

Country: Oman

Exchange Rate: 1 OMR = 2.61 USD

Oman’s economy, much like many Gulf countries, heavily relies on oil exports, although it has managed to diversify. Oman possesses the 25th largest oil reserves globally, with identified reserves reaching up to 5.5 billion barrels.

The Omani Rial was first introduced as the nation’s legal currency in 1973, replacing the rial Saidi (not Saudi riyal) after a change in regime. The rial is divided into 1000 baisa, representing the lower denomination.

From 1973 to 1986, the Omani rial was pegged to the American dollar at a fixed rate of 1 rial = $2.895 USD. However, in 1986, this pegged rate was updated to 1 rial = $2.6008 USD.

2. Bahraini Dinar

Country: Bahrain

Exchange Rate: 1 BHD = $2.65

The Kingdom of Bahrain, a small island country situated between the Qatar peninsula and the northeastern coast of Saudi Arabia, introduced the dinar in 1965. It replaced the Gulf rupee at a rate of 10 rupees = 1 dinar.

In 1980, Bahrain’s government officially pegged the dinar to the IMF’s Special Drawing Rights (SDRs). Following the peg, the currency was fixed at $1 USD = 0.376 BD, or 1 BD = $2.65957 USD.

After Malta adopted the Euro as its legal currency, the Bahraini Dinar became the second-highest-valued currency unit.

Today, commonly used denominations of the Bahraini Dinar include 1, 5, 10, and 20 Dinar banknotes, as well as coins in denominations like 5, 10, 25, 50, 100, and 500 fils.

1. Kuwaiti Dinar

Country: Kuwait

Exchange Rate: 1 KWD = $3.26

The Kuwaiti dinar is the highest-valued currency in the world, with impressive conversion rates against the dollar. It was introduced into Kuwait’s legal system in 1960, replacing the Gulf rupee. Initially, the Kuwaiti dinar had an equivalent value to the pound sterling.

In 1990, during the Iraq invasion, the Kuwaiti dinar was briefly replaced by the Iraqi dinar as the legal currency, and significant amounts of banknote denominations were looted by the invading forces. After liberation, it was reinstated, and a new banknote series was introduced for the first time.

Today, common denominations of the Kuwaiti dinar include 1/4, 1/2, 1, 5, 10, and 20 Dinar banknotes, as well as coins in denominations like 5, 10, 20, 50, and 100 fils.

Cryptocurrencies

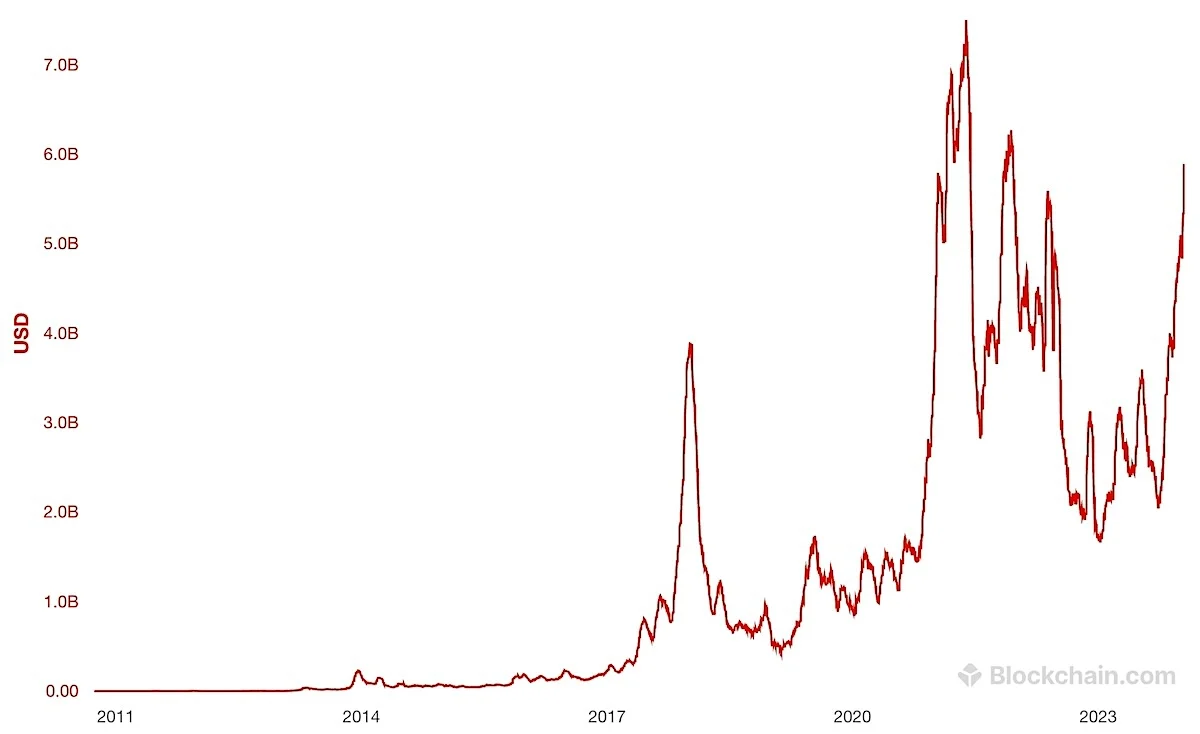

Estimated transaction value of Bitcoin

Estimated transaction value of Bitcoin

Exchange Rate: 1 Bitcoin = 41,600 USD; 1 Ether = 2450 USD

Cryptocurrencies have evolved significantly since the development of Bitcoin in 2009. Considering the ongoing developments in blockchain technology, regulatory frameworks, and the integration of digital assets into traditional finance, we can’t leave cryptocurrencies out of this list.

At present, Bitcoin and Ethereum are two of the most well-known and widely used cryptocurrencies.

#Bitcoin: A Technology That’s Lighting Up The Night Combining ancient traditions with modern innovations, Bitcoin is revolutionizing the way we think about finance. Embrace the future pic.twitter.com/K4rQc5nl8e

— Bitcoin (@Bitcoin) January 21, 2024

While Bitcoin was the first decentralized cryptocurrency that laid the foundation for the entire cryptocurrency ecosystem, Ethereum introduced a new paradigm by enabling the creation of smart contracts and decentralized applications (DApps).

Both are traded on various cryptocurrency exchanges, and their value can be extremely volatile.

This prompts a question in my head: is it the beginning of a new worldwide currency? Maybe not, but there is something mysterious about Bitcoin and Ethereum that we will get to know after a year or so, which will ultimately decide its future.

More to Know

How is the value of a currency determined?

The value of a currency is determined by a complex interplay of various financial, economic, and geopolitical factors.

Financial and economic indicators include GDP, inflation, employment rates, and interest rates set by central banks. Political stability, market sentiment, and trade balances also affect currency values.

The foreign exchange market, where currencies are traded, shows continuous adjustments driven by real-time data and global economic dynamics. The interplay of these factors in the foreign exchange market determines the relative strength or weakness of a currency at any given moment.

Why are some currencies pegged to other currencies or commodities?

This is done to achieve economic stability and policy goals. Pegging a currency to a stable and widely-used currency like the US Dollar to the Euro can provide a level of economic stability. It anchors the value of the domestic currency, making it more predictable for businesses, consumers, and investors.

This practice also aims to attract foreign investment and control inflation. Some countries peg their currency to commodities like gold or a basket of goods to form a tangible link between their currency and real-world assets.

While pegging provides stability, it also comes with challenges, requiring diligent monitoring and frequent intervention by the country’s central bank to uphold the desired exchange rate and adapt to changing economic conditions.

What are the potential risks of having a high-valued currency?

Although a high-valued currency brings numerous benefits, it also poses some risks and challenges for a country’s economy. The primary risk is that it can make a nation’s exports more expensive for foreign buyers.

This may lead to a decline in export competitiveness as other countries with weaker currencies can offer similar products and services at lower prices. The appreciation of the currency can also affect foreign investment and tourism, as the cost of investing or visiting becomes comparatively higher.

Furthermore, a persistently strong currency can create deflationary pressures within the country. When the currency’s value is high, imported goods become more affordable, leading to potential reductions in prices for imported products. This, in turn, may prompt domestic businesses to lower their prices to stay competitive.

Read More

Mysteriously delegate

What?