Money

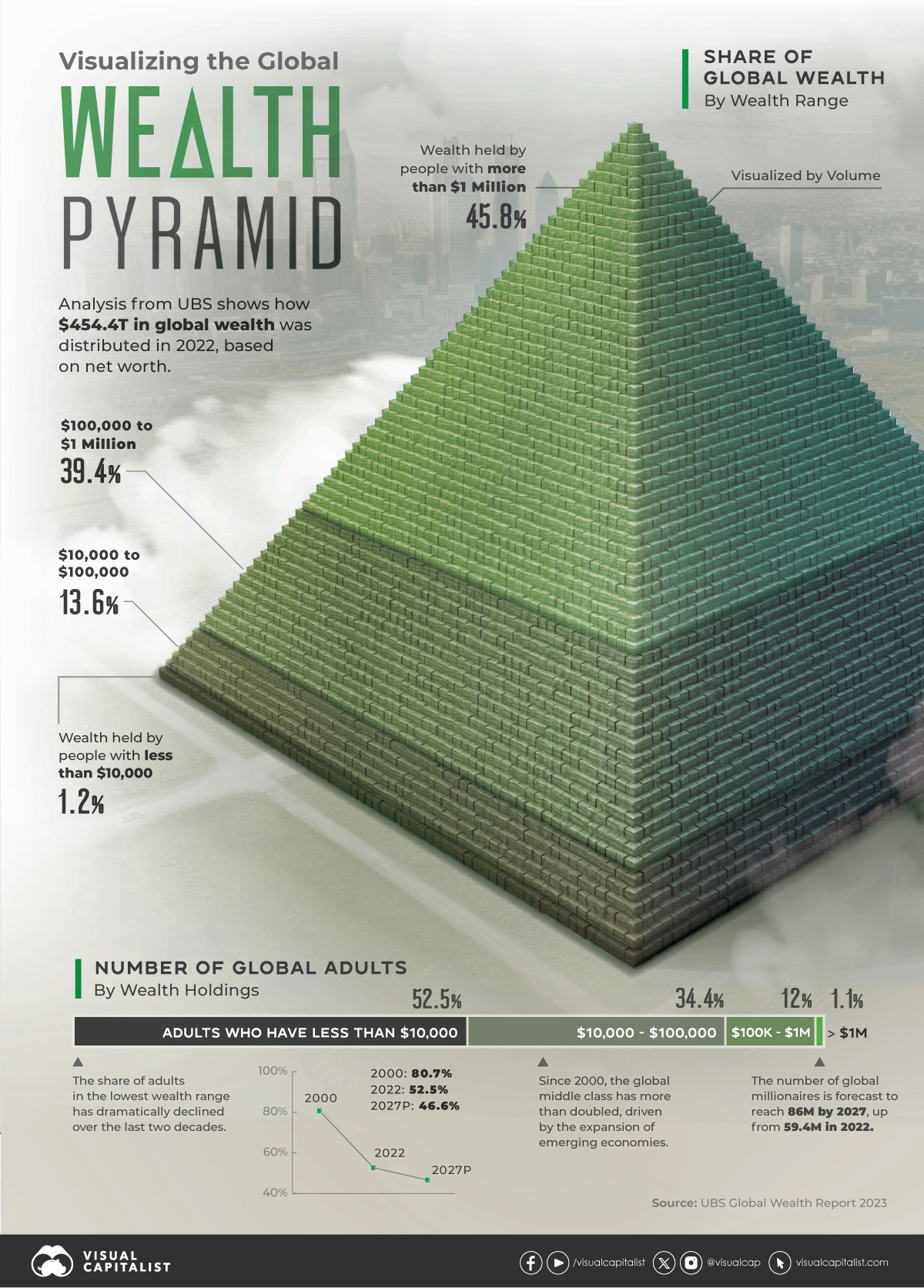

Visualizing the Pyramid of Global Wealth Distribution

Visualizing the Pyramid of Global Wealth Distribution

Who controls global wealth?

In 2022, the world’s millionaires held nearly half of net household wealth. Decades of low interest rates led equities and real estate values to soar, and these assets are disproportionately held among the world’s wealthiest.

While a steep rise in interest rates decreased these fortunes in 2022, the share of wealth controlled by the global millionaire population remains substantial.

The above graphic shows the distribution of global household wealth, based on the annual 2023 UBS Global Wealth Report.

The Distribution of Global Wealth

Worldwide net private wealth stood at $454.4 trillion in 2022.

Here’s how it was distributed across various levels of net worth, which takes a person’s financial and real assets such as housing, and subtracts their debt:

| Net Worth | Number of Adults | Share of Adults | Total Wealth | Share of Global Wealth |

|---|---|---|---|---|

| More than $1 million | 59.4M | 1.1% | $208.3T | 45.8% |

| $100,000 to $1 million | 642.0M | 12.0% | $178.9T | 39.4% |

| $10,000 to $100,000 | 1.8B | 34.4% | $61.9T | 13.6% |

| Less than $10,000 | 2.8B | 52.5% | $5.3T | 1.2% |

The highest wealth rung controls $208.3 trillion in wealth, or 45.8% of the global total. Just 1.1% of the world adult population fall in this bracket.

Those with $100,000 to $1 million have the next greatest share, at 39.4% of net household wealth.

We can see that wealth ownership begins to decline dramatically in the next bracket. People with $10,000 to $100,000 control just 13.6% of global wealth. However, the number of people in the global middle class have more than doubled over the last two decades, driven by the rapid expansion of China.

Interestingly, the lowest segment of wealth has shrunk considerably since 2000. Between 2000 and 2022, it fell from 80.7% to 52.5% of the global population, and is projected to keep decreasing. Despite this, the total share of wealth controlled by this rung is just 1.2% of the global total.

Future Outlook

By 2027, global wealth is estimated to reach $629 trillion. Here’s the forecast for how wealth distribution is set to evolve:

| Net Worth | Percent of Global Adults 2000 | Percent of Global Adults 2022 | Percent of Global Adults 2027P |

|---|---|---|---|

| More than $1 million | 0.4% | 1.1% | 1.5% |

| $100,000 to $1 million | 5.5% | 12.0% | 14.8% |

| $10,000 to $100,000 | 13.4% | 34.4% | 37.0% |

| Less than $10,000 | 80.7% | 52.5% | 46.6% |

Over this time period, the global millionaire population is set to reach 86 million. Below, we show how this is projected to change in select markets:

| Country / Region | Number of Millionaires 2022 | Number of Millionaires 2027P | Change 2022-2027P |

|---|---|---|---|

| 🇺🇸 U.S. | 22.7M | 26.4M | 16% |

| 🇨🇳 China | 6.2M | 13.2M | 112% |

| 🇫🇷 France | 2.8M | 4.0M | 43% |

| 🇯🇵 Japan | 2.8M | 3.9M | 40% |

| 🇩🇪 Germany | 2.6M | 3.4M | 30% |

| 🇬🇧 UK | 2.6M | 4.8M | 86% |

| 🇨🇦 Canada | 2.0M | 3.3M | 63% |

| 🇦🇺 Australia | 1.8M | 2.8M | 53% |

| 🇮🇹 Italy | 1.3M | 1.7M | 25% |

| 🇰🇷 South Korea | 1.3M | 2.1M | 64% |

| 🇳🇱 Netherlands | 1.2M | 1.4M | 17% |

| 🇪🇸 Spain | 1.1M | 1.4M | 25% |

| 🇨🇭 Switzerland | 1.1M | 1.5M | 39% |

| 🇮🇳 India | 849,000 | 1.4M | 69% |

| 🇹🇼 Taiwan | 765,000 | 1.3M | 70% |

| 🇭🇰 Hong Kong SAR | 630,000 | 1.1M | 73% |

| 🇧🇪 Belgium | 536,000 | 746,000 | 39% |

| 🇸🇪 Sweden | 467,000 | 670,000 | 44% |

| 🇧🇷 Brazil | 413,000 | 788,000 | 91% |

| 🇷🇺 Russia | 408,000 | 569,000 | 40% |

As the above table shows, double-digit growth in the millionaire population is projected for many markets, with China, Brazil, and the UK forecast to see the fastest growth by 2027.

Overall, total global wealth is forecast to increase 6.7% annually on average by 2027 factoring in current global inflation forecasts and GDP projections.

Markets

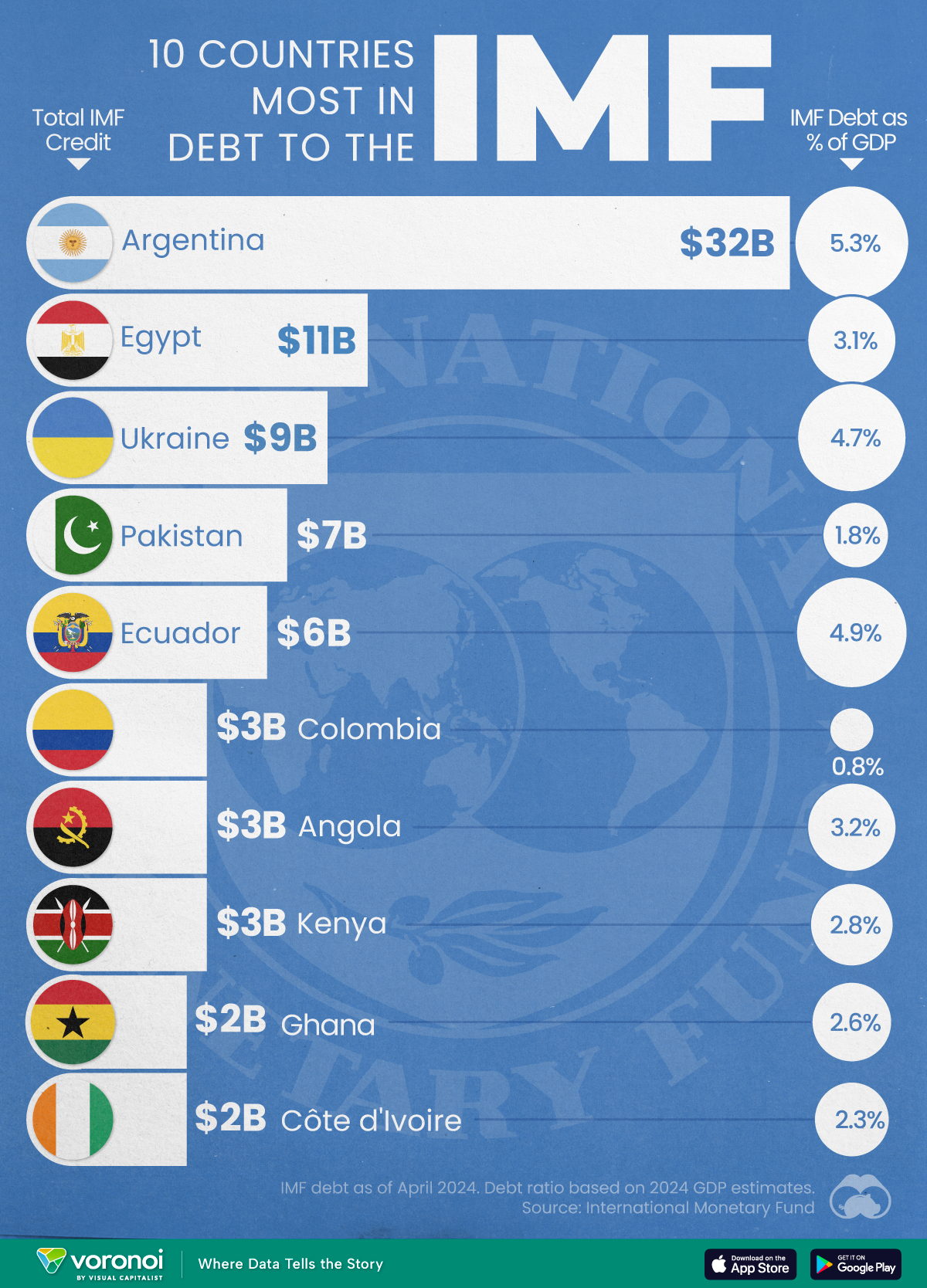

Top 10 Countries Most in Debt to the IMF

Argentina tops the ranking, with a debt equivalent to 5.3% of the country’s GDP.

Top 10 Countries Most in Debt to the IMF

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Established in 1944, the International Monetary Fund (IMF) supports countries’ economic growth by providing financial aid and guidance on policies to enhance stability, productivity, and job opportunities.

Countries seek loans from the IMF to address economic crises, stabilize their currencies, implement structural reforms, and alleviate balance of payments difficulties.

In this graphic, we visualize the 10 countries most indebted to the fund.

Methodology

We compiled this ranking using the International Monetary Fund’s data on Total IMF Credit Outstanding. We selected the latest debt data for each country, accurate as of April 29, 2024.

Argentina Tops the Rank

Argentina’s debt to the IMF is equivalent to 5.3% of the country’s GDP. In total, the country owns more than $32 billion.

| Country | IMF Credit Outstanding ($B) | GDP ($B, 2024) | IMF Debt as % of GDP |

|---|---|---|---|

| 🇦🇷 Argentina | 32 | 604.3 | 5.3 |

| 🇪🇬 Egypt | 11 | 347.6 | 3.1 |

| 🇺🇦 Ukraine | 9 | 188.9 | 4.7 |

| 🇵🇰 Pakistan | 7 | 374.7 | 1.8 |

| 🇪🇨 Ecuador | 6 | 121.6 | 4.9 |

| 🇨🇴 Colombia | 3 | 386.1 | 0.8 |

| 🇦🇴 Angola | 3 | 92.1 | 3.2 |

| 🇰🇪 Kenya | 3 | 104.0 | 2.8 |

| 🇬🇭 Ghana | 2 | 75.2 | 2.6 |

| 🇨🇮 Ivory Coast | 2 | 86.9 | 2.3 |

A G20 member and major grain exporter, the country’s history of debt trouble dates back to the late 1890s when it defaulted after contracting debts to modernize the capital, Buenos Aires. It has already been bailed out over 20 times in the last six decades by the IMF.

Five of the 10 most indebted countries are in Africa, while three are in South America.

The only European country on our list, Ukraine has relied on international support amidst the conflict with Russia. It is estimated that Russia’s full-scale invasion of the country caused the loss of a third of the country’s economy. The country owes $9 billion to the IMF.

In total, almost 100 countries owe money to the IMF, and the grand total of all of these debts is $111 billion. The above countries (top 10) account for about 69% of these debts.

-

Public Opinion6 days ago

Public Opinion6 days agoCharted: How Americans Feel About Federal Government Agencies

-

Healthcare2 weeks ago

Healthcare2 weeks agoWhat Causes Preventable Child Deaths?

-

Energy2 weeks ago

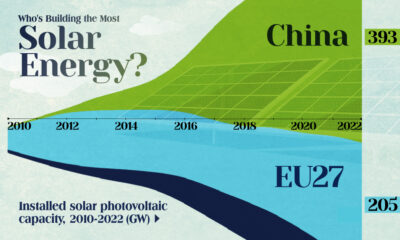

Energy2 weeks agoWho’s Building the Most Solar Energy?

-

Markets2 weeks ago

Markets2 weeks agoMapped: The Most Valuable Company in Each Southeast Asian Country

-

Technology1 week ago

Technology1 week agoMapped: The Number of AI Startups By Country

-

Healthcare1 week ago

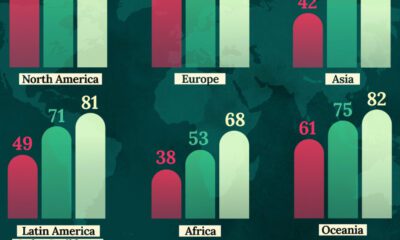

Healthcare1 week agoLife Expectancy by Region (1950-2050F)

-

Markets1 week ago

Markets1 week agoThe Growth of a $1,000 Equity Investment, by Stock Market

-

Markets1 week ago

Markets1 week agoMapped: Europe’s GDP Per Capita, by Country