The Chinese Renminbi Yuán

The Renminbi Yuán was introduced as the official national currency in China in 1949. Since November 2015, the renminbi yuán has been one of the world's reserve currencies, along with the euro, U.S. dollar, yen and British pound.1 Yuán is divided into 10 Jiǎo or 100 Fēn.

List of all currencies

Overview: China

Exchange rate history 1 CNY in USD

The graph shown here shows the exchange rate development from January 2018 to March 2024. The exchange rate for 1 CNY moved during this time from USD 0.16 to USD 0.14. In these 74 months it fell by 12.1 percent.Banknotes and Coins

As China's central bank, the People's Bank of China (PBOC) is responsible for issuing and regulating the renminbi. 1 yuán is equal to 10 jiǎo, which in turn are divided into 10 fēn. However, due to their low value, Fēn have virtually disappeared from circulation today. In everyday life, banknotes of 100, 50, 20, 10, 5, 2 and 1 yuán exist. Jiǎo are also still issued as 1, 2 and 5 banknotes. Coinage comes in various denominations of all three units.Larger banknotes than the 100 yuán banknote are deliberately not produced. 100 yuán is equivalent to about € 12.80 or US$ 13.50. The cash payment of larger sums of money is therefore associated with a correspondingly large amount of material. In this way, the Chinese government is attempting to make it more difficult to counterfeit banknotes and, at the same time, to shift payment transactions to digital ones that are easy to trace and control.

The Future of the Digital Yuán

These efforts include the digital RMB, which has already been legal tender since 2020. Officially, however, it is still in the development and testing phase. The digital yuán is seen as having the potential not only to supplement the existing cash in China, but even to replace it at a later stage. Although it is based on blockchain technology, it is a centralized digital currency whose transactions can be monitored and controlled by the government.Currency reserves for the Renminbi yuán

According to the International Monetary Fund, the total broad money (M3) amounted to CNY 261.580 trillion at the end of 2022. For currency hedging, reserves were held in a total amount of 22.279 trillion yuáns. This corresponds to a ratio of 1:11.7. In other words, not even 1 of 11 yuáns is deposited with a countervalue.Approximately 789.26 billion yuáns (3.5%) of the currency reserves exist in gold reserves. The remainder consists of foreign currencies, special drawing rights in the International Monetary Fund and other reserve positions.

› Worldwide currency and gold reserves

Sources

All conversion rates are based on data from the European Central Bank.Data on currency and gold reserves are from the International Monetary Fund.

Currency and gold reserves worldwide

Currency and gold reserves worldwide Cost of living in a global comparison

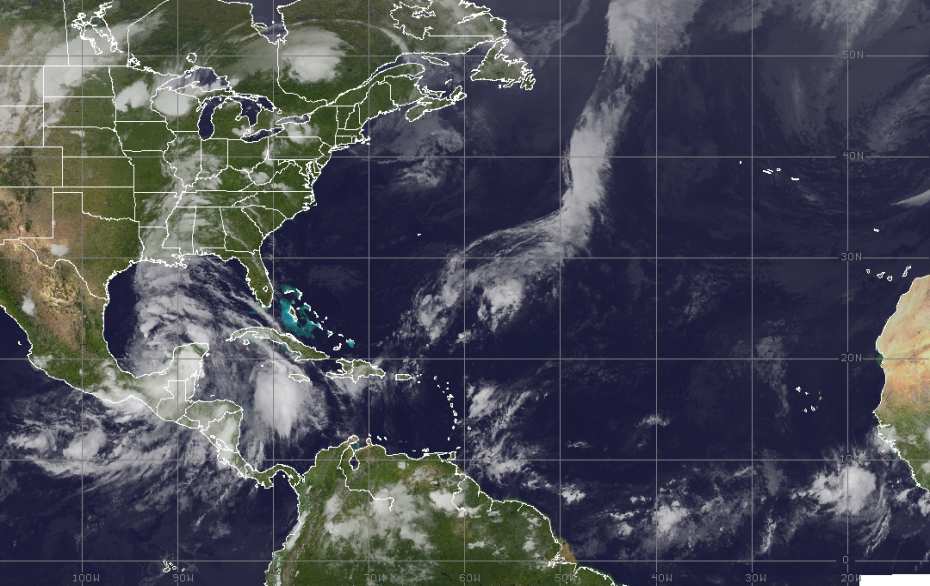

Cost of living in a global comparison Recent Hurricanes in the Dominican Republic

Recent Hurricanes in the Dominican Republic