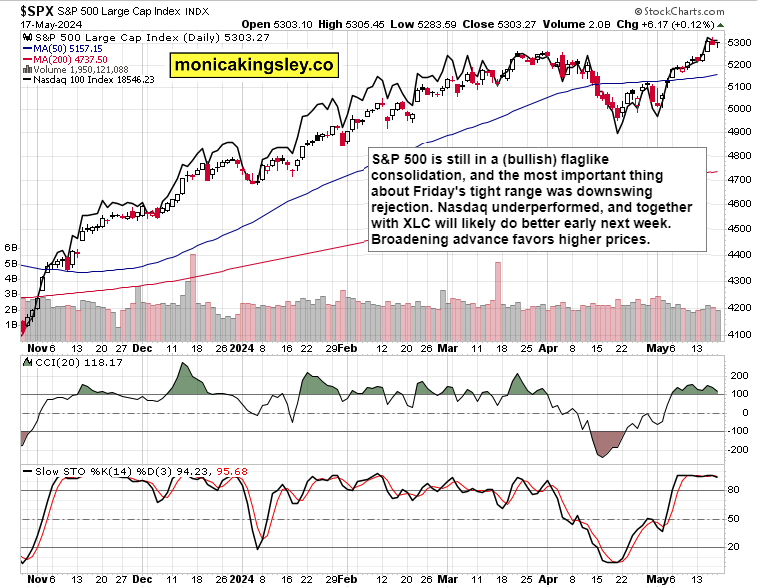

S&P 500 remained in the consolidation one day longer, bond yields rose and rotations faltered as tech with semis offered short-term buying opportunities rather than selling ones. What follows, is that I still view the market as going higher rather than setting up for a slide, as one with improving internals, and with the sectoral leadership as talked amply lately.

In spite of the rising volatility seen in many high beta stocks, the market as a whole has not topped, and the flaglike structure on the daily offers and offered plenty of opportunities to get in, and enjoy the spurts of risk-on directional volatility such as the one we all benefited from on Wednesday CPI.

Look not further than rate cut odds since that data announcement, how little it changed since – and then see the bond market chart such as the one below, that put in proper context Thursday and Friday rise in yields that didn‘t really make the dollar flourish.

Once we get through the Fed speakers‘ intraday volatility, housing data with services and manufacturing PMI and the usual unemplloyment claims, are what matters. The key point to remember is that right after PPI, Powell again practically ruled out rate hikes, which was also what formed the late Oct bottom. Forget not the market moving NVDA earnings Wednesday after the close – it‘s about guidance.

S&P 500 and Nasdaq

As written Friday, if not 5,315, then 5,307 as daily supports are to do the job, and they held the late session flush at bay.

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

Recommended content

Editors’ Picks

AUD/USD saw neutral movements, markets gear up for Fed and CPI

The AUD/USD pair experienced mixed trading on Tuesday, facing some bearish pressure and lingering around the 0.6605 area. This shift occurred as sellers re-entered the market after a minor rebound on Monday. The ongoing Fed two-day meeting and the US May inflation data release will be the key drivers this week.

EUR/USD extends into a third straight down day as Fed rate call looms

EUR/USD slid into a third straight loss on Tuesday as market sentiment sours on the back of roiled EU parliamentary elections. Elections saw a firm swing into support for center-right and far-right parties by European voters and steep losses for left-leaning political parties.

Gold steadies as traders brace for US CPI data, FOMC’s monetary policy decision

Gold price advanced for the second straight day amid a stronger US Dollar, yet it remains near familiar levels as traders brace for the release of crucial data from the United States. XAU/USD traders are in wait-and-see mode as the Federal Open Market Committee begins its two-day meeting.

Altcoins likely to shed more this week as Apple’s WWDC fails to catalyze bull rally Premium

Despite the start of Apple’s WWDC 2024 event, the crypto market has failed to react sufficiently. This development denotes the lack of interest among buyers and what’s next for the industry, especially if the outlook fails to improve.

Understanding how ECB and FOMC meetings this week can impact stocks

This week, it's time to tread carefully as we navigate through some significant events in the financial world. The stock market can be quite the rollercoaster, especially when big players like the European Central Bank and the Federal Reserve are making moves.

-638517537419201431.png)