Top Growth Companies With High Insider Ownership On Chinese Exchanges May 2024

Amidst a backdrop of buoyant holiday spending and positive trade data, Chinese markets have shown signs of recovery, with major indices like the Shanghai Composite and CSI 300 experiencing gains. In such an optimistic climate, growth companies with high insider ownership on Chinese exchanges may offer interesting insights into market confidence and potential resilience.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

YanKer shop FoodLtd (SZSE:002847) | 29.2% | 23.9% |

Shandong Longhua New Material (SZSE:301149) | 34.4% | 39.4% |

Zhejiang Songyuan Automotive Safety SystemsLtd (SZSE:300893) | 20% | 24.2% |

Suzhou Sunmun Technology (SZSE:300522) | 37.6% | 63.4% |

Arctech Solar Holding (SHSE:688408) | 38.7% | 25.9% |

UTour Group (SZSE:002707) | 24% | 33.1% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Anhui Huaheng Biotechnology (SHSE:688639) | 28.3% | 28.5% |

Jilin University Zhengyuan Information Technologies (SZSE:003029) | 12.1% | 69.2% |

Offcn Education Technology (SZSE:002607) | 26.1% | 72.3% |

Let's take a closer look at a couple of our picks from the screened companies.

Quectel Wireless Solutions

Simply Wall St Growth Rating: ★★★★★☆

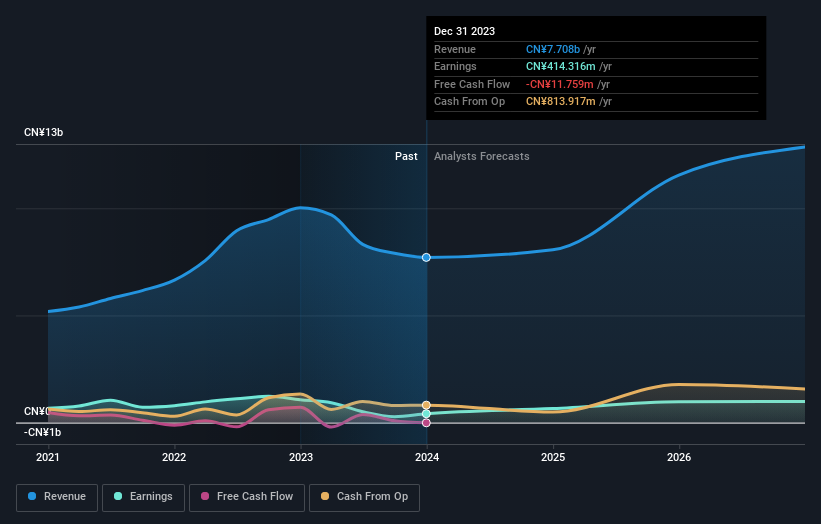

Overview: Quectel Wireless Solutions Co., Ltd. is a global company that specializes in the research, development, design, production, and sales of wireless communication modules and solutions, with a market capitalization of approximately CN¥11.83 billion.

Operations: The company generates revenue primarily through the design, production, and sale of wireless communication modules and solutions globally.

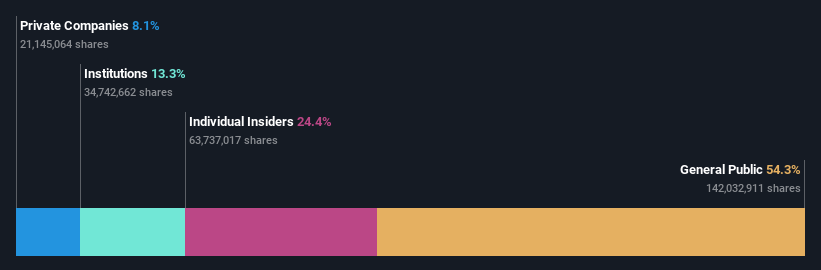

Insider Ownership: 24.4%

Earnings Growth Forecast: 42% p.a.

Quectel Wireless Solutions, a growth company with high insider ownership in China, is currently trading at 49% below its estimated fair value. Despite this undervaluation, the company has demonstrated robust financial performance with a significant rebound in net income from a loss last year to CNY 54.77 million this quarter. Quectel's revenue and earnings are expected to grow significantly over the next three years, outpacing the Chinese market average. However, investors should be cautious of large one-off items impacting financial results and a forecasted low return on equity of 15.4% in three years' time.

Dive into the specifics of Quectel Wireless Solutions here with our thorough growth forecast report.

Sichuan Development LomonLtd

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sichuan Development Lomon Co., Ltd. is a company based in China, specializing in the research, development, production, and sales of phosphorus chemical products, with a market capitalization of approximately CN¥14.44 billion.

Operations: The company specializes in phosphorus chemical products, generating all its revenue from this segment.

Insider Ownership: 18.2%

Earnings Growth Forecast: 29.1% p.a.

Sichuan Development LomonLtd, a Chinese firm with high insider ownership, faces challenges despite its growth prospects. Its recent earnings reflect a decline in both revenue and net income, with sales dropping to CNY 1.67 billion from CNY 1.99 billion year-on-year and net income decreasing to CNY 103.51 million. However, the company's earnings are expected to grow by 29.1% annually over the next three years, outperforming the broader Chinese market's growth rate of 23.3%. This growth is tempered by concerns over low return on equity projections and insufficient dividend coverage.

Zhejiang Jinke Tom Culture Industry

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Jinke Tom Culture Industry Co., Ltd. operates in the cultural and entertainment sector, with a market capitalization of approximately CN¥15.65 billion.

Operations: The company generates revenue primarily from its mobile internet culture industry segment, totaling CN¥1.30 billion.

Insider Ownership: 17.2%

Earnings Growth Forecast: 116.4% p.a.

Zhejiang Jinke Tom Culture Industry Co., LTD. is navigating a period of significant revenue growth, with forecasts indicating an annual increase of 28%, surpassing the Chinese market's average of 14.1%. Despite a recent downturn in quarterly earnings, where net income fell to CNY 62.12 million from CNY 102.21 million year-on-year, the company is expected to become profitable within three years, showing potential for substantial earnings growth at a rate of 116.37% annually. However, its share price has been highly volatile recently, which may concern some investors.

Make It Happen

Discover the full array of 405 Fast Growing Chinese Companies With High Insider Ownership right here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:603236 SZSE:002312 and SZSE:300459.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com