Commercial brokerages devise battle plans as profits plunge

Commercial brokerages devise battle plans as profits plunge

Trending

Commercial brokerages trim payroll and diversify to stem losses

Fewer transactions result in smaller staff and a search for “resilient” income streams

Commercial real estate brokerages from coast to coast are cutting costs through layoffs and efficiency measures.

As higher interest rates lower the number of transactions and eat into profits, North America’s largest brokerages have cut spending this year through “precision cost trimming,” CoStar News reported, citing regulatory earnings calls.

Brokerages ranging from Calabasas-based Marcus & Millichap to its larger publicly traded rivals, CBRE, JLL, Cushman & Wakefield, Newmark and Toronto-based Colliers have announced cost-cutting initiatives.

To shave a buck this year, the firms have trimmed staff as hopes dwindle that the Federal Reserve will significantly lower interest rates. The total number of layoffs was not disclosed.

Pressure to trim expenses in other ways is growing as big brokerages selectively invest in talent and acquisitions to earn money by providing management and consultative services while waiting for commercial sales to rebound.

“There’s a lot of what I would call ‘quiet cutting’ going on right now,” Robert Shibuya, CEO of Dallas-based real estate advisory firm Mohr Partners, told CoStar. “I know that all of the big brokerages are still cutting because their people have been calling me for work.”

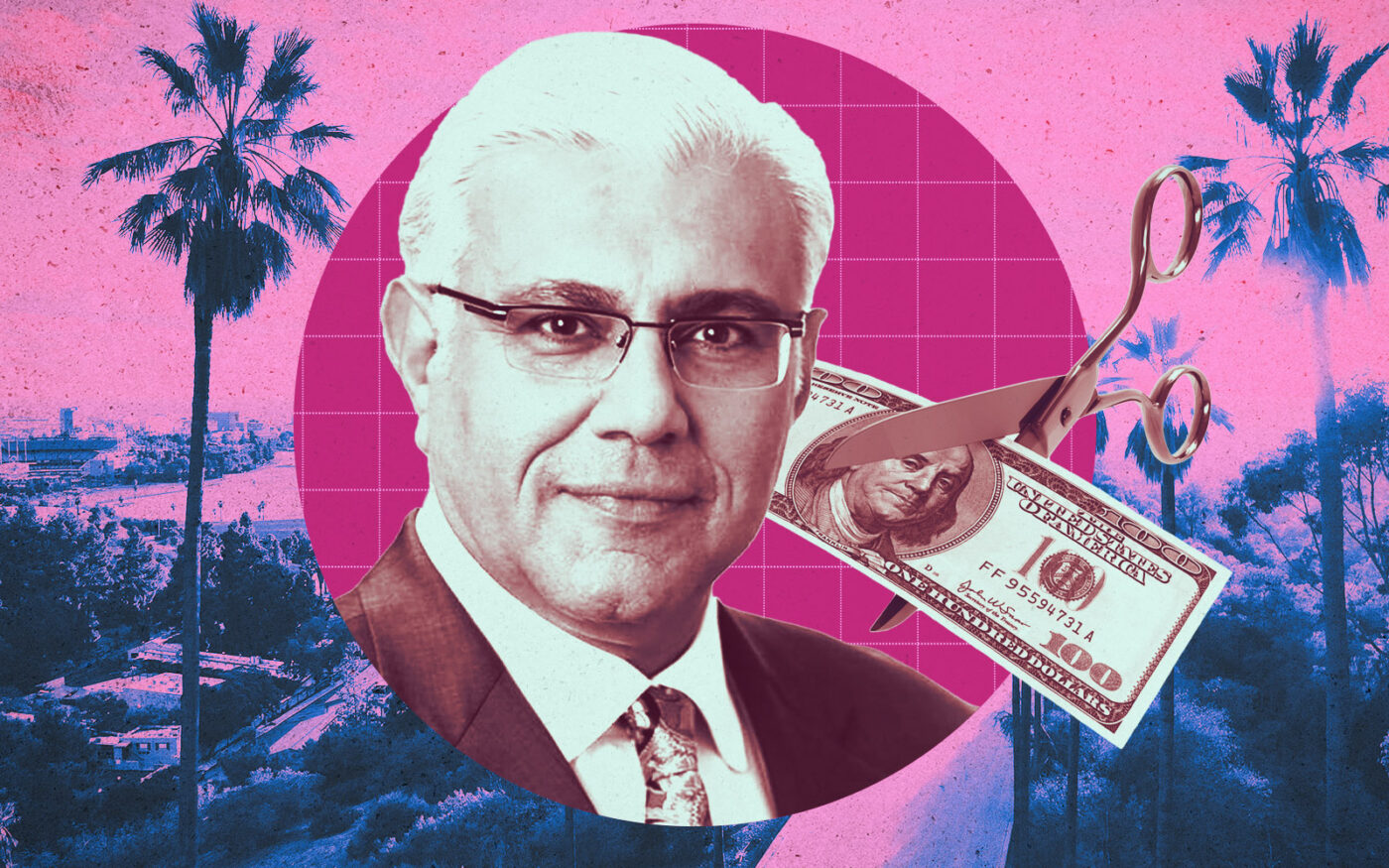

Marcus & Millichap’s decline in brokerage commissions from sales contributed to its fourth consecutive quarterly loss, even after the brokerage trimmed costs 5 percent from a year earlier to $69 million.

CEO Hessam Nadji said market disruptions since the pandemic have upended sales and the recruiting and training of new brokers.

Investment property sales and financing fell early in the pandemic only to recover in 2021 and 2022, then dive last year as higher interest rates caused sales to dry up, Nadji said. That lower demand has resulted in higher turnover, especially for newer brokers, making it harder for the firm to expand its sales force.

“The last three- to four-year period has provided nothing resembling a typical market environment, in which we train people, mentor people and they learn the fundamentals of brokerage,” Nadji said during the company’s most recent earnings call. “This market disruption is the primary reason that skill sets aren’t developing in a way that we’re used to seeing.”

Chicago-based JLL, the world’s second-largest brokerage, credited a recent revenue surge to benefits from cost cuts coupled with growth in leasing and “resilient” businesses such as workplace and property management.

The changes helped drive a $66.1 million profit in the first quarter, compared with a $9.2 million loss in the year-earlier period, CFO Karen Brennan said in an earnings call.

“As we strengthen our service and product offerings, we will selectively add people and capabilities, both organically and through very targeted” mergers and acquisitions, CEO Christian Ulbrich told investors.

Cushman & Wakefield, which reported a 29 percent increase in earnings over the prior-year quarter by lowering expenses and higher leasing revenue, has delivered on its cost-savings plans, Morningstar analyst Suryansh Sharma said in an email.

“Keeping a rein on expenses is essential, given the current macroeconomic challenges,” Sharma told CoStar. He said Cushman management has projected that cost and efficiency initiatives will mostly offset an increase in inflation costs this year.

While brokerage layoffs probably won’t match levels of the past two years when the businesses shed hundreds of jobs, CBRE and other companies are likely to keep reducing their employee counts in certain areas to further cut corporate costs, Shibuya added.

Despite the layoffs, the five largest global real estate services firms ranked by revenue — CBRE, JLL, Cushman & Wakefield, Colliers and Newmark — have added employees over the years by acquiring companies not as reliant on volume sales.

They include project management, investment management, technology and engineering services.

— Dana Bartholomew

Read more

Commercial brokerages devise battle plans as profits plunge

Commercial brokerages devise battle plans as profits plunge

CBRE profit plummets as i-sales revenue slumps

CBRE profit plummets as i-sales revenue slumps

JLL eyes layoffs as profits tumble 59%

JLL eyes layoffs as profits tumble 59%