Abstract

Externalities arise when the decisions of an agent have direct effects on the welfare of others. This chapter presents an overview on the economics of externalities. Relying on Pareto efficiency, the analysis is presented in a general equilibrium framework and evaluates the efficient management of externalities. The investigation also focuses on the role of non-convexity and transaction costs. It covers alternative institutional setups, including markets, government interventions, and contracts. It reexamines how efficient management of externalities remains consistent with aggregate profit maximization under transaction costs and non-convexity. It indicates how pricing can support an efficient allocation under externalities, but this may require nonlinear pricing under non-convexity. And it explores how the minimization of transaction costs is an integral part of the efficient management of externalities.

The author would like to thank two anonymous reviewers for useful comments on an earlier draft of the chapter.

Similar content being viewed by others

Keywords

JEL

Introduction

Externalities are common in economics: they arise whenever an agent makes decisions that affect the welfare of other agents [1, 2]. The agents can be producers or consumers. And the externalities can be positive (when they improve the welfare of others) or negative (when they have adverse effects on others). Examples abound. Pollution is a negative production externality when it causes damages to crops or public health. Second-hand smoke is a negative consumer externality when a smoker has adverse effects on the health of nearby nonsmokers. Bees generate positive production externality when, besides producing honey, they also provide pollination services to surrounding crops and orchards. An individual getting vaccinated against a communicable disease involves a positive consumer externality when it reduces the odd of infection for both himself and other people nearby. Thus, externalities are prevalent. But how they should be managed is less clear. One argument is that externalities make unregulated markets inefficient (when market prices do not reflect the full social cost or benefit of goods and services). In this case, recommendations are often made for government interventions implementing policies that can “internalize” the externalities (e.g., [1, 3,4,5]). Others have argued that externalities can be managed by contracts among the affected agents, in which case an efficient outcome can be attained without government intervention [6]. This debate raises two important questions. First, how to characterize an efficient allocation in the presence of externalities? Second, how can we evaluate the role of markets versus non-market institutions in the efficient management of externalities? These are the key questions addressed in this chapter.

It is well known that, in the absence of externalities and under convexity conditions, competitive markets can implement an efficient allocation [7]. This has stimulated much interest in relying on market institutions and decentralized decision-making to support efficient allocations. But externalities create significant challenges to market allocations [8]. First, by affecting the ability to decentralize decision-making in an efficient manner, externalities undermine the efficiency of unregulated markets (e.g., [5]). Second, as argued by Starrett [9] and Baumol and Bradford [10], production externalities can imply non-convex technologies. In addition, environmental goods often generate externalities while being produced in non-convex ecosystems [11]. It is well known that, under non-convexity and uniform pricing, markets can fail to be efficient (e.g., [12,13,14,15,16,17]). Chavas and Briec [13] showed that nonlinear pricing can be required under non-convexity. Following Chavas [18], it means that nonlinear pricing may be needed to manage externalities efficiently. Third, as emphasized by Coase [6] and others, various institutional choices (including contracts and the legal system) can also be used to manage externalities.

Relying on the classical Pareto efficiency criterion, this chapter provides a broad overview on the economics of externalities. By definition, externalities imply the effects of some agents on others. Managing externalities means developing some coordination scheme among these agents, which typically involves the use of resources. We call the costs of these resources “transaction costs.” They include information cost, search cost, and enforcement cost. The economics of transaction costs has been analyzed by Coase [19], Foley [20], Hahn [21], Williamson [22], Williamson and Winter [23], Shleifer [24], and others. Transaction costs vary across economic institutions and are relevant in the evaluation of externality management. This applies to market as well as nonmarket institutions (including government and contracts).

The efficient management of externalities suggests a need to integrate Coase’s [6] analysis of contracts with the role of transaction costs and non-convexity. This chapter argues that the Coase theorem (stating that the efficient management of externalities is consistent with aggregate profit maximization) holds under transaction costs and non-convexity. This result applies to production externalities as well as coordination/exchange externalities. In addition, the efficient management of consumption externalities is consistent with the minimization of aggregate consumer expenditure. In this context, we examine how transaction costs play a role in efficiency analysis and how the minimization of transaction costs is an integral part of efficient allocations. Such results apply under non-convexity provided that we allow for nonlinear pricing.

In the presence of non-convexity, the efficient management of externalities becomes more complex. First, the classical dichotomy often made in economics between nonmarket institutions and competitive markets (exhibiting uniform pricing for all market participants) is not very helpful. Indeed, when externalities generate non-convexity, markets exhibiting nonlinear pricing may be needed to implement efficient allocations. Second, within market institutions, the implementation of nonlinear pricing (where prices vary across agents) requires the identification and implementation of price discrimination schemes. Such choices would be made by firm managers and/or policy makers (a “visible hand”) and would typically involve transaction costs. This indicates that transaction costs play a role in the management of externalities under markets as well as nonmarket institutions.

The chapter is organized as follows. Section 2 motivates the analysis of efficiency under externalities using graphical arguments. A general equilibrium characterization of Pareto efficiency under externalities, non-convexity, and transaction costs is presented in Sect. 3. The analysis goes beyond Baumol and Oates [1] in several ways. First, it relies on a benefit function as an intuitive measure of aggregate welfare (the maximization of aggregate benefit providing a convenient representation of efficiency). Second, the linkages between the maximization of aggregate benefit and pricing give useful insights into the role of markets in supporting efficient allocations under externalities. For example, the approach identifies conditions under which the implementation of simple Pigouvian taxes/subsidies is inappropriate (when uniform pricing is inefficient). Third, the analysis stresses the role of transaction costs in choosing institutions and policies. Policy implications for the efficient management of externalities are discussed in Sect. 4. Finally, Sect. 5 concludes.

Motivations

To motivate the analysis, we examine a production process involving two outputs (y1, y2) produced under a given set of resources. We consider alternative situations, all illustrated in Fig. 1. We start the analysis with a situation where there are no externalities. Without externalities, the outputs satisfy (y1, y2) ∈ Y0 ⊂ ℝ2, where Y0 denotes the feasible set without externalities. We assume that the feasible set Y0 is convex, corresponding to a technology exhibiting diminishing marginal productivity. We now introduce externalities in the analysis.

P1: An externality arises when the decisions of one agent have direct effects on the welfare of other agents.

Coase [6] discusses an example with two agents: a rancher managing livestock and a farmer producing crops, the externality coming from straying livestock that destroy crops growing on the neighboring farm. In this context, letting y1 be livestock production and y2 be crop production, there is a negative externality of y1 on y2. From P1, at least two agents are required. Indeed, in the Coase example, if the farmer and the rancher were to merge into a single firm, then the management of crop losses due to livestock damages would reduce to an issue of internal management (in which case the externality would be “internalized”).

We examine two externality scenarios. Under scenario 1, the outputs satisfy (y1, y2) ∈ Y1 ⊂ ℝ2 with Y1 ⊂ Y0 and the feasible set Y1 is convex. Under scenario 2, (y1, y2) ∈ Y2 ⊂ ℝ2 with Y2 ⊂ Y0 but the feasible set Y2 is non-convex. These two scenarios are illustrated in Fig. 1. Both scenarios represent negative externalities that have adverse effects on productivity and reduce the feasible set. As showed in Fig. 1, introducing externalities implies an inward shift in the boundary of the feasible set from isoquant (A B C) to isoquant (A E1 C) under scenario 1 and to isoquant (A E2 C) under scenario 2. Note that all isoquants go through the points A and C: there is no externality when only one product is produced (i.e., when either y1 = 0 or y2 = 0). But when products are produced (i.e., when y1 > 0 and y2 > 0), then negative externalities between y1 and y2 implies a reduction in productivity (due to crop losses generated by straying livestock in the Coase example). As discussed below, the distinction between scenario 1 (where Y1 is convex) and scenario 2 (where Y2 is non-convex) will prove important.

While Fig. 1 reflects negative externalities reducing the feasible set, it also shows that, when external effects are large enough (under scenario 2), this reduction is associated with a shift from a convex set Y0 to a non-convex set Y2.

P2: Externalities can lead to non-convexity in the production set.

Property P2 has been noted in the literature by Starrett [9], Baumol and Bradford [10], and Dasgupta and Maler [11]. We discuss below how non-convexity creates significant challenges to the analysis of economic efficiency under externalities.

This section focuses on a graphical analysis involving two firms (a rancher and a farmer in the Coase example) and one consumer. Firm 1 (the rancher) produces output y1 (livestock production) while firm 2 (the farmer) produces y2 (crop output), with y1 having negative effects on the production of y2. This example will help motivate the more general analysis presented in the rest of the paper.

First, consider scenario 1 where negative externalities imply that Y1 ⊂ Y0, the feasible set Y1 being convex. This scenario is illustrated in Fig. 2. Figure 2 shows that the efficient allocation is given by point E1. Indeed, point E1 generates the highest possible utility level represented by the indifference curve (D E1 D’). At the efficient point E1, the slope of the indifference curve (D E1 D’) is tangent to the isoquant line (A E1 C) (the upper bound of the feasible set Y1). And in the neighborhood of point E1, the slope of both lines is equal to the slope of the line (F E1 F′) in Fig. 2. In turn, this slope is equal to (−p2/p1), where (p1, p2) are the (social) shadow prices of (y1, y2). When the feasible set is convex, taking prices (p1, p2) as given, the line (F E1 F′) is the budget line supporting the efficient point E1 for the two producers and the consumer.

But what if producers failed to take into consideration the external effects of their decisions on others? In general, a failure to internalize production externalities would affect production incentives. In the Coase example, if the external cost of the externality imposed on the farmer is neglected, the rancher would have incentives to produce y1 beyond what is socially optimal, leading to a market equilibrium where prices \( \left({p}_1^{\prime },{p_2}^{\prime}\right) \) differ from (p1, p2). This is illustrated in Fig. 3 for the market good y1. Figure 3 distinguishes between a social supply curve (where production decisions reflect the presence of externalities) and a private supply curve (where externalities are ignored in an unregulated market). In Fig. 3, the efficient point E1 corresponds to \( \left({p}_1,{y}_1^{\ast}\right) \) and is situated at the intersection of the social supply curve and demand curve. But the unregulated market equilibrium is given by point E1’ where \( \left({p}_1^{\prime },{y}_1^{\prime}\right) \) differs from \( \left({p}_1,{y}_1^{\ast}\right) \) because production decisions ignore external effects. Such a market equilibrium would necessarily be inefficient. In this context, government intervention can help. It can be done in at least two ways. First, government could set regulations/standards or issue permits/quotas stipulating the efficient quantities to be produced (i.e., \( {y}_1^{\ast } \) and \( {y}_2^{\ast } \) in Figs. 2 and 3). Second, government could implement Pigouvian taxes/subsidies that reflect the social cost of the externality [5]. When the feasible set is convex, such Pigouvian taxes/subsidies would restore efficiency [1, 3, 5].Footnote 1

P3: In unregulated markets facing externalities, government policy can help restore efficiency. This can be done through regulations using standards/permits/quotas; or through price policies imposing Pigouvian taxes/subsidies when the feasible set is convex.

But what if the feasible set is not convex? We now turn our attention to scenario 2 where negative externalities are associated with the feasible set Y2 being non-convex. This scenario is illustrated in Fig. 4. The efficient allocation corresponds to point E2 in Fig. 4. Indeed, point E2 generates the highest possible utility level represented by the indifference curve (D E2 D’). Again, at the efficient point E2, the slope of the indifference curve (D E2 D’ is tangent to the isoquant line (A E2 C) (the upper bound of the feasible set Y2). And in the neighborhood of E2, the slope of both lines is equal to the slope of the line (F E2 F′) in Fig. 4. What is new in Fig. 4 is that the linkages between the slope of the line (F E2 F′) and efficiency breaks down. Indeed, if the two firms faced prices given by the slope of (F E2 F′), they would have incentive to produce at point C, where only output y2 is produced. This is showed in Fig. 4 where the lines (F E2 F′) and (C C″) have the same slopes (reflecting the same relative prices), but aggregate revenue is higher at point C than at point E2. Yet, point C is inefficient as it generates lower utility, the indifference curve (C C′) being lower than the indifference curve (D D’). In other words, under the non-convexity of the set Y2, the slope of line of (F E2 E’) no longer defines global prices that can support an efficient allocation. Note that this slope still provides a local measure of the shadow prices of (y1, y2) in the neighborhood of the efficient point E2. But this local measure does not provide a global representation of efficient pricing. This raises the question: Does there exist a pricing scheme that can support an efficient allocation? As showed in Fig. 4, an efficient pricing scheme is given by the budget line (G E2 G’), the slope of this line reflecting the shadow relative prices of (y1, y2). Like the line (F E2 F′), the line (G E2 F′) is tangent to both the indifference curve (D E2 D’) and the isoquant (D E2 D’) in the neighborhood of the efficient point E2. But unlike (F E2 F′), the budget line (G E2 G’) provides incentives for the firms to produce at the efficient point E2. And in contrast with (F E2 F′), the budget line (G E2 G’) is nonlinear. Interpreting the slope of budget lines as measures of relative prices, we deduce that a pricing scheme supporting an efficient allocation must involve nonlinear pricing. Noting that this statement holds only under the non-convexity of the feasible set (i.e., under scenario 2), this gives the following result.

P4: In a market economy with externalities, nonlinear pricing may be required to support an efficient allocation when the feasible set is non-convex.

Knowing from property P2 that externalities can lead to non-convexity of the feasible set, property P4 indicates that linear pricing may not support an efficient allocation. In such a situation, uniform Pigouvian taxes/subsidies mentioned in property P3 would not be efficient.Footnote 2

Such complexities raise a more fundamental question: What is the most efficient way to manage externalities? Trying to identify the appropriate institutional and policy response to externality issues has generated a debate among economists and policy makers. At least three different lines of arguments have been explored. A first line is that externality issues can be managed through government intervention. This includes regulation and/or Pigouvian taxes/subsidies chosen to make market prices reflect the social cost of the externalities [3, 5]. But as noted above, standard Pigouvian taxes may not always lead to efficient allocations. A second line is to note that production externality issues can be resolved when the affected firms merge. In this case, the externalities can be “internalized” under efficient management by the merged firm. A third line is that externalities can be managed through contracts between the affected parties [6]. In the Coase example mentioned above, this would involve a contract between the rancher and the farmer that would stipulate how livestock is managed to reduce or eliminate crop damages. For example, a contract could stipulate building a fence to prevent livestock from straying and destroying the crop grown on the neighboring farm. This could be efficient if the cost of building a fence is less than the crop damages. As stressed by Coase [6], under this contract option, there is no need for government intervention.

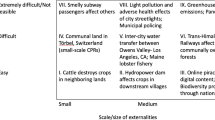

So, how can externalities be managed efficiently? There are many institutional options, including government intervention, mergers, and contracts.Footnote 3 In general, it is difficult to tell which option is better. If each option could be implemented under perfect information and at zero cost, then all options may be seen as equally efficient, in which case efficiency alone would not provide much guidance.Footnote 4 But most situations involve imperfect information and the management of externalities is typically costly. This suggests introducing transaction costs explicitly in the analysis. Defining transaction cost as the cost of the resources used in the process of coordination/exchange, this will provide additional insights on how externalities can be managed efficiently. This is illustrated in Fig. 5 under two institutional options, A and B, where institution B exhibits larger transaction costs (i.e., uses more resources) than institution A in managing externalities, ceteris paribus. Resources used in externality management are no longer available for consumption. As a result, the feasible set for consumer goods is larger under institution A than under institution B. As showed in Fig. 5, it follows that institution A is deemed efficient compared to institution B. Indeed, point EA attained under institution A generates a higher level of utility (as given by the indifference curve (D EA D’)) than point EB attained under institution B. This generates the following result.

P5: Transaction costs are relevant in the management of externalities: ceteris paribus, institutions exhibiting lower transaction costs are deemed more efficient.

Property P5 states that transaction costs play an important role in the efficient management of externalities. It indicates that each institutional option (government intervention, merger, or contract) may be desirable on efficiency ground when associated with low transaction costs. Alternatively, any option involving large transaction costs may be inefficient. To the extent that information costs are included among transaction costs, property P5 would apply to information: efficient management of externalities should be handled by institutions that have good access to information. These arguments suggest that government intervention may be seen as desirable when government has good information about the externalities and government action can be implemented at relatively low cost (e.g., [5]).Footnote 5 Similarly, contracts provide a good option to manage externalities when contractual costs are low and the affected agents are well informed [6, 24]. Finally, the merger option may be desirable when the management of the merged firm is well informed and effective in “internalizing” the externalities [19, 27].

A General Equilibrium Analysis of Efficiency under Externalities

Based on the motivating example presented in Sect. 2, we now present a general model of externalities. Following Chavas [18], consider an economy consisting of m commodities and n economic agents. We distinguish between two groups of agents: consumers and producers. Let Nc be the set of nc consumers, and Ns the set of ns producers. The set of all agents is N = Nc ∪ Ns = {1, 2, …, n}, where n = nc + ns. The i-th consumer chooses a consumption bundle xi = (xi1, …, xim) ∈ Xi ⊂ ℝm, i ∈ Nc, where the feasible set Xi is assumed to be convex and to have a lower bound, i ∈ Nc. Let \( x=\left({x}_1,\dots, {x_n}_c\right) \), where \( x\in X={X}_1\times \dots \times {X_n}_c \). Consumer preferences for the i-th consumer are represented by a continuous utility function ui(x), i ∈ Nc. The utility functions are general and allow for non-zero income effects. And given \( x=\left({x}_1,\dots, {x_n}_c\right) \), they allow for externalities amongconsumers (as the consumption decision of a consumer can affect the utility of other consumers).

The allocation of m commodities among the n agents also involves production and exchange activities. The production activities of the j-th producer are denoted by yj = (yj1, …, yjm) ⊂ ℝm, j ∈ Ns. When the k-th commodity is a consumer good, yjk is the nonnegative quantity produced by the j-th producer (yjk ≥ 0), j ∈ Ns, and xik is the nonnegative quantity consumed by the i-th consumer (xik ≥ 0), i ∈ Nc. Let \( y=\left({y}_1,\dots, {y_n}_s\right)\in Y\subset {\mathbb{R}}^{m\ {n}_s} \), where Y is the feasible set for production activities. In general, the feasible set Y represents a joint production process, allowing for externalitiesamong producers.

Exchange can take place among agents. Let the vector tji = {tjik:k = 1, …, m}∈ℝm denote the exchanged quantities of commodities provided by the j-th agent to the i-th agent, j, i ∈ N. When the k-th commodity is a consumer good, tjik ≥ 0 is the quantity traded from the j-th agent to the i-th consumer. We consider the case where coordination and exchange among agents can be costly and involve the use of resources. Let z = (z1, z2, …, zn), where zi = (zi1, …, zim) ∈ ℝm is the vector of commodities used by the i-th agent in coordination and exchange activities, i ∈ N. The costs of z are the transaction costs from coordination and exchange activities among the agents. Such costs include transportation cost, information cost, search cost, contractual cost, and enforcement cost. The feasible set for (z, t) is denoted by Z, with (z, t) ∈ Z. Again, this allows for externalities in coordination and exchange amongagents.

Assume that the sets Y, Z, and X are closed, that (0, 0) ∈ Z, and that the set \( \left({\sum}_{i\in {N}_c}{X}_i\right)\cap \left\{{\sum}_{j\in {N}_s}{y}_j:\left({y}_1,\dots, {y}_m\right)\in Y\right\} \) has a non-empty interior. Importantly, we allow the sets Y and Z to be non-convex. In this context, a feasible allocation is defined as a vector (x, y, z, t) satisfying

where x ∈ X, y ∈ Y, (z, t) ∈ Z. Equations (1) and (2) are commodity balance constraints. When the k-th good is an output and a consumer good, yjk ≥ 0 is the quantity produced by the j-th producer, tjik ≥ 0 is the quantity traded from the j-th agent to the i-th agent, and (1) implies that the j-th producer cannot sell more than its production yjk net of resources used in coordination and exchange zjk, j ∈ Ns. And when the k-th commodity is an input, then yjk ≤ 0 where ∣yjk∣ is the input quantity used by the j-th producer, tjik ≤ 0 where ∣tjik∣ is the quantity traded from the j-th agent to the i-th agent, and (1) implies that ∣yjk ∣ ≤ ∑i ∈ N|tjik| − zjk, j ∈ Ns, meaning that the use of the k-th input by the j-th producer ∣yjk∣ cannot exceed its availability from exchange (∑i ∈ N| tjik| ) net of zjk..

Similarly, when the k-th commodity is a consumer good, we have xik ≥ 0, and (2) implies that the i-th consumer cannot consume more than what it can acquire (∑j ∈ Ntjik) net of zi, i ∈ Nc. And when the k-th commodity is a “consumer bad” (e.g., pollution), let xik ≤ 0 where ∣xik∣ is the quantity of the k-th bad facing the i-th consumer, and let tijk ≤ 0 where ∣tijk∣ is the quantity of the k-th bad exchanged from the i-th agent to the j-th agent, i ∈ Nc. This shows that a feasible allocation in (1, 2) applies under general conditions, including situations of externalities between producers and consumers where production/trade activities have adverse effects on consumer welfare.

Finally, note that the analysis can include dynamics and uncertainty. Following Debreu [7] and using a state-contingent approach, each decision can be defined to be specific to a given time period and a given state of nature representing uncertainty (e.g., weather conditions). The feasible sets X, Y, and Z would then reflect the information available to each of the n agents. In this case, externalities may arise when information and learning involve social networks [28].

Our analysis focuses on efficient allocations, relying on the classical Pareto efficiency criterion: a feasible allocation (x∗, y∗, z∗, t∗) is Pareto efficient if there is no other feasible allocation (x, y, z, t) that can make one individual better off without making anyone else worse off.

Our analysis of Pareto efficiency relies on a benefit function. Consider the commodity bundle \( g=\left(0,\dots, 0,1\right)\in {\mathbb{R}}_{+}^m \) where the m-th commodity is “money” treated as a private good that that can be exchanged costlessly among the n individuals. We assume that consumer preferences are non-satiated in the m-th good (money). Following Luenberger [29], using g as a reference bundle, define the aggregate benefit function as

if there is a feasible \( \upbeta =\left({\upbeta}_1,\dots, {\upbeta_n}_c\right) \),

= − ∞ otherwise,

where \( U=\left({U}_1,\dots, {U_n}_c\right) \). The benefit function B(x, U) in (3) gives the largest amount of the bundle g that consumers facing utilities U are willing to give up to reach consumption x. The function B(x, U) in (3) provides a general measure of aggregate consumer benefits under consumption externalities.Footnote 6 When \( g=\left(0,\dots, 0,1\right)\in {\mathbb{R}}_{+}^m \) with the m-th commodity being money, we set the unit price of the bundle g to be 1, meaning that our welfare measurements involve monetary evaluations. Yet, the analysis allows for production and consumption externalities with respect to the first (m − 1) goods. And it allows for transaction costs to arise when exchange in the first (m − 1) commodities takes place.

Next, define a maximal allocation as an allocation (x, y, z, t) solving the following maximization problem

And (x, y, z, t) is said to be zero maximal if, in addition, U is chosen in (3) such that V(U) = 0. The following result was obtained by Luenberger [29, 30] and Chavas [18].

Proposition 1:

A Pareto efficient allocation is equivalent to a zero-maximal allocation given in (3) with \( U=\left({U}_1,\dots, {U_n}_c\right) \) being chosen such that V(U) = 0.

Proposition 1 holds in the presence of externalities, non-convexity, and transaction costs. It means that the investigation of Pareto efficiency under externalities can be based on the analysis of zero-maximal allocations. The function V(U) in (3) has an intuitive interpretation: it is the distributable surplus that maximizes aggregate benefit [29, 32]. From (3), a maximal allocation makes aggregate benefit as large as possible. And zero-maximality means that this surplus must be entirely redistributed to consumers. In this context, Proposition 1 states that Pareto efficiency involves the maximization of aggregate benefit and then its complete redistribution.

In addition, the zero-maximality condition V(U) = 0 is an implicit equation for \( U=\left({U}_1,\dots, {U_n}_c\right) \) that characterizes the Pareto utilityfrontier. Noting that V(U) is non-increasing in U, the set of U that satisfies V(U) ≥ 0 defines the space of reachable utility levels, and {U : V(U) = 0} identifies the upper bound of this space as the Pareto utility frontier. In this case, moving along the Pareto utility frontier corresponds to efficient allocations associated with different welfare distributions among consumers. These results establish the characterization of efficiency under externalities, transaction costs, and non-convexity under general conditions.

By identifying the efficient quantities produced, consumed, and traded, Proposition 1 can be used in the evaluation of contracts and government regulations in the presence of externalities. When externalities are evenly distributed, Proposition 1 is consistent with government regulations imposing uniform standards over space. But efficient contracts/standards would change depending on the nature and extent of the externalities. For example, efficient standards would vary across space when the externalities are spatially distributed. In this situation, efficient regulation would require information on the spatial nature of the externalities. In addition, non-convexity can provide incentives to concentrate external effects in a small area, in which case spatially uniform standards would be inefficient [33].

Efficient Pricing under Externalities

We now examine the role of markets and pricing in controlling externalities. Studying the linkages between efficiency and market allocations is not new (e.g., [34, 35]). Here, we follow Chavas [18] to explore the economics of efficiency and pricing in the presence of externalities under general conditions (including non-convexity (from P2) and transaction costs (from P5)).

Let F be the set of continuous and non-decreasing functions f from ℝm to ℝ that satisfy the translation property: f(y + α g) = α + f(y) for any y ∈ ℝm and any α ∈ ℝ. Consider the generalized Lagrangian functional L:

where \( f=\left({f}_1,\dots, {f_n}_s\right)\in {F}_s=F\times \dots \times F \) and \( h=\left({h}_1,\dots, {h_n}_c\right)\in {F}_c=F\times \dots \times F \) are “penalty functions” associated with constraints (1) and (2), respectively. Given g = (0, …0, 1), the m-th commodity is used as a numeraire good. When the unit price of g is normalized to be equal to 1, then fi and hi can be interpreted as monetary values of goods associated with the i-th agent, i ∈ N. In this context, we interpret the functions f and h as reflecting pricing schemes. Note the Lagrangian in (4) is “generalized” in the sense that it allows the functions (f, h) to be nonlinear. This is an extension of the standard Lagrangian approach applied under convexity where the penalty functions (f, h) are taken to be linear, their slopes being Lagrange multipliers measuring the shadow prices of constraints (e.g., [36, 37]). As illustrated in Fig. 4, the presence of non-convexity requires us to consider nonlinear penalty functions (and nonlinear pricing as discussed below).

For a given U, consider the case where the generalized Lagrangian in (4) has a saddle-point (x∗, y∗, z∗, t∗, f∗, h∗) ∈ [X × Y × Z × Fs × Fc] that satisfies

for any x ∈ X, y ∈ Y, (z, t) ∈ Z, f ∈ Fs, h ∈ Fc.Footnote 7 The first inequality in (6) implies the maximization of the Lagrangian with respect to (x,y, z, t) and the second inequality implies its minimization with respect to (f, h). In addition, we have L(x∗, y∗, z∗, t∗, f∗, h∗, U) = V(U), implying that the Lagrangian approach in (6) provides a dual formulation to the maximization of aggregate benefit given in (4). The Lagrangian approach also gives the efficient pricing scheme (f∗, h∗). Chavas [18] obtained the following result.

Proposition 2:

A Pareto efficient allocation satisfies

with \( U=\left({U}_1,\dots, {U_n}_c\right) \) being chosen such that V(U) = 0.

Proposition 2 gives a dual representation of Pareto efficiency under externalities, allowing for externalities, non-convexity, and transaction costs. It provides useful information on the role of markets in the efficient management of externalities. We interpret the function fj as measuring the value of goods associated with the j-th producer, j ∈ Ns, and the function hi as measuring the value of goods associated with the i-th consumer, i ∈ Nc. This interpretation applies to market institutions as well as nonmarket institutions (in which case the functions f’s and h’s represent valuations associated with implicit markets; see Rosen [39] and Ekeland et al. [40]).

Equations (7, 8, and 9) follow from the first inequality in (6), while Eq. (10) follows from the second inequality in (6). Equation (7) states that, conditional on U and the pricing scheme h, consumption x is chosen to minimize aggregate consumer expenditure, \( {\sum}_{i\in {N}_c}{h}_i\left({x}_i\right) \). Equations (8, 9) are profit maximizing conditions. In Eq. (8), \( {\sum}_{j\in {N}_s}{f}_j\left({y}_j\right) \) is the aggregate value from all production activities and πs(f) is the largest possible aggregate profit given the pricing scheme f. In Eq. (9), \( \Big\{{\sum}_{i\in {N}_c}{h}_i\left({\sum}_{j\in N}{t}_{ji}\hbox{--} {z}_i\right) \)\( \hbox{--} {\sum}_{j\in {N}_s}{f}_j\left({\sum}_{i\in N}{t}_{ji}+{z}_j\right)\Big\} \) is the aggregate value from coordination and exchange activities, and πT(f, h) is the largest possible profit from trade, conditional on f and h. Equation (10) establishes linkages between aggregate profit, πs(f) + πT(f, h), net of aggregate expenditure, E(h, U). Note that the function V(U) in (10) is the same as the distributable surplus V(U) defined in (3), making it clear that V(U) is a welfare measure with a monetary interpretation. Then, Eq. (10) states that the distributable surplus V(U) is obtained by choosing the pricing functions f and h that minimize aggregate profit minus aggregate expenditure. Finally, choosing U such that V(U) = 0 means that, under Pareto efficiency, the distributable surplus V(U) is entirely redistributed.

Denote the solution to Eq. (10) by (f∗, h∗). From proposition 2, given the aggregate expenditure function E(h, U) in (7) and the aggregate profit functions πs(f) in (8) and πT(f, h) in (9), Eq. (10) defines the pricing scheme (f∗, h∗) that yields the distributable surplus V(U). Then, choosing U such that V(U) = 0 in (10) implies that πs(f∗) + πT(f∗, h∗) − E(h∗, U) = 0. This corresponds to an aggregate budget constraint where aggregate consumer expenditure E(h∗, U) equals aggregate profit πs(f∗) + πT(f∗, h∗). This provides a basis supporting the measures commonly used in national accounts: the total value of goods and services can be measured equivalently from the production side πs(f∗) + πT(f∗, h∗), or from the consumption side E(h∗, U). And with {U : V(U) = 0} defining the Pareto utility frontier, moving along this utility frontier corresponds to efficient allocations associated with different distributions of income among consumers. Recall that our analysis covers general consumer preferences and allows for income effects. In the presence of income effects, it means that efficient allocations would change along the Pareto utility frontier (as production, consumption, trade, and monetary values would typically change under different income redistributions).

Proposition 2 generalizes the Coase theorem [6]. Indeed, Proposition 2 and expression (8) imply that aggregate profit maximization is consistent with Pareto efficiency. This is the essence of the Coase theorem [6], making it clear that aggregate profit maximization is at the heart of Pareto efficiency, with or without externalities. It indicates that a failure to maximize aggregate profit would be inconsistent with efficiency. But the analysis in Coase [6] was presented assuming no transaction costs. As argued in Chavas [18], aggregate profit maximization remains a valid characterization of the efficient management of externalities under two important generalizations: (1) under transactions costs; and (2) in the presence of non-convexity in production and exchange activities. These are important generalizations of the Coase theorem. They stress the generality of the arguments presented by Coase [6] and their importance leading him to win the Nobel Prize in 1991.

Another important result is given in Eq. (9): aggregate profit maximization for exchange activities is also consistent with Pareto efficiency. This is an insight that was explored in Coase [19] but not in Coase [6]. Thus, Proposition 2 provides a nice integration of Coase’s two seminal papers. First, the consistency between aggregate profit maximization and Pareto efficiency applies to production as well as coordination/exchange activities. Importantly, this result holds in the presence of externalities in consumption and coordination/exchange activities and under non-convex technology. Second, as stressed in [19], assessing the relative efficiency of markets versus nonmarket institutions requires evaluating the role of transaction costs. As argued in Chavas [18], this is a “missing piece of the puzzle” in Coase [6]. Identifying which institutions can manage externalities efficiently depends on their associated transaction costs. The efficient management of externalities is associated with the institutions that maximize aggregate profit, including both aggregate profit from production activities (as stated in (8)) and aggregate profit from coordination/exchange activities (as stated in (9)). The profit maximization condition in (9) implies the minimization of transaction costs. In other words, efficient institutions are the ones that maximize aggregate profit (as discussed in Coase [6]) as well as minimize transaction costs (as stressed in Coase [19]).

It is sometimes argued that the Coase analysis implies that the efficient management of externalities is independent of the assignment of property rights [41]. In general, this argument is false. Indeed, reassigning property rights typically affects the distribution of income. In the presence of income effects, this would affect consumption decisions and thus resource allocation [42]. Thus, given the empirical prevalence of income effects, it is incorrect to assert that the efficient management of externalities is independent of property rights. Note that this argument holds under very general conditions: it applies with or without transaction cost; and it applies in the presence of non-convexity. In other words, it is inappropriate to argue that the assignment of property rights is irrelevant in the efficiency evaluation of externalities.

While Eqs. (7, 8) state that aggregate profit maximization is consistent with Pareto efficiency, what does it say about decentralized decision making? In general, in the presence of externalities among firms, production and exchange activities cannot be fully decentralized. Indeed, production externalities would make firm-level profit maximization inefficient. As illustrated in Fig. 3, efficiency requires that external effects among producers be explicitly taken into consideration. Similarly, under coordination/exchange externalities (e.g., due to social learning), firm-level profit maximization applied to trading firms would be inefficient (by failing to consider external effects among traders). In such cases, some coordination schemes are needed among the agents facing externalities.

How does Proposition 2 relate to the standard welfare theorems establishing close linkages between Pareto efficiency and markets (e.g. [43])? As illustrated in Fig. 2, externalities do not always lead to non-convexity. Under convexity, the analysis of efficiency is simpler. In this case, the separating hyperplane theorem applies, meaning that there exists a hyperplane separating the feasible set from the efficient consumption set [37], the slope of the hyperplane measuring prices supporting an efficient allocation. Then, the functions f and h in (7)–(10) can be taken to be linear: fj(yj) = psi yj, j ∈ Ns, and hi(xi) = pci xi, i ∈ Nc, where the p′s are prices reflecting the social value of the commodities.Footnote 8 In Fig. 2, the separating hyperplane is given by the line (F E1 F′). The slope of the hyperplane is equal to (−p2/p1), where (p1, p2) being the social prices supporting an efficient allocation. But as discussed in Sect. 2, under decentralized decisions, neglecting the externalities would affect supply/demand decisions, leading to inefficiency as observed prices \( \left({p}_1^{\prime },{p_2}^{\prime}\right) \) differ from efficient prices (p1, p2) (as illustrated in Fig. 3). Under this scenario, inefficiency can be restored by government intervention imposing Pigouvian taxes/subsidies reflecting the social cost of the externalities.

As argued by Starrett [9] and Baumol and Bradford [10], externalities can lead to non-convexity. This is the scenario illustrated in Fig. 4, where negative externalities are large enough to make the feasible set non-convex. The investigation of non-convexity is not new (e.g., [13,14,15,16,17]). It is well known that introducing non-convexity for Y or Z can invalidate the standard welfare theorems. The reason is that, under non-convexity, the separating hyperplane theorem no longer holds and cannot be used to identify efficient prices. This is illustrated in Fig. 4 where the linear pricing line (F E2 F′) fails to support the efficient allocation E2 (as it would provide incentives to produce at the inefficient point C). But as discussed in Sect. 2, the nonlinear pricing line (G E2 G’) would support the efficient allocation E2. This pricing line corresponds to a hypersurface separating the feasible set from the efficient consumption set. Again, the slope of this separating hypersurface provides information about prices. The separating hypersurface being nonlinear implies nonlinear pricing.Footnote 9 This is a scenario where the pricings schemes (f, h) in (7)–(10) must be nonlinear. Interestingly, Eq. (7) still associates efficiency with aggregate expenditure minimization. And Eqs. (8, 9) associate efficiency with aggregate profit maximization. Thus, the problem created by non-convexity does not come from aggregate profit maximization (which continues to hold under efficiency). The problem comes from uniform pricing. Under non-convexity, efficiency can be attained by moving away from uniform pricing and implementing a nonlinear pricing scheme [13]. In Fig. 4, this involves moving from the uniform price line (F E2 F′) to the nonlinear pricing line (G E2 G’). This argument applies to externality-driven non-convexity of the production set Y. But it also applies to possible non-convexity in the feasible set Z. For example, externalities among traders could also generate non-convexity in Z. Again, such non-convexity invalidates the separating hyperplane theorem, implying that uniform prices may fail to support an efficient allocation and require nonlinear pricing schemes f∗ and h∗ as identified in (10).

This stresses the importance of nonlinear pricing in efficiency analysis under non-convexity. When externalities generate non-convexity, this implies that economists and policy makers should not insist on uniform pricing in the efficiency evaluation of externalities. Indeed, nonlinear pricing may be required to implement an efficient allocation in the presence of externalities. As noted by Wilson [44], nonlinear pricing schemes are commonly observed in many markets. The challenges of implementing nonlinear pricing in support of efficiency are discussed below.

Finally, while the efficient pricing schemes (f∗, h∗) were identified in (10), one issue remains: how to discover and implement such pricing schemes? Under nonmarket institutions (e.g., contracts), these pricing schemes need not be explicit: they would be shadow prices in implicit markets supporting an efficient allocation [39, 40]. Alternatively, under market institutions, the pricing schemes (f∗, h∗) are an explicit part of a market economy. Under linear pricing (where fj(yj) = psi yj, j ∈ Ns, and hi(xi) = pci xi, i ∈ Nc), the prices \( {p}_{si}^{\ast } \) and \( {p}_{ci}^{\ast } \) are easy to identify and implement: they are the market-clearing prices that satisfy the commodity balance Eqs. (1 and 2), respectively. As illustrated in Fig. 2, linear pricing can always support an efficient allocation under convexity, and identifying efficient schemes reduces to finding the “right prices”. In competitive market prices in the absence of externalities, the market clearing prices correspond to Adam Smith’s “invisible hand.” In the presence of externalities, this can involve Pigouvian taxes that make market prices equal to social prices [1, 3, 5].

But non-convexity and nonlinear pricing make economic evaluations more complex. In this case, the nonlinear pricing schemes (f∗, h∗) have two roles to play: they clear the markets; and they provide the proper incentives to implement an efficient allocation. This second role arises as a separate function only under non-convexity. This raises the question: In situations where the role of pricing goes beyond just “clearing the markets,” who choose the nonlinear pricing schemes (f∗, h∗)? In this case, the pricing strategy is chosen by the managers in charge of marketing and/or the policy makers in charge of pricing policy. These are scenarios where implementing an efficient allocation requires a “visible hand” as pricing decisions are made by managers and/or policy makers. Such pricing decisions require the use of information and managerial skills that are typically not costless. This implies that, under non-convexity and nonlinear pricing, transaction costs would be relevant in the evaluation of pricing schemes supporting efficient allocations. In such situations, transaction costs would play a role in the efficient management of externalities under markets as well as nonmarket institutions. These issues are further discussed in the next section.

Efficient Policies

The analysis presented in the previous section provides two approaches to the characterization of Pareto efficiency in the presence of externalities: Proposition 1 identifies efficient production, consumption, and trade; Proposition 2 relies on a dual generalized Lagrangian approach that also evaluates the role of pricing. From a policy viewpoint, can we use these two Propositions to recommend whether externalities should be managed through market-based mechanisms (e.g., as opposed to regulations)? The answer to this question is: No. Indeed, Propositions 1 and 2 provide alternative representations of the same efficient allocations. This means that Proposition 1 does not imply that regulation is a preferred solution to an externality problem. Similarly, Proposition 2 does not imply that market-based mechanisms provide superior means of controlling externalities.

How can economists assist policy makers in choosing policies supporting efficient allocations in the presence of externalities? Typically, tradeoffs exist between regulatory approaches versus market-based approaches to externality control. If Propositions 1 and 2 do not assist in evaluating these tradeoffs, economists may make recommendations on ideological grounds (e.g., market-loving economists argue in favor of market-based solutions, while government-loving economists argue in favor of regulations). This is not desirable: ideological arguments do not help identify the tradeoffs between alternative policy options. Yet, economists can make constructive contributions to the policy-making process by focusing attention on the role of transaction costs.

As first argued by Coase [19], transaction costs play a fundamental role as they affect the limits of organizations and firms and the functioning of markets (e.g., [20,21,22,23,24]). Such arguments also apply to institutions affecting the management and control of externalities [24, 45]. Two issues have the subject of special attention (e.g., [4]). First, when externalities can be reduced through technological innovations, any policy response to externalities needs to provide proper incentives to support innovations. Second, information is typically costly and is an important part of transaction costs. Access to information is crucial in the design and implementation of efficient allocations (e.g., [46, 47]). Without good information, any management or policy would fail to assess the nature and extent of externalities. This is a scenario where poorly informed decision-makers would fail to provide efficient management of externalities. This argument is often presented against government regulations: poorly informed regulators would fail to develop and implement efficient policies dealing with externalities. This is a likely scenario when externalities vary across space and obtaining information about local externalities is difficult (e.g., [48]). But poor information is not specific to regulators. For example, when externalities are global and there are economies of scale in obtaining information about externalities, private agents may be less informed than policy makers about the exact nature of externalities.

In general, obtaining information about externalities or new technologies is costly. The cost and utilization of this information typically vary across policy options. Higher information cost would contribute to a downward shift in the Pareto utility frontier, indicating that economic efficiency would improve under institutions that have lower information costs and a better access to information. This argument applies across institutions, including markets, contracts, and regulation. Shleifer [24] has argued that the prevalence of regulations in market economies can be explained in part by the failure of courts and their (in)effectiveness in settling contract disputes. This raises the question of identifying the institution(s) that can obtain good information and use it to implement an efficient control of externalities.

Our analysis has examined the role of pricing. Figure 2 indicates that externalities do not always generate non-convexity, in which case linear pricing and Pigouvian taxes/subsidies are appropriate. But Fig. 4 shows that externalities can generate non-convexity that requires nonlinear pricing. More generally, externalities are not the only possible source of non-convexity. Another source of non-convexity involves the presence of fixed cost. It is well known that fixed cost can make competitive markets inefficient (e.g., [12, 14, 28]). For example, under fixed cost and increasing returns to scale, marginal cost pricing is inefficient: marginal cost would be lower than average cost and competitive firms would exit (as marginal cost pricing would generate negative firm profit, revenue being insufficient to cover the fixed cost). Yet, nonlinear pricing can support an efficient allocation (when many consumers buy at marginal cost, but some consumers pay a higher price that allows firms to cover their fixed cost). For this reason, some industries have moved in the direction of using nonlinear pricing (e.g., [44]). An interesting example is the case of block pricing for electricity (e.g., [49,50,51,52]). The electricity industry has three important characteristics: (1) electricity-generating power plants have large fixed cost (thus exhibiting non-convexity); (2) the demand for electricity varies over time (e.g., peak demand occurring during heat wave); and (3) fuel-based power plants pollute the air (thus generating negative externalities). One may think about implementing a Pigouvian tax to cover the social cost of the externality. But in this case, a uniform Pigouvian tax is not efficient: a “high uniform price” would be needed to cover the fixed cost of building an additional power plant to supply electricity during peak periods. The inefficiency comes from two sources: the “high” electricity price would have negative impacts on the welfare of most consumers; and when active, the additional power plant would increase pollution. With fixed cost creating non-convexity, the efficient nonlinear pricing would involve many consumers paying the (lower) marginal social cost of electricity (including the cost of pollution), while some consumers pay higher prices inducing a reduction in their electricity consumption during peak periods. In this case, the higher price paid by some consumers would play two roles: (1) covering the fixed cost of power plant, thus making the pricing scheme sustainable; and (2) reducing the demand for electricity during peak periods. This last effect creates a double dividend: it saves on the cost of building an additional power plant; and it reduces pollution during peak periods. In this case, uniform Pigou taxes would be inefficient. But while nonlinear pricing can be efficient, it also has distributional effects [49]. And to achieve efficiency, nonlinear pricing faces the difficulties of identifying the price-responsive consumers who are going to pay higher prices as well as the nature and timing of the price discrimination scheme [50]. Addressing these difficulties requires more information (compared to uniform pricing) and creates significant challenges for designing and implementing market-based policies that can achieve efficiency.

Previous environmental policies can shed useful lights on the relative effectiveness of alternative policy options to externality control. Experiences have varied greatly depending on the nature and extent of the externality [53]. For illustration purpose, we consider three examples. First, the depletion of the stratospheric ozone layer and its link with pollution were identified in the 1970s. This generated a strong regulatory response leading to the 1987 Montreal Protocol and the international banning of ozone-depleting chemicals [54, 55]. Evidence indicates that this strong policy response was effective: healing of the Antarctic ozone layer is in progress [56]. Second, acid rain was another environmental issue identified as an effect of sulfur dioxide (SO2) emission from US coal-fired power plants. This is a situation where externalities vary across space (as some power plants pollute more than others). The US policy response was a “cap and trade” acid rain program enacted under the 1990 Clean Air Act [57, 58]. The program consisted in the government setting maximum emission allowances for US electric power plants while permitting a market exchange for allowances among plants. The program has been credited as a great success: it drastically reduced SO2 emissions from US coal-fired power plants and it did so at a lower cost than a comparable command-and-control regulation [59]. The US acid rain program illustrates how market-based policies can provide a flexible and cost-effective way of reducing pollution.

Our last example involves climate change. Nordhaus [60] identifies climate change and its linkages with greenhouse gases (GHG) emission as the “ultimate challenge” for economics. (Nordhaus received the Nobel Prize in economics in 2018 for his research on climate change.) The production of GHG from human activities (mostly carbon dioxide CO2 generated from burning fossil fuels) contributes to increasing atmospheric temperature on earth with significant long-term effects on global climate [61]. Attempts to reduce GHG emission has led to the 1997 Kyoto Protocol and the 2015 Paris Agreement. The debate has focused on evaluating the social cost of carbon and on considering the imposition of Pigouvian taxes on GHG emission. At this point, there are some disagreements. On the policy side, the United States withdrew from the Paris agreement in 2017. On the economic side, uncertainties related to climate dynamics and economic valuations have made it difficult for economists and policy makers to agree on precise estimates of the social price of carbon [60], thus lessening the political support in favor of a Pigouvian tax on GHG. Finally, there is some concern that a carbon tax may not be an effective way of dealing with GHG externalities (e.g., [62]). Patt and Lilliestam [62] argue that the most effective response to climate change issues will be technological, implying that current policies should be supporting technological innovations that reduce our reliance on fossil fuels. Patt and Lilliestam [62] contend that a carbon tax alone would not be enough to move the world economy away from fossil fuels toward low-carbon technologies.

These examples illustrate the complexities of designing and implementing efficient policies dealing with externalities. In general, the nature and magnitude of externalities matter. So does the information available on their effects. In the context of pollution, the presence (or absence) of close substitutes to the pollutants or to the polluting technology plays a role. Finally, policy making always depends on the bargaining ability of different interest groups to deal with each other. This argument applies at the local level, national level, and international level (e.g., [53]). This stresses the importance of the political economy of externalities.

Conclusion

This chapter has investigated the efficiency of resource allocation in the presence of externalities. The analysis applies to markets as well as nonmarket institutions (including contracts and government). We argue that externalities can lead to non-convexity and the need for nonlinear pricing. In this context, while simple Pigouvian taxes/subsidies can help, they are inappropriate when uniform pricing is inefficient. We also examine the effects of transaction costs on efficient allocations and coordination/exchange activities. Reducing transaction costs is an integral part of the efficiency of resource allocation. This argument applies to contracts, regulations as well as market-based policies and their relative abilities to control externalities. The analysis provides useful insights into the efficiency of alternative governance structures dealing with externalities.

Notes

- 1.

- 2.

As discussed below, government intervention can still be helpful to achieve efficiency through quantity regulations and/or through nonlinear pricing policies.

- 3.

- 4.

Note that equity considerations (not addressed in this chapter) can also play a role in evaluating alternative externality management strategies.

- 5.

In this context, when comparing government pricing policies versus government standards/quotas, economists often follow Pigou [5] and argue in favor of pricing policies on the ground that they are easier to implement and require less information (especially in the presence of heterogeneous agents). These issues are further discussed in Sect. 4.

- 6.

- 7.

- 8.

- 9.

References

Baumol WJ, Oates WE (1988) The theory of environmental policy, 2nd edn. Cambridge University Press, Cambridge

Laffont JJ (2008) Externalities. In: Durlauf S, Blume LE (eds) The new Palgrave dictionary of economics, 2nd edn. Palgrave Macmillan, London

Baumol WJ (1972) On taxation and the control of externalities. Am Econ Rev 62:307–322

Cornes R, Sandler T (1996) The theory of externalities, public goods and club goods. Cambridge University Press, Cambridge

Pigou AC (1920) The economics of welfare. Macmillan, London

Coase RH (1960) The problem of social cost. J Law Econ 3:1–44

Debreu G (1959) Theory of value. Wiley, New York

Arrow K (1969) The organization of economic activity: issues pertinent to the choice of market versus non-market allocation. In: The analysis and evaluation of public expenditures: the PPB system. Government Printing Office, Washington, DC

Starrett D (1972) Fundamental non-convexities in the theory of externalities. J Econ Theory 4:180–199

Baumol WJ, Bradford DF (1972) Detrimental externalities and non-convexity of the production set. Economica 39:160–176

Dasgupta P, Maler KG (2003) The economics of non-convex ecosystems: introduction. Environ Resour Econ 26:499–525

Brown DJ (1991) Equilibrium analysis with non-convex technologies. In: Hildenbrand W, Sonnenschein H (eds) Handbook of mathematical economics, vol 4. Elsevier, Amsterdam

Chavas JP, Briec W (2012) On efficiency under non-convexity. Econom Theor 50:671–701

Guesnerie R (1975) Pareto optimality in non-convex economies. Econometrica 43:1–29

Khan MA (1999) The Mordukhovich normal cone and the foundations of welfare economic. J Public Econom Theor 1:309–338

Khan MA, Vohra R (1987) An extension of the second welfare theorem to economies with nonconvexities and public goods. Q J Econ 102:223–242

Mordukhovich BS (2005) Nonlinear prices in nonconvex economies with classical pareto and strong Pareto optimal allocations. Positivity 9:541–568

Chavas JP (2015) Coase revisited: economic efficiency under externalities, transaction costs and non-convexity. J Inst Theor Econ 171:709–734

Coase RH (1937) The nature of the firm. Economica 4:386–405

Foley DK (1970) Economic equilibrium with costly marketing. J Econ Theory 2:276–291

Hahn FH (1971) Equilibrium with transaction costs. Econometrica 39:417–439

Williamson OE (1989) Transaction cost economics. In: Handbook of industrial organization, vol 1. North Holland, Amsterdam

Williamson OE, Winter SG (eds) (1991) The nature of the firm, origins, evolution, and development. Oxford University Press, Oxford

Shleifer A (2010) Efficient regulation. Working paper no. 15651, National Bureau of Economic Research, Cambridge, MA

Stavins RN (1995) Transaction costs and tradeable permits. J Environ Econ Manag 29:133–148

Varian HR (1994) A solution to the problem of externalities when agents are well-informed. Am Econ Rev 84(1994):1278–1293

Coase RH (1992) The institutional structure of production. Am Econ Rev 82:713–719

Radner R (1968) Competitive equilibrium under uncertainty. Econometrica 36:31–58

Luenberger DG (1995) Externalities and benefits. J Math Econ 24:159–177

Luenberger DG (1992a) New optimality principles for economic efficiency and equilibrium. J Optim Theory Appl 75:221–264

Luenberger DG (1992b) Benefit functions and duality. J Math Econ 21:461–481

Allais M (1981) La Théorie Générale des Surplus. Economies et Sociétés Institut des Sciences Mathématiques et Economiques Appliquées, Paris

Helfand GE, Rubin J (1994) Spreading versus concentrating damages: environmental policy in the presence of nonconvexities. J Environ Econ Manag 27:84–91

Dixit AK, Norman V (1980) Theory of international trade: a dual general equilibrium approach. Cambridge University Press, London

Luenberger DG (1994) Dual Pareto efficiency. J Econ Theory 62:70–85

Bertsekas DP (1995) Nonlinear programming. Athena Scientific, Belmont

Takayama A (1985) Mathematical economics, 2nd edn. Cambridge University Press, Cambridge

Gould FJ (1969) Extensions of Lagrangian multipliers in nonlinear programming. SIAM J Appl Math 17:1280–1297

Rosen S (1974) Hedonic prices and implicit markets: product differentiation in pure competition. J Polit Econ 82:34–55

Ekeland I, Heckman JJ, Nesheim L (2004) Identification and estimation of hedonic models. J Polit Econ 112:S60–S109

Stigler GJ (1989) Two notes on the Coase theorem. Yale Law J 99(3):631–633

Hurwicz L (1999) Revisiting externalities. J Public Econom Theor 1(2):225–245

Mas-Colell A, Whinston MD, Green J (1995) Microeconomic theory. New York, Oxford university press

Wilson RB (1993) Nonlinear pricing. Oxford University Press, Oxford

Papandreou AA (2003) Externalities, convexity and institutions. Econ Philos 19:281–309

Salanié B (1999) The economics of contracts. The MIT Press, Cambridge, MA

Tirole J (1999) Incomplete contracts: where do we stand? Econometrica 67:741–781

Fabrizio KR, Rose NL, Wolfram CD (2007) “Do markets reduce costs”? Assessing the impact of regulatory restructuring on US electric generation efficiency. Am Econ Rev 97(4):1250–1277

Borenstein S (2012) The redistributional impact of nonlinear electricity pricing. Am Econom Rev Econom Policy 4(3):56–90

Borenstein S, Bushnell JB (2018) Do two electric pricing wrongs make a right? Cost recovery, externalities and efficiency. Working paper 24756, National bureau of economic research, Cambridge, MA

Dutta G, Mitra K (2017) A literature review on dynamic pricing of electricity. J Oper Res Soc 68:1131–1145

Joskow PL, Wolfram CD (2012) Dynamic pricing of electricity. Am Econ Rev 102(3):381–385

Sandler T (2017) Environmental cooperation: contrasting international environmental agreements. Oxford Econ Pap 69(2):345–364

Haas PM (1991) Policy responses to stratospheric ozone depletion. Glob Atmos Change 1(3):224–234

Morrisette PM (1989) The evolution of policy responses to stratospheric ozone depletion. Nat Resour J 29(3):794–820

Solomon S, Ivy DJ, Kinnison D, Mills MJ, Neely RR III, Schmidt A (2016) Emergence of healing in the Antarctic ozone layer. Science 353(6296):269–274

Joskow PL, Schmalensee R (1998) The political economy of market-based environmental policy: the U.S. acid rain program. J Law Econ 41(1):37–84

Stavins RN (1998) What can we learn from the grand policy experiment? Lessons from SO2 allowance trading. J Econom Perspect 12(3):69–88

Chan HR, Chupp BA, Cropper ML, Muller NZ (2018) The impact of trading on the costs and benefits of the acid rain program. J Environ Econ Manag 88:180–209

Nordhaus W (2019) Climate change: the ultimate challenge for economics. Am Econ Rev 109(6):1991–2014

Velders GJM, Andersen SO, Daniel JS, Fahey DW, McFarland M (2007) The importance of the Montreal protocol in protecting climate. Proc Natl Acad Sci 104(12):4814–4819

Patt A, Lilliestam J (2018) The case against carbon prices. Joule 2:2494–2498

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 Springer Nature Singapore Pte Ltd.

About this entry

Cite this entry

Chavas, JP. (2022). Economics of Externalities: An Overview. In: Ray, S.C., Chambers, R.G., Kumbhakar, S.C. (eds) Handbook of Production Economics. Springer, Singapore. https://doi.org/10.1007/978-981-10-3455-8_13

Download citation

DOI: https://doi.org/10.1007/978-981-10-3455-8_13

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-10-3454-1

Online ISBN: 978-981-10-3455-8

eBook Packages: Economics and FinanceReference Module Humanities and Social SciencesReference Module Business, Economics and Social Sciences