‘You either die a hero or live long enough to see yourself become the villain’. This iconic quote from the movie, The Dark Knight, brings to fore how the threat of decline or failings is greater so when a person scales a peak. We have witnessed this across the ages in politics, sports and the corporate world. Of course, as with anything in this world, there are always exceptions. These ‘exceptions’ first become a hero and then live long enough to see themselves become a legend (for the ages ).

Jim Simons — the math wizard and founder of one of the world’s most successful Hedge Funds, Renaissance Technologies LLC, who died on May 10, 2024 — was one such legend. He leaves behind a ‘Don Bradman’-like record and legacy that may be very challenging to beat for generations to come. His flagship fund, Medallion Fund, beat every investment contemporary out there by a wide margin with a staggering performance of 66.1 per cent average annual returns (39.1 per cent net of fees) from 1988 to 2018. It had just one marginally down year in that period.

During the years of the brutal dotcom crash when the Nasdaq composite fell by 80 per cent and S&P 500 by 50 per cent, the Medallion Fund gave returns of 128 per cent in the year 2000, 57 per cent in 2001 and 52 per cent in 2002. Similarly, during the global financial crisis in 2008 when the S&P 500 crashed 38 per cent, the Medallion Fund generated profits of 152 per cent! Staggering annual returns combined with consistency and returns uncorrelated to markets were its hallmark. While some part of this was made possible by Medallion restricting the size of the fund and investing across asset classes across the world, the significant part was entirely due to the secret sauce that Jim Simons developed.

The passing away of Jim Simons is a great loss for the global investment community indeed, all the more so coming as it did within months of the demise of another investing legend, Charlie Munger, who died on November 28, 2023.

One can’t but marvel at how much the two had in common. Both did not start out in life to become investors: Jim Simons was a math professor initially, while Charlie Munger was an attorney. Both launched their investing career only around the age of 40. Both were deeply impacted by personal tragedies at different times in their lives, however, they successfully coped with them by resorting to their passion — mathematics and trading for Jim, while it was a little bit of physics, basic math, breaking down and deeply understanding how the world functions and investing, for Charlie.

So, what exactly was the secret sauce that made them so successful? Again, borrowing a quote from the Batman series, this time from Batman Begins – ‘If you make yourself more than just a man, if you devote yourself to an ideal, and if they can’t stop you, then you become something else entirely – Legend’

How they evolved into legends is well-captured in two excellent books — The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution and Poor Charlie’s Almanack: The Wit and Wisdom of Charles T. Munger

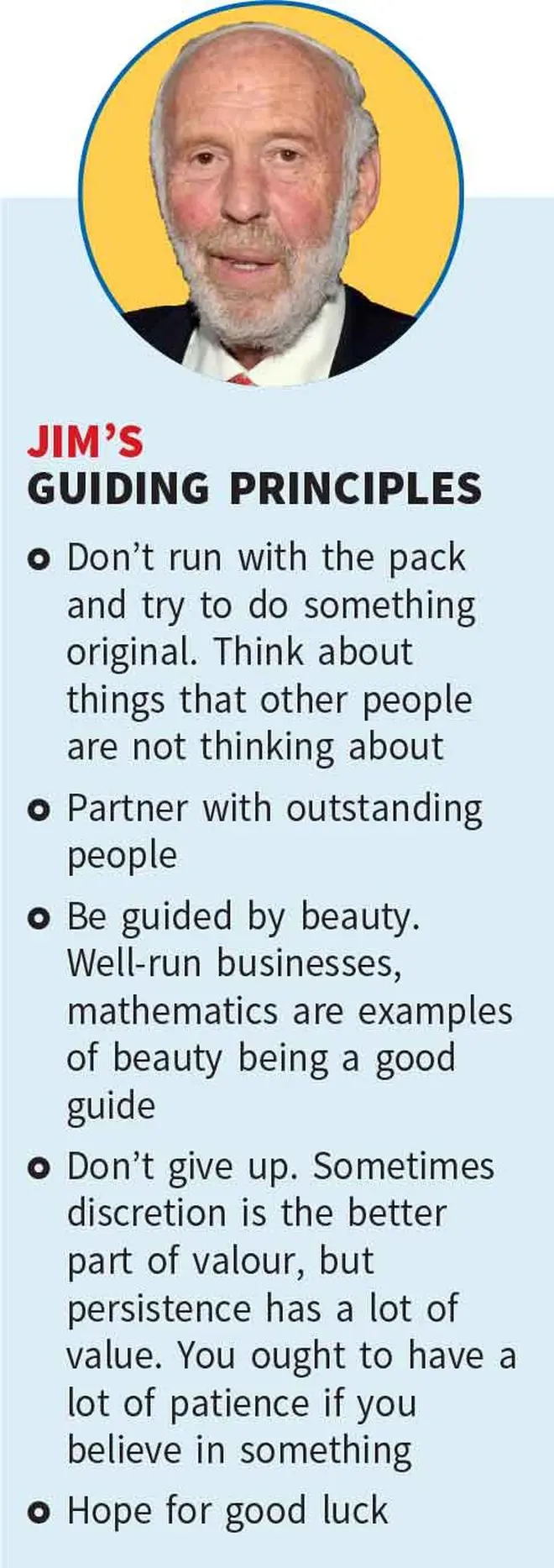

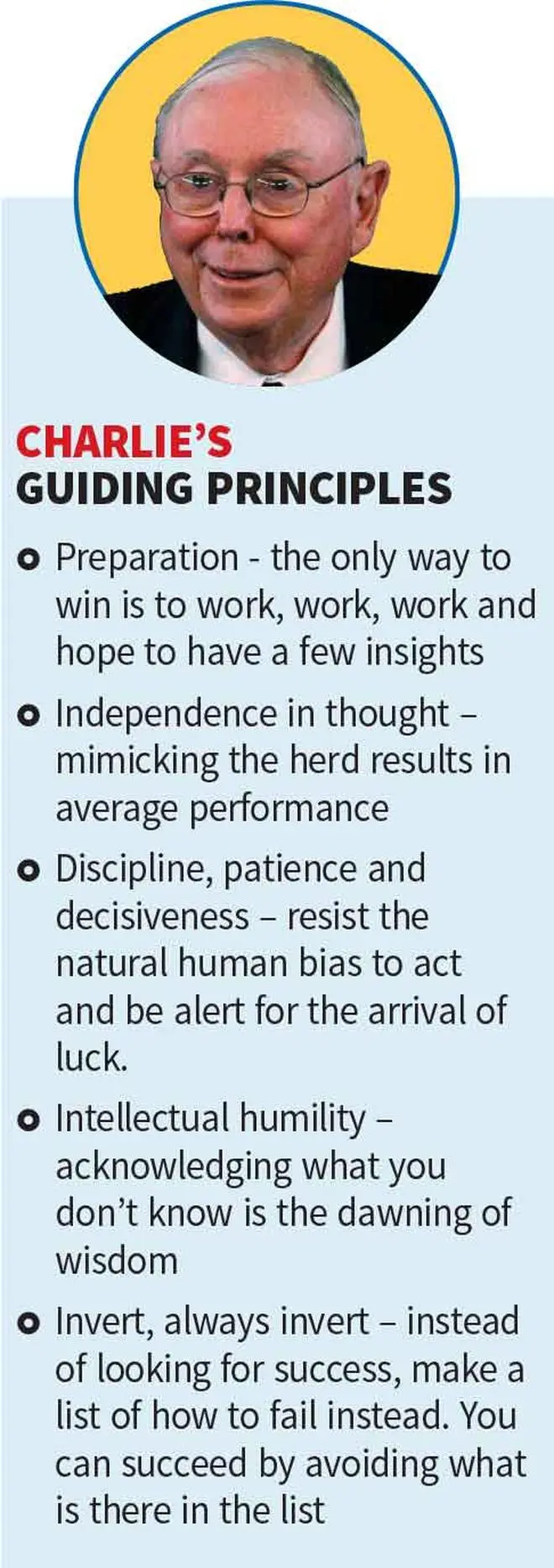

We distil here the basic ingredients of their secret sauce, their guiding principles — which can guide all investing enthusiasts as well in their wealth-creation journey.

.

Partnering with the right people

Jim’s early journey after founding Renaissance Technologies was anything but a cakewalk. Jim was a pioneer in quant investing at a time when much of Wall Street viewed it with distrust, and the crucial aspect to his success early on was in recruiting the right talent with the right skill sets.

His team was filled with PhDs in mathematics from Ivy League schools, many of them his former colleagues when he was a math professor or worked as a code breaker on a government contract. For many of them, their mind was oriented towards intellectual pursuits rather than minting money. As a result, the founding team had to endure a lot of churn and team issues before Renaissance could develop a sustainable successful trading algorithm that could be applied across asset classes. While not everyone who joined early on stayed put, Jim’s partnership with each of them, and the value they added in building a better algorithm, contributed immensely to its success.

In fact, one of the crucial turning points that catapulted Renaissance into growth was when one of the founders of Medallion Fund, Henry Laufer (also a former colleague of Jim when he was a professor) determined that it would be more effective to have a single algorithmic trading model with tweaks for different asset classes, rather than having separate models for each asset class. This enabled Renaissance to pick common trading opportunities across asset classes and also made it more scalable as new asset classes could be added to it when required. The book chronicles many such instances where partnering with right people, and good ideas that germinated from them, contributed to Renaissance’s parabolic growth

So too was the case with Charlie Munger, whose partnership with Warren Buffett laid the foundation for the remarkable success of Berkshire Hathaway.

The key learning here is that if we want to succeed as an investor we too must partner with the right people. These need not be commercial partnerships, but simpler things, such as having a discussion on a stock with an objective person, ensuring that the person giving you stock ideas is unbiased and knowledgeable, duly considering why another person might have contrary views on a stock.

Having the right partner to discuss ideas helps in identifying our blind spots, and in generating sound ideas as well.

Discipline, persistence, patience in sticking to process

While unlike Charlie, Jim was a recluse and gave fewer interviews, in one of his rare talks he mentioned how one rule they diligently stuck to throughout the decades of Renaissance’s journey was to never override the computer. If their view was totally contrary to the trades the computer suggested, they stuck to what the computer suggested however strongly their emotions were in favour of the opposite trade. This worked wonders for them, as the results show.

The only rare instances they intervened was in the case of black swan events, like a few days during the dotcom crash and another time during the ‘Quant Quake’ of August 2007. Even during these times, they refrained from initiating new positions, but rather switched off certain strategies temporarily or reduced positions to lower risk. For example, during the Quant Quake, their losses over a few days was at 20 standard deviations from the average. Statistically, even three standard deviations is rare and extreme. Hence it required the rare intervention in Jim’s view.

Similar to Jim when it comes to sticking to process, but different in the way it was implemented, Charlie had a mental checklist that was well-ingrained in his DNA from years of study, learning and experience. He stuck to what his mental computer suggested after he processed data and vetted it against a checklist. Charlie’s logic is simple – he mixes all the factors, and if in his assessment the gap between valuation and price is not attractive, he moves on to something else. He has never deviated from this process, showing remarkable discipline over decades. He once said, if required he was ready to wait even for a decade to make a good investment.

This raises an important aspect to reflect on. How faithfully have we followed a well-developed pre-determined framework in our investing journey? Have we been impulsive in buying or selling stocks and deviated from the process?

Jim and Charlie exemplify how far discipline in investing can take us.

Intellectual humility and acknowledging the role of luck

‘The best laid plans of mice and men often go awry.’

Process, discipline, persistence and patience are crucial ingredients for a successful wealth creation journey, but without some element of luck the destination may not be reached. Both Jim and Charlie have been upfront on the role luck has played in their success. In fact, on Wall Street, there is a quote that is well telegraphed but usually not heeded by many - ‘if you are not humble, the markets will humble you.’ Traders/investors with intellectual humility acknowledge this.

The good thing about incorporating the ingredients of process, discipline, persistence and patience is that you give yourself a better chance to stay longer in the game to greet lady luck when she arrives. In a long enough timeline, every person will have his/her share of good luck in life and investing.

So if you feel you have had bad luck in the stock markets, assess whether you had the other ingredients right. If not, then it is less to do with luck. On the other hand, if you have followed the right steps, then may be some persistence can ensure you stay long enough to enjoy your dose of luck.

If, however, you have been very lucky in the stock markets, acknowledge the role of luck. It will go a long way in extending your successful stint.

Are you a trader or an investor?

Jim and Charlie had so much in common, yet their approach to stock markets was completely opposite. Jim was a short-term trader while Charlie, on the other hand, was focused only on long-term investments.

Jim found his early experience in fundamental investing ‘stomach wrenching’, while Charlie couldn’t care less what markets would do in a year or two, forget a few days, which was the time horizon Jim was focused on. Jim’s trading portfolio was loaded with thousands of positions across stocks and other asset classes, while Charlie’s portfolio could be counted on your fingers.

Both figured out early on as to what they did not want to do and what their circle of competence was.

Both believed that markets were inefficient. Human psychology impacted markets that provided opportunities for them. Jim’s deep interest in and love of math convinced him early on, on the existence of certain patterns that play out in the world. He wanted to use his math skills to predict these patterns and profit from them.

Charlie’s love of physics, indulgence in basic maths and his understanding of the world gifted him with a rational approach that convinced him of his abilities to assess how things will play out over the long term once human greed and fear took stocks/markets to extremes.

Both capitalised on the stock markets based on what they were good at and stuck to their guns.

So, the takeaway here is this – before engaging actively in the markets have you figured out whether you are a trader or an investor?

Do you believe you are a long-term investor, but yet spend time trying to predict where stocks will be in a week or month from now? Or are you actually trader, but hold on to losses in stocks or F&O without adhering to stop losses? Such behaviour represents the anti-thesis to path that Jim and Charlie carved out to become succesful.

Being a trader or an investor requires a few common principles, but entirely different approach. A fitting tribute to Jim’s and Charlie’s legacy would be when more and more amongst us identify our circle of competence and accordingly engage with the markets!