Business

Lanka Hospitals Academy consolidates its hold on healthcare education in Sri Lanka

Lanka Hospitals Academy, the healthcare education arm of Lanka Hospitals PLC, has reached a significant milestone with the inauguration of its new premises. The new facility, located at No. 657, Elvitigala Mawatha, Colombo 05, in the vicinity of the hospital, marks a new chapter in the academy’s commitment to providing high-quality healthcare education and producing skilled professionals in various healthcare disciplines.

Deepthi Lokuarachchi, Group CEO of Lanka Hospitals PLC said, “Lanka Hospitals is taking its professional healthcare education to the next level, producing the most sought-after healthcare professionals of different disciplines. Lanka Hospitals Academy has become the ‘apex’ body in healthcare education, offering a wide range of courses from pharmacy, caregiving, phlebotomy and nursing.”

The new premises of Lanka Hospitals Academy are equipped with state-of-the-art facilities and modern amenities to provide students with a conducive learning environment. The academy offers a range of courses designed to meet the needs of aspiring healthcare professionals, ensuring that graduates are well-prepared for the challenges of the healthcare industry.

Dr. Lasantha Karunasekara, Deputy CEO/Director Medical Services of Lanka Hospitals PLC, highlighted the academy’s commitment to maintaining international standards in clinical exposure and training.

Business

UNDP and IFC helping Sri Lanka to discover financial inclusion

By Sanath Nanayakkare

The barriers to financial inclusion have been a longtime problem in Sri Lanka as financial literacy has thus far been the prerogative of only the nation’s affluent customers.

However, eventually the Central Bank of Sri Lanka, 40 other national institutions, the public and private sector of the country along with the United Nations Development Programme (UNDP) and the International Finance Corporation (IFC) are now looking to help broaden financial literacy among the general public of the country to help them achieve financial freedom without allowing it to remain an exclusive right anymore.

This was revealed when the Financial Literacy Roadmap of Sri Lanka (2024-2028) was unveiled at the Central Bank of Sri Lanka on May 21st 2024.

The roadmap developed under the Financial Literacy and Capacity Building pillar of the National Financial Inclusion Strategy (NFIS) quite obviously incorporates sequenced actions proposed by the United Nations Development Programme and the International Finance Corporation (IFC) which were described by the Central Bank Governor Dr. Nandalal Weerasinghe as vital partners in rolling out the roadmap.

Introducing Mr. Beewise – the Sri Lankan Financial Literacy Expert in the first-ever financial inclusion roadmap for Sri Lanka, the multi-stakeholder knowledge tank promotes two aspects leading to financial inclusion in Sri Lanka; namely, knowledge and skills and attitude of the Sri Lankan general public by taking a cue from the busy bees.

“Bees, skilled in searching for and using resources reflect the value of knowledge to steer the day to day life prudently. The skills bees demonstrae in collecting nectar and producing honey reflect the practical skills needed in finance, budgeting, saving, investing and managing debt. And that is why we are referring to the analogue of the bee in this context,” said UNDP Resident Representative for Sri Lanka, Ms. Azusa Kubota.

“One of the mandates the Central Bank has been given is Financial Inclusion, and our endeavor towards this national agenda is strengthened and supported by the United Nations Development Programme (UNDP), the International Finance Corporation (IFC) and the members of the National Financial Inclusion Council,” said CBSL Governor Dr. Nandalal Weerasinghe.

He further said:

“Financially literate people make informed decisions about savings, investments and borrowings. They are more likely to understand the impact of the monetary policy decisions we take, and respond appropriately in line with monetary policy stance, contributing to effective monetary policy implementation.”

“Secondly, financially literate consumers will make informed choices and will demand efficient, transparent and responsible culture from the financial institutions rather than we need to regulate them all the time. Financial literacy will increase public trust in the financial system by supporting individuals to understand how the financial system works. This understanding is very important for the public to make their financial decisions. Further, financial consumers will be empowered to safeguard themselves against financial frauds which are growing with the new of technologies. More importantly, financial literacy can support reducing over-indebtedness and alleviating poverty.”

“Informed access to financial services enables people to manage their finances better, save for the future and invest in opportunities that benefit them. In the long run, this will reduce the burden on the government in terms of having to provide a social safety net, and will enable them to have better living conditions. Financially literate people can come out of poverty from their own financial decisions. A forward looking aspect of financial literacy advocates equipping the future generations with necessary financial capabilities to be financially resilient when they become adults. So, it is important for them to acquire financial literacy at school and university level.”

“Thus investing in financial literacy will be an investment in higher social and economic returns. So there are clear social and economic benefits out of financial literacy in any country. In this backdrop, the Central Bank of Sri Lanka is striving to improve the financial inclusion landscape of Sri Lanka through various initiatives.”

“The introduction of National Financial Inclusion strategy in 2021 with the help of all stakeholders by the Central Bank is currently in its implementation phase. That marks a significant milestone. The new CBSL Act entrusts the duty of promoting financial inclusion. The mandate has been given to the CBSL to formally promote financial inclusion. This road map provides an evidence based policy framework aimed at positively changing the financial behavior towards the betterment of the general public in Sri Lanka.

“Thirdly, creating of vigilant consumers is important to ensure consumer protection. As a whole, the implementation of this roadmap will be crucial in realizing the aspirations of financial inclusion in Sri Lanka,” he said.

Business

JKH records strong Q4 2023/24 with recurring EBITDA growth of 20% to Rs.13.97 billion

Summarised below are some of the key operational and financial highlights for the fourth quarter ended 31 March 2024. The commentary on the annual performance is available on the JKH Annual Report 2023/24:

• During the fourth quarter, the Group reported a strong performance across most businesses, with Consumer Foods, Transportation and Leisure, in particular, recording significant growth.

The performance seen in most of the businesses is a reflection of the improving macroeconomic conditions in the country and is a continuation of the growth momentum witnessed in the third quarter of 2023/24.

• Recurring Group EBITDA in the fourth quarter of 2023/24 recorded a growth of 20% to Rs.13.97 billion [Q4 2022/23: Rs.11.65 billion]. This growth is despite a higher surplus recognition at UA in the fourth quarter of the previous year due to a timing difference, and the appreciation of the Sri Lankan Rupee by approximately 12%. The average exchange rate was

Rs.355 in the fourth quarter of 2022/23 compared to Rs.313 in the fourth quarter 2023/24, which had a negative translation impact on businesses with foreign currency denominated revenue streams. Further, the Group recognised of an asset write-off amounting to Rs.639 million in the Property industry group, as explained below.

• The strong growth in the Transportation industry group was driven by the Bunkering business, Lanka Marine Services, on account of a significant growth in volumes over 50% due to the Red

Sea crisis which resulted in an increase in vessel traffic to the coastal waters of Sri Lanka.

The Group’s Port and Shipping business, South Asia Gateway Terminals (SAGT), recorded an increase in throughput of 13%. which drove growth in profitability.

Business

Pan Asia Bank and Wogi to introduce Global Customer Reward platform to revolutionize customer experience

Pan Asia Bank is happy to announce that it has formed a new agreement with Wogi, a Global Digital Platform of loyalty and digital incentives. This partnership aims to provide greater customer engagement through customer rewards, which in turn advances our mission to offer consumers cutting-edge, environmentally friendly banking products throughout Sri Lanka.

“In Pan Asia Bank, we always put the customer first and make sure that we are constantly improving the banking experience while also being sustainable in every bit of our operations,” said Naleen Edirisinghe, CEO of Pan Asia Bank. “Our cooperation with Wogi marks a major milestone in our journey towards creating a customer centric culture, while this initiative will also fully align with one of our brand’s goals to be a partner of sustainable development and green banking. He also stated that, Wogi will bring loads of International expertise which will provide a novel experience to both organizations and Sri Lankan customers.

Wogi is one of the few digital platforms that offer a vast array of digital rewards from over sixty major brands, including: Singer, Damro, eZ Cash, ODEL, Nike, ALDO, Levis, Cotton Collection, Glomark, Daraz, Aviratè, amante, Kapruka, Cool Planet, Saaraketha, Aroma Bliss Ceylon, Ceylon Curry Club, Heladiv Tea Club, The Steuart, Siddhalepa, Scope Cinemas, Albert Edirisinghe, Mallika Hemachandra Jewellers, Keells, and so forth. Customers of Pan Asia Bank will benefit from this partnership by receiving rewards certificates for a variety of events and occasions, which will be easily delivered thanks to our cooperation with Wogi. These vouchers provide our clients with unmatched flexibility and choice in their incentive selections, and they can be quickly used online or in-store.

Wogi empowers success by creating incentive-driven behaviour. The company was founded in 2015 with offices in Sri Lanka, Singapore, Malaysia, Thailand, Vietnam, Indonesia and Hong Kong. Wogi offers global rewards and incentive solutions for enterprises. Wogi has forged partnerships with more than 1600 consumer brands across 39 markets, providing a vast selection of over 5000 reward options. These offerings cater to consumers, employees, and channel partners, serving as reward redemption options and incentive payments for major local, regional, and global clients.

Anusha Malwatta, Director Business Development Wogi stated that, “We are excited to team up with Pan Asia Bank to launch a new phase of benefits and rewards for the customers throughout Sri Lanka. At Wogi, we are on a mission to inspire success through incentive-based behaviors, and our partnership with Pan Asia Bank is just the right partner to help us achieve this goal. In collaboration, we are determined to innovate the rewards landscape in Sri Lanka through a wide variety of curated rewards and a smooth redemption process for Pan Asia Bank cardholders.”

The Pan Asia Bank is always looking for new ways to collaborate and provide solutions that will benefit our customers and the environment, as well as maintain our commitment to sustainability and customer satisfaction.

-

Latest News3 days ago

Latest News3 days agoPresident highlights Global North’s failure in Climate Change Financing at 10th World Water Forum

-

News5 days ago

News5 days agoIndia-gifted ambulance service in Sri Lanka in need of critical support

-

News6 days ago

News6 days agoBipartisan US Congress legislation calls for self-determination for Eelam Tamils

-

Features5 days ago

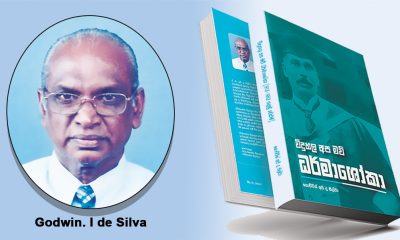

Features5 days agoA valuable publication of the history of Dharmasoka College, Ambalangoda

-

News3 days ago

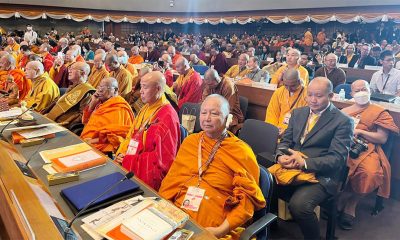

News3 days ago73 countries attend UN International Vesak Day 2024 in Thailand

-

Features5 days ago

Features5 days agoRituals in a village community at Paiyagala 75 years ago

-

Features5 days ago

Features5 days agoWestern Discontents, India’s Long Election and Sri Lankan Anniversaries

-

Business3 days ago

Business3 days agoSri Lankan ambassador to Viet Nam in warm discussion with leading Southeast Asian EV manufacturer