UK Growth Companies With High Insider Ownership And A Minimum 15% Earnings Increase

The United Kingdom market has shown positive momentum, rising 2.5% in the last week and achieving a 5.8% increase over the past year, with earnings projected to grow by 13% annually. In this buoyant environment, growth companies with high insider ownership and robust earnings growth are particularly compelling, as these factors often signal strong confidence in the company's future prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

Name | Insider Ownership | Earnings Growth |

Getech Group (AIM:GTC) | 17.2% | 86.1% |

Gulf Keystone Petroleum (LSE:GKP) | 10.6% | 43.9% |

Petrofac (LSE:PFC) | 16.6% | 115.4% |

Spectra Systems (AIM:SPSY) | 23.3% | 26.3% |

Foresight Group Holdings (LSE:FSG) | 31.7% | 28.9% |

Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 27.9% |

Plant Health Care (AIM:PHC) | 19.7% | 94.4% |

Velocity Composites (AIM:VEL) | 29.5% | 140.5% |

TEAM (AIM:TEAM) | 25.8% | 58.6% |

Afentra (AIM:AET) | 38.3% | 198.2% |

Let's uncover some gems from our specialized screener.

Fintel

Simply Wall St Growth Rating: ★★★★☆☆

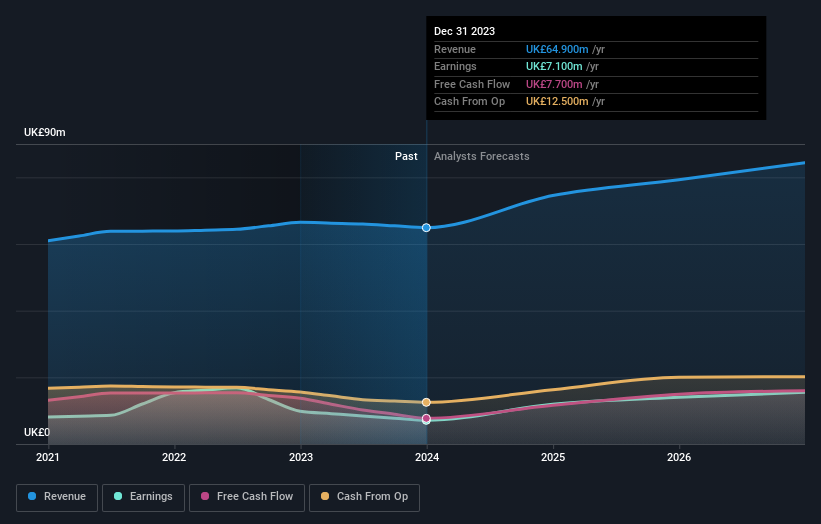

Overview: Fintel Plc operates as a provider of intermediary services and distribution channels to the retail financial services sector in the UK, with a market capitalization of approximately £320.89 million.

Operations: The company generates its revenue from three main segments: Research & Fintech (£22.30 million), Distribution Channels (£20.20 million), and Intermediary Services (£22.40 million).

Insider Ownership: 32.8%

Earnings Growth Forecast: 23.9% p.a.

Fintel, a UK-based company, showcases a promising growth trajectory with its revenue expected to outpace the broader UK market. Despite a recent dip in net income from GBP 9.8 million to GBP 7.1 million and earnings per share decreasing slightly, Fintel's long-term earnings are projected to grow robustly by 23.88% annually. However, it's important to note that this growth comes amidst some financial fluctuations marked by significant one-off items impacting results. The firm also recently increased its dividend payout, reflecting confidence in its financial health despite these challenges.

Click to explore a detailed breakdown of our findings in Fintel's earnings growth report.

Our valuation report unveils the possibility Fintel's shares may be trading at a premium.

Gulf Keystone Petroleum

Simply Wall St Growth Rating: ★★★★★★

Overview: Gulf Keystone Petroleum Limited is a company focused on the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq, with a market capitalization of approximately £266.62 million.

Operations: The company generates revenue primarily from the exploration and production of oil and gas, totaling $123.51 million.

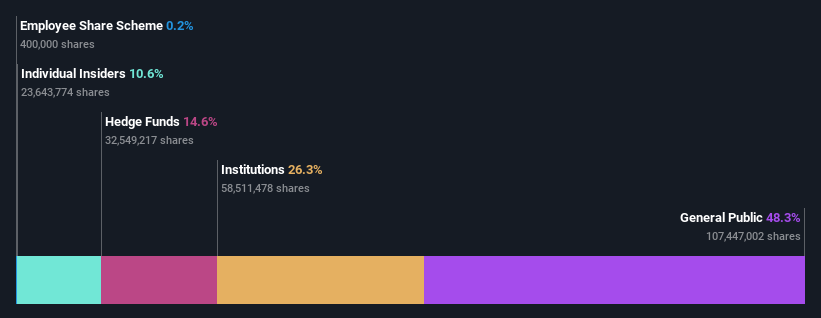

Insider Ownership: 10.6%

Earnings Growth Forecast: 43.9% p.a.

Gulf Keystone Petroleum, despite a challenging year with sales dropping to US$123.51 million and a shift from a net income of US$266.09 million to a net loss of US$11.5 million, is set for recovery. Analysts predict robust revenue growth at 24% annually, outpacing the UK market's 3.6%, and foresee profitability within three years. However, shareholder dilution occurred over the past year, reflecting some concerns despite these optimistic growth forecasts.

TBC Bank Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TBC Bank Group PLC operates as a financial entity offering a range of services including banking, leasing, brokerage, insurance, and card processing to both corporate and individual clients in Georgia, Azerbaijan, and Uzbekistan, with a market capitalization of approximately £1.63 billion.

Operations: The company generates revenue from banking, leasing, brokerage, insurance, and card processing services across Georgia, Azerbaijan, and Uzbekistan.

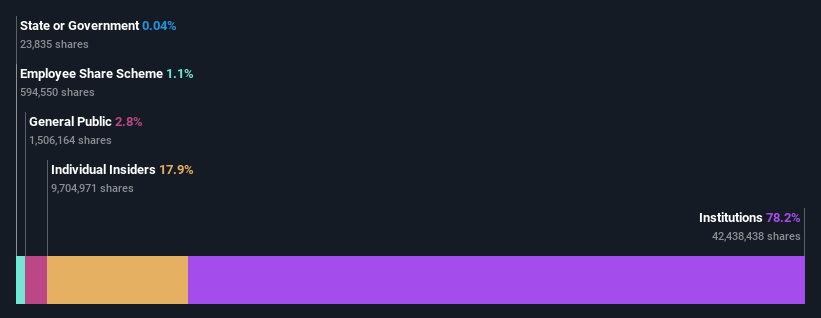

Insider Ownership: 17.9%

Earnings Growth Forecast: 15.2% p.a.

TBC Bank Group PLC, with substantial insider ownership, trades at 43% below its estimated fair value, indicating potential undervaluation. The company's earnings are expected to grow by 15.2% annually, surpassing the UK market average of 12.8%. Recent financial results show a strong uptick in net interest income and net income, reflecting robust operational performance. However, it has a high level of bad loans at 2.1%, which poses a risk to stability.

Where To Now?

Gain an insight into the universe of 59 Fast Growing UK Companies With High Insider Ownership by clicking here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include AIM:FNTL LSE:GKP and LSE:TBCG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com