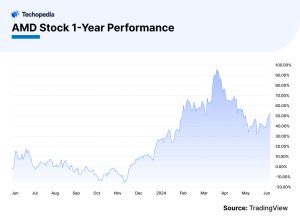

Advanced Micro Devices (AMD) saw its stock price soar to a record high earlier this year — but does the recent fall represent a buying opportunity?

Shares in the US-based semiconductor manufacturer hit $211.38 in March on the back of upbeat management comments about the benefits of artificial intelligence.

However, AMD’s stock price has since lost 21%, and this wasn’t helped by its first-quarter results, which only marginally beat analysts’ expectations.

Source: TradingView

In our AMD stock forecast, we examine the company’s outlook, analyze why it may look attractive, and reveal analysts’ AMD stock predictions for 2024, 2025, and beyond.

Key Takeaways

- AMD hit an all-time high closing price earlier this year.

- The stock price has fallen 21% over the last two months.

- AMD achieved revenue of $5.5 billion in the first quarter.

- Wall Street analysts view AMD stock as a ‘moderate buy’, as of May 21, 2024.

Summary of the Latest AMD Stock Predictions

| AMD Stock Forecast

(as of May 21, 2024) |

1-Year Forecast | 2025 (December) | 5-Year Forecast

(May 2029) |

| MarketBeat | $185.26 | – | – |

| WalletInvestor | $182.36 | $215 | $250.59 |

| TipRanks | $192.56 | – | – |

| CoinCodex | $275.80 | – | $2,084.85 |

AMD Stock Analysis

How have the holders of Advanced Micro Devices stock fared over the last 12 months and what have been the factors behind this performance?

Investors in AMD have enjoyed a pretty positive year. The stock almost doubled in value from $108 in May 2023 to an all-time high closing price of $211.38 in March this year.

Even though the stock has since come off the boil, the closing price of $166.33 on May 20, 2024, still represents a 12-month increase of 54%.

Prospects for AI

The stock has performed pretty well year-to-date, reaching an all-time high closing price of $211.38 in early March. This was 53% up on the $138.58 level at the start of 2024.

This was partly due to increasingly upbeat comments about the potential benefits to the business of artificial intelligence.

This included the announcement that Thomas Zacharia was joining AMD as senior vice president of strategic technology partnerships and public policy.

AMD said he would lead the global expansion of the business and help “fast-track the deployment” of customized AMD-powered AI solutions.

In a statement, Lisa Su, AMD’s chair and chief executive, said:

“Thomas is a distinguished leader with decades of experience successfully creating public/private partnerships that have resulted in consistently deploying the world’s most powerful and advanced computing solutions, including the world’s fastest supercomputer Frontier.”

Separately, Microsoft announced in late May that it planned to offer its cloud computing customers a platform of AMD AI chips that will compete with components made by Nvidia.

Further details are expected to be announced at this year’s Microsoft Build event, which will take place in Seattle from May 21 to 23.

AMD News: Financial Results Announced

AMD announced revenue of $5.5 billion for the first quarter of 2024. This represented a modest 2.2% increase over the $5.35 billion achieved in the same period last year.

The gross profit came in at $2.6 billion — up from 9% on the previous year’s $2.4 billion — while the gross margin was up three percentage points to 47%.

Net income, meanwhile, was $123 million. This represented a 188% improvement over the $139 million loss suffered in the first quarter of 2023.

| GAAP Quarterly Financial Results | Q1 2024 | Q1 2023 | Y/Y |

| Revenue ($M) | $5,473 | $5,353 | Up 2% |

| Gross profit ($M) | $2,560 | $2,359 | Up 9% |

| Gross margin | 47% | 44% | Up 3 ppts |

| Operating expenses ($M) | $2,537 | $2,514 | Flat |

| Operating income (loss) ($M) | $36 | $(145) | Up 125% |

| Operating margin | 1% | (3)% | Up 4 ppts |

| Net income (loss) ($M) | $123 | $(139) | Up 188% |

| Diluted earnings (loss) per share | $0.07 | $(0.09) | Up 178% |

Source: AMD

The company also revealed record Data Center segment revenue of $2.3 billion, up 80% year-over-year, driven by growth in AMD InstinctTM GPUs and 4th Gen AMD EPYCTM CPUs.

“Revenue increased 2% sequentially driven by the first full quarter of AMD Instinct GPU sales, partially offset by a seasonal decline in server CPU sales,” it stated.

Client segment revenue was $1.4 billion, up 85% year-over-year, driven primarily by AMD RyzenTM 8000 Series processor sales.

“Gaming segment revenue was $922 million, down 48% year-over-year and 33% sequentially due to a decrease in semi-custom revenue and lower AMD RadeonTM GPU sales,” it added.

AMD Stock Forecast: Analyst Views

Let’s take a look at the AMD stock predictions of analysts.

Danni Hewson, head of financial analysis at AJ Bell, told Techopedia that the company’s performance will always be measured against the achievements of its main competitor.

“Investors might see AMD as a David figure in the battle with the Goliath-like Nvidia for market share,” she said. “AMD shares have enjoyed incredible growth over the last five years, but their performance has been utterly eclipsed by its AI chip-making rival.”

Hewson believes the recent tie-up with Microsoft suggests AMD does have sharp enough claws to carve out a distinct market in this burgeoning world of AI excitement.

“With the computing giant offering its cloud customers the option of choosing between AMD’s AI chips and those of Nvidia it’s setting up an intriguing battle,” she said.

“However, investors will want to see the fruits of AMDs labor laid out in black and white in its financial performance because this is a company playing catch up and coming back after a slow start is never easy.”

Opportunities ‘There for the Taking’

Susannah Streeter, head of money and markets, Hargreaves Lansdown, is disappointed that AMD only marginally beat estimates for first-quarter revenue and earnings.

She told Techopedia:

“Given AMD’s valuation, shares are particularly vulnerable when growth undershoots hopes. At the moment, it’s finding it tough going to convert strong demand for its AI products into significant growth.”

However, Streeter believes the opportunities are “there for the taking” given that the microchip designer offers a comprehensive range of microprocessors and graphics cards. It’s also one of the few players with the technology capable of powering the latest advances in AI.

“This has revved up its Data Center division, which has now become the company’s largest segment by revenue,” she said. “This offers big potential going forward with the huge spend being ring fenced around the world for infrastructure upgrades.”

Despite its potential, Streeter acknowledged AMD has a long way to go to become a serious competitor to Nvidia and pointed out that it’s “bogged down” with weaknesses elsewhere.

“Sales have been more fragile for AMD’s gaming chips and with no major console releases due imminently, this may remain the case for some time,” she said.

She also highlighted weak demand from some customers in the embedded segment, such as automobile manufacturers.

“As AMD outsources its manufacturing, supply chain issues appear to be also putting a ceiling on its own growth,” she added.

Will AMD ‘Take a Piece of the AI GPU Pie’?

Brian Colello, a strategist at Morningstar, has a fair view estimate of $145 on the stock. He highlighted solid first-quarter results and a decent second-quarter outlook.

“We suspect some investors were hoping for a higher forecast for AMD’s budding data center graphics process unit business for artificial intelligence,” he wrote in an AMD stock forecast.

However, he’s optimistic about its prospects in this area.

“We anticipate that AMD will take a piece of the AI GPU pie,” he said. “Its revenue coming from a brand new business is quite impressive in absolute terms, but we don’t see many signs that AMD will reach parity with Nvidia in AI GPUs soon.”

Latest AMD Stock Predictions for 2024, 2025 & 2030

So, is AMD a buy, hold, or sell?

AMD stock is viewed as a ‘moderate buy,’ according to the views of 30 Wall Street analysts compiled by MarketBeat as of May 21, 2024.

Twenty eight have ‘buy’ recommendations in place, while two see it as a ‘hold’. Their consensus view is the AMD stock price could rise 11.38% to $185.26 over the coming year.

However, the most optimistic analysts have an AMD price target of $250, while the lowest forecast has the stock falling to $110.

The following table shows the 10 latest analysts’ AMD stock predictions.

| Date | Analyst Firm | Action | Rating Change | Price Target | Percentage Change |

| 5/13/2024 | Jefferies Financial Group | Initiated Coverage | Buy ➝ Buy | $200.00 ➝ $190.00 | +25.07% |

| 5/7/2024 | DZ Bank | Upgrade | Hold ➝ Buy | $190.00 | +21.97% |

| 5/2/2024 | Benchmark | Lower Target | Buy ➝ Buy | $245.00 ➝ $200.00 | +40.37% |

| 5/1/2024 | Citigroup | Lower Target | Buy ➝ Buy | $192.00 ➝ $176.00 | +20.00% |

| 5/1/2024 | UBS Group | Lower Target | Buy ➝ Buy | $205.00 ➝ $200.00 | +39.61% |

| 5/1/2024 | Roth Mkm | Lower Target | Buy ➝ Buy | $190.00 ➝ $180.00 | +25.65% |

| 5/1/2024 | KeyCorp | Lower Target | Overweight ➝ Overweight | $270.00 ➝ $230.00 | +56.44% |

| 5/1/2024 | Evercore ISI | Lower Target | Outperform ➝ Outperform | $200.00 ➝ $193.00 | +31.27% |

| 5/1/2024 | Wedbush | Reiterated Rating | Outperform ➝ Outperform | $200.00 | +35.58% |

Source: MarketBeat

Meanwhile, TipRanks has the stock down as a ‘strong buy,’ according to its AMD share price forecast of 35 analysts. Twenty nine see it as a ‘buy’, while six have ‘hold’ recommendations in place.

Their consensus view is that the AMD stock price could enjoy a 15.77% uplift to $192.56 over the coming year, although opinions ranged from $140 to $265.

WalletInvestor’s algorithmic forecast has the stock rising by almost 10% to $182.36 over the next 12 months. According to its 5-year AMD stock forecast, the stock can reach $250,59 in May 2029.

As far as an AMD stock forecast for 2030 is concerned, Coincodex has the stock reaching $3,456.98 if it maintains its current 10-year average growth rate.

Note that analysts’ and algorithm-based projections might prove to be wrong.

AMD Profile

To round up our AMD stock forecast, we look at the company’s history.

It was founded back in 1969 as a Silicon Valley start-up focused on leading-edge semiconductor products.

Since then, it has grown into a global giant. It is currently the world’s fourth largest electronics company, with a market capitalization of $268.84 billion.

AMD makes processors that are used in everything from supercomputers and game consoles to always-on cloud infrastructures and laptops.

The Bottom Line: Should I Invest in AMD Stock?

The latest AMD stock forecasts can help you get a broader picture of AMD stock performance; however, whether you should invest in AMD depends on your view of the company’s prospects.

The consensus view of Wall Street analysts polled by MarketBeat as of May 21, 2024, is pretty positive, with 28 having ‘buy’ recommendations in place and the remaining two viewing it as a ‘hold.’

However, analysts can be wrong. You’ll need to conduct your own research to decide whether AMD is an attractive holding.

As with all investments, there are potential pros and cons.

For example, Microsoft offering its cloud customers the option of choosing between AMD’s AI chips and those of Nvidia is obviously intriguing. On the downside, however, AMD faces a lot of industry competition in its various segments, so a lot will depend on how it fares over the coming months.

Do your own research and always remember your investment decision depends on your attitude to risk, your expertise in the stock market, the spread of your portfolio, and how comfortable you feel about losing money.

The information in this article does not constitute investment advice and is meant for informational purposes only.

FAQs

Is AMD a good stock to buy?

Will AMD stock go up or down?

Should I invest in AMD stock?

What will AMD stock be worth in 2025?

References

- AMD – 41 Year Stock Price History | AMD | MacroTrends (Macrotrends)

- AMD Hires Thomas Zacharia to Expand Strategic AI Relationships (Ir.amd)

- Microsoft offers cloud customers AMD alternative to Nvidia AI processors | Reuters (Reuters)

- Get ready for Microsoft Build 2024 | Microsoft Entra Identity Platform (Devblogs.microsoft)

- AMD Reports First Quarter 2024 Financial Results (D1io3yog0oux5.cloudfront)

- AMD Stock Price Quote – NASDAQ:AMD | Morningstar (Morningstar)

- AMD Stock Price Quote – NASDAQ:AMD | Morningstar (Marketbeat)

- AMD Stock Price Quote – NASDAQ:AMD | Morningstar (Tipranks)

- Advanced Micro Devices Stock Forecast, “AMD” Share Price Prediction Charts (Walletinvestor)

- Advanced Micro Devices (AMD) Stock Forecast & Price Prediction 2025, 2030 (Coincodex)

- About AMD (Amd)

- Largest electronics companies by market cap (Companiesmarketcap)

- About AMD (Amd)