2 Healthcare Stocks to Buy and Hold for Great Long-Term Potential

Your long-term investment portfolio should have meaningful exposure to healthcare stocks. People will always seek treatments for disease, so demand for the sector won't go away any time soon. Moreover, there's a wide variety of healthcare companies, making it an attractive sector for any type of investor.

Consider how this value stock and this growth stock below might enhance your portfolio.

1. Pfizer

Pfizer (NYSE: PFE) is one of the world's leading pharmaceutical companies, but it's fallen out of favor with investors after a few bumpy years. The drug maker experienced a massive surge in sales and earnings during the COVID-19 pandemic's height, thanks to demand for vaccines and other related treatments.

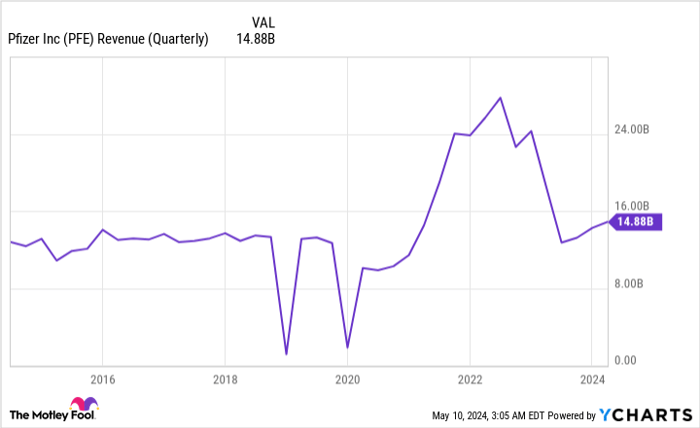

Pfizer's sales and earnings then dropped sharply as those treatments were less coveted by the public, but the most recent quarterly results suggest that things have normalized and that the company can return to modest growth.

PFE Revenue (Quarterly) data by YCharts

A robust research and development pipeline is essential for a pharmaceutical company's future success, and Pfizer has one of the strongest pipelines in the industry. It has over 100 candidates in various stages of clinical trials, many of which have major revenue potential.

The company has scored several important approvals in recent years, and it supplemented internal development with a handful of large acquisitions. Analysts expect substantially higher revenue potential by the end of the decade, thanks to those efforts.

Image source: Getty Images.

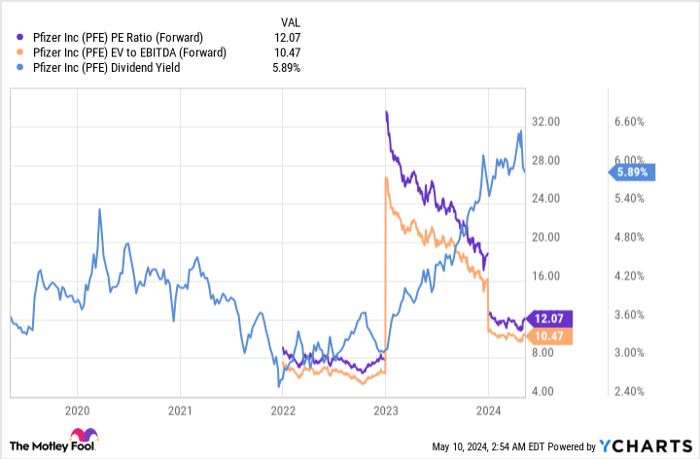

The market seems to be discounting Pfizer's opportunities, according to the stock's valuation ratios. Its forward price-to-earnings ratio is under 13, and its enterprise-value-to-EBITDA ratio is even lower. The stock is cheap relative to its current and forecast near-term profits. Its dividend yield is around 6%, so the stock is also inexpensive relative to the dividends that it currently pays.

PFE PE Ratio (Forward) data by YCharts

These valuation metrics are surprising for a business with a clear pathway to growth. Pfizer also recently beat analysts' quarterly earnings estimates, so there's evidence that it's moving through a recovery phase ahead of schedule.

COVID treatments still make up a significant portion of Pfizer's revenue, and those are likely to struggle. Fortunately, its reliance on those products is dwindling. It's also reasonable to apply some discount to the expected future cash flows from products in Pfizer's pipeline. Regulatory, clinical, and competitive pressures all present uncertainty and potential challenges.

Nonetheless, this value stock pays a healthy dividend today, so there's a basis for immediate and compounding gains, regardless of how the stock price moves in the short term. Over the long term, the cheap valuation ratios mean that it's priced to appreciate if the company can capitalize on its drug pipeline.

2. CRISPR Therapeutics

CRISPR Therapeutics (NASDAQ: CRSP) is a disruptive biotechnology stock that has been turning heads recently. The company is one of the leaders in gene therapy. It is developing several products that could drastically change the way serious diseases are treated.

The company received its first regulatory approvals last year. Its first product, Casgevy, is now approved in the United States, the United Kingdom, the European Union, Saudi Arabia, and Bahrain for the treatment of sickle cell disease and transfusion-dependent beta thalassemia. Casgevy was developed in a partnership with Vertex Pharmaceuticals, which seems to be valuable for successfully commercializing the product.

There are already numerous treatment centers around the world that are seeing patients. The biotech companies have also signed important contracts with private insurers and government payors, so there has been agreement on pricing and a clear pathway to revenue in the near term. It's been an eventful few months for CRISPR.

CRISPR lies on the opposite end of the growth-value spectrum from Pfizer. The biotech company still hasn't reported any meaningful revenue, and it burns cash every quarter. It only has one product that's just starting to be commercialized, and it will have to share that revenue with Vertex. Its $5 billion market capitalization relies on speculation about potential cash flows from products that are still in development.

The company's recent success should give investors confidence. However, it faces clear risks associated with product development, regulatory clearance, bringing products to market, and competition. CRISPR could handsomely reward shareholders by disrupting the biotech industry, but there's uncertainty to overcome.

Should you invest $1,000 in Pfizer right now?

Before you buy stock in Pfizer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Pfizer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $550,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

Ryan Downie has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends CRISPR Therapeutics, Pfizer, and Vertex Pharmaceuticals. The Motley Fool has a disclosure policy.