Warren Buffett Has Trimmed 13% of His Apple Stock. Should You?

The first weekend in May marked the yearly investing pilgrimage as tens of thousands of value investors congregated in Omaha for the Berkshire Hathaway (NYSE: BRK.A) annual meeting. They went to ask questions and listen to answers from the legendary investor Warren Buffett while also paying tribute to the passing of his late partner, Charlie Munger. Buffett answered dozens of questions throughout the weekend, but it was perhaps a different news item that got the most headlines: He sold some of his Apple (NASDAQ: AAPL) position.

The largest holding in his gargantuan stock portfolio, Apple is one of the businesses Buffett has praised for their high quality ever since greatly increasing his position a little over five years ago. Now -- for reasons I will get into -- he decided to lower his exposure to the consumer electronics giant.

Should you follow Buffett and trim your Apple position as well?

Why he sold (according to him)

According to regulatory filings, Berkshire sold approximately 1% of its Apple stake in the fourth quarter of 2023. In the first quarter of 2024, this accelerated to a 13% trimming, a sizable sale worth more than $10 billion. To be clear, Buffett didn't sell his entire position and still owns over $100 billion worth of Apple shares, but it was the first large trim of his position since loading up on the stock in the 2016-2018 period.

During the annual meeting, Buffett was asked about his Apple sale. He said the sale was because of tax reasons after seeing large gains in the stock. The corporate tax rate is just 21%, which was lowered in 2017 and helped highly profitable businesses such as Apple. Buffett said he was worried the government would need to raise taxes in order to finance its deficit spending. If the corporate tax rate is hiked to 30% or 40% or even higher, Apple will face a significant earnings headwind.

But is this the entire reason why Buffett sold? I don't think so.

High earnings multiple, stagnant revenue

Buffett doesn't like to bash his holdings. A lot of people out there listen intently to what he says, which, in the past, has caused him to avoid giving direct stock advice. However, we can look at his criteria for owning a stock and compare it to Apple today.

There are three main criteria Buffett looks for when buying a stock: a wide competitive moat, a cheap earnings multiple, and a good chance earnings grow over the next three to five years. Apple clearly has a strong competitive advantage, with all the consumers around the world locked into the iPhone ecosystem. I don't think Buffett is concerned about a moat erosion with Apple.

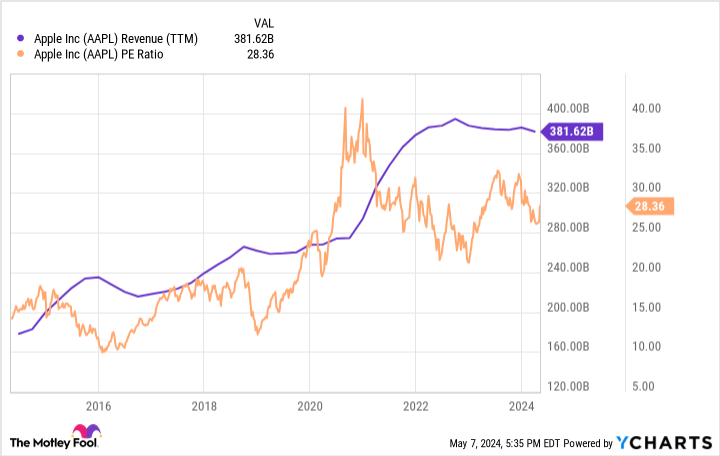

I do think he has some concerns over the stock's valuation, though. Apple trades at a price-to-earnings ratio (P/E) of about 28, which is significantly higher than the P/E of 10 he bought it for in 2018. Buffett likes to buy stocks with earnings multiples below 15 (and ideally below 10). Apple today is almost twice as expensive as the typical stock he buys.

Earnings growth is likely also a concern for Buffett. Apple's revenue hasn't grown much in the last few years after a pandemic boom as the consumer market for smartphones, smartwatches, and laptops has saturated. This comes despite its services revenue growing at a double-digit rate last quarter.

Add these two factors together and it isn't surprising to see Buffett raising cash and trimming his Apple position.

What about the $110 billion buyback?

There were a lot of headlines about Apple's record $110 billion stock repurchasing plan. It is perhaps why its stock was up after posting declining revenue in the first quarter. This is the largest buyback announcement of all time and will help Apple reduce its shares outstanding, which has some investors excited. The issue is that $110 billion is small compared to Apple's market cap of $2.8 trillion. It is only 4% of its market cap, a sizable but not significant amount for the company.

Don't let the buyback headlines fool you: Buffett is probably smart to trim his Apple position. The stock makes up around 50% of his equity portfolio, and he likely doesn't want that large of a position in a company trading at close to 30 times earnings with declining revenue.

Congratulations to you if Apple has a huge position in your portfolio. The stock has likely made you a lot of money. However, given the current dynamics with the company, it wouldn't be the worst idea to trim this position along with Buffett in order to diversify.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $550,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 6, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and Berkshire Hathaway. The Motley Fool has a disclosure policy.

Warren Buffett Has Trimmed 13% of His Apple Stock. Should You? was originally published by The Motley Fool