Editors at the Washington Examiner ponder the ongoing impact of inflation.

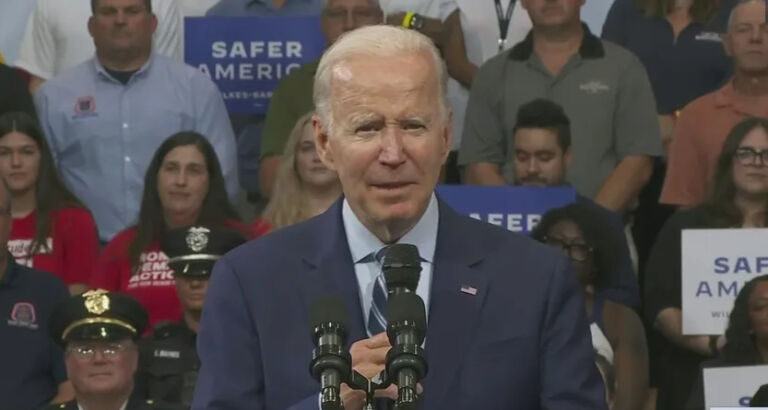

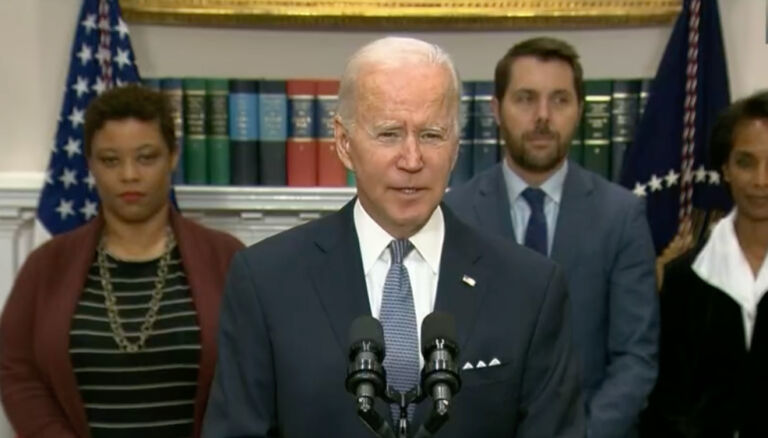

President Joe Biden bragged at the start of the year that inflation was coming down and it was lower than “any other major economy at the time.” While the first point was true — inflation was falling — it is no longer so, and the Federal Reserve’s battle to control price rises has backslid since. This is largely because of the president’s profligate spending, and, despite Democratic claims otherwise, data continue to demonstrate that inflation is worsening. Voters know it.

In the first four months of this year, consumer price index inflation rose from 3.1% to 3.4% on a 12-month annualized basis. In absolute terms, the CPI has risen by 1.4% in the past four months, or 4.2% on an annualized basis. That’s more than twice the Fed’s maximum target of 2%. While core CPI, a Fed-preferred measure that strips away the volatile categories of food and energy, has slightly decreased on a 12-month annualized basis from 3.9% in January to 3.6% in April, core CPI has increased by 1.5% in absolute terms, or 4.5% on an annualized basis.

Worse, producer price index inflation, a leading indicator because wholesale prices are eventually passed on to the consumers, has more than doubled since January from 0.9% to 2.2% a year. While April’s data for personal consumption expenditure price inflation is still forthcoming, PCE inflation soared in March to its highest level since November of 2023. On a three-month annualized basis, a more precise picture than the annual measure, the Fed’s preferred inflation measure of core PCE rocketed from 3.7% in February to 4.4% in March, more than twice the Fed’s 2% maximum inflation target.

Despite Biden’s assertions to the contrary, voters understand this, and it feeds into expectations. The Federal Reserve Bank of New York’s April survey found that annual median inflation expectations among consumers rose from 3% to 3.3%, with gasoline inflation expectations rising to 4.8% and food price inflation expectations rising to 5.3%.