Can I get a car loan? High rates, regulatory uncertainty hurt Americans' ability to borrow

Consumers increasingly doubt that they’ll be approved for a loan to buy a car or refinance a mortgage, with about a third saying they expect to be rejected.

The sentiment is justified; credit companies said they saw deteriorating consumer credit conditions in the first quarter of 2024, according to the American Financial Services Association’s inaugural Consumer Credit Conditions (C3) Index, the first economic survey to specifically track what consumer lenders are seeing in the U.S. economic marketplace.

Twice as many lenders reported that conditions worsened over the first three months of the year than reported that they improved.

It makes sense that consumers are increasingly concerned about their ability to borrow, because most consumers and businesses want access to credit to meet their financial needs – whether to cover unexpected expenses or to gain a degree of financial flexibility during rough patches.

Americans are concerned about U.S. economy

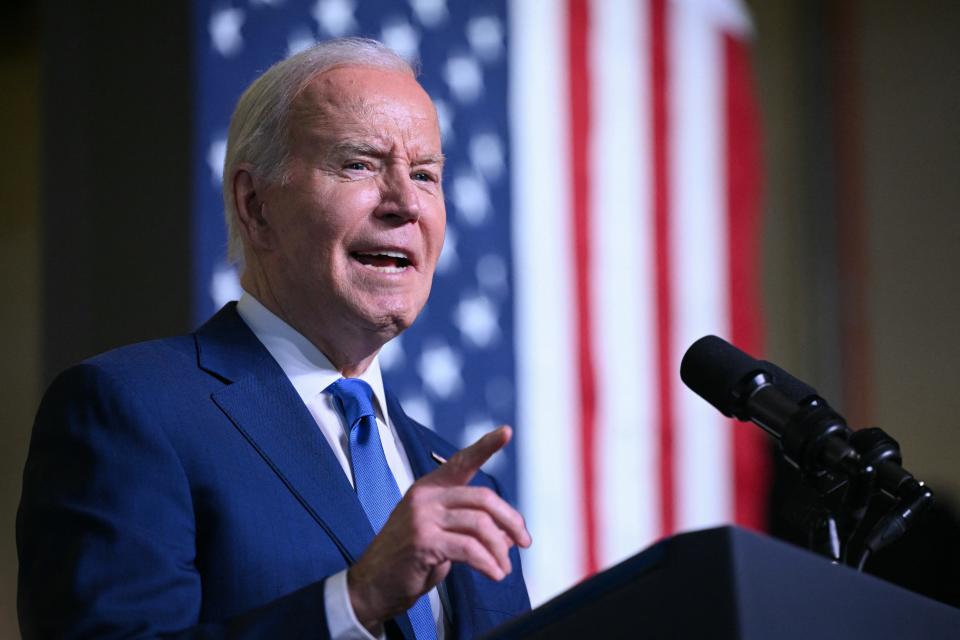

At a time when the Biden administration and many economists insist that the U.S. economy is doing well, why all of this concern among Americans − even pessimism? For starters, prices for consumer goods and services as well as interest rates remain high. Also of importance: Lenders are plagued by regulatory uncertainty.

Risk assessment and underwriting rules by federal regulators influence how lenders make their decisions and whether their customers and clients qualify for, or even seek, credit or loans. A lender is less likely to approve a credit application for someone with less than perfect credit or who appears more financially vulnerable if their underwriting process or risk evaluation will expose them to regulatory scrutiny.

Opinion alerts: Get columns from your favorite columnists + expert analysis on top issues, delivered straight to your device through the USA TODAY app. Don't have the app? Download it for free from your app store.

Regulation of financial services industry creates confusion

For consumer credit lenders, the Consumer Financial Protection Bureau’s oversight of the financial services industry has been confusing. Created by the Dodd-Frank Act in 2010, the CFPB was supposed to ensure a financial marketplace that worked well for borrowers and lenders. Instead, the CFPB’s actions are sowing doubt in the industry that it regulates, thereby threatening access to credit for tens of millions of Americans and small businesses when they may need it most.

The issue is the CFPB’s refusal to use the standard formal rulemaking process to set clear rules for the financial services industry. Instead, the agency uses blog posts, press releases, vague guidance, opinion letters and enforcement actions to establish policies that make little sense.

In April, a number of consumer finance companies spent time on Capitol Hill and with the Biden administration briefing leaders on the state of the consumer credit marketplace and the important role credit plays in the U.S. economy. Lenders of all stripes – whether banks, auto finance companies, installment lenders or credit card companies – depend on clear rules to serve consumers. The CFPB-created confusion trickles down, leading to the tightening of credit for consumers and businesses, which results in the bleak outlook on borrowing being reported by consumers.

It's not often that representatives of an industry ask a regulator to, well, regulate – or for Congress to undertake greater oversight, but both activities are crucial to return the CFPB to the role Congress envisioned and to restore the confidence that contributes to a vibrant, growing business environment and consumer marketplace.

Bill Himpler is president and CEO of the American Financial Services Association.

You can read diverse opinions from our Board of Contributors and other writers on the Opinion front page, on Twitter @usatodayopinion and in our daily Opinion newsletter.

This article originally appeared on USA TODAY: Can I get a home loan? High rates, complex rules hurt homebuyers.

Yahoo Finance

Yahoo Finance