The increased popularity of social media as a forum for market participants to post and exchange opinions has been accompanied by heightened interest from academic researchers who have sought to determine if there is valuable information in the postings. For example, the June 2020 study “Do Individual Investors Trade on Investment-related Internet Postings?” investigated whether social media postings help individual investors identify investment strategies that deliver superior performance in the future. The authors found that “it is mainly unsophisticated individuals who rely on investment-related Internet postings when making investment decisions, but this does not help them identify traders with superior skills.” These findings are consistent with those of the authors of the October 2020 study “Attention Induced Trading and Returns: Evidence from Robinhood Users,” who found: “Large increases in Robinhood users are often accompanied by large price spikes and are followed by reliably negative returns.”

The findings are also consistent with those of the authors of the March 2021 paper “The Rise of Reddit: How Social Media Affects Retail Investors and Short-Sellers’ Roles in Price Discovery,” who found that “Reddit social media activity encourages retail buying behavior, and deters shorting.” They added: “Social media activity and retail flows cultivate price bubbles, while the short-sellers correct the bubbles created by social media activity and retail order flows.” And the author of the June 2020 study “Investor Emotions and Earnings Announcements” had a particularly interesting finding—investors are typically excited about firms that do end up exceeding expectations, but their enthusiasm was excessive and resulted in negative post-announcement returns.

A new study found some interesting and surprising results.

Latest Research

Seeking Alpha (SA) was created in 2004. It was designed as a forum where the investment community could post their stock recommendations and alpha-generating ideas (strategies that outperform appropriate risk-adjusted benchmarks). It has evolved into a multifunctional platform offering many tools for the user, including reading investment advice articles, viewing earnings call transcripts, monitoring stocks and bonds, and discussing investment strategies. SA differs from other social media types, as their information pieces are lengthier. And while the articles are of varying degrees of sophistication, “some are similar to analyst reports, some seem to be written by experts and contain technical language of the industry, and others read like major news outlet reports.” Another differentiator is that all published articles are screened by an editorial board. However, while having an editorial board provides an additional check, it does not ensure that articles contain accurate information or are free from falsification. (Note: I have published numerous articles on SA.) Finally, SA does not require any qualifications for individuals to become contributors to their articles.

Duo Pei, Abhinav Anand, and Xing Huan, authors of the January 2024 study “Seeking Alpha: More Sophisticated Than Meets the Eye,” investigated the information content of articles from the crowdsourced investment advice platform, focusing on its timeliness and relevance for more sophisticated investors. Prior research has found that, of the profiles of SA users that create watchlists, 14% were executives, 24% were full-time investors, and 42% were finance professionals.

- Ranked on a monthly basis, the mean SASCORE was zero and the median was -0.056.

- SA article sentiment provided directional information for both immediate market returns and 90-day drift returns, which was incremental to the information in the most recent earnings surprise and earnings announcement returns—there was a persistent correlation between Seeking Alpha sentiment and returns without reversal. The immediate return monotonically increased in decile ranks, and the drift return and change in spread also generally increased with higher ranks—the more positive the information revealed in the SA article, the more positive the immediate return, drift return, and the option volatility spread.

- Both stock and options market investors reacted to SA information, indicating its relevance for both retail and more sophisticated investors.

- Changes in option volatility spread and volatility skew followed the publication of SA articles—providing value-added information (a more positive volatility spread has been shown to correlate with good news, while a higher volatility skew is an indicator of bad news), as SA publication led to changes in both the stock and options markets.

- SA information appeared to be incremental to common risk factors—a hedged portfolio strategy that bought the firms with the most positive SA sentiment and sold those with the most negative sentiment yielded economically and statistically significant (at the 5% confidence level) positive monthly returns of 68 basis points (against the Fama-French three-factor model) and 57 basis points (against the Carhart four-factor model) after controlling for size, market-to-book, and momentum.

- The negative loading on HML in the Fama-French 3-factor model and the positive loading on the momentum factor in the Carhart four-factor model suggested SA is more likely to cover growth firms (specifically large growth stocks) and firms that exhibit momentum. The table below shows the monthly raw and adjusted returns sorted on SA score.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Their findings led the authors to conclude: “The correlation between SASCORE and returns suggests that Seeking Alpha articles contain incremental information about returns, beyond information about size, market-to-book, or momentum factors.” They added:

“The observations in this study suggest even though individual investors may not achieve superior returns by trading, their collective knowledge aggregated through a social media platform provides incremental information for pricing in the stock and options markets.”

Before jumping to conclusions, consider the following.

SA Articles Favor Growth and Momentum Stocks

The authors found that SA articles focused on large growth stocks and stocks with positive momentum. The focus on these stocks helps explain the alpha generated against common factor models. The tables below provides an explanation for that outcome. In Exhibit 1, Panel B shows that the largest low (high) value stocks exceeded (lagged) return expectations based on their book-to-market characteristics. For the largest stocks (top row), the low book-to-market stocks (growth stocks) produced positive alpha (regressed against beta, size, and value factors) at a statistically significant 2.07%, while high book-to market stocks (value stocks) produced negative alpha of -1.57%. However, investors also care about returns (you cannot spend alpha, only returns). You will note in Panel A that the returns were comparable (10.41% for the largest growth stocks and 10.22% for the largest value stocks).

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

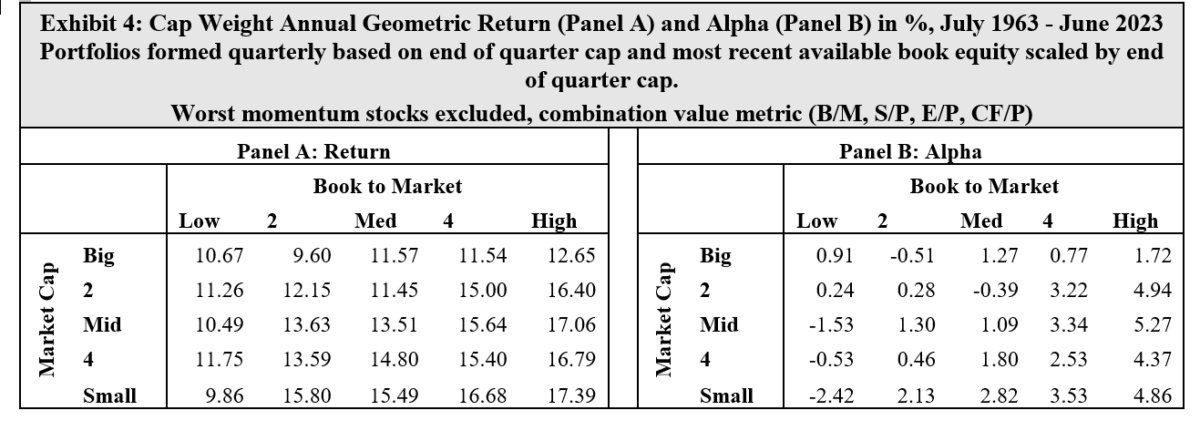

Now let’s consider two other important issues. The first is that book-to-market is just one way to measure value (and it’s not necessarily the best way, particularly because intangible capital now plays a much larger role in valuations). Other metrics such as price-to-earnings, price-to-sales, and price-to-cash flow not only have provided incremental information to the cross-section of returns, but while all these metrics are highly correlated, using multiple metrics have provided diversification benefits. That is why research-oriented investment firms such as Alpha Architect, AQR, Avantis, Bridgeway, and Dimensional do not rely solely on book-to-market to construct their value-oriented portfolios. The second is that the empirical research on momentum has led these same firms to incorporate momentum into their strategies (at the very least, screening out of their eligible universes stocks with negative momentum). The table below shows the results of screening out negative momentum stocks and using an ensemble of metrics to build value portfolios. Note that the largest value stocks dramatically outperformed the largest growth stocks, and their alphas are almost doubled that of the largest growth stocks.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Investor Takeaways

The finding that the recommendations from SA articles resulted in statistically significant risk-adjusted alphas (returns unexplained by conventional academic models using factors such as the market, size, value, momentum, profitability, and quality for equity portfolios) is surprising given that the empirical evidence shows how difficult it is for institutional investors such as mutual funds to show outperformance beyond the randomly expected (as can be seen in the annual SPIVA Scorecards) because of market efficiency. It is also surprising given that it has been well-documented that frequent trading by individuals and/or their overconfidence renders their trading unprofitable. In addition, the body of evidence demonstrates that naive retail investors can be easily convinced they have an edge—they know something the market hasn’t yet incorporated into prices.

With that said, there are many papers devoted to extracting information from text using natural language processing models. Their results could be considered a form of sentiment, of which momentum is another example. Sentiment tends to work in the shorter term and reversals in the longer term. In that sense, perhaps the results are not all that surprising.

Another takeaway is that it is often a long way from concept (the recommendations) to implementation—acting on the recommendations and not imposing one’s own judgment. In addition, the study did not include any of the trading costs of implementing the recommendations, which at least would have reduced the alphas found.

Finally, the exhibits presented showed that at least some of the findings on alpha generation can be explained by the fact that SA articles tend to focus on large growth stocks. However, they also showed that by incorporating empirical research findings (screening for negative momentum and using other value metrics besides book-to-market) to intelligently design portfolios (as well as using patient trading strategies), significant value added (structural alpha) can be created—not all value indexes/systematic funds are created equal.

Larry Swedroe is the author or co-author of 18 books on investing, including his latest Enrich Your Future.

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based on third party data and may become outdated or otherwise superseded without notice. The opinions expressed may change without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined the accuracy, or confirmed the adequacy of this article. LSR-24-648

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.