Direct from BOOM Finance and Economics at the links below

Hat Tip to my colleague at BOOM Fin4ance and Economics Substack (Subscribe for Free) – also on LinkedIn and WordPress. Covid Medical News Network CMN News BOOM Blog and All Editorials (over 5 years) at BOOM Finance and Economics | Designed for Critical Thinkers — UPDATED WEEKLY (WordPress.com)

BOOM Finance and Economics seeks out the very best information from authoritative sources and strives for consistency in its quality and trustworthiness. Over 5 years, BOOM has developed a loyal readership which includes many of the world’s most senior economists, central bankers, their senior advisers, fund managers, and academics. If you want a real edge in understanding the complex world of finance and economics, subscribe to BOOM on Substack or as a Follower on LinkedIn.

BOOM EDITORIAL THIS WEEK

JARED BERNSTEIN HAS NO CLUE WHATSOEVER? Jared Bernstein is the Chairman of the Council of Economic Advisers to President Joe Biden. An interview was recently published on Twitter/X. It shows Jared Bernstein unable to explain how the US Government finances itself. He dithers and stumbles forward. BOOM was shocked by the lack of knowledge, the confusion, and the inability to explain US Government finances. https://twitter.com/FindingMoneyDoc/status/1786050601236779078

Biden’s economic advisor, Jared Bernstein turns into a bumbling mess after he’s asked why the government borrows money if they can keep printing it. We are so screwed. https://twitter.com/CollinRugg/status/1786467722790048050

As well as President Joe Biden’s chief economic advisor, Bernstein was also a senior fellow at the Center on Budget and Policy Priorities from 2009-11. Bernstein was the chief economist and economic adviser to Joe Biden when he was Vice President in the Obama Administration.

He is an ex-Jazz musician, who graduated with a bachelor’s degree in music from the Manhattan School of Music where he studied double bass. He also earned a Master of Social Work from Hunter College and a DSW in social welfare from Columbia University’s School of Social Work.

However, somehow, in 1992, Bernstein started working as a senior official at the Economic Policy Institute (EPI), a liberal think tank with a focus on issues affecting low and middle-income working people. In 1995-96, he served at the United States Department of Labor as Deputy Chief Economist. He then returned to the EPI, as senior economist and director of the Living Standards Program.

Bernstein sits on the Congressional Budget Office’s advisory committee and contributes to the financial news network, CNBC. It all sounds like the stellar career of an economics expert. Until this was published on Twitter/X; fortunately, it will not be censored.

QUOTE from the Twitter Post: “Biden economic advisor Jared Bernstein turns into bumbling mess after he’s asked why the government borrows money if they can just keep printing it. We are so screwed.” Question: “They print the dollar. So why does the government even borrow?

Bernstein: “Well, so the, I mean again, some of this stuff gets some of the language that the mmm, some of the language and concepts are just confusing. … The government prints money and then it lends that money by selling bonds. Is that what they do? They, they, they, yeah, they, they, they sell bonds. … So, yeah, I, I, I guess I’m just, I don’t, I can’t really talk. I don’t, I don’t get it. I don’t know what they’re talking about.”

BOOM TO THE RESCUE — THIS IS HOW IT WORKS, JARED – THE FED DOES NOT “PRINT MONEY.” BOOM can offer some help and clarity to Jared (if he cares enough to learn) and others if needed.

The Federal Reserve is America’s central bank. Its job is to manage the US money supply, 98% of which is digital at origin and begins life on electronic banking ledgers. That credit money is (mostly) created by commercial banks whenever they extend a new loan to a willing borrower. The loan is denominated in the nation’s currency.

Physical cash, when issued by the US Treasury, makes up the remaining 2% of the money supply at origination. Many people say the Fed “prints money.” But the Fed doesn’t have a printing press that cranks out physical currency. Only the US Department of Treasury can do that.

The Bureau of Engraving and Printing (BEP) is a government agency within the United States Department of the Treasury. It designs and manufactures U.S. physical currency (cash) and securities (Treasury Notes, Bills, Bonds, and TIPS). One of its major goals is to prevent counterfeiting. The currency’s design also conveys dignity, the power of the U.S. economy, and familiar markings distinguish it be American. The BEP uses distinct designs, paper, and ink. It added subtle background colours to improve security in 2003.

The BEP at the Treasury prints physical dollars (currency/cash), referred to as Federal Reserve Notes (FRN), each year for delivery to the Federal Reserve Banking System and distribution to the commercial banking system. The BEP also redeems Notes that are physically damaged or mutilated.

The Federal Reserve operates as the nation’s central bank that ensures adequate amounts of physical currency and coins are distributed into circulation. It also (indirectly) manages the volumes of digital credit money that exist on commercial bank ledgers. It does that via the overnight official interest rate setting by the FOMC (the Federal Open Market Committee).

Rarely (very rarely), does the Fed engage in QE (Quantitative Easing) when it purchases Treasury Securities from the US Treasury or the open market. It funds QE through the expansion of Banking Reserves within the banking system. The central bank can sell the assets purchased under a QE Program into the open market whenever it wishes. The US Government spends the proceeds of its Bond sales from QE into the economy to provide extra economic stimulus.

The BEP does not produce coins; all U.S. coinage is created by the United States Mint. The US Mint is a bureau of the Department of the Treasury. The US Government’s Treasury Department can (and does) print physical US Dollar notes (at the BEP) and also mints coins (at the US Mint).

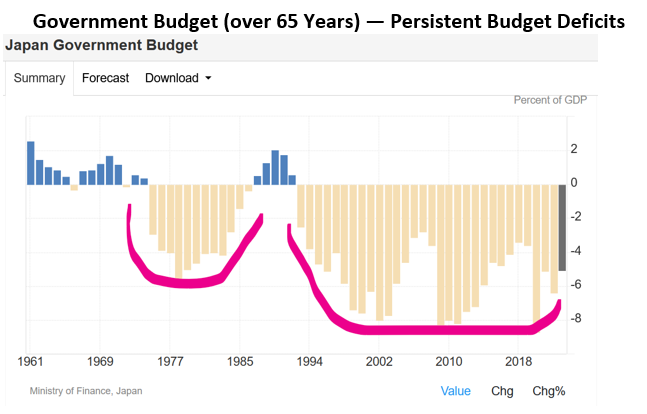

When the government spends more than it receives in taxation revenues, it creates a Budget Deficit. It finances the excess spending through the issuance of Treasury Securities (T-Notes, T-Bills, and T-Bonds) to willing investors. These securities are contractual promises made by the US Government.

Most nations do similar in order to finance their budget deficits. Remember, QE is a rare event and the volumes of money involved in QE are relatively small over time compared to the normal cumulative sales of Government securities that occur every year and compared to the cumulative amount of GDP over time. That video of Bernstein bumbling is now public knowledge. There are many articles in the mainstream media critical of Bernstein’s performance. It cannot be censored.

JAPAN IS AN EYE OPENER — ECONOMIC AND FINANCIAL ASPECTS

They live with the constant risk of death from earthquakes, volcanoes, and tsunamis. Somehow, they contain their anxiety about these risks. They will manage it if and when it comes and many will (clearly) not survive. That reality of nature challenging their existence is a constant threat that tends to have a sobering effect.

They are pragmatic and always ready to help. Everything is super efficient. It is almost the exact opposite of what their nation was before and during WW2. Housing is functional and varies in quality.

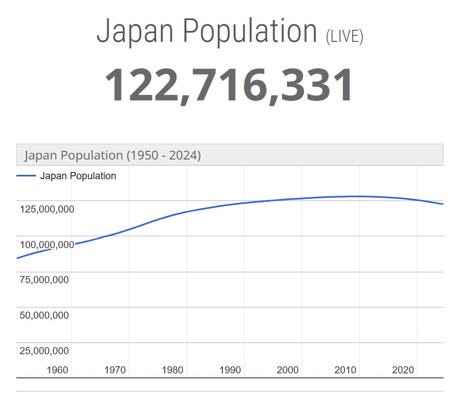

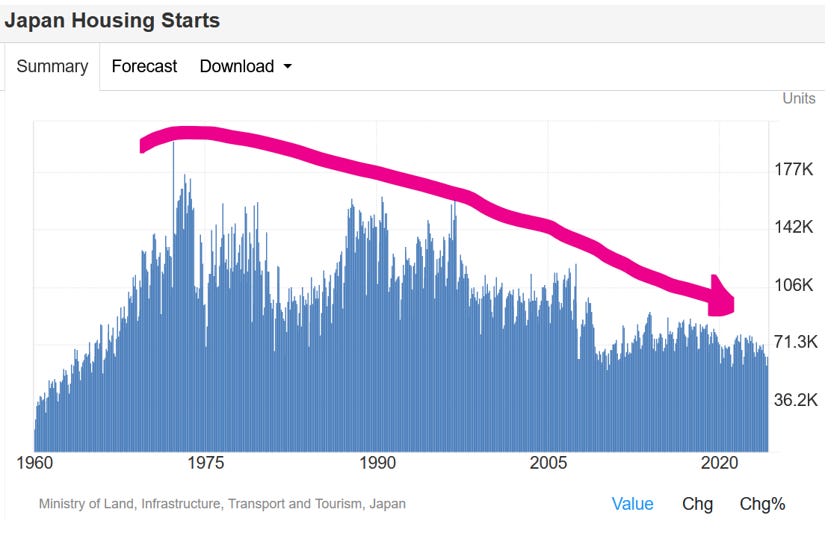

Good leadership in a monoculture is probably the key to understanding much of that. However, the Japanese realise that they live in a very uncertain and threatening natural environment. So they are willing to work cooperatively, together as a team. But they know what happened in the past when compliance with poor leadership left their nation almost destroyed. The total population peaked in 2009 at just above 128 million. Since then it has declined to 122.5 million. That is a 4.3% contraction from the peak. The current annual rate of decrease is 0.54%.

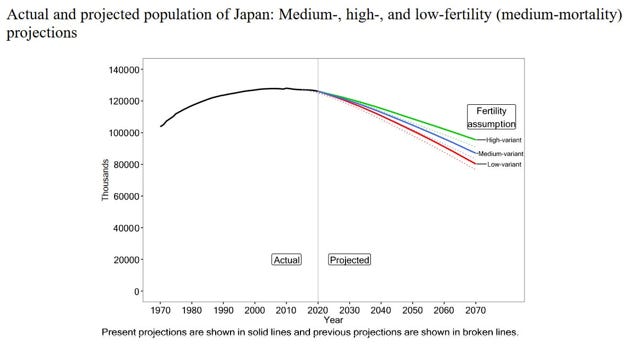

Japan’s population is projected to decrease by 30% in 2070, and the population aged 65+ will then make up about 40% of the population. The percentage of the population aged 65+ is currently just below 30% (in 2020). While the projected future total fertility rates are lower than those in the previous revision released in 2017, the pace of population decline should slow slightly due to an increase in life expectancy and a rise in net migration of non-Japanese nationals.

Compared to the previous projections in 2017, the 2023 revision expects a further decline in fertility, a slight increase in life expectancy, and a rise in net migration. Over the next 50 years, the total population is projected to decrease to nearly 70% of the current level (medium-fertility/medium-mortality scenario). This decrease will have significant economic impacts.

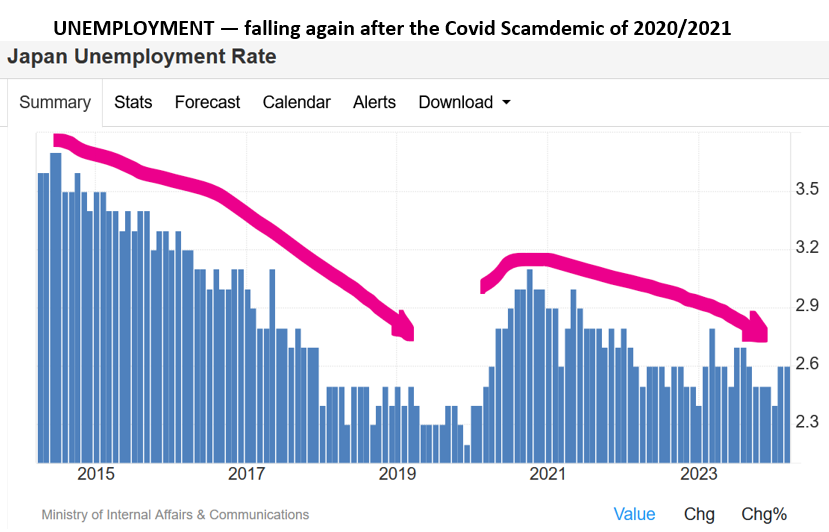

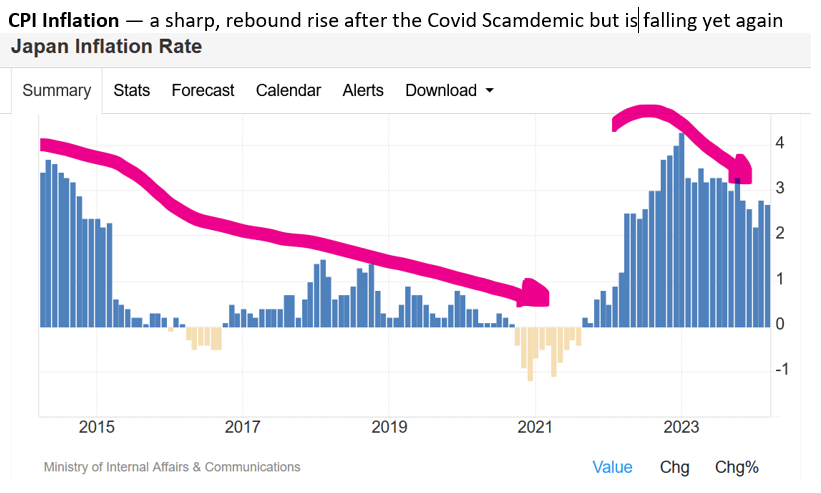

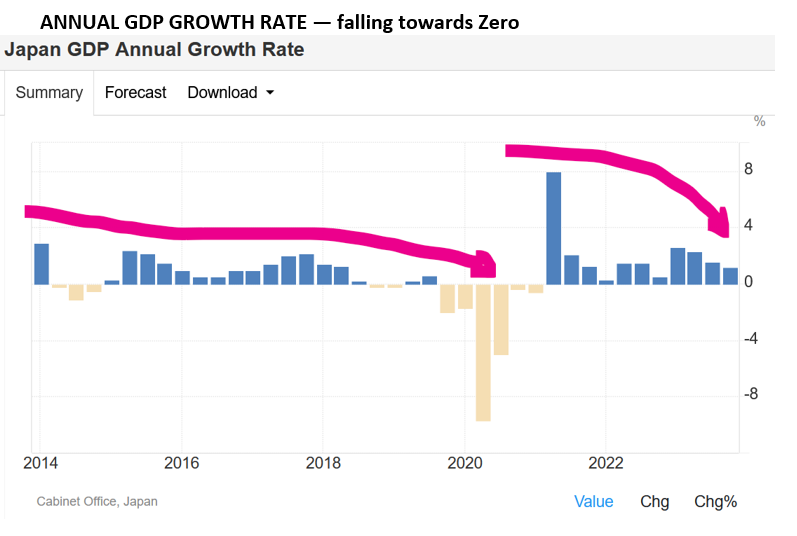

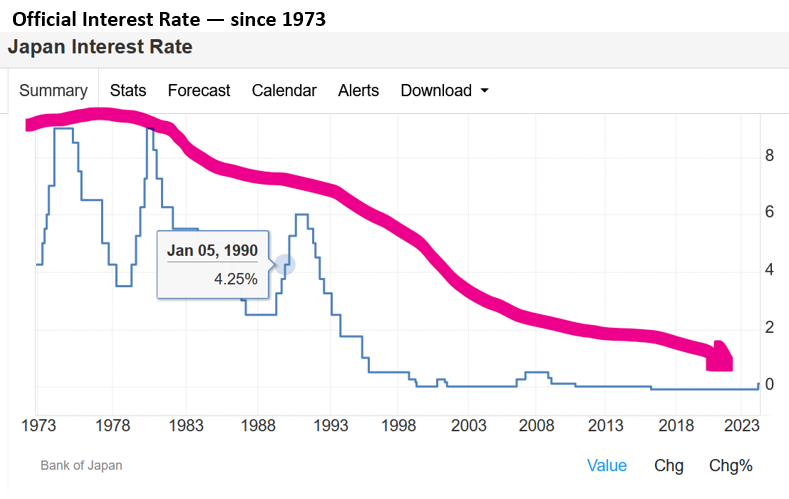

No Western, advanced economy has ever experienced such a scenario. The Money Supply will inevitably fall in response to falling demand for bank credit. CPI dis-inflation (or deflation) and asset price deflation will be an inevitable and persistent reality. Thus everything should either fall in price (deflation) or a decline in the rate of increase in price (dis-inflation). The economy is destined to contract. De-growth is the new paradigm. Low CPI inflation and low interest rates could become the norm. Unemployment should remain low.

The Japanese government has reformed its immigration policy to encourage more migrant workers in recent years. However, there are a lot of other nations competing for those migrants. So any increased population numbers from migration will be marginal over time and therefore in economic terms insignificant.

In such a situation, the currency exchange rate on international markets could decline as demand volume for the yen falls. These declines are all in anticipation of the de-growth to come.

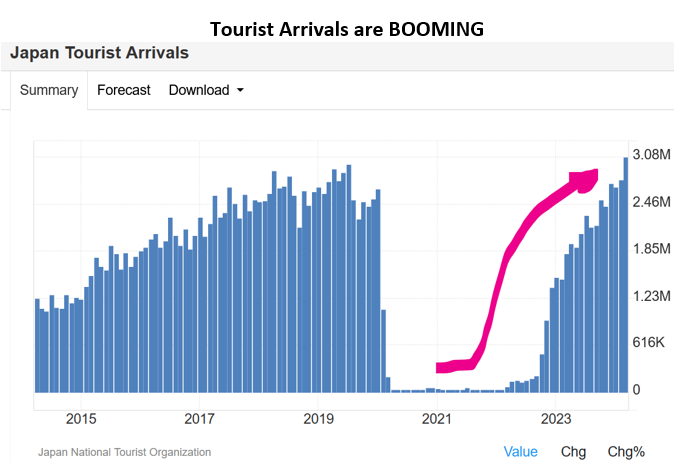

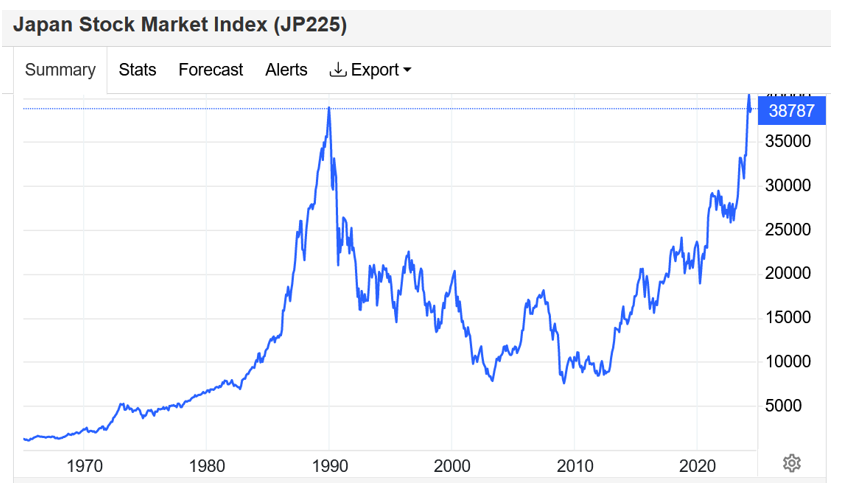

De-growth is a reality now in Japan. The process cannot be stopped. So far, the people appear to be benefiting from it. Their standard of living is high with abundant food, goods, and services being readily available and employment levels high. Is this the future for all advanced economies?

Banking Profits are good considering the contraction in population numbers, it is logical to expect falling GDP, low unemployment, and low CPI inflation to continue in Japan. BOOM is expecting that credit expansion will eventually not respond to low interest rates and then the profitability of Japanese commercial banks should start to fall. However, that is not evident yet. Japanese banks are still in the Top 10 based on total profits and profits per person.

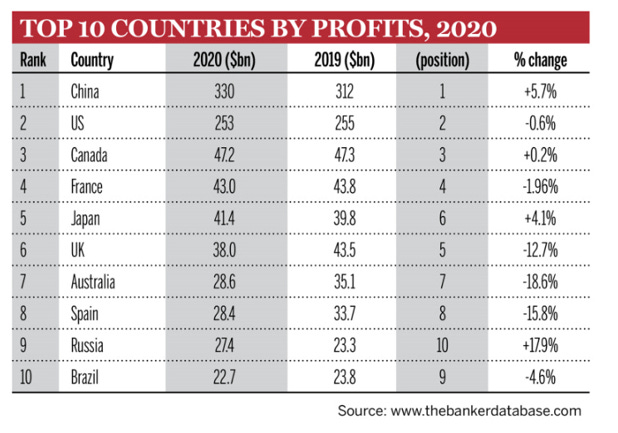

Banking profits can be analysed in many ways. However, let’s look at banking profits in the Top 10 Nations, and then compare those profits on a population basis, Japan is in the middle of the pack.

Bank Profits (2020) on a Population Basis (UN Estimate 2022):

- China US$330bn/1.4bn pop. = $235 per person

- United States $253bn/340 million pop. = $744 (pp)

- Canada $47.2bn/38.4 million pop. = $1,230 (pp

- France $43bn/64 million pop. = $671 per person (pp)

- Japan $41.4bn/124 million pop. = $333 (pp)

- United Kingdom $38bn/67.5 million pop. = $562 (pp)

- Australia $28.6bn/26 million pop. = $1,100 (pp)

- Spain $28.4bn/47.5 million = $597 (pp)

- Russia $27.4bn/144 million = $190 (pp)

- Brazil $22.7bn/215 million = $105 (pp)

Thus, the most profitable commercial banks in the world are in the following order based on a per capita basis:

- Canada $1,230 per person (pp)

- Australia $1,100 (pp)

- United States $744 (pp)

- France $671 (pp)

- Spain $597 (pp)

- United Kingdom $562 (pp)

- Japan $333 (pp)(pp)

- China $235 (pp)

- Russia $190 (pp)

- Brazil $ 05 (pp)

We can also compare Bank Profits per capita on a Total Nominal GDP basis (2022 World Bank estimate) — the list then becomes a comparison of ratios.

- Australia — $1,100/$1.675tn = 656

- Canada — $1,230/$ 2.14tn = 574

- Spain — $597/$1.4tn = 426

- France — $671/$ 2.78tn = 241

- United Kingdom — $562/$ 3tn = 187

- Russia — $190/$ 2.24tn = 84

- Japan — $333/$ 4.23tn = 78

- Brazil — $105/$ 1.9tn = 55

- United States $744/$ 25.4tn = 29

- China — $235/$ 18tn = 13

Australian Bank profits per capita and each Dollar of GDP rise to the top of the list. China falls to the bottom. Japan holds its position at #7, above Brazil, the United States, and China. The US falls dramatically from 3rd position to second last. China is last which is exactly what you would expect from a communist nation that runs a Potemkin Village of commercial banks.

BANK PROFITS AS A PERCENTAGE OF TOTAL GDP Another way of thinking about Banking profits is to consider the total Bank Profits as a percentage of Annual National Nominal GDP (the total value of goods produced and services provided in a country during one year). For example, in Banking Profits as a percentage of Annual GDP; Japan falls to the bottom of the pack. Perhaps this is a sign of weakness for the future.

- Canada, 2.2%

- Spain, 2.02%

- China, 1.8%

- Australia, 1.7%

- France, 1.54%

- UK, 1.266%

- Russia, 1.2%

- Brazil, it is 1.2%

- USA, about 1%

- Japan, 0.98%

PRE-PROGRAMMING HOW THE BRAIN WORKS — YOU CAN BE CONTROLLED — EASILY. Watch as this young man as he is so easily hoodwinked:

IS THIS CORRUPTION REVEALED? — THOUSANDS OF MEDIA DOCTORS PAID BY THE BIG PHARMA COVID VACCINE COMPANIES. Watch how these “independent” doctors provide their advice to TV viewers in the UK. 350 Comments — Here’s just one:

“These are monsters. So many of them are in the “public service”. These greedy freaks have destroyed all confidence in the medical “industry”. It’s Horrifying.”

BOOM’s QUANTITATIVE BOOSTING FOR THE PEOPLES MONEY EXPLAINED: https://boomfinanceandeconomics.wordpress.com/2019/12/15/boom-as-at-15th-december-2019/ AND BOOM’s Perfect Economy: https://boomfinanceandeconomics.wordpress.com/2020/01/18/boom-as-at-19th-january-2020/

COMING NEXT:

- The Financial Jigsaw Part 2 – NORTH versus SOUTH – Saturday, May 26, 2024

- BOOM Weekly Global Review – Tuesday, May 28, 2024

- Letter from Great Britain – BRITAIN’S BLOOD FEUD – Saturday, June 1, 2024 – (Andrew Briden MP)

In economics, things work until they don’t. Make your conclusions and do research. BOOM does not offer investment advice.

CLICK HERE FOR PODCASTS: OUR BRAVE NEW ECONOMIC WORLD

BANKS DON’T TAKE DEPOSITS, THEY BORROW YOUR MONEY: LOANS CREATE DEPOSITS — this is how almost all new money is created in the economy (by commercial banks making loans). https://www.bankofengland.co.uk/quarterly-bulletin/2014/q1/money-creation-in-the-modern-economy. Watch the short 15-minute video and see Professor Richard Werner brilliantly explaining how global banking systems work.

In 2014, Richard Werner provided the first empirical evidence that banks create credit out of thin air. They do this whenever they issue a loan or, more specifically, purchase a promissory note. This is a walk-through of exactly how they do it.

Many economists are unaware of this and even ignore the banking & finance sectors in their econometric models.

DISCLAIMER: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that website or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any neither securities or investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources that are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. By Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Thankyou for the Paul Weston video share.

That was a darn good vid!

There is nothing wrong with Japan having a smaller population…currently, Japan imports 40% of its food…One day, that won’t be possible…

Correct P, Like the UK, “Japan has few natural resources, and its agricultural sector remains heavily protected. Japan’s main imports include mineral fuels, machinery, and food.” “The U.S. is a major supplier of food products all over the world, providing stable annual production at least thus far). Japan’s food self-sufficiency rate is 38% Japan is dependent on imports, and thus sensitive to trade disruptions.”

In the UK “Production was at 60% for all food and 73% for indigenous foods, changing from 61% and 74% in 2021. The UK relies on imports for roughly 40% of its food.” But if HMG got out of the way, the UK could be self-sufficient in food as was almost the case during the war when I remember “dig for victory” LOL.

Thank you for your articles Peter.

You explain things well.

With the possible coming mass die off of the essential personnel who were required to be poked, along with the mass infiltration of western countries with non westerners I would say the west lost the asymmetric war of disinfo and dis~injection.

Essential personnel=Death of the firstborn of Egypt.

Fauci/Vaccination=Angel of death.

The vaccine side effects=Pandemic which kills one third of the earth.

Immigrant invasion=Locusts with heads of men, birds of heaven to a feast.

Peace.

Yes, the West has no way of competing with the Global South (85% of the global population). https://www.unz.com/pescobar/the-russia-global-south-connection-africa-as-strategic-partner/?utm_source=email&utm_campaign=pescobar

I didnt see it in the article… Did you happen to mention that Japan is a CREDITOR nation and owns more US debt than any other nation?

Japan has been begged and then coerced NOT to sell US debt at the destruction of their own economy.

I will never understand how there are these proclamations of ‘know finance and economics’ by reading BOOM when this guy knows barely more than the chief econo advisor to the president.

It takes more than reading Austrian Economists takes on economics to actually understand what is going on in the world. Of course, since 99% of the people that read from these alternative sites do not have a clue about debt, money or any of the financial system, then the author can sound insightful.

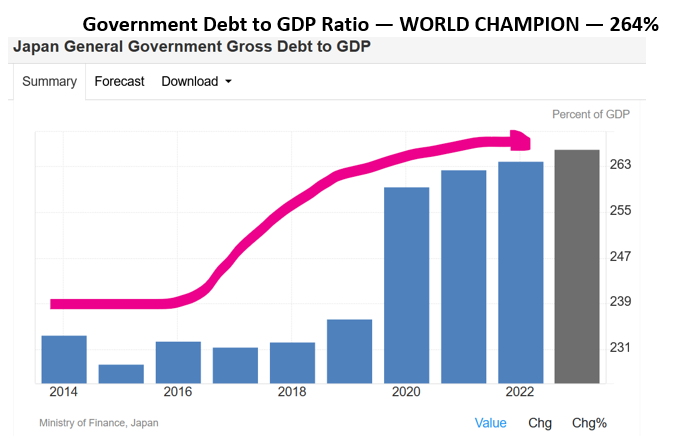

Yes, BOOM thinks that the higher the national debt, the better the country will perform. “As of March 2023, the Japanese public debt is estimated to be approximately 9.2 trillion US Dollars (1.30 quadrillion yen), or 263% of GDP, and is the highest of any developed nation; 43.3% of this debt is held by the Bank of Japan.

I disagree with BOOM as I am Austrian in economics, but not pure. I do not agree with 100% commodity-backed money, but I do believe in sovereign money (cash) and credit money 50/50 balance ideally. BOOM wrote about it long ago: