The shares of Harley Davidson Inc. (NYSE:HOG) are down about 12% over the past year, and in my view, that represents an excellent entry price for investors. I'll go through my reasoning below by focusing on the financial history here, and by modeling future price based on a reasonable dividend forecast. I'll then make a comment about the stock and its relative valuation. In my view, investors should buy Harley Davidson at these levels.

Financial Snapshot

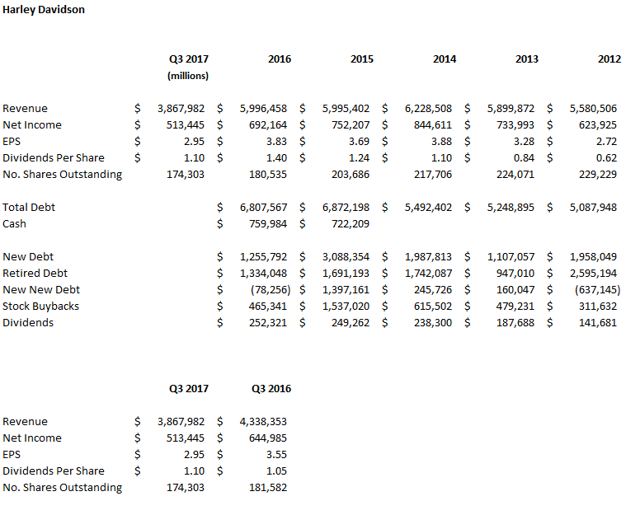

A quick review of the financial history here indicates that Harley Davidson is a relatively volatile business. Both the top and bottom lines have risen and fallen (sometimes dramatically) over the past five years.

I'm not surprised by the fact that this business is affected by the business cycle, though. What I'm impressed by is the fact that in the teeth of this volatility, management has treated shareholders very well. Specifically, over the past five years, management has returned about $4.5 billion to shareholders. Just over $1 billion of this was in the form of dividends, and the balance came from share buybacks. It's for this reason that the share count has declined at a CAGR of about 4.9% over the past 5 ¾ years. This is critical to my mind, because if a management team isn't shareholder friendly I'm almost guaranteed a capital loss. The fact that management of Harley Davidson is shareholder focused is a necessary (though not sufficient) reason to invest.

Turning to the balance sheet, there is a tremendous amount of debt on hand, but I'm not that worried about it because the interest expense is just under .5%. This is a ludicrously low interest burden and suggests to me that the company should actually not pay down debt. Additionally, I take some comfort in the fact that fully 23% of it is due in 2021 or later.

Turning to the balance sheet, there is a tremendous amount of debt on hand, but I'm not that worried about it because the interest expense is just under .5%. This is a ludicrously low interest burden and suggests to me that the company should actually not pay down debt. Additionally, I take some comfort in the fact that fully 23% of it is due in 2021 or later.

Modelling the Dividend

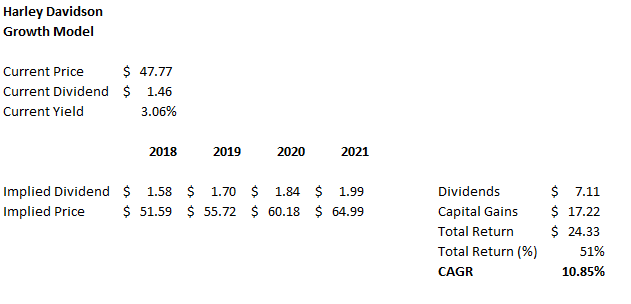

Though investors may find the financial past of a company interesting, they are buying a future and for that reason I must spend some time forecasting what I consider to be a reasonable future here. When I perform a forecast, I engage in a ceteris paribus assumption. This means that I hold all variables constant but one. I'll "move" the dividend at its historical rate, and infer something about likely price based on that.

The dividend per share has grown at a CAGR of about 17% over the past six years. While I consider this a sustainable rate for the short term, I'll be more conservative with my forecast, and assume a dividend per share growth rate of about 8% going forward. When I perform this forecast, I infer a CAGR for the shares of just shy of 11%. I consider this to be a very reasonable return for the risks of investing in this iconic brand.

The dividend per share has grown at a CAGR of about 17% over the past six years. While I consider this a sustainable rate for the short term, I'll be more conservative with my forecast, and assume a dividend per share growth rate of about 8% going forward. When I perform this forecast, I infer a CAGR for the shares of just shy of 11%. I consider this to be a very reasonable return for the risks of investing in this iconic brand.

Technical Snapshot

As per our ChartMasterPro Daily Trade Model, the trend for HOG would turn bullish with a daily close above $47.50. This would signal a bullish breakout from a downtrend channel on the daily charts which began on September 27. The shares found support at the $45.50 level and bounced from there after announcing earnings. From here, we see the shares climbing to the $53.00 level over the next three months.

Today we will buy HOG call options which will provide us with approximately 14x leverage on our long trade. Our initial stop-loss exit signal will be a daily close below $46.50.

For investors in the shares, we recommend that you hold for three months or $53.00, whichever comes first. For longer-term investors (years, not months), we believe HOG is a solid addition to any dividend growth portfolio over the next four years.

Conclusion

For better or worse, investors don't usually access the future cash flows of a given business directly. They buy those future cash flows in the capital market, and those market act according to rules that don't seem to make sense. The shares may swing up and down wildly, relative to the fortunes of the underlying business. In my view, it makes sense to invest when other investors are pessimistic about the business. Doing so allows me to buy shares when they are inexpensive, and this insulates me against downturns in the business. At the moment the shares of Harley Davidson are trading at a significant (45%) discount to the overall market. Additionally, the shares are trading at an inexpensive valuation relative to their own history:

Given the friendly management, the possibility of share appreciation supported by dividend growth and the fact that the shares are objectively cheap, I think long term investors would be wise to buy Harley Davidson at these levels.