Beware! The “LSF9 Master Participation Trust” Is Operating As A Secret-Agent.

Since 2014, assignments began appearing from JPMorgan Chase Bank to “U.S. Bank Trust, N.A., as Trustee for LSF9 Master Participation Trust” as shown here: lsf9-assignment

Very little information is available regarding this named trust, other than its registration in July of 2014 in the State of Delaware. Homeowners, frustrated by last-minute Plaintiff/Defendant name switches from Chase to this Trust, and by a complete lack of transparency regarding the identities of those involved with this Trust, have been stonewalled in discovery and steamrolled by the Courts who continue to rule, based upon a presumption, that this “LSF9 Master Participation Trust” is a legitimate assignee trust with beneficial rights to the loans. Not so fast.

In the case involving this particular assignment, evidence has surfaced that shows the “LSF9 Master Participation Trust” is in fact not a trust holding beneficial rights to the Defendant’s loan, but rather it is an undisclosed “Participation Agent” for yet more undisclosed investors. In essence, the named assignee and Plaintiff in this case, “U.S. Bank Trust, N.A. as Trustee for LSF9 Master Participation Trust” is nothing more than a sham. It is a trustee / fiduciary purporting to represent a secret agent disguised as a trust, to which this secret agent appears to be acting on behalf of undisclosed investors, and those undisclosed investors are apparently represented by “U.S. Bank, N.A. as the Indenture Trustee;” not “U.S. Bank Trust, N.A.” Sound confusing? It should, because that is their intention – to hide and obfuscate the real parties in interest and their true authorities.

Take a look at the cover page for the “Securitization Servicing Agreement” provided by the Plaintiff “U.S. Bank Trust, N.A. as Trustee for LSF9 Master Participation Trust.”

Notice that the “LSF9 Master Participation Trust” is delegated with the capacity “as Participation Agent.” It is not the actual trust where the subject loan appears to have been pledged. This was intentionally withheld in the assignment for reasons set forth more fully below. You can also see that “U.S. Bank, N.A.” is delegated as the “Indenture Trustee” for the actual Trust – “VOLT XXVII Asset-Backed Notes, Series 2014-NPL7” to which this Trust is not the assignee and is not the named Plaintiff.

Still, in furtherance of the deceit, Caliber’s witness submits this affidavit with the following: caliber-servicer-affidavit-clip

This is clearly a false affidavit, as Caliber is named as the servicer for “U.S. Bank, National Association, as Indenture Trustee for VOLT XXVII Asset-Backed Notes, Series 2014-NPL7” according to the “Securitization Servicing Agreement.”

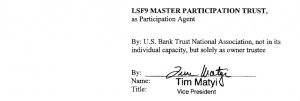

Now, below are the signatories to this agreement. Notice it is not signed by any officer of “LSF9 Master Participation Trust, as Participation Agent.” Instead, it is signed by “Tim Matyi – Vice President – U.S. Bank Trust National Association, not in its individual capacity, but solely as owner trustee.” Not only is this party not named in the agreement, but there is no “Power of Attorney” or “Attorney-In-Fact” accompanying this signature, AND, it appears that “Tim Matyi” is Vice President of both “U.S. Bank Trust, N.A.” and “U.S. Bank, N.A.”

[These are different entities by the way. See subsidiary list here: https://www.sec.gov/Archives/edgar/data/36104/000119312512075125/d261300dex21.htm]

In addition, “U.S. Bank Trust, N.A.” also failed to identify its apparent capacity in both the assignment and as the named Plaintiff which should have included, “not in its individual capacity, but solely as owner trustee.”

The fact that the “LSF9 Master Participation Trust” is just a “Participation Agent” is a major clue that the loans claimed as owned by this entity are likely involved in “Loan Participation Agreements,” as is self-evident by the words “Master Participation Trust.” So, what exactly are “Loan Participations?” I believe the following article and excerpts may shed some light as to why the named assignee / Plaintiff is missing its capacity language “as Participation Agent.”

The risks and rewards of multiple lender financings: loan participations and syndicated loans

http://www.lexology.com/library/detail.aspx?g=2f1b5567-fdf3-483f-982d-1fb41a6d9810

________________________________

- Loan Participations

In a loan participation, the originating lender transfers all or part of its interest in a loan to a participant pursuant to a participation agreement. The participation agreement defines the rights and obligations between the participant and the originating lender, including the participant’s rights, if any, to direct the originating lender’s actions and decisions regarding material aspects of the loan. The participant purchases an economic interest in the financing arrangements and is typically entitled to share in the economic benefit thereof, i.e., the right to receive principal and interest payments, and collect certain loan fees, while undertaking the obligation to fund any additional loans on behalf of the originating lender as required by the underlying credit agreement between the originating lender and the borrower.

In most participation agreements, the originating lender’s interest in the loan is sold outright to the participant, and the originating lender does not become an agent, trustee, or fiduciary of the participant. To ensure such a relationship is not impliedly created, the participant agreement should expressly provide that the relationship between the lender and the participant is that of a buyer and a seller, and the intention of the participation is to transfer full economic rights from the lender to the participant without the creation of a fiduciary or agent relationship.

Importantly, the borrower remains directly obligated to the originating lender under the credit agreement between the originating lender and the borrower, notwithstanding the loan participation. The participant does not become a party to the credit agreement and does not have any direct contractual relationship with the borrower. As a result, the participant does not maintain any direct claims against the borrower or any collateral securing the loan.

III. Benefits and Risks of Loan Participations

In a participation, the participant has no direct rights against the borrower, but does not have any direct obligations under the loan agreement (e.g., commitment to lend).

Participations may create value for the lender, especially in a distressed situation, by creating a market for the beneficial interest, while allowing the lender to remain the record owner of the loan for purposes of maintaining its relationship with its client.

By selling the participation, the lender is able to reduce its credit risk in the loan while adding another source of financing for the borrower in the event that the terms of the credit agreement require additional funding. Simultaneously, the sale of its beneficial interest allows the lender to realize capital while permitting the lender to use the proceeds of the sale to take advantage of new lending opportunities.

However, the participation can prove to be quite burdensome on the lender. Understandably, given the rights at stake, participation agreements can be quite complex and require substantial negotiation.

Further, servicing the participation can prove a challenge for the lender. Since the lender is the intermediary between the borrower and the participant, the lender may spend much time and effort transferring funds received by the borrower or advanced by the participant, or, to the extent required by the participation agreement, providing current information about the loan and the borrower to the participant.

Moreover, the participant may have the right to prevent material economic changes to the credit agreement. If the lender provides the participant with such veto rights, the participant, regardless of the size of its interest in the loan, may be able to block an entire restructuring of the facility. As the participation agreement must comply with the terms of the credit agreement, it is prudent for the lender to carefully analyze the terms and conditions of the credit agreement to ensure there are no inconsistent provisions.

From the perspective of the participant, because the participation agreement is solely between the lender and the participant, in most cases, the participant enjoys the benefit of purchasing a beneficial interest in the loan while keeping its anonymity. This allows the participant to shelter the existence of the participation relationship from the borrower, other lenders, and the global loan market. However, it is possible for the credit agreement to contain certain conditions upon the transfer of the lender’s beneficial interest in the loan, such as (i) requiring the borrower’s consent; (ii) requiring notice to the borrower; (iii) restricting the amount that can be transferred; and (iv) requiring that the participant be an eligible assignee.

While the participant may not have direct rights against the borrower, the participant can preserve its rights under the credit facility within the participation agreement. Significantly, participant agreements might allow the participant to prevent material amendments to the credit agreement and any material waivers of rights by the lender. It is also not uncommon for the credit agreement to provide the participant with third party beneficiary rights when participation is contemplated at the time the initial credit is extended by the lender.

As a legal matter, the participant is not in privity with the borrower and does not maintain any direct causes of action or rights of set-off against the borrower. Rather, the participant must generally rely on the lender to protect its rights. If the participation agreement does not provide the participant with the ability to force the lender to enforce remedies against the borrower, the participant could be left in a relatively weaker position.

________________________________

A lot more can be said about this, but it appears that these “participation agreements” may be at the root of all the secrecy and lack of transparency, as participants are not deemed “creditors” with rights against the borrower even though they may have purchased the loans – in secret. As I continue to drill-down on this, it just may be that the “participants” in whatever entity owns these loans, has no legal recourse against the borrowers, but are foreclosing anyway behind the veil of these deceptive assignments.

Bill Paatalo – Private Investigator – OR PSID#49411

Bill.bpia@gmail.com

(406) 328-4075

This is great work. Thank you for your dedication and superior knowledge regarding the massive fraud taken place.

I would highly recommend Bill as a great resource if you are facing “the banks”, who have stacked the deck

Thanks for spending time educating me today.

Hi Bill, I’m a first time tax lien investor, so I find this article very insightful. Upon my initial investigation prior to the bidding process, I was informed that there was no mortgage lien on the property, (the home owner had past away in 2009 and the family was not interested in the property) and the company Lareta, LLC (formerly Land America) was taking care of the taxes per the tax collector.

Out of nowhere, documents for LSF8 Master Participation Trust as the assignment of Mortgage is recorded received as of April 14 and May 30, 2014. In November 2014 there was no court record of this company on file. My claim was recorded 1/6/2015, LSF8 claim for Lis Pendens- Amended was recorded 1/30/2015.

My intent is to foreclose on the property. So my question is, based on the article, can this company be legally removed as a contender?

Thanking you in advance. Please advise. Esther

Some of these robo “signature” attempts make me chuckle. The 1st two are clearly the same person. No question about it. But it seems the alleged Vice President of US Bank “Tim Matyi” doesn’t even know how to spell his own last name.

Man, I would love to be the deposing Attorney.

So, ehm… um… Mr. “Watyi” is it? or do you prefer “Matyi”?! lol.

In fact, I’m willing to bet that all 5 of those signatures were done by the same 1 person.

That’s not even the name of the CEO for Caliber Home Loans. lol.

So, it appears that the Volt LLC is the underwriter? The trusts, REMIC and Delaware Statutory Trusts always have the name of the depositor in them. LSF stands for Lone Star Funding which would have to be the depositor.

Now, these DST’s suffer from the same failures as REMICs. The notes are never actually endorsed and they use the same fake assignments. REMIC assignments always fail to mention the Depositor which is the only entity that can deposit ANYTHING into the trust. They go from original lender directly into the trust. The original lender is NEVER EVER a party to the trust and can’t deposit anything into the trust vehicle.

The only reason original notes are endorsed in blank is because the original lender did not know what sponsor was going to purchase them or what trust they would be going into.

I also argue that the original lender, a non-party to the trust, can not use a blank endorsement that is effective beyond the sponsor of the trust.