AAC Holding's (AAC) main defense since the news that Jerrod Menz and serveral others as well as the Forterus subsidiary were indicted on second degree murder has been that the coroner's report stated that the patient died of natural causes. New evidence from the Grand Jury has surfaced however that reveals that this defense is questionable as the lead coroner believes that the patient would still be alive if he had access to supplemental oxygen. Further testimony describes eyewitness accounts of Jerrod Menz fleeing the scene of the crime with a garbage bag full of "house meds."

AAC's Defense

From the first day that the news broke, AAC's main defense has been that the coroner ruled that the patient had died of natural causes.

On the second quarter conference call:

"We firmly believe that the California Department of Justice case is without merit. We will vigorously defend the company and each individual in court. The case involves the death in 2010 of a client who was found dead of natural causes in his room the morning after he checked into one of our facilities."

And later on that same conference call:

"We are not currently aware of any evidence that the company or any of these individuals charged were responsible for the resident's death. The coroner concluded the client died of hypertension cardiovascular disease. The individual also had a history of chronic obstructive pulmonary disease according to a police report. The coroner made absolutely no findings that the death had anything to do with his treatment at our facility."

However, the Chief Coroner believes that the patient died from a lack of oxygen, not from natural causes.

In testimony from the Grand Jury, however, Riverside County Chief Coroner Dr. Joseph Cohen suggested otherwise. Dr. Fajardo did the first autopsy and concluded that the patient had died of natural causes. However, the Chief Coroner of Riverside County has a policy where in the case of an unattended death and there were pre-existing medical conditions, that an effort to find out whether or not the pre-existing medical conditions played into the death. However, in the case of the patient's death, Dr. Cohen concluded that Dr. Fajardo had not investigated the patient's previous medical condition. In his sworn testimony, Dr. Cohen stated that he believed if Dr. Fajardo had investigated the oxygen issues, the medical records, and the drug issues that he would have found that the patient died of a lack of oxygen.

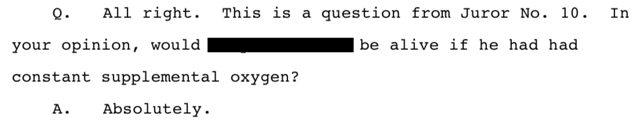

In one powerful exchange, Dr. Cohen states that the patient would still be alive if he had a constant flow of supplemental oxygen.

You can view the entirety of Dr. Cohen's testimony here, it starts on page 1279 and ends on page 1304.

Jerrod Menz Fleeing the Crime Scene

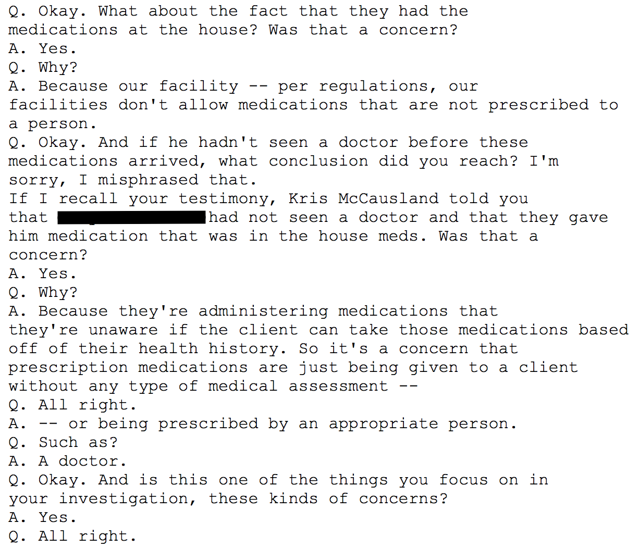

In the last article on AAC, the issue of the "house supply" of drugs was raised. At the time, Forterus and AAC would have a supply of drugs that had not been prescribed to the patients, but were used to detox patients before they had seen a doctor. AAC has never addressed these allegations.

Jose Ochoa's grand jury testimony tells the story of Jerrod Menz fleeing the crime scene after the patient's death with a garbage bag filled with prescription medicine.

According to testimony from Janelle Ito-Orille, who works for the California Department of Health Care Services, and now works there as a supervisor. In her testimony, she says that the drugs that Jerrod Menz was driving away from the facility with, should never have even been there in the first place.

You can view the full excerpt of her testimony here.

Jose Ochoa was a senior counselor at A Better Tomorrow [Forterus] at the time when the patient died. In his court testimony, he describes shocking scenes of Jerrod Menz fleeing the scene of the crime with a garbage bag that was filled with approximately 5 pounds of prescription medication. Again, it is worth noting that this is not some disgruntled former employee, but testimony in a court under oath. You can view the entirety of the exchange here.

Jose Ochoa was going to leave the Irongate facility and go to the Corning facility in a red truck. He spoke with Jerrod Menz and Jim Fent for 15-20 minutes before leaving and, according to Ochoa, the black 32-gallon trash bag filled with prescription drugs. When they were leaving, Jerrod Menz tossed the keys to his new Ford to Mr. Ochoa and took the black garbage bag to the red truck and drove off. At this time Ochoa testified that there were plainclothes detectives at the Irongate facility.

Ochoa drove Menz's new Ford to the Corning facility. Once there, Ochoa testifies that he saw the red truck in the parking lot, and when Ochoa entered the Corning facility he saw Jerrod Menz and the black trash bag, still filled with the medication.

Conclusion

Given that AAC's main defense all along has been that the patient died of natural causes, the revelation that the lead coroner believes that the patient would still be alive if he had access to supplemental oxygen is a huge deal. And Jerrod Menz's actions of leaving the Irongate facility simply add to the laundry list of sketchy and questionable things that AAC employees and the company have done.