Cisco Systems, Inc. (NASDAQ:CSCO) designs, manufactures, and sells Internet protocol networking and other communication and information technology related products. Cisco has long been a popular pick amongst Dividend Growth Investors (DGI), but does it still deserve a position in a DGI portfolio? With revenues unchanged since 2013, should an investor with no current position look to get involved with CSCO? In this piece, we will take a look at the company's most recent earnings compared to prior years, and also discuss the company's plan for future growth.

Source: Cisco Investor Relations

Recent Results

CSCO was a technology darling in the late 90's and early 2000s, with the company's market cap reaching $555 billion in 2000 during the dot-com period. A year later, the company saw their market cap fall to $151 billion as intense competition combined with weak consumer spending started taking its toll on the company. Fast forward to today, and not much has changed with the company's market cap sitting at $161 billion. Here is a snapshot at the company's most recent earnings release.

FY '17 | Y/Y Change | |

Revenue | $ 48,005 | (2.5%) |

Gross Margin % | 63.0% | 0.1 |

Operating Income | $ 11,973 | (5.4%) |

Net Income | $ 9,609 | (10.5%) |

EPS | $ 1.90 | (10.0%) |

Source: Information derived from company earnings

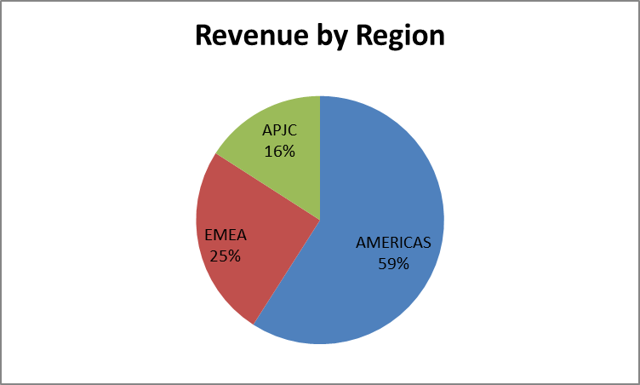

As mentioned above, the company's revenue is essentially unchanged since 2013, and dropped 2.5% from prior year to $48 billion. In addition, Operating Income and Net Income decreased 5.4% and 10.5%, respectively, over prior year. The company reports revenues through three regions: Americas, EMEA (Europe Middle East Africa), and APJC (Asia Pacific Japan China). Take a look below at how revenues were reported amongst various regions in 2017.

As you can see, the company relies heavily on the America's region for about 60% of total revenue, and the reliance has remained roughly the same over the past six years. The area where change is being seen and will continue to be seen is in the revenue segments. The company reports revenue through two segments: Products and Service. Cisco has long dominated the hardware space within technology, but due to fierce competition from the likes of Juniper Networks (JNPR) and Arista Networks (ANET), who have developed their own communication hardware devices, the ability to price these items at a premium similar to twenty years ago is much tougher. As of 2017, Cisco made 74% of their revenue from products compared to just 26% being service related.

Company Transition

Since CEO Chuck Robbins stepped in as the new CEO in 2015, replacing long time CEO John Chambers, he has steered the company towards more of a software company, spending billions on software and cloud services. During the company's 2017 Investor Day, Mr. Robbins laid out a plan to release its Internet-based Network solution that will have more focus on software networking, improving security, allowing Artificial Intelligence-based adoption, and more. These are just a few items that will add a growth engine to its slowing revenue stream to offset the reliance of its switching and routing hardware products. As such, since 2012, the CSCO has increased service based revenue from 21% to 26% of total revenues. Robbins understands the importance to shrink the company's reliance on hardware products and transition to a more subscription based revenue stream. The transition to more of a subscription based revenue stream should provide the company with a new growth engine, which could propel the company forward once the transition is complete.

The reason for the change is due to the fact of service revenue being more consistent due to its recurring nature. Service revenue tends to have high margins in the 60-70%, which should give a slight lift to the already high margins the company operates at.

The company also has been active when it comes to growth through acquisitions. In 2017, Cisco made the following acquisitions:

- AppDynamics - $3.7 billion

- Springpath - $320 million

- MindMeld - $125 million

- Observable Networks - undisclosed amount

These acquisitions are all related to CSCO's strategy to transition more to a software company, as they all relate to software networks, data centers, and security.

Valuation

Year-to-date the company is up 7.5% compared to the S&P 500 being up 12%. The stock has been trading sideways for the past four months between $30 and $32. Investors are trying to determine 1) Will the transition to a more service based revenue stream work? 2) Do they have the patience to wait for the company to turn things around? 3) Is the dividend still sustainable? and 4) Is the stock price attractive? All of these are great questions, so let's take a quick look.

As mentioned above, the service based revenue will provide a more stable income stream at high margins. The company already operates with high margin, but when economic growth slows, so does hardware sales, and by transitioning to more service based revenues will help eliminate the cyclical trend some.

Patience in management to properly steer the company in the right direction is at the discretion of the investor. An investor with a long time horizon may find the stock attractive as an income play as the company currently yields a dividend of 3.58%. Whether the stock is trading at an attractive price is another story, which we will look more into below.

As previously mentioned, the stock currently yields a dividend of 3.58%, which is about 12 basis points higher than the five year average of 3.46%. Excluding the 2012 raise of over 120%, the company has increased their dividend 15% per year on average, which is a healthy raise each year from an income investor point of view. Part of the reason the company has been able to increase their dividend at such a healthy pace is due to the fact the company has nearly $70 billion in cash overseas. Currently the company has a payout ratio (using diluted EPS) of 61%, which is the highest over the past five years. The payout ratio has hovered around 46% on average over the past five years, but with the company's amount of cash and the increasing free cash flow, the dividend seems rock solid. Also, with new service revenue acting as a new growth initiative and a revenue stabilizer, I feel more confident in the dividend in the near future. Revenues not growing since 2013 are a cause for concern, but during that same period of time the company has increased FCF 10%, which eases concerns for the time being. Since 2012, CSCO has increased FCF 25%.

CSCO currently trades for $32.50 and has a P/E value of 17.11, which is a bit high compared to the company's five year average of 13.29. On a Price to FCF per share basis, the stock currently trades at 12.71, which is the highest point over the past five years. The company has traded at an average P/FCF of 10.44, which suggests the stock is overvalued. Looking at Price/Sales, the company currently trades at a multiple of 3.42, well above the five year average of 2.57, which also suggests the price is a bit rich at current levels. Here is a snapshot at the valuation metrics previously mentioned.

Currently | 5 Year Avg | |

Price/Earnings | 17.11 | 13.29 |

Forward P/E | 13.37 | 13.29 |

Price/FCF | 12.71 | 10.44 |

Price/Sales | 3.42 | 2.57 |

ROA | 7.4% | 8.3% |

TL/A | 49.1% | 46.4% |

A couple of additional items I included in the chart above relates to the company's Balance Sheet. Over the past five years, the company has had an Return on Assets of 8.3%, but the most recent earnings release only produced a return of 7.4%, which means the transition the company is going through has taken a hit on efficiency. Hopefully this is something that will turn around going forward. As for risk, we can see the company has been financing their assets via debt, as the TL/A ratio has increased to 49.1% compared to the company's five year average of 46.4%.

In conclusion, I believe in the direction Cisco's management is directing them. Could the transition to a more service based or cloud based focus started earlier, yes, but the fact that the company is adapting to the current times is a plus. The service contracts will provide a more stable income stream, but during the transition period, which the company is trying to accelerate through acquisitions, may see short term headwinds with a long term reward. Looking at the stock from merely a valuation perspective, the stock appears overvalued basically with every metric we discussed. I do not believe a stock going through a big transition warrants a premium at this time. However, when looking at the stock with a long term view, if you have the patience, the company rewards you with a stable dividend of 3.57%, and will reward you over the long haul.

Note: I hope you all enjoyed the article and found it informative. If you do not currently follow me and would like to be notified of future articles, please hit the "Follow" button above. As always, I look forward to reading your comments below and feel free to leave any feedback. Happy Investing!