If you’re shopping for a loan, line of credit, or credit card, it’s important to consider all the costs involved — not just the monthly payment. Make sure you know your total cost of borrowing money by looking at these four things:

1. Loan amount

The amount of money you borrow may influence the interest rate, terms available and possible fees you pay over the life of the loan. So, determine how much money you actually need to borrow. A higher loan amount may require a longer term to keep your monthly payments manageable.

Tip

2. Interest rate / Annual Percentage Rate (APR)

When comparing rates, you will want to focus on the APR rather than simply looking at the interest rate. The APR is the amount of annual interest plus fees you'll pay averaged over the full term of the loan. Focusing on the APR allows you to better compare the cost of borrowing from different lenders, who may all have different fee structures. Look for an account with a low APR - the lower the APR, the lower your monthly payment will be.

Tip

Fixed or a variable rate?

Loans typically have a fixed rate and fixed term, while a line of credit or credit card usually has a variable rate and a revolving term. Know the pluses and minuses of each:

- With a fixed-rate loan, your interest rate won't change. And because the payment includes both principal and interest, your loan will be paid off at the end of the term as long as you make every payment on time. Having a predictable monthly payment may make it easier to stay on budget and manage your finances.

- With a variable rate loan or line of credit, your interest rate and monthly payment can change over time. The initial interest rate may start lower than a fixed-rate loan, but can increase over time. So, keep in mind how long it will take you to pay off your debt as changes in the rate could impact your monthly payment.

3. Loan Term

Your loan term (or repayment period) is the time it will take to repay your loan if you only make the required minimum monthly payments.

The length of your loan term affects both your monthly payment and the total amount of interest you will pay over the life of the loan.

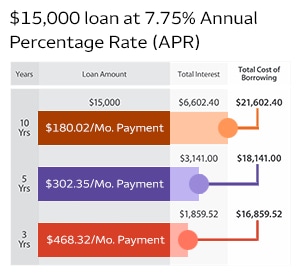

Consider these three examples. Each loan has the same $15,000 principal loan amount and an Annual Percentage Rate (APR) of 7.75%. But see how the loan term affects the monthly payment and the total cost of borrowing. This chart is for illustration purposes only.

With a 10-year term, you would pay $180.02 a month for a total of $21,602.40 at the end of the loan term. Compare that to a 5-year term, with a $302.35 monthly payment and a total cost of $18,141.00. Lastly, consider the 3-year term, with a $468.32 monthly payment and a total cost of $16,859.52.

Notice that the total interest paid would be $6,602.40 with the 10-year term, $3,141.00 with the 5-year term, and only $1,859.52 with the 3-year term.

As you can see, a longer loan term can help keep your monthly payment low, but that low payment comes with a higher total cost of borrowing.

Keep in mind that no matter what your loan term is, most loans allow you to pay more than your required monthly payment. The more money you are able to put toward the principal, the faster you'll pay off your loan — and the less you will pay in interest.

Tip

4. Loan Fees

Check for additional fees and charges that can increase the amount you pay — the more fees, the higher the cost of borrowing. Common fees can include:

- Origination fees - the amount charged for processing the loan application and underwriting services

- Prepayment penalty - the fee charged if you pay off your loan before the end of the term

- Annual fees - the amount you’ll pay each year for having the account

- Transfer fees - the fee for transferring your balance from one credit account to another

Sign On

Sign On